Professional Documents

Culture Documents

(MR) Commissioner - of - Internal - Revenue - v. - Royal20210505-11-17kzxbg

Uploaded by

Kobe Lawrence Veneracion0 ratings0% found this document useful (0 votes)

7 views4 pagesOriginal Title

(MR) Commissioner_of_Internal_Revenue_v._Royal20210505-11-17kzxbg

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pages(MR) Commissioner - of - Internal - Revenue - v. - Royal20210505-11-17kzxbg

Uploaded by

Kobe Lawrence VeneracionCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

EN BANC

[C.T.A. EB CASE NO. 1832. November 21, 2019.]

(C.T.A. Case No. 8844)

COMMISSIONER OF INTERNAL REVENUE, petitioner, vs.

ROYAL CLASS TRADING AND TRANSPORT CORPORATION ,

respondent.

RESOLUTION

UY, J : p

For resolution is petitioner's "MOTION FOR RECONSIDERATION (Re:

Decision dated 29 July 2019)" filed on August 15, 2019, 1 with

respondent's "COMMENT (on Petitioner's Motion for Reconsideration)"

filed on September 25, 2019, 2 praying for the reversal and setting aside of

this Court's Decision dated July 29, 2019, the dispositive portion of which

reads:

"WHEREFORE, in light of the foregoing considerations, the

Petition for Review is DENIED for lack of merit. Accordingly, the

assailed Decision dated November 16, 2017 and Resolution dated

March 28, 2018, both rendered by the Court in Division in CTA Case

No. 8844 are AFFIRMED.

SO ORDERED."

In the instant Motion, petitioner avers that the Court in Division has no

jurisdiction over the original Petition for Review filed by respondent; and that

the Court erred in ruling that the Revenue Officer (RO) who conducted the

audit of respondent's books of accounts was allegedly not authorized, and in

further declaring that the subject assessment is void for lack of authority of

the said RO.

Furthermore, petitioner posits that this Court erred in applying the

ruling of the Supreme Court in the case of Commissioner of Internal Revenue

vs. Sony Philippines, Inc.; 3 and that the said ruling is not applicable to this

case.

On the other hand, in its Comment, respondent contends that the Court

En Banc has exhaustively discussed the same points being raised in the

Motion for Reconsideration; and that there were no new issues being raised

by petitioner. CAIHTE

THE COURT'S RULING

Petitioner's Motion for Reconsideration lacks merit.

Except for the invocation of a provision under Revenue Memorandum

Order (RMO) No. 8-2006 4 to support his position that there is no more need

for the issuance of a new LOA, the arguments raised by petitioner in the

instant Motion are mere reiteration of matters which have already been

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

extensively considered, weighed and resolved in the assailed Decision. Thus,

this Court En Banc finds no compelling reason to reconsider, modify or

reverse its Decision, and shall no longer belabor, in this Resolution, to repeat

the disquisitions made in the said Decision.

Petitioner specifically invokes the following provision of RMO No. 8-

2006, to wit:

"F. On Disposition of Dockets.

xxx xxx xxx

2. In case the report of investigation submitted for review

was returned to the investigating office for compliance with additional

requirements and the original investigating Revenue Officer (RO)

and/or Group Supervisor (GS) has been transferred, resigned or

retired:

xxx xxx xxx

In case of reassignment, a memorandum to that effect

shall be issued by the head of the investigating office to the

concerned taxpayer and the concerned RO and/or GS."

Petitioner contends that pursuant to RMO NO. 8-2006, it has been a

standard operating procedure of revenue officers to issue a memorandum to

other revenue officers, who will continue the audit examination, which a

former revenue officer could not continue due to reassignment.

We are not convinced.

Indeed, a reading of RMO No. 8-2006 provides the requirement of the

issuance of a mere memorandum to inform the concerned taxpayer and the

concerned Revenue Officer and/or Group Supervisor in cases of

reassignment. However, it must be pointed out that nowhere in the above-

quoted provision is it stated that the issuance of a new LOA could be

dispensed with, in case of reassignment. DETACa

Thus, a reassignment memorandum, as established under RMO No. 8-

2006, cannot be the source of authority for an RO to examine the books of

accounts and other accounting records of taxpayers.

Moreover, respondent has issued Revenue Memorandum Circular

(RMC) No. 75-2018, 5 pertinent portions of which are hereby quoted as

follows:

"This Circular is being issued to highlight the doctrinal rule

enunciated by the Supreme Court in the case of 'Medicard

Philippines, Inc. vs. Commissioner of Internal Revenue' (G.R.

No. 222743, 05 April 2017) on the mandatory statutory

requirement of a Letter of Authority (LOA), for the guidance of

all concerned, particularly internal revenue officers tasked with

assessment and collection functions and review of disputed

assessments.

The judicial ruling, invoking a specific statutory

mandate, states that no assessments can be issued or no

assessment functions or proceedings can be done without the

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

prior approval and authorization of the Commissioner of

Internal Revenue (CIR) or his duly authorized representative,

through an LOA. The concept of an LOA is therefore clear and

unequivocal. Any tax assessment issued without an LOA is a

violation of the taxpayer's right to due process and is

therefore 'inescapably void.'

xxx xxx xxx

To help forestall any unnecessary controversy and to encourage

due observance of the judicial pronouncements, any examiner or

revenue officer initiating tax assessments or performing assessment

functions without an LOA shall be subject to appropriate

administrative sanctions." (Emphases and underscoring supplied)

Thus, even respondent himself recognizes that without the requisite

LOA being issued to the concerned RO, any resulting tax assessment

brought about by such RO's examination and audit of the taxpayer's books

of accounts and other accounting records is inescapably void.

Considering that in the instant case, no new LOA was issued in favor of

the revenue officer who examined respondent's books of accounts and other

accounting records, the subject tax assessment is void.

WHEREFORE, in light of the foregoing considerations, petitioner's

Motion for Reconsideration is DENIED for lack of merit. aDSIHc

SO ORDERED.

(SGD.) ERLINDA P. UY

Associate Justice

Roman G. del Rosario, P.J., Cielito N. Mindaro-Grulla, Catherine T.

Manahan and Jean Marie A. Bacorro-Villena, JJ., concur.

Juanito C. Castañeda, Jr., J., I reiterate my separate concurring opinion.

Esperanza R. Fabon-Victorino, J., I concur with the separate concurring

opinion of Justice Castañeda.

Ma. Belen M. Ringpis-Liban, J., I join Justice Castañeda's separate

concurring opinion.

Maria Rowena G. Modesto-San Pedro, J., is on leave.

Footnotes

1. EB Docket, pp. 146 to 169.

2. EB Docket, pp. 174 to 175.

3. G.R. No. 178697, November 17, 2010.

4. SUBJECT: Prescribing Guidelines and Procedures in the Implementation of the

Letter of Authority Monitoring System (LAMS).

5. SUBJECT: The Mandatory Statutory Requirement and Function of a Letter of

Authority.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Metroplex Berhad v. Sinophil Corp.20211222-12-172o893Document11 pagesMetroplex Berhad v. Sinophil Corp.20211222-12-172o893Kobe Lawrence VeneracionNo ratings yet

- Rules of Court CODAL PDFDocument196 pagesRules of Court CODAL PDFJobelle Ü Amboy100% (27)

- Anson Trade Center vs. Pacific BankingDocument2 pagesAnson Trade Center vs. Pacific BankingKobe Lawrence VeneracionNo ratings yet

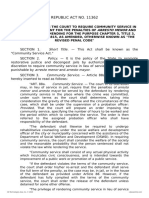

- Guidelines in Imposition of Community Service ActDocument7 pagesGuidelines in Imposition of Community Service ActKobe Lawrence VeneracionNo ratings yet

- 2 Philippine - Stock - Exchange - Inc. - v. - Court - Of20211111-23-15l8nkoDocument17 pages2 Philippine - Stock - Exchange - Inc. - v. - Court - Of20211111-23-15l8nkoAurora SolastaNo ratings yet

- PPSA Reviewer PDFDocument15 pagesPPSA Reviewer PDFKobe Lawrence VeneracionNo ratings yet

- 2019-Community Service ActDocument2 pages2019-Community Service ActRoque LimNo ratings yet

- Plaintiff-Appellee: First DivisionDocument14 pagesPlaintiff-Appellee: First DivisionRadz BolambaoNo ratings yet

- Application of An Existing Corporation To Increase Its Foreign Equity Under The Foreign Investments Acts of 1991Document2 pagesApplication of An Existing Corporation To Increase Its Foreign Equity Under The Foreign Investments Acts of 1991Kobe Lawrence VeneracionNo ratings yet

- AMLA (As Amended)Document19 pagesAMLA (As Amended)Kobe Lawrence VeneracionNo ratings yet

- rr16-2005 2Document55 pagesrr16-2005 2Kobe Lawrence VeneracionNo ratings yet

- 0 The Development of The Telecommunications Industry in The PhilippineDocument27 pages0 The Development of The Telecommunications Industry in The PhilippineKobe Lawrence VeneracionNo ratings yet

- Philippine Plastics Industry Association20210424-12-15y6pxzDocument7 pagesPhilippine Plastics Industry Association20210424-12-15y6pxzKobe Lawrence VeneracionNo ratings yet

- Succession Rights and the Need for a Separate Special ProceedingDocument96 pagesSuccession Rights and the Need for a Separate Special ProceedingKaye BroboNo ratings yet

- Andal v. AndalDocument145 pagesAndal v. Andalian clark MarinduqueNo ratings yet

- GMCR Inc. v. Bell Telecommunication20210507-12-1zbfn1Document17 pagesGMCR Inc. v. Bell Telecommunication20210507-12-1zbfn1Kobe Lawrence VeneracionNo ratings yet

- California Manufacturing Corporation v. LaguesmaDocument2 pagesCalifornia Manufacturing Corporation v. LaguesmaKobe Lawrence VeneracionNo ratings yet

- LTFRB Ordered to Nullify Memoranda Authorizing Fare Hikes Without Due ProcessDocument19 pagesLTFRB Ordered to Nullify Memoranda Authorizing Fare Hikes Without Due ProcessMonique LhuillierNo ratings yet

- 206131-2017-Metropolitan Bank and Trust Co. v. Liberty20211014-12-CgooftDocument18 pages206131-2017-Metropolitan Bank and Trust Co. v. Liberty20211014-12-CgooftKobe Lawrence VeneracionNo ratings yet

- 213257-2018-Shareholders Approval On Any Change S in The20211216-12-176r8ucDocument1 page213257-2018-Shareholders Approval On Any Change S in The20211216-12-176r8ucKobe Lawrence VeneracionNo ratings yet

- International Convention On The Protection of The Rights of All Migrant Workers and Members of Their FamiliesDocument21 pagesInternational Convention On The Protection of The Rights of All Migrant Workers and Members of Their FamiliesSha KNo ratings yet

- (Vers. 2 SPECPRO) Rule 73-77 (Digests This)Document30 pages(Vers. 2 SPECPRO) Rule 73-77 (Digests This)Kobe Lawrence VeneracionNo ratings yet

- 2016 FRB - No. - 1920210424 12 1rdz26aDocument5 pages2016 FRB - No. - 1920210424 12 1rdz26aKobe Lawrence VeneracionNo ratings yet

- 215054-2018-Advisory On Purewealth EBC Corp. And20211222-11-18czs12Document5 pages215054-2018-Advisory On Purewealth EBC Corp. And20211222-11-18czs12Kobe Lawrence VeneracionNo ratings yet

- Tan - v. - Sycip20210424-14-16ev1b5Document11 pagesTan - v. - Sycip20210424-14-16ev1b5Kobe Lawrence VeneracionNo ratings yet

- Republic Act No. 10172: CD Technologies Asia, Inc. 2018Document3 pagesRepublic Act No. 10172: CD Technologies Asia, Inc. 2018Megan Manahan100% (1)

- R.A. 9048Document4 pagesR.A. 9048georgina616No ratings yet

- G.R. Nos. 171947 48 Metropolitan Manila Development Authority v. Concerned Residents of Manila Bay PDFDocument18 pagesG.R. Nos. 171947 48 Metropolitan Manila Development Authority v. Concerned Residents of Manila Bay PDFRuchi Rabuya BaclayonNo ratings yet

- 2 People v. Casio PDFDocument18 pages2 People v. Casio PDFIñigo Mathay RojasNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Charatible Trust FINAL BOOKDocument80 pagesCharatible Trust FINAL BOOKAmitNo ratings yet

- Overexploitation of Parrots in The NeotropicsDocument6 pagesOverexploitation of Parrots in The NeotropicsElenananaNo ratings yet

- Myasthenia GravisDocument45 pagesMyasthenia GravisVirgilio Reyes ManuelNo ratings yet

- 10 - Bus 105 and 107-1Document400 pages10 - Bus 105 and 107-1Alao LateefNo ratings yet

- Acute Ankle Sprain - An UpdateDocument7 pagesAcute Ankle Sprain - An UpdateFran Leiva CorreaNo ratings yet

- Sacha Doucet-Kim Cancer AssignmentDocument3 pagesSacha Doucet-Kim Cancer AssignmentSacha Doucet-KimNo ratings yet

- Brown Creative Vintage Rustic Motivational Quote PosterDocument1 pageBrown Creative Vintage Rustic Motivational Quote PosterRafunzel Pe BandoquilloNo ratings yet

- Reflection Paper On Specific Bible Passages in Relation To The Divine ComedyDocument2 pagesReflection Paper On Specific Bible Passages in Relation To The Divine ComedyjosedenniolimNo ratings yet

- Music For ChildrenDocument6 pagesMusic For Childrenscribblers1813% (8)

- Calculus For EngineersDocument268 pagesCalculus For EngineersSr_Tabosa100% (1)

- Arvydas Sliogeris The Thing and Art Two Essays On The Ontotopy of The Work of Art 1Document168 pagesArvydas Sliogeris The Thing and Art Two Essays On The Ontotopy of The Work of Art 1Richard OhNo ratings yet

- Historical CriticismDocument1 pageHistorical CriticismPatricia Ann Dulce Ambata67% (3)

- On Counterfactuality: A Multimodal Approach To (Apparent) Contradictions Between Positive Statements and Gestures of NegationDocument12 pagesOn Counterfactuality: A Multimodal Approach To (Apparent) Contradictions Between Positive Statements and Gestures of NegationYulia NikolaevaNo ratings yet

- The Authors Guild vs. Google, Inc. Facts: Plaintiffs, Who Are Authors of Published Books UnderDocument15 pagesThe Authors Guild vs. Google, Inc. Facts: Plaintiffs, Who Are Authors of Published Books UnderElead Gaddiel S. AlbueroNo ratings yet

- BengzonDocument5 pagesBengzonmceline19No ratings yet

- FSLDMDocument5 pagesFSLDMaiabbasi9615No ratings yet

- GCC Students-IN Unit 5 Travel and TourismDocument3 pagesGCC Students-IN Unit 5 Travel and TourismMuhammad IrzanNo ratings yet

- Cinderella Play ScriptDocument6 pagesCinderella Play ScriptKhayla Khairunnisa81% (21)

- European Management Journal: Rainer Lueg, Ronny RadlachDocument14 pagesEuropean Management Journal: Rainer Lueg, Ronny RadlachPutri MutiraNo ratings yet

- Test Tenses en AnswersDocument4 pagesTest Tenses en AnswersAmit Kumar LalNo ratings yet

- Guía BaccettiDocument11 pagesGuía BaccettiPercy Andree Bayona GuillermoNo ratings yet

- SMRP SAMPLE Guide To The Maintenance and ReliabiliDocument17 pagesSMRP SAMPLE Guide To The Maintenance and ReliabiliSaul sanchez MantillaNo ratings yet

- Beed III-lesson 1.1-The Curricula in School Sept 4 2021Document7 pagesBeed III-lesson 1.1-The Curricula in School Sept 4 2021catherine r. apusagaNo ratings yet

- AnalogyDocument50 pagesAnalogyNathaniel Campeciño89% (9)

- 10 1 1 125Document456 pages10 1 1 125Radu GrumezaNo ratings yet

- The Nazi Master PlanDocument28 pagesThe Nazi Master PlanFolad109No ratings yet

- Retaining Wall With PilesDocument7 pagesRetaining Wall With PilesEngineering KaizenNo ratings yet

- Income Tax and GST PDFDocument152 pagesIncome Tax and GST PDFAdharsh EsNo ratings yet

- Artic Sun 5000Document16 pagesArtic Sun 5000AndrésNo ratings yet

- Boston University Student Research: Zipcar, IncDocument28 pagesBoston University Student Research: Zipcar, Incforeverjessx3No ratings yet