Professional Documents

Culture Documents

Allianz General Insurance Company (Malaysia) Berhad

Uploaded by

mysara othmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allianz General Insurance Company (Malaysia) Berhad

Uploaded by

mysara othmanCopyright:

Available Formats

Allianz General Insurance Company (Malaysia) Berhad 200601015674 (735426-V)

(Licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia)

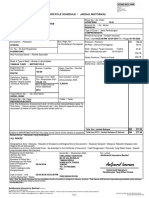

Prepared for: ______________________________________________ Print Date : ______________________

PRODUCT DISCLOSURE SHEET

(Read this Product Disclosure Sheet before you decide to take up the Comprehensive General Liability Insurance. Be

sure to also read the general terms and conditions)

Financial Service Provider : Allianz General Insurance Company (Malaysia) Berhad

(“Insurer”/“We”/”Our”/”Us”)

Product Name : Comprehensive General Liability

1. What is this product about?

This policy is to protect Insured against third party liability claim including cost and expenses occurring during the

period of indemnity and caused by an occurrence in connection with Insured’s business .

2. What are the covers / benefits provided?

This policy will indemnify Insured up to limit of indemnity;-

when Insured is legally liable to pay as damages for

a) Bodily Injury to third party or

b) Damage to third party’s tangible property

as a result of performing of the contract work

provided that such liability to third party bodily injury of property damage occurred during the policy

period

In addition, this policy also pays for legal costs and expenses of defending such claim and it is included as part of

the limit of indemnity

Extensions of coverage :

Excess Automobile Liability

Contractual Liability

Sudden and Accidental Pollution Liability

Damage to Principal’s existing property

Period of Indemnity is the same as contract duration but maximum 36 months or 12 months period of indemnity

and renewable upon expiry.

3. How much premium do Insured have to pay?

The total premium that Insured have to pay may vary depending on the underwriting requirements of the Insurer.

The following factors will affect the premium;-

- Contract Value

- Contract Duration

- Detailed Scope of Works

- Location of Risk

- Limit of Indemnity

- Experience in the business

- Loss history

- Third party surrounding property

- Liability assumed by Insured

4. What are fees and charges that Insured have to pay?

Type %/Amount

Commission paid to the insurance 15% of premium/ RM XX

intermediaries (If any)

Services Tax 6% of premium

Stamp Duty RM10.00

5. What are some of the key terms and conditions that I should be aware of?

Importance of disclosure

Non-Consumer Insurance Contract

Product Disclosure Sheet – Comprehensive General Liability Insurance Page 1 of 3

E & OE.

Allianz General Insurance Company (Malaysia) Berhad 200601015674 (735426-V)

(Licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia)

Pursuant to Paragraph 4 (1) of Schedule 9 of the Financial Services Act 2013, if you are applying for this

Insurance for purposes related to your trade, business or profession, you have a duty to disclose any matter

that you know to be relevant to our decision in accepting the risks and determining the rates and terms to be

applied and any matter a reasonable person in the circumstances could be expected to know to be relevant,

otherwise it may result in avoidance of contract, claim denied or reduced, terms changed or varied, or

contract terminated.

This duty of disclosure for Non-Consumer Insurance Contract shall continue until the time the contract is

entered into, varied or renewed. You also have a duty to tell us immediately if at any time after your contract

of insurance has been entered into, varied or renewed with us, any of the information given is inaccurate or

has changed.

An appropriate limit of indemnity is taken up.

Excesses – being the amount which is to be borne by the Insured in the event of a claim

This insurance is subjected to 60 days Premium Warranty, i.e. premium due must be paid and received by

Insurer within sixty (60) days from inception. Failing which, policy is automatically cancelled and 60 days pro

rate premium shall be entitled to Insurer.

6. What are the major exclusions under this policy?

This policy does not cover certain losses such as:

a) Under workmen’s compensation Act 1952, employers’ liability, disability benefits, unemployment

compensation law or similar law;

b) For Pure Financial Loss. The term “Pure Financial Loss” means any loss other than Bodily Injury and/or

Property Damage;

c) For libel or slander, or infringement or passing off of plan, copyright, patent, trade name, trade mark,

registered design or any other intellectual proprietary rights;

d) For Property Damage to any property owned by, occupied by or rented to the Named Insured, or to

any work or operation performed by or on behalf of the Named Insured, or to any property in the

Named Insured’s care, custody or control;

e) Arising out of sole negligence of the Principal(s) or any other indemnitee(s);

f) Arising out of the rendering of or failure to render any professional service;

g) Arising out of any commodity, article, goods or thing sold or supplied;

h) Arising out of ownership, possession, use or operation of watercraft or aircraft;

i) Arising out of penalty or liquidated damages clauses, or punitive or exemplary damages;

j) Arising out of asbestiform talc, asbestos, diethylstibesterol, dioxin, urea formaldehyde, polychlorinated

biphenyls, toxic mould or electric magnetic field;

k) Arising out of pollution or environmental impairment of whatsoever kinds unless this Policy is extended

to indemnify against such liability to the extent as stated under the Sudden and Accidental Pollution

Liability Clause;

l) arising out of war (whether declared or not), invasion, act of foreign enemy, hostilities, civil war,

insurrection, rebellion, revolution, mutiny, military or usurped power, sack or pillage in connection

therewith, confiscation or destruction by any government or public authority;

m) Arising out of terrorism (as per Terrorism Exclusion Clause);

n) Arising out of radiations (as per Institute Radioactive Contamination Exclusion Clause); or

o) Arising out of completed operation hazards (as per Completed Operation Liability Exclusion Clause).”

p) Arising out of demolition works.

q) Arising out of all transit related risk ( ie transportation )

Note: This list is non-exhaustive. Please refer to the sample policy contract for the full list of exclusions under this policy.

7. Can Insured cancel my policy?

Insured may cancel policy by giving written notice to the Insurer. Upon cancellation, Insured is not entitled to any

refund of the premium.

8. What do Insured need to do if there are changes to the contact details?

It is important that Insured to inform Insurer of any change in contact details to ensure that all correspondences

reaches Insured in a timely manner.

Product Disclosure Sheet – Comprehensive General Liability Insurance Page 2 of 3

E & OE.

Allianz General Insurance Company (Malaysia) Berhad 200601015674 (735426-V)

(Licensed under the Financial Services Act 2013 and regulated by Bank Negara Malaysia)

9. Where can Insured get further information?

Should Insured have any enquiries or require additional information, please refer to our agent or our nearest

branch or contact our Customer Service Department at;

Allianz Customer Service Center

Allianz Arena

Ground Floor, Block 2A, Plaza Sentral

Jalan Stesen Sentral 5, Kuala Lumpur Sentral

50470 Kuala Lumpur.

Allianz Contact Center: 1 300 22 5542

Email: customer.service@allianz.com.my

AllianzMalaysia

allianz.com.my

IMPORTANT NOTE:

YOU MUST ENSURE THAT YOUR LIABILITY IS INSURED AT THE APPROPRIATE AMOUNT. YOU SHOULD READ

AND UNDERSTAND THE INSURANCE POLICY AND DISCUSS WITH THE AGENT OR CONTACT THE INSURANCE

COMPANY DIRECTLY FOR MORE INFORMATION.

The information provided in this disclosure sheet is valid as at 01/09/2018.

Product Disclosure Sheet – Comprehensive General Liability Insurance Page 3 of 3

E & OE.

You might also like

- M9 EMockDocument23 pagesM9 EMockjjjj0% (1)

- Workmens Compensation Pds PDFDocument2 pagesWorkmens Compensation Pds PDFLucasNo ratings yet

- Allianz Product Disclosure Sheet - Professional Indemnity (English)Document3 pagesAllianz Product Disclosure Sheet - Professional Indemnity (English)Eddie TweNo ratings yet

- Allianz General Insurance Company (Malaysia) BerhadDocument6 pagesAllianz General Insurance Company (Malaysia) BerhadSiti Nurazlin FariddunNo ratings yet

- Takaful First PartyDocument3 pagesTakaful First Partyahrafza91No ratings yet

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocument4 pagesProduct Disclosure Sheet: Pacific & Orient Insurance Co. BerhadHamzah AzizanNo ratings yet

- 2 Fire Consequential Loss Insurance Product Disclosure Sheet-English VersionDocument3 pages2 Fire Consequential Loss Insurance Product Disclosure Sheet-English VersionAshish TiwariNo ratings yet

- Product Disclosure Sheet: Prepared For: Print DateDocument4 pagesProduct Disclosure Sheet: Prepared For: Print DatePhua Kien HanNo ratings yet

- Product Disclosure Sheet: Pacific & Orient Insurance Co. BerhadDocument4 pagesProduct Disclosure Sheet: Pacific & Orient Insurance Co. Berhadrasheed265No ratings yet

- Air Meet Liability PdsDocument3 pagesAir Meet Liability PdsNoraini Mohd ShariffNo ratings yet

- Sompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetDocument6 pagesSompo Motor Insurance (Private Car Comprehensive Policy) : Product Disclosure SheetMuhammad Shamaran AbdullahNo ratings yet

- Third Party Fire and Theft - Product Dislosure Sheet - EnglishDocument4 pagesThird Party Fire and Theft - Product Dislosure Sheet - EnglishhishamhamdanNo ratings yet

- Airport Contractors Liability PdsDocument2 pagesAirport Contractors Liability PdsNoraini Mohd ShariffNo ratings yet

- Auto365 Comprehensive Premier - PDS - Kur - ENG - 1022Document4 pagesAuto365 Comprehensive Premier - PDS - Kur - ENG - 1022Kanggatharan MunusamyNo ratings yet

- PDSMotor FormDocument3 pagesPDSMotor FormAkoo MeraNo ratings yet

- RETAIL PRICE PROTECTION GAP INSURANCE POLICYDocument6 pagesRETAIL PRICE PROTECTION GAP INSURANCE POLICYrajipoNo ratings yet

- Takaful MyMotor Motor PDS ENGDocument4 pagesTakaful MyMotor Motor PDS ENGNamirahMujahidahSyahidahNo ratings yet

- Property & Pecuniary InsuranceDocument13 pagesProperty & Pecuniary Insurancetyrose88No ratings yet

- PDS RoadWarrior ENG AZ0623Document3 pagesPDS RoadWarrior ENG AZ0623achmadegNo ratings yet

- NotesDocument10 pagesNotesgimgiNo ratings yet

- PDS Motor InsuranceDocument3 pagesPDS Motor InsuranceHooter ShooterNo ratings yet

- General Aviation Hull PdsDocument3 pagesGeneral Aviation Hull PdsNoraini Mohd ShariffNo ratings yet

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- EN Machinery - Breakdown - Product Disclosure Sheet PDFDocument2 pagesEN Machinery - Breakdown - Product Disclosure Sheet PDFDikshit KapilaNo ratings yet

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- Zurich Motor Disclosure SheetDocument6 pagesZurich Motor Disclosure SheetSyazwan SuhaimiNo ratings yet

- P o Product Disclosure Sheet - Travel Pa 1630048667Document3 pagesP o Product Disclosure Sheet - Travel Pa 1630048667Haikal MashkovNo ratings yet

- Georgia Laws Rules Regulations Pertinent To All AdjustersDocument5 pagesGeorgia Laws Rules Regulations Pertinent To All AdjustersEUGENE DEXTER NONESNo ratings yet

- Lonpac2 PDSDocument4 pagesLonpac2 PDSAZLAN ABDULLAINo ratings yet

- Premco Business Insurance PolicyDocument67 pagesPremco Business Insurance PolicyPremier CommercialNo ratings yet

- PACIFIC & ORIENT INSURANCE CO. BERHAD FOREIGN WORKERS INSURANCE GUARANTEEDocument3 pagesPACIFIC & ORIENT INSURANCE CO. BERHAD FOREIGN WORKERS INSURANCE GUARANTEEHaikal MashkovNo ratings yet

- Policy PLATINUM EUDocument19 pagesPolicy PLATINUM EUmeNo ratings yet

- Underwriting PracticesDocument13 pagesUnderwriting Practicesbishnoi.monikaanand.anandNo ratings yet

- InsuDocument7 pagesInsumisssweet786No ratings yet

- United India Insurance Co REPORT 22.07.19Document53 pagesUnited India Insurance Co REPORT 22.07.19Trilok SamtaniNo ratings yet

- Introduction to Insurance and its Key ConceptsDocument53 pagesIntroduction to Insurance and its Key ConceptsTrilok SamtaniNo ratings yet

- Digit Two-Wheeler Liability Only PolicyDocument11 pagesDigit Two-Wheeler Liability Only PolicyNikhil ReddyNo ratings yet

- GenInsNotes-KeyWordsDocument8 pagesGenInsNotes-KeyWordsKaranveer SinghNo ratings yet

- Fidelity Guarantee Insurance: Product Disclosure SheetDocument3 pagesFidelity Guarantee Insurance: Product Disclosure Sheetmarlynrich3652No ratings yet

- Fire Insurance - Product Disclosure SheetDocument2 pagesFire Insurance - Product Disclosure SheetchenghaocchNo ratings yet

- Insurance Management: Karnatak University Dharwad Kousali Institute of Management StudiesDocument20 pagesInsurance Management: Karnatak University Dharwad Kousali Institute of Management StudiesZelam PalreshaNo ratings yet

- Salient Feature: National Insurance Company LimitedDocument5 pagesSalient Feature: National Insurance Company LimitedSaurav DuttaNo ratings yet

- Chapter 4 Premiums GuideDocument15 pagesChapter 4 Premiums GuideAmanda LoveNo ratings yet

- Swamy InsuranceDocument7 pagesSwamy InsuranceSannidhi MukeshNo ratings yet

- Product Liability Insurance Policy - AxaDocument4 pagesProduct Liability Insurance Policy - AxaAbhishekNo ratings yet

- AI Aviation Hangarkeepers Liability WordingDocument16 pagesAI Aviation Hangarkeepers Liability WordingRatih PrimatiaNo ratings yet

- Motor insurance policy summaryDocument6 pagesMotor insurance policy summaryNurul IzzatiNo ratings yet

- Digit Two-Wheeler Liability Only PolicyDocument11 pagesDigit Two-Wheeler Liability Only Policyfaiyaz432No ratings yet

- Workmens Compensation TakafulDocument3 pagesWorkmens Compensation TakafulFaizZiyannNo ratings yet

- Insurances: More Share Flag Favs Channels Authorpointlite Like It Dislike It Add To FavouritesDocument10 pagesInsurances: More Share Flag Favs Channels Authorpointlite Like It Dislike It Add To FavouritesJhanvi PatelNo ratings yet

- What Is The Role of Insurance CommissionDocument6 pagesWhat Is The Role of Insurance CommissionAnonymous SgwrSoNo ratings yet

- Digit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversDocument15 pagesDigit Commercial Vehicle Package Policy (Miscellaneous and Special Types of Vehicle) Add On CoversWPP 3204No ratings yet

- Life Insurance PDSDocument2 pagesLife Insurance PDSAkmal HelmiNo ratings yet

- CSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Document8 pagesCSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovNo ratings yet

- CGL - RinkuDocument50 pagesCGL - RinkuXitish MohantyNo ratings yet

- Glossary of Insurance Terms A-ZDocument19 pagesGlossary of Insurance Terms A-Zpram006No ratings yet

- Assignment On The Overview of South Asia Insurance Company LTD DocxDocument8 pagesAssignment On The Overview of South Asia Insurance Company LTD Docxriduan niamNo ratings yet

- Types of Insurance in Construction ContractsDocument13 pagesTypes of Insurance in Construction ContractsGagana Sandaruwan100% (1)

- Test 2Document12 pagesTest 2Namish MohanNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Smartivity Labs Employee Tax Form GuideDocument2 pagesSmartivity Labs Employee Tax Form GuideSanjeev Kumar50% (2)

- Chapter 22Document61 pagesChapter 22Tim LeeNo ratings yet

- Micro-Insurance ModelDocument6 pagesMicro-Insurance ModeltudballmNo ratings yet

- Real Estate Fraud Expert Report - Re FTC vs. Nudge, Ryan Poelman, Brandon Lewis, Clint Sanderson, Philip Smith, Et. Al.Document211 pagesReal Estate Fraud Expert Report - Re FTC vs. Nudge, Ryan Poelman, Brandon Lewis, Clint Sanderson, Philip Smith, Et. Al.Triton007100% (2)

- Personal 50 30 20 Budget Excel SpreadsheetDocument4 pagesPersonal 50 30 20 Budget Excel Spreadsheetebony thomasNo ratings yet

- EUIPO e-learning content tender specificationsDocument19 pagesEUIPO e-learning content tender specificationsMihaela IancuNo ratings yet

- Mahindra & Mahindra Limited (M&M) Is An Indian Multinational AutomobileDocument25 pagesMahindra & Mahindra Limited (M&M) Is An Indian Multinational Automobilevarunsood0050% (1)

- Changing Trends in Indian Commercial Vehicle IndustryDocument58 pagesChanging Trends in Indian Commercial Vehicle Industryvibhuti1batraNo ratings yet

- Marine Insurance TypesDocument20 pagesMarine Insurance TypesNihal MohammedNo ratings yet

- RMI Test 2Document5 pagesRMI Test 2shawelNo ratings yet

- CD The Home Insurance Company Vs Eastern Shipping LinesDocument2 pagesCD The Home Insurance Company Vs Eastern Shipping LinesMaribeth G. TumaliuanNo ratings yet

- SEO Services Contract Template Free Microsoft WordDocument12 pagesSEO Services Contract Template Free Microsoft WordDanz HolandezNo ratings yet

- Appendix To Chapter Four: Applying Supply and Demand Analysis To Health CareDocument6 pagesAppendix To Chapter Four: Applying Supply and Demand Analysis To Health CaredeepikaNo ratings yet

- CAR RENTAL ProposalDocument5 pagesCAR RENTAL ProposalPnp Initao MpsNo ratings yet

- Annotated Bibliography Draft-1Document5 pagesAnnotated Bibliography Draft-1api-217663549No ratings yet

- Personal Financial StatementDocument4 pagesPersonal Financial StatementKent WhiteNo ratings yet

- Motorcycle Insurance ScheduleDocument6 pagesMotorcycle Insurance ScheduleGambar GambarNo ratings yet

- 500 FortuneDocument24 pages500 Fortunecrafted with happinessNo ratings yet

- ASFAR & CO. v. BLUNDELL AND ANOTHER. - (Document7 pagesASFAR & CO. v. BLUNDELL AND ANOTHER. - (Abel KiraboNo ratings yet

- IA Audit Report - SampleDocument6 pagesIA Audit Report - SampleMounirDridi100% (1)

- Corporate Agents: Lrgi Group PresentationDocument10 pagesCorporate Agents: Lrgi Group PresentationAnjali AllureNo ratings yet

- Indenture PDVSA 2020Document16 pagesIndenture PDVSA 2020Miguel ZajíaNo ratings yet

- Project Report SmuDocument76 pagesProject Report SmuChandan Srivastava100% (1)

- Ont Drug Benefit ActDocument11 pagesOnt Drug Benefit Actbijalshah7985No ratings yet

- E Zobel V CA DigestDocument2 pagesE Zobel V CA DigestCarlyn Belle de GuzmanNo ratings yet

- ACCTAX ReviewerDocument12 pagesACCTAX ReviewerAdrian Mark GomezNo ratings yet

- Acceptance of Deposits by CompaniesDocument23 pagesAcceptance of Deposits by CompaniesShruti Garg0% (1)

- HDFC acquires Apollo Munich Health InsuranceDocument5 pagesHDFC acquires Apollo Munich Health InsuranceAmit SrivastavaNo ratings yet

- 001 VOL 1B Pasvi 19 03 19Document89 pages001 VOL 1B Pasvi 19 03 19Dhaval ParmarNo ratings yet