0% found this document useful (0 votes)

85 views1 pageAudit Walkthrough Guide

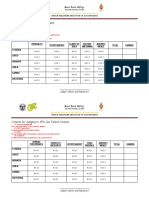

The document provides guidance on conducting a preliminary review of a prospective client's books before taking them on as an official client. It outlines specific areas to examine like assets, liabilities, equity, bank reconciliations, sales tax payments, income and expenses to evaluate the state of their books and determine how much cleanup work will be required.

Uploaded by

mah loveCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

85 views1 pageAudit Walkthrough Guide

The document provides guidance on conducting a preliminary review of a prospective client's books before taking them on as an official client. It outlines specific areas to examine like assets, liabilities, equity, bank reconciliations, sales tax payments, income and expenses to evaluate the state of their books and determine how much cleanup work will be required.

Uploaded by

mah loveCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd