Professional Documents

Culture Documents

Financial Statement 1q 2020

Uploaded by

Milena DańczyszynOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Statement 1q 2020

Uploaded by

Milena DańczyszynCopyright:

Available Formats

Wawel S.A.

Condensed financial statement

for the 1st quarter of 2020

prepared pursuant to the International Financial

Reporting Standards endorsed by EU

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 2

TABLE OF CONTENTS:

I. FINANCIAL STATEMENT 3

II. ADDITIONAL INFORMATION 7

1. GENERAL INFORMATION 7

2. CHARACTERISTICS OF FINANCIAL RESULTS GENERATED IN THE REPORTING PERIOD 8

3. ADOPTION OF THE IFRS 11

4. IMPORTANT VALUES BASING ON PROFESSIONAL JUDGMENT AND ESTIMATIONS 13

5. OTHER EXPLANATORY NOTES TO THE FINANCIAL STATEMENT 13

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 3

I. FINANCIAL STATEMENT

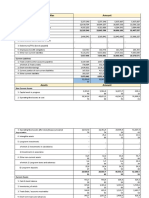

state as of state as of state as of

Financial statement (PLN k) 2020-03-31 2019-12-31 2019-03-31

Assets Not audited Audited Not audited

Fixed assets

402 826 405 377 410 202

1. Fixed tangible assets

381 405 385 396 389 291

2. Goodwill

2 008 2 008 2 008

3. Intangible assets

2 601 2 490 1 046

4. Long-term receivables

81 81 81

5. Shares in affiliates valued by equity method

1 372 1 452 1 507

6. Long-term accruals, including

51 50 59

7. Deffered income tax assets

15 308 13 900 16 210

Current assets

416 505 398 343 388 670

1. Inventory

77 517 63 824 48 473

2 Short-term receivables

140 809 183 841 155 971

2.1.Receivables due to deliveries and

136 406 178 859 154 447

services

2.2. Receivables due to income tax (CIT)

4 403 4 982 1 524

3. Short-term accruals

3 682 383 3 110

4. Cash and other financial assets

194 497 150 295 181 116

- cash

193 096 148 970 179 542

- other financial assets

1 401 1 325 1 574

Total assets

819 331 803 720 798 872

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 4

state as of state as of state as of

Financial statement (PLN k) 2020-03-31 2019-12-31 2019-03-31

Liabilities

Not audited Audited Not audited

Equity 704 330 690 602 687 424

1. Share capital 7 499 7 499 7 499

2. Share premium account 18 146 18 146 18 146

3. Other components of equity -2 123 -2 123 -1 370

4. Supplementary capital 607 941 607 941 568 140

5. Revaluation capital 710 710 748

6. Retained profits / uncovered losses 72 157 58 429 94 261

Liabilities 115 001 113 118 111 448

1. Provisions for liabilities 12 240 12 240 10 418

1.1. Provision for retirement and related benefits 12 240 12 240 10 418

2. Liabilities due to deliveries, services, and other

69 824 76 616 71 942

liabilities

3. Liabilities due to employee benefits 7 872 8 472 7 146

4. Accruals and other liabilities 25 065 15 790 21 943

4.1. Employees related accruals 8 010 6 882 7 429

4.2. Other accruals 17 055 8 908 14 514

Total liabilities 819 331 803 720 798 872

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 5

1st quarter of 1st quarter of

TOTAL INCOME STATEMENT 2020 2019

(k PLN)

Not audited Not audited

I. Revenue 134 446 142 272

Revenue arising from contracts with Clients 133 252 140 887

Revenue from retail sales 1 194 1 385

II. Expenses (117 913) (121 458)

Cost of sales (84 581) (88 359)

Other operating revenue / expenses (73) 26

(16 013) (13 907)

Selling costs

(17 246) (19 218)

Administrative expenses

III. Profit on operating activities 16 533 20 814

Financial revenues 848 732

Financial expenses (197) (151)

IV. Pretax profit 17 184 21 395

Income tax (3 456) (4 209)

V. Net income from continuing

13 728 17 186

operations

VI. Other total incomes 0 0

VII. The sum of the total incomes 13 728 17 186

The diluted earnings per share did not occur.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 6

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 7

1st quarter of 1st quarter of

2020 2019

CASH-FLOW STATEMENT (in k PLN)

not audited not audited

A. Net cash-flow from operating activities 17 184 21 395

I. Gross profits (loss) 31 207 33 531

II. Total adjustments: 7 379 7 173

1. Amortization (46) (16)

2. Profit/loss due to the exchange differences 75 105

3. Interests and dividends 110 (53)

4. Profit/loss from investment activity 0 0

5. Reserve change (13 692) 13 003

6. Stocks change 42 453 23 299

7. Receivables change (6 788) (8 679)

8. Short-term liabilities change (except for loans and credits) 6 001 3 482

9. Change in prepayments and accrued income (4 285) (4 783)

10 Paid income tax 48 391 54 926

III. Net cash-flow from operating activities 17 184 21 395

B. Net cash-flow from the investment activity

1. Sales of intangible and tangible fixed assets 36 23

2. Purchase of intangible and tangible fixed assets (3 712) (5 071)

3. Repayments of loans 0 16

3. Other outflows from investment activities (1) 0

IV. Net cash-flow from the investment activity (3 677) (5 032)

C. Net cash-flow from financial activities

1. Dividend and other payments to shareholders 0 0

2. Payment of liabilities due to financial lease agreements (484) (421)

3. Interest (104) (116)

V. Net cash-flow from financial activities (588) (537)

D. Total net cash flows 44 126 49 357

E. Balance change of pecuniary assets including 44 126 49 357

- change in pecuniary assets due exchange differences 0 0

F. Opening balance of pecuniary assets 148 970 130 185

G. Closing balance of pecuniary assets (F+/-D) 193 096 179 542

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 8

II. ADDITIONAL INFORMATION

1. GENERAL INFORMATION

1.1 Legal status and basic subject of activity as per the Polish Classification of Activities (PKD)

Wawel Spółka Akcyjna seated in Kraków.

The Company is registered in the National Court Register kept by the District Court for Kraków -

Śródmieście, 11th Commercial Department in Kraków under the number 14525.

According to the sections of the Polish Classification of Activities the basic subject of the company’s activity

is production of cocoa, chocolate and confectionary products denoted with the symbol (PKD 2007) 1082Z.

The Company’s shares are traded in the official market of the WSE. According to the classification adopted

by the WSE, the Company is acting in the food industry sector.

1.2 The Company’s duration is indefinite.

1.3 The periods for which the financial statement and comparable data are presented.

The financial data presented cover the period from January 1 to March 31, 2020.

The comparable data cover the period from January 1 to March 2019 and in financial statement cover the

period from 1st January to December 31, 2019.

1.4 Information concerning the composition of the Management Board and the Supervisory Board

MANAGEMENT BOARD

President of the Management Board Dariusz Orłowski

Member of the Management Board Wojciech Winkel

SUPERVISORY BOARD

Chairman of the Supervisory Board Nicole Opferkuch

Vice Chairman of the Supervisory Board Eugeniusz Małek

Secretary of the Supervisory Board Paweł Bałaga

Member of the Supervisory Board Laura Opferkuch

Member of the Supervisory Board Christoph Köhnlein

Member of the Supervisory Board Paweł Tomasz Brukszo

Member of the Supervisory Board Max Alexander Schaeuble

1.5 The Issuer is not a dominant entity in relation to other entities and it does not draw up a consolidated

statement.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 9

1.6 As at March 31, 2020, the following shareholders possessed more than 5 % of votes at the General

Shareholders' Meeting:

Shareholding as for the date of report for 1st quarter 2020

Share in

Number of Number of Share in

Name of shareholders votes at

shares votes capital

GMS

Hosta International AG seated

in w Münchenstein 781 761 781 761 52.13% 52.13%

(Switzerland)

MetLife OFE * 147 029 147 029 9.80% 9.80%

Aviva OFE Aviva Santander ** 84 201 84 201 5.61% 5.61%

Nationale-Nederlanden OFE ** 76 322 76 322 5.09% 5.09%

Other shareholders 410 442 410 442 27.37% 27.37%

TOTAL 1 499 755 1 499 755 100.00% 100.00%

*) information on the number of shares given in accordance with the notification received by the Issuer pursuant to art.

69 in conjunction from art. 87 par. 1 point 3 lit. b of the Act on Public Offering, Conditions Governing the Introduction

of Financial Instruments to Organised Trading, and Public Companies dated July 29th 2005.

**) information on the number of shares given in accordance with the notification received by the Issuer pursuant to

art. 69 of the Act on Public Offering, Conditions Governing the Introduction of Financial Instruments to Organised

Trading, and Public Companies dated July 29th 2005.

2. CHARACTERISTICS OF FINANCIAL RESULTS GENERATED IN THE REPORTING PERIOD

2.1. Results generated in Q 1 2020.

In the 1st quarter of 2020, the company generated a gross profit of PLN 16.5 million, which means a

decrease of PLN 4.3 million, i.e. 26 compared to the same period of the previous year.

Tab. 1

k PLN 1st quarter 1st quarter Change Change

2020 2019 in k PLN in %

Net income from the sales 134 446 142 272 -7 826 -5.8

Gross profit (loss) from sales 49 865 53 913 -4 048 -8.1

Sales costs 16 013 13 907 2 106 13.2

General administrative expenses 17 246 19 218 -1 972 -11.4

Profit (loss) from operational

16 533 20 814 -4 281 -25.9

activity

Gross profit (loss) 17 184 21 395 -4 211 -24.5

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 10

The company's gross result in the 1st quarter of 2020, compared to the same period of 2019, was primarily

affected by the following factors:

- decrease of revenue by PLN 7.8 million,

- decrease of value of administrative expenses by PLN 2.0 million,

- increase of value of sales costs by PLN 2.1 million,

In order to compare these two analyzed periods the margin rates EBIDTA, EBIT, gross cash flow and net

cash flow was applied.

Tab. 2

Financial indicators 1Q 1Q Dynam.

2020 2019 2020 / 2019

EBITDA (in k PLN)

23 912 27 987 85%

Operational profit + amortization

EBITDA margin (% share in revenue) 17.8% 19.7%

EBIT (in k PLN)

16 533 20 814 79%

Operational profit

EBIT margin (% share in revenue) 12.3% 14.6%

Gross cash flow (in k PLN)

24 563 28 568 86%

Gross profit + amortization

Gross cash flow margin (% share in revenue) 18.3% 20.1%

Net cash flow (tys. zł)

21 107 24 359 87%

Net profit + amortization

Net cash flow margin (% share in revenue) 15.7% 17.1%

2.2 Important events within the period 01.01.2020 - 31.03.2020

Do not occur.

2.3 Important events after balance date

Apart from the events indicated in this quarterly report, there were no significant events after the balance

sheet date that should be included in it.

2.4. Factors and events of a non-typical nature significantly influencing the financial results.

Do not occur.

2.5. Description of the basic threats and risks related to the other months of the fiscal year.

The following should be mentioned among the main threats and risk factors:

COVID-19

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 11

At the end of 2019, news from China regarding COVID-19 (coronavirus) appeared for the first time. In the

first months of 2020, the virus spread around the world, and its negative impact on the global economy

gathered momentum.

Starting from the second half of March, the first noticeable effects of the pandemic were affecting the

Company's operations, i.e. the decrease in the number of orders from our business partners. And these

changes were not initially significant. However, with each subsequent week of April, the situation began to

change. Today we are observing a significant negative impact of a pandemic on the Company's sales, and

therefore also on its results. It is difficult today to estimate the potential negative impact of Covid - 19 on

the Company's results, including the impact for the next quarter. Everything depends on the degree of

"opening up the economy", canceling the bans and restrictions related to the panddemic directly related to

the sphere of retail trade as well as public activity.

fluctuations in the prices of the essential production raw materials (mostly cocoa seeds);

Chart 1

Source: stooq.pl

occurrence of unfavourable for the Company changes of the exchange rates (mostly EUR,

USD, GBP).

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 12

Chart 2

Source: stooq.pl

The Company does not possess any periodical foreign currency agreements and does not plan the

important operations related to the opening the transactions with the currency risk due to its limited

influence on the Company's result. The inflows due to the export in the material part (ca. 34%) protect the

expenses due to the raw materials import used to manufacturing the finished products. Other open

currency exposition due to the import purchase is calculated at the price of finished product. But the Issuer

allows for possibility of entering into the currency term transactions related to the currency purchase to the

extent necessary to cover the current raw materials purchases.

Furthermore, in connection with the unstable political and economic situation in Ukraine, there is a risk

associated with the business activity of the “Lasoszczi” Company (an affiliate in which Wawel S.A. holds

48.5% share). Therefore, the Management Board does not exclude the possibility of making - in the next

reporting periods - the write-offs for impairment of held shares and loans granted to the “Lasoszczi”

Company whose total book value as at March 31, 2020 equalled PLN 2,660 thousand (of which shares of

PLN 1,372 thousand and loans together with interest of PLN 1,288 thousand).

3. ADOPTION OF THE INTERNATIONAL FINANCIAL REPORTING STANDARDS

3.1 Declaration of compliance:

These interim condensed financial statements were prepared in compliance with the International

Accounting Standard No. 34 “Interim financial reporting” endorsed by EU (“IAS 34”).

The interim condensed financial statements do not include all information and disclosures required for the

annual financial statements and should be read along with the financial statements of the Company for the

year ended on December 31, 2019 and approved to be published on 13.03.2020.

The interim financial results may not fully reflect the achievable financial result for the fiscal year.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 13

The interim condensed consolidated financial statements were prepared on the assumption that the

Company would continue as a going concern in the foreseeable future. As for the date of approval of this

consolidated financial statement there are not any circumstances indicating any threat for the going

concern principle.

3.2 Standards applied for the first time.

The accounting principles (policies) applied to prepare the condensed interim financial statement are

consistent with those applied to prepare the annual financial statement of the Company for the year

terminating on December 31, 2019, with the exception of the following new or amended standards and

interpretations that are effective for annual periods beginning on or after January 1, 2020.

Amendments to the Conceptual Framework References in the International Financial Reporting

Standards (published on March 29, 2018) - not approved by the EU until the date of approval of these

financial statements - applicable to annual periods beginning on or after January 1, 2020 or later,

Amendment to IFRS 3 Business Combinations (published on October 22, 2018) - not approved by the EU

until the date of approval of these financial statements - applicable to annual periods beginning on or

after January 1, 2020 or later,

Amendments to IAS 1 and IAS 8: Definition of Materiality (published on October 31, 2018) - until the

date of approval of these financial statements, not approved by the EU - applicable to annual periods

beginning on or after January 1, 2020 or later.

The above-mentioned changes in standards and interpretations did not apply to the Company or had an

intangible impact on the financial position, results of the Company or on the scope of information

presented in the condensed financial statements of the Company.

3.3 Standardy oraz interpretacje opublikowane, ale jeszcze nie obowiązujące.

The Company did not decide to make an early application of any standard, interpretation or amendment

that was issued but is not yet effective in light of the provisions of law of the European Union.

According to the Company’s estimates, other standards, interpretations and amendments to standards

would not have a significant impact on the financial statement, if they were applied by the Company as at

the balance sheet date.

3.4 Voluntarily changes in accounting principles.

The Company has not changed any Accounting Principles in comparison to the previous financial

statements.

3.5 Comparability of financial data for the preceding year and the data from the financial statements for

the reporting period.

In the presented financial statements for first nine months of 2020 and 2019 it has preserved the principle

of comparability of data.

4. IMPORTANT VALUES BASING ON PROFESSIONAL JUDGMENT AND ESTIMATIONS

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 14

4.1 Professional judgment.

At preparation of the condensed interim financial statements, the Entity’s management is required to make

certain estimates, judgments and assumptions that affect the presented revenues, costs, assets and

liabilities and related notes and disclosures of contingent liabilities. The uncertainty of these assumptions

and estimates may cause the material adjustments of the carrying amount of assets and liabilities in the

future.

4.2 Uncertainty of estimations and assumptions

The basic assumptions referred to the future and other key sources of uncertainty as of the end of the

period, with which the significant risk of the significant adjustment of the assets and liabilities accruing

amount in the next fiscal year is connected, are described below. The Company adopted the assumptions

and estimations about the future based on the knowledge as of the date of these financial statements. The

assumptions and estimations may change as a result of the future events being a consequence of the

market changes or changed beyond the Company’s control. Such changes are reflected in the estimations

and assumptions, when occurred.

Impairment of non-current assets and goodwill

The Company did not identify any assumptions of impairment and did not carry out any test for

impairment.

Impairment of interest in associate

The Company did not identify any assumptions of impairment and did not carry out any test for

impairment.

Measurement of provisions for employee benefits

The provisions due to the employee benefits were estimated by actuarial methods.

Deferred tax assets

The Company recognizes the deferred tax assets basing on the assumption that the tax profit

allowing to use them will be achieved in future. The deterioration of the achieved tax results in the

future might cause that this assumption would be unjustified.

Depreciation rates

The amount of depreciation rates is set basing on the expected period of useful life of the assets of

the property, plant and equipment as well as the intangible assets. Annually, the Company carries

out the verification of adopted useful life periods basing on the current estimations.

5. OTHER EXPLANATORY NOTES TO THE FINANCIAL STATEMENT

5.1 Functional and reporting currency.

This financial statement was drawn up in polish zlotys. The reporting and functional currency is polish zloty.

The financial data in the financial statement were presented in thousands zlotys.

5.2 Chosen financial data contained in this statement have been converted into EURO according to the

following rules:

Financial data for 2020:

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 15

- the particular items of the assets and liabilities for the balance sheet – according to the average exchange

rate announced for 2020-03-31 by the National Bank of Poland:

1 EUR = 4,5523 PLN

- the particular items of the profit and loss account and the cash flow account for the months of 2020 –

according to the exchange rate constituting the arithmetic mean of the average exchange rates determined

by the National Bank of Poland as of the last day of each month of first 3 months of 2020.

1 EUR = 4,3963 PLN

Financial data for 2019:

- the particular items of the assets and liabilities for the balance sheet – according to the average exchange

rate announced for 2019-12-31 by the National Bank of Poland:

1 EUR = 4.2585 PLN

- the particular items of the profit and loss account and the cash flow account for the period from 2019-01-

01 to 2019-03-31 – according to the exchange rate constituting the arithmetic mean of the average

exchange rates determined by the National Bank of Poland as of the last day of each month of first 3

months of 2019.

1 EUR = 4.2978 PLN

5.3 Important events after the interim period completion, which were not reflected in the financial

statement for the relevant interim period.

Did not occur

5.4 Information on the paid or declared dividend.

On April 23, 2020 the Management Board of Wawel S.A. adopted resolution under which decided to

submit to the Supervisory Board the application about allocating from the Issuer’s net profit for 2019, the

amount of 44 992 650.00PLN (30.00 PLN per one share) for paying dividend.

5.5 Information on changes in contingent liabilities or contingent assets, which occurred from the end of

the last fiscal year.

Liabilities and assets do not occur.

5.6 Information on issue, buy-out and repayment of debt securities and capital securities

Do not occur.

5.7 Change in the entity’s structure in the interim period

Did not occur.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 16

5.8 Goals and policy of the financial risk management

In the period of first 3 months of 2020 any goals or policy of the financial risk management did not change

in comparison to 2019.

5.9 Financial instruments

In the Company’s opinion, the fair value of cash, short-term deposits, trade receivables, granted loans,

listed equity instruments, trade liabilities and other liabilities does not differ from the carrying amount,

mainly as a result of the short maturity date.

5.10 Discontinuing operations

Do not occur.

5.11 Seasonality of issuer’s business activity

The business activity of the Issuer is characterized by the seasonality, which results from the structure of

manufactured and sold products. Due to the fact that 75% - 80% of the sale constitute the products from

the group of filled chocolate, full chocolate and chocolate candies, their sale is lower during the summer

months, but the lowest level is in II quarter. The biggest revenues and profits are generated in I and IV

quarter of the calendar year.

The diagram below presents the amounts in sale revenues in the last four quarters of Company’s activity in

comparison to the same quarters of the previous year.

Chart 3

5.12 Information on operating sectors

Pursuant to the requirements of IFRS 8, the operating sectors need to be identified basing on internal

reports on these elements of the Company, which are verified on a regular basis by the persons deciding on

allocation to the relevant sector and assessing the financial results. The Company runs homogenous

business activity consisting of manufacture and sale of confectionery. However for the management needs

the internal system of financial reporting allows identifying the financial results pursuant to the markets.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 17

The results in the market segments are as follows:

Tab. 3

1st quarter 2020 (not audited) Country Export Total

Income from sales of products, goods and materials 113 555 20 891 134 446

Cost of products, goods and materials sold 73 022 11 559 84 581

Gross profit (loss) from sales 40 533 9 332 49 865

1st quarter 2019 (not audited) Country Export Total

Income from sales of products, goods and materials 128 252 14 020 142 272

Cost of products, goods and materials sold 79 814 8 545 88 359

Gross profit (loss) from sales 48 438 5 475 53 913

The capital expenditures are not alocated according to the markets, because all of the fixed assets used are

situated in Poland.

Information on major clients:

In the first 3 months of 2020, the Company and one external entity performed the sales transaction

exceeding 10% of the total revenues from sales of the Company.

The sales transactions referred to the segment “Domestic sales”.

5.13 Information on allowances revaluating the inventories amount to the achievable net amount and

reversal of allowances:

In Q1 2020 the revaluation allowances for inventories of materials was not changed and the revaluation

allowances for inventories of finished goods was decreased by PLN 1 k.

5.14 Information on revaluation allowances for impairment of financial assets, impairment of non-

current assets, impairment of intangible assets or other assets and any reversal of such allowances

- in Q1 2020 the write-downs for debts for principal amount and interest were increased by the amount of

PLN 365 k.

5.15. Information on establishment, increase, use and release of provisions

In Q1 2020 the provision was not changed in comparison to December 31, 2019.

5.16 Information on provisions and assets due to deferred income tax realized in Q3 2019

- The balance of the provision for deferred income tax was increased by the amount of PLN 1 214 k

- The balance of the assets due to deferred income tax was decreased by the amount of PLN 194 k.

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 18

5.17 Information on significant purchase and sale transactions of fixed tangible assets

Did not occur.

5.18 Information on significant liability due to the purchase of fixed tangible assets

Do not occur.

5.19 Information on significant settlement due to court procedures

Do not occur.

5.20 Indication of adjustments of the previous periods

Do not occur.

5.21 Information on changes in the economic situation and business activity conditions, which affect

significantly the fair value of financial assets and liabilities of the entity

Do not occur.

5.22 Information on failure to pay any credit or loan or on breaching of the credit or loan agreement

Do not occur.

5.23 Significant transactions with the related entities under other conditions than market.

Did not occur.

5.24 Information on change in the classification of financial assets as a result of change of target or use of

such assets.

Did not occur.

5.25 Opinion of the Management Board concerning the possibility of published forecasts of results for

2020

The Company did not published the forecast of the financial results for 2020.

5.26 Wawel S.A. shareholders possessing directly or indirectly by the related entities at least 5% of votes

at the GMS of the Issuer:

Tab. 4

Shareholding as for the date of report for 2019

Share in

Number Number Share in

Name of shareholder votes at

of shares of votes capital

GMS

Hosta International AG z siedzibą w

781.761 781.761 52,13% 52,13%

Münchenstein (Szwajcaria)

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 19

MetLife OFE * 147.029 147.029 9,80% 9,80%

Aviva OFE Aviva Santander ** 84.201 84.201 5,61% 5,61%

Nationale-Nederlanden OFE ** 76.322 76.322 5,09% 5,09%

Change in shareholding from the date of forwarding the report for 2019 to the date of forwarding

the report for 1st quarter of 2020

There were no changes.

Shareholding as for the date of report for 1st quarter 2020

Share in

Number Number Share in

Name of shareholder votes at

of shares of votes capital

GMS

Hosta International AG z siedzibą w

781.761 781.761 52,13% 52,13%

Münchenstein (Szwajcaria)

MetLife OFE * 147.029 147.029 9,80% 9,80%

Aviva OFE Aviva Santander ** 84.201 84.201 5,61% 5,61%

Nationale-Nederlanden OFE ** 76.322 76.322 5,09% 5,09%

*) information on the number of shares given in accordance with the notification received by the Issuer pursuant to art.

69 in conjunction from art. 87 par. 1 point 3 lit. b of the Act on Public Offering, Conditions Governing the Introduction

of Financial Instruments to Organised Trading, and Public Companies dated July 29th 2005.

**) information on the number of shares given in accordance with the notification received by the Issuer pursuant to

art. 69 of the Act on Public Offering, Conditions Governing the Introduction of Financial Instruments to Organised

Trading, and Public Companies dated July 29th 2005.

5.27 Specification of the changes in Issuer’s shareholding by the managing and supervising person:

Tab. 8

Shareholding as for the date of report for 2019

Number Number

Managing person Type of held shares

of shares of votes

President of the Management

41 41 registered shares

Board – Dariusz Orłowski

Member of the Management

1 1 bearer shares

Board - Wojciech Winkel

Change in shareholding from the date of forwarding the report for 2019 to the date of forwarding

the report for 1st quarter of 2020.

There were no changes.

Shareholding as for the date of report for 1st quarter 2020

Number Number

Managing person Type of held shares

of shares of votes

President of the Management

41 41 registered shares

Board – Dariusz Orłowski

Member of the Management

1 1 bearer shares

Board - Wojciech Winkel

Condensed financial statemet for the1st quarter of 2020

Wawel S.A. 20

Tab. 6

Shareholding as for the date of report for 2019

Number Number

Supervising person Type of held shares

of shares of votes

Eugeniusz Małek 2 2 bearer shares

Paweł Bałaga 1 640 1 640 bearer shares

st

Change in shareholding from the date of forwarding the report for 1 quarter 2019 to the date of

forwarding the report for 1st quarter of 2020.

There were no changes.

Shareholding as for the date of report for 1st quarter 2020

Number Number

Supervising person Type of held shares

of shares of votes

Eugeniusz Małek 2 2 bearer shares

Paweł Bałaga 1 640 1 640 bearer shares

5.28 Proceedings in progress before the court, entity competent for the arbitrage proceeding or public

administration entity.

There are not any disputes.

5.29. Information on granting the guaranty for the credit or loan or awarding the warranty by the issuer.

The guarantees and warranties awarded by Wawel S.A. constituting at least 10% of the own equity of the

Issuer do not occur.

5.30 Other information significantly affecting the assessment of the financial standing and financial result

of the issuer.

Apart from the events described in this quarterly report, the Management Board is not aware of any other

important information that may have a significant impact on the assessment of the issuer's personnel,

property and financial situation.

Condensed financial statemet for the1st quarter of 2020

You might also like

- A04 T86uxmwsyll4x6ve.1Document44 pagesA04 T86uxmwsyll4x6ve.1citybizlist11No ratings yet

- Test Sheet 194: 2021 - 2022: Term: I: F/m&m/ep/4.9Document3 pagesTest Sheet 194: 2021 - 2022: Term: I: F/m&m/ep/4.9Lavanya SharmaNo ratings yet

- Balance de payement GabonDocument35 pagesBalance de payement GabonabondoengandzasteveneNo ratings yet

- EquityDocument3 pagesEquityyasrab abbasNo ratings yet

- A04 Zur57zgu4yzwvtfj.1Document47 pagesA04 Zur57zgu4yzwvtfj.1Paul BluemnerNo ratings yet

- Annual ReportDocument105 pagesAnnual ReportDedy SunNo ratings yet

- IFRS Reporting Specialist Case StudyDocument11 pagesIFRS Reporting Specialist Case StudyglmncubeNo ratings yet

- Financial Statements Fin202 STDocument17 pagesFinancial Statements Fin202 SThannlqs180026No ratings yet

- Development AssignmentDocument19 pagesDevelopment AssignmentMuhammad hanzla mehmoodNo ratings yet

- Web BS 2010 QuarterlyDocument1 pageWeb BS 2010 QuarterlyInés PcNo ratings yet

- Debt 3Document16 pagesDebt 3mohsin.usafzai932No ratings yet

- Nasr City Cons 12 2020EDocument48 pagesNasr City Cons 12 2020EAly A. SamyNo ratings yet

- Work Group 3Document6 pagesWork Group 3Khanh Ly TruongNo ratings yet

- LGE - 22 1Q - Separate - F - SignedDocument71 pagesLGE - 22 1Q - Separate - F - SignedMariam GaboNo ratings yet

- ICICI Prudential Pension Funds Abridged Financial StatementsDocument44 pagesICICI Prudential Pension Funds Abridged Financial StatementsSpl FriendsNo ratings yet

- Axis Bank - AR21 - Standalone Financial StatementsDocument80 pagesAxis Bank - AR21 - Standalone Financial StatementsArbaz TaiNo ratings yet

- Standalone Balance Sheet HighlightsDocument9 pagesStandalone Balance Sheet HighlightsLeo SaimNo ratings yet

- Co Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021Document3 pagesCo Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021gilton amadadiNo ratings yet

- Financial Statements for WPP 2006Document22 pagesFinancial Statements for WPP 2006Nhi NguyenNo ratings yet

- So Lieu Tai Chinh HAGL - Copy3.Document6 pagesSo Lieu Tai Chinh HAGL - Copy3.Dao HuynhNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Agricultural Development Bank Limited: Unaudited Financial Results (Quarterly)Document3 pagesAgricultural Development Bank Limited: Unaudited Financial Results (Quarterly)sanjiv sahNo ratings yet

- Hrta LK TW Iii 2020Document65 pagesHrta LK TW Iii 2020Alvina drNo ratings yet

- Cosco Example PDFDocument4 pagesCosco Example PDFBeatrice BallabioNo ratings yet

- Berger Paints Bangladesh Limited Statement of Financial PositionDocument8 pagesBerger Paints Bangladesh Limited Statement of Financial PositionrrashadattNo ratings yet

- Balance Sheet & SPL - EchoDocument59 pagesBalance Sheet & SPL - EchoPunkstaz Mevil BcharyaNo ratings yet

- Bal Jyoti English School Hoklabari 078-79Document10 pagesBal Jyoti English School Hoklabari 078-79Ragnar LothbrokNo ratings yet

- Axis Bank - AR21 - Consolidated Financial StatementsDocument48 pagesAxis Bank - AR21 - Consolidated Financial StatementsRakeshNo ratings yet

- PV OIl Financial AnalysisDocument20 pagesPV OIl Financial AnalysisNguyễn Minh ThànhNo ratings yet

- Icef Fy-2020-21 3Document8 pagesIcef Fy-2020-21 3Nishikant MishraNo ratings yet

- Coca ColaDocument10 pagesCoca ColaJelyn JagolinoNo ratings yet

- FY 2020 EMDE Megapolitan+Developments+TbkDocument126 pagesFY 2020 EMDE Megapolitan+Developments+TbkCaster XampakhNo ratings yet

- Mock Exam BSC - VDDocument32 pagesMock Exam BSC - VDRADHIKA BANSALNo ratings yet

- Interim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Document23 pagesInterim Consolidated Condensed Financial Statements For The Six Months 633c1a0975d75Сергей АнуфриевNo ratings yet

- AF21-036 BCKiT Laudert2020 - 01032020 - Vi - F (E)Document37 pagesAF21-036 BCKiT Laudert2020 - 01032020 - Vi - F (E)Nguyễn Trọng NghĩaNo ratings yet

- Financial Statement Analysis of Masan Company Masan GroupDocument24 pagesFinancial Statement Analysis of Masan Company Masan GroupTammy DaoNo ratings yet

- Financial Statements December 31, 2010 and 2009Document48 pagesFinancial Statements December 31, 2010 and 2009b21t3chNo ratings yet

- LK PT Ifishdeco Konsolidasian 2021Document74 pagesLK PT Ifishdeco Konsolidasian 2021Pramayurgy WilyakaNo ratings yet

- Review of Financial PerformanceDocument2 pagesReview of Financial Performancemian UmairNo ratings yet

- Qantas DataDocument31 pagesQantas DataChip choiNo ratings yet

- 2011H1-Consolidated - Financial - Report EvergreenDocument96 pages2011H1-Consolidated - Financial - Report EvergreenBaber ZubairiNo ratings yet

- Data June 2014-Q2Document1 pageData June 2014-Q2Amit MeenaNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- 100 - NHK 2020 Q1 FS - Sedar FinalDocument16 pages100 - NHK 2020 Q1 FS - Sedar FinalHoward QinNo ratings yet

- Coca-Cola and Pepsi Economic Analysis ReportDocument39 pagesCoca-Cola and Pepsi Economic Analysis ReportJing Xiong67% (3)

- IRMA Financial Accounting Exam Cash Flow AnalysisDocument5 pagesIRMA Financial Accounting Exam Cash Flow AnalysisDharampreet SinghNo ratings yet

- National Foods Finance QuizDocument2 pagesNational Foods Finance QuizTalha JavedNo ratings yet

- Chapter 2Document32 pagesChapter 2AhmedNo ratings yet

- Key Ratios 09 NokiaDocument3 pagesKey Ratios 09 NokiaAditya BistNo ratings yet

- PT Hartadinata Abadi TBK Dan Entitas Anak/and Its SubsidiariesDocument66 pagesPT Hartadinata Abadi TBK Dan Entitas Anak/and Its SubsidiariesDavid LeonardoNo ratings yet

- Realestate Annual Handbook 2018Document65 pagesRealestate Annual Handbook 2018Sayed DanishNo ratings yet

- PT Unilever Indonesia Tbk 2011 Annual ReportDocument10 pagesPT Unilever Indonesia Tbk 2011 Annual ReportHarwendah RengganisNo ratings yet

- 247806Document51 pages247806Jack ToutNo ratings yet

- Balance Sheet: ASAT31 MARCH, 2017Document2 pagesBalance Sheet: ASAT31 MARCH, 2017Mandeep BatraNo ratings yet

- Laporan Keuangan BOLT 31-12-2021 (1) - RemovedDocument9 pagesLaporan Keuangan BOLT 31-12-2021 (1) - RemovedLeni AnggraNo ratings yet

- QCT Energy Private Limited Financial Statements FY 2020-21Document10 pagesQCT Energy Private Limited Financial Statements FY 2020-21Swapnil WankhedeNo ratings yet

- Group 2 DataDocument41 pagesGroup 2 DataHùng Anh LươngNo ratings yet

- Análisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018Document8 pagesAnálisis Fundamental: USD in Millions Except Per Share Data. 2014 2015 2016 2017 2018andusotoNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Banking Awareness MCQs for IBPS PO Clerk Exam PrepDocument36 pagesBanking Awareness MCQs for IBPS PO Clerk Exam PrepRam IyerNo ratings yet

- Kisan Credit Card Explained in 40 CharactersDocument6 pagesKisan Credit Card Explained in 40 CharactersAshok RathodNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- F3Final MCBDocument107 pagesF3Final MCBShahzaib RahimNo ratings yet

- Banking & Financial Contacts 2Document7 pagesBanking & Financial Contacts 2Aditya TamminaNo ratings yet

- NPA in Banks PPT @Document10 pagesNPA in Banks PPT @MadhavNo ratings yet

- PARTNERSHIP LIQUIDATION CASH DISTRIBUTION AND JOURNAL ENTRIESDocument2 pagesPARTNERSHIP LIQUIDATION CASH DISTRIBUTION AND JOURNAL ENTRIESAndrea BreisNo ratings yet

- Contract of Indemnity AnalysisDocument19 pagesContract of Indemnity AnalysisImran PerwezNo ratings yet

- (499148095) DR MLC SolutionsDocument29 pages(499148095) DR MLC SolutionskvnnunzNo ratings yet

- Eastern Region Nov 2018 payroll report for Upper West Akim DistrictDocument1 pageEastern Region Nov 2018 payroll report for Upper West Akim DistrictLorlortor JuliusNo ratings yet

- Transfer DeedDocument1 pageTransfer DeedAli BukhariNo ratings yet

- Leverage Ratio FIN420 2023Document7 pagesLeverage Ratio FIN420 20232023466162No ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- CARD - Case Analysis SampleDocument51 pagesCARD - Case Analysis SampleCatherine Mae MacailaoNo ratings yet

- Superhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inDocument7 pagesSuperhouse Limited: Email: Share@superhouse - in Url: HTTP://WWW - Superhouse.inAmrut BhattNo ratings yet

- PhonePe Statement Sep2023 Mar2024Document20 pagesPhonePe Statement Sep2023 Mar2024Abhishek SalunkeNo ratings yet

- REPORTINGDocument8 pagesREPORTINGMUHAMMAD HUMZANo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aDocument19 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1aMiguel AmihanNo ratings yet

- NMC Self Declaration FormDocument12 pagesNMC Self Declaration Formजेनिश न्यौपानेNo ratings yet

- The Indian CRM MarketDocument6 pagesThe Indian CRM MarketChethan KumarNo ratings yet

- Android Hacker-S HandbookDocument2 pagesAndroid Hacker-S HandbookJack LeeNo ratings yet

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberNo ratings yet

- Engineering EconomicsDocument57 pagesEngineering Economicscharles gueta100% (1)

- Property, plant and equipment audit of SKDJGNRUIBIDUG CorporationDocument8 pagesProperty, plant and equipment audit of SKDJGNRUIBIDUG CorporationROMAR A. PIGANo ratings yet

- Solution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzDocument16 pagesSolution Manual For Ethical Obligations and Decision Making in Accounting Text and Cases 2nd Edition by MintzLoriSmithamdt100% (42)

- Chapter Two For Accounting 111Document31 pagesChapter Two For Accounting 111mohamad200579No ratings yet

- Bill of Exchange MaybankDocument3 pagesBill of Exchange MaybankBuayaz GamingNo ratings yet

- CRR SLR and AlltermsDocument139 pagesCRR SLR and Alltermschitransh90No ratings yet

- Loans and AdvancesDocument10 pagesLoans and AdvancesshalwNo ratings yet