Professional Documents

Culture Documents

5 Discount Topic

Uploaded by

Ky AW0 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

5-Discount-Topic

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pages5 Discount Topic

Uploaded by

Ky AWCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Discount Topic

Discount Type (2) မ်ဳိးရွိသည္။

(1) Trade Discount (ကုန္သြယ္ေလွ်ာ့ေငြ)

(2) Cash Discount (ေငြေပၚေလွ်ာ့ေငြ)

Trade (or) Cash Discount (၂မ်ဳိး)လံုးအတြက္ ကိုယ္ကရရင္ Discount Received

ကိုယ္ကေပးရင္ Discount Allowed

Theory အရ Trade Discount ဆိုရင္ Double Entry စာရင္းသြင္းရန္ မလိုအပ္ပါ…

Cash Discount ဆိုရင္ Double Entry စာရင္းမသြင္းလို႔ မရပါ..

-Discount Received ဆို P&L မွာ Income ျပ

-Discount Allowed ဆို P&L မွာ Expense ျပ

Discount Received စာရင္းသြင္းပံုမ်ား

Trade Discount (Received) အတြက္

For Example

Purchase Vale: 100 Ks (Trade Discount Received: 10 Ks)

Debit Purchase (Net of Trade Discount) 90 ks

Credit Accounts Payable (Net of Trade Discount) 90 ks

-Trading A/c ၏ Purchase Amt မွာ Dis (Amt)ကို တပါထဲေလၽွာ့ထားရင္ P&L တြင္ Income ျပလို႔မရပါ။

Double Entry စာရင္းသြားရန္မလို။

-Purchase မွာ Dis (Amt)ကို တပါထဲ ေလၽွာ့မထားရင္ P&L တြင္ Income ျပန္ျပရမည္။

Cash Discount Received

Accounts Payable 90 Ks မွာ Dis (5 Ks) ရမည္

Debit Accounts Payable 5 ks

Credit Discount Received (income statement) 5 ks

- ဂ်ာနယ္ရိုက္ျပီး P&L မွာ Income ျပရမည္။

Journal Entry for Discount Received

Creditor’s A/C Debit

To Cash A/C Credit

To Discount Received A/C Credit

Discount Allowed စာရင္းသြင္းပံုမ်ား

Trade Discount (Allowed) အတြက္

For Example

Sales Value: 100 Ks (Trade Discount Allowed: 10 Ks)

Debit Accounts Receivable (Net of Trade Discount) 90 ks

Credit Sales (Net of Trade Discount) 90 ks

-Sale Revenue မွာတပါထဲေလၽွာ့ထားရင္ P&L တြင္ Exp ျပရန္မလို။

-Sale Revenue မွာ Discount ကိုတပါထဲမေလၽွာ့ထားရင္ P&L တြင္ Exp ျပန္ျပရမည္။

Cash Discount (Allowed) အတြက္

Accounts Receivable 90 Ks မွာ Cash Discount Allowed: 5 Ks ေပးလိုက္မည္

Debit Discount Allowed (income statement) 5 ks

Credit Accounts Receivable 5 ks

- ေၾကြးဆပ္ေငြကို Cash Book (DR Side)တြင္ အျပည့္ျပျပီး Cash Book (Credit Side) မွာ

- Discount Allowed အျဖစ္ အထြက္ျပျခင္းနည္း (သို႔) ဂ်ာနယ္ရိုက္ျပီး P&L မွာ Exp ျပရမည္။

Journal Entry for Discount Allowed

Cash A/C Debit

Discount Allowed A/C Debit

To Debtor’s A/C Credit

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Lab #2 Chapter 2 - The Economic ProblemDocument14 pagesLab #2 Chapter 2 - The Economic ProblemLucasStarkNo ratings yet

- Chapter 24 Answer KeyDocument3 pagesChapter 24 Answer KeyShane TabunggaoNo ratings yet

- Baby SpaDocument1 pageBaby SpaSureshNo ratings yet

- Sample Reaction PaperDocument4 pagesSample Reaction PaperDe Lara, Quenilyn100% (1)

- Classification of Reserves and ResourcesDocument27 pagesClassification of Reserves and Resourcesnina chentsovaNo ratings yet

- Imc Report of Group-5 Ayush Rathi Pgp21037 Ayushi Jain Pgp21038 Chakshika Pgp21042 Deepali Saini Pgp21046Document4 pagesImc Report of Group-5 Ayush Rathi Pgp21037 Ayushi Jain Pgp21038 Chakshika Pgp21042 Deepali Saini Pgp21046kartikay GulaniNo ratings yet

- Fund Manager's Report - JUNE 2023Document35 pagesFund Manager's Report - JUNE 2023smartboy.sb06No ratings yet

- Indigo Paints LimitedDocument402 pagesIndigo Paints LimitedSuresh Kumar DevanathanNo ratings yet

- A. What Will Be Your Business Strategy? Product-Differentiation or Low-Cost Provider?Document7 pagesA. What Will Be Your Business Strategy? Product-Differentiation or Low-Cost Provider?manpreetNo ratings yet

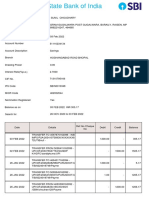

- Account StatementDocument12 pagesAccount StatementSunil ChoudharyNo ratings yet

- All Are Proper Segregation of Functions Except DDocument3 pagesAll Are Proper Segregation of Functions Except DSai AlviorNo ratings yet

- Costram Chapter 9Document2 pagesCostram Chapter 9Jere Mae MarananNo ratings yet

- The Effects of Covid On Micro EnterpriseDocument28 pagesThe Effects of Covid On Micro EnterpriseJay ArNo ratings yet

- Lesson 10 - Financial ManagementDocument8 pagesLesson 10 - Financial ManagementLand DoranNo ratings yet

- S 17 by A Third Party SAMPLEDocument22 pagesS 17 by A Third Party SAMPLErahul bajajNo ratings yet

- Fin - Financial PlanningDocument20 pagesFin - Financial PlanningZymon Andrew MaquintoNo ratings yet

- CH-7 Irrigation Performance AssessmentDocument31 pagesCH-7 Irrigation Performance AssessmentmitkiedegaregeNo ratings yet

- Q1-2021 Trading Update Presentation DEF - 0Document13 pagesQ1-2021 Trading Update Presentation DEF - 0MarcelloNo ratings yet

- Russell Egan 170521 Aged Care Email To QLD CoalitionDocument3 pagesRussell Egan 170521 Aged Care Email To QLD Coalitionrdegan77No ratings yet

- E-Commerce Assignment#3...Document6 pagesE-Commerce Assignment#3...Mohsin ShaikhNo ratings yet

- A Summer Internship Project Report On: Customer Satisfaction at JioDocument55 pagesA Summer Internship Project Report On: Customer Satisfaction at JioAarnav RoyNo ratings yet

- The British Accounting Review: Arifur Khan, Mohammad Badrul Muttakin, Javed SiddiquiDocument17 pagesThe British Accounting Review: Arifur Khan, Mohammad Badrul Muttakin, Javed Siddiquijannatul ferdusNo ratings yet

- Module 6Document6 pagesModule 6Raymart CruzNo ratings yet

- Chapter 5 Financial MarketsDocument63 pagesChapter 5 Financial MarketsGuda GudetaNo ratings yet

- Co-Operative BanksDocument13 pagesCo-Operative BanksIMPEL Learning SolutionsNo ratings yet

- Marketing Management PhilosophiesDocument2 pagesMarketing Management PhilosophiesMark NgugiNo ratings yet

- Chapter 2 Riba and InterestDocument37 pagesChapter 2 Riba and InterestMd. Abdul HalimNo ratings yet

- LABORATORIO 1 (Lic .Informática)Document20 pagesLABORATORIO 1 (Lic .Informática)David Manuel Rodríguez HernándezNo ratings yet

- 2022 CL Review Day 1 - HandoutDocument4 pages2022 CL Review Day 1 - HandoutNasudi AspricNo ratings yet

- DERIVATIVEDocument5 pagesDERIVATIVEorihara aoiNo ratings yet