Professional Documents

Culture Documents

Sas #25 - Accounting Information System

Uploaded by

Euli Mae SomeraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sas #25 - Accounting Information System

Uploaded by

Euli Mae SomeraCopyright:

Available Formats

ACC 100: Accounting Information System

Student Activity Sheet #25

Name: Class number:

Section: BSMA - SJ3 Schedule: Date:

Lesson title: Daily Chores in Quickbooks Materials:

Lesson Objectives: FLM Student Activity Sheets

1. Cash Management

References:

QuickBooks Simple Start for

Dummies

“Success is stumbling from failure to failure with no loss of enthusiasm.”

― Winston S. Churchill

A. LESSON PREVIEW / REVIEW

1) Introduction

The Cash Flow Planner lets you manage your business finances, forecast your cash flow,

and get actionable insights, in one place.

Please read the learning targets before you proceed to the succeeding activities. The learning

targets are your goals. Remember, you need to achieve your learning targets at the end of

the lesson.

2) Activity 1: What I Know Chart

What do you know about Recording a Sales Receipt in Quickbooks? Try answering the

questions below by writing your ideas under the What I Know column. You may use key words

or phrases that you think are related to the questions.

What I Know Questions: What I Learned (Activity 4)

How do you record sales receipt

using Quickbooks? 1. Select + New.

2. Select Sales receipt.

3. Select the customer from

the Customer dropdown. ...

4. Enter the sales info, such

as the payment method.

5. Enter line items for the

products and services you

sold.

6. When you're done, select

Save and send to email the

receipt.

This document is the property of PHINMA EDUCATION

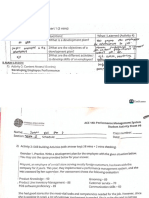

ACC 100: Accounting Information System

Student Activity Sheet #25

Name: Class number:

Section: Schedule: Date:

B. MAIN LESSON

1) Activity 2: Content Notes

Effortlessly manage your business cash flow right in QuickBooks

It’s an uncertain time for business, but the new cash flow planner can give you insight into your cash flow

for the next 90 days. View an overview of your cash flow, and gaze into the future for your business by

playing with future expense and income scenarios — without messing up your actual books.

Take control of your cash flow

Sync your bank to gain insight into your cash flow. Discover ways to improve it, like chasing overdue

invoices, and reviewing whether you really need those recurring expenses.

Gaze into your future

See how your cash flow might look in the next 90 days, by playing with potential purchases, investments

and income scenarios — without messing up your actual books.

See your cash flow projection

Stay prepared by forecasting money-in and money-out transactions over 30 and 90 days. Your data

imports and syncs automatically for up-to-the-minute cash flow analysis, without multiple spreadsheets.

➢ Gaze and play with your business’ future using the 90 day cash flow planner.

➢ Run and export reports including profit & loss, and balance sheet.

➢ Share a summary of your books with your accountant.

What is the Cash Flow Planner?

The Cash Flow Planner is an interactive tool that forecasts cash flow, the money going in and out for your

business over the next 90 days. It looks at your financial history to forecast future money in and money

out events. You can also add and adjust future events to see how certain changes affect your cash flow

without impacting your books.

You also have a Cash Flow Overview to get a picture of your cash flow position and take actions to

improve it including:

Money In – Overdue invoices, open invoices, quotes

Money Out – Overdue bills, open bills and other recurring expenses.

To view the Cash Flow Planner and Cash Flow Overview go to the Cash Flow left menu item on your

dashboard:

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Student Activity Sheet #25

Name: Class number:

Section: Schedule: Date:

How does the forecast work? What data is included?

The Cash Flow Planner chart uses historical data from your bank accounts connected to QuickBooks

Online to forecast future recurring income and expenses. This includes categorised and uncategorised

transactions. You can also manually include data to forecast cash flow by adding events that may occur

in the future.

The Cash Flow Planner chart does not include:

Credit card transactions

Transactions you’ve entered manually into QuickBooks

Multi-currency enabled files

Activity 3: Skill Building

Using Quickbooks as an accounting tool, why being cash flow positive is important to your

business?

An increase in a company's liquid assets is indicated by positive cash flow. This makes it

_________________________________________________________________________

possible for it to pay off debts, reinvest in its company, return money to shareholders,

_________________________________________________________________________

cover expenses, and act as a safety net against upcoming financial difficulties.

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

______________________

3

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Student Activity Sheet #25

Name: Class number:

Section: Schedule: Date:

Activity 4: What I know Chart, Part 2

Now let’s check your final understanding of Flexible Learning. I hope that everything about the

topic is clear to you. This time you must fill out the What I Learned column.

Activity 5: Check for Understanding and Keys to Correction

Independent Practice

Write TRUE if the statement is correct, otherwise write FALSE.

TRUE 1. The Cash Flow Planner chart uses historical data from your bank accounts connected to

QuickBooks Online to forecast future recurring income and expenses.

TRUE 2. The Cash Flow Planner includes categorised and uncategorised transactions. You can also

manually include data to forecast cash flow by adding events that may occur in the future.

TRUE 3. The Cash Flow Planner is an interactive tool that forecasts cash flow, the money going in

and out for your business over the next 90 days

C. LESSON WRAP-UP

1) Activity 6: Thinking about Learning

A. Work Tracker

You are done with this session! Let’s track your progress. Shade the session number you just

completed.

P1 P2 P3

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

B. Think about your Learning

1. Please read again the learning targets for the day. Were you able to achieve those learning

targets? If yes, what helped you achieve them? If no, what is the reason for not achieving them?

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

2. What question(s) do you have as we end this lesson?

___________________________________________________________________________

___________________________________________________________________________

__________________________________________________________________________

KEY TO CORRECTIONS:

Activity 3:

Answers may vary.

Activity 5:

1. TRUE

2. TRUE

4

This document is the property of PHINMA EDUCATION

ACC 100: Accounting Information System

Student Activity Sheet #25

Name: Class number:

Section: Schedule: Date:

3. TRUE

FAQs

Tips for Cashflow Management

4 tips for cash flow management

There are a number of tips for managing cash flow for your small business. Here are four to consider.

• Practice calculating it yourself: Calculating cash flow is fairly simple if you know your operating

expenses and your revenue. First, identify the period you want to calculate. Subtract the

business’s operating expenses for that period from the business’s revenue of the same period.

• Maintain some cash reserves: As a business owner, it’s not your job to anticipate every speed

bump on your journey. But it does help to have a rainy-day fund to pay for any damage you take

as a result. Having enough savings to help cover a month or two of expenses will help ensure

you never fall behind when business is slow.

• Focus on cash flow management, not profits: If your business invoices customers, you know

what it means to wait (and wait) to get paid. Consider offering discounts to customers who pay

early, and charging a late fee for those who miss their deadline. You might also adjust your

contract with customers, so invoice due dates are more air-tight. Otherwise, you might invest in

an invoicing software that can remind customers to pay on your behalf.

• Operating activities: You’ll soon learn it’s possible to be profitable while still experiencing slow or

negative cash flow. For instance, say you’ve sent out 10 invoices for $100 each, based on work

you did amounting to $50 per job. You’ve made a profit of $500. Alas, until your customers pay

those invoices, you’re in the hole (cash flow negative) by $500—the amount you invested in

those jobs. That’s why it’s important to put more stock into your cash flow than your profits.

Focusing on profits might give you an inaccurate picture of how your business is performing.

This document is the property of PHINMA EDUCATION

You might also like

- Daily Chores in QuickbooksDocument8 pagesDaily Chores in QuickbooksPrincess Nicole Posadas OniaNo ratings yet

- Sas #24 - Accounting Information SystemDocument6 pagesSas #24 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- Sas8 Acc100Document12 pagesSas8 Acc100XieNo ratings yet

- Daily Chores in Quickbook 2Document4 pagesDaily Chores in Quickbook 2Princess Nicole Posadas OniaNo ratings yet

- Sas #23 - Accounting Information SystemDocument4 pagesSas #23 - Accounting Information SystemEuli Mae SomeraNo ratings yet

- The Expenditure Cycle 1Document15 pagesThe Expenditure Cycle 1Princess Nicole Posadas OniaNo ratings yet

- Solution Manual For Managerial Accounting 9th Edition by CrossonDocument28 pagesSolution Manual For Managerial Accounting 9th Edition by Crossonenviecatsalt.ezeld100% (46)

- Lesson 1Document22 pagesLesson 1Not Going to Argue Jesus is KingNo ratings yet

- Full Download Solution Manual For Principles of Financial Accounting 11th Edition by Needles PDF Full ChapterDocument36 pagesFull Download Solution Manual For Principles of Financial Accounting 11th Edition by Needles PDF Full Chapterpaltryaricinexftu5100% (19)

- QuickBooks SyllabusDocument10 pagesQuickBooks SyllabusNot Going to Argue Jesus is KingNo ratings yet

- Week 1 Module 1 Chapter 1 Statement of Financial Position 2Document10 pagesWeek 1 Module 1 Chapter 1 Statement of Financial Position 2Joyce TanNo ratings yet

- A. Course Code - Title: B. Module No - Title: C. Time Frame: D. Materials: 1Document15 pagesA. Course Code - Title: B. Module No - Title: C. Time Frame: D. Materials: 1firestorm riveraNo ratings yet

- IIANHS LASformatDocument7 pagesIIANHS LASformatDystral CliffNo ratings yet

- Republic of The Philippines Department of Education Public Technical - Vocational High SchoolsDocument10 pagesRepublic of The Philippines Department of Education Public Technical - Vocational High SchoolsKristel AcordonNo ratings yet

- Budgeting: Accounting CycleDocument3 pagesBudgeting: Accounting CycleDyane CruzNo ratings yet

- Administer Subsidiary Accounts and LedgersDocument43 pagesAdminister Subsidiary Accounts and LedgersrameNo ratings yet

- Transaction Cycle - Topic2 - Revenue CycleDocument25 pagesTransaction Cycle - Topic2 - Revenue CycleMarjorie LopezNo ratings yet

- ACCT 1026 Lesson ONEDocument13 pagesACCT 1026 Lesson ONEAnnie RapanutNo ratings yet

- Quarter 1Week6Modu: Let's Talk Accounting Cycle in BusinessDocument26 pagesQuarter 1Week6Modu: Let's Talk Accounting Cycle in BusinessTaj MahalNo ratings yet

- Recorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksDocument52 pagesRecorded in The Accounting Books. "Non-Accountable Events" Are Not Recorded in The Accounting BooksAnnie RapanutNo ratings yet

- Fnal - Module 8 Assesing Business OperationDocument48 pagesFnal - Module 8 Assesing Business OperationMarvin Panlilio0% (1)

- Entrep Module 3 Assesing Business OperationDocument48 pagesEntrep Module 3 Assesing Business OperationLove EsponjaNo ratings yet

- The Expenditure Cycle 2Document12 pagesThe Expenditure Cycle 2Princess Nicole Posadas OniaNo ratings yet

- Accounting Information System Term PaperDocument5 pagesAccounting Information System Term Paperafdtuwxrb100% (1)

- SABTLECTURE07Document26 pagesSABTLECTURE07namudajiyaNo ratings yet

- Q1 LAS Business Finance 12 Week 4 3Document6 pagesQ1 LAS Business Finance 12 Week 4 3Paulo AragonNo ratings yet

- Q1 LAS Business Finance 12 Week 4Document6 pagesQ1 LAS Business Finance 12 Week 4Gerlie BorneaNo ratings yet

- Acb3 02Document42 pagesAcb3 02rameNo ratings yet

- Accounts Volume 1Document503 pagesAccounts Volume 1Utkarsh100% (1)

- Introduction of Accounting: Self-Learning ModuleDocument15 pagesIntroduction of Accounting: Self-Learning ModuleAdrian Nicole SangoyoNo ratings yet

- Topic 1 Handout Cover Page 2023 Term3Document4 pagesTopic 1 Handout Cover Page 2023 Term3Sakura HayashiNo ratings yet

- Abdul Sami FADocument76 pagesAbdul Sami FAAbdul SamiNo ratings yet

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- FY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Document37 pagesFY19 - QBDT Client - Lesson-6 - Enter Sales Information - BDB - v2Nyasha MakoreNo ratings yet

- Accounting I Syllabus: Instructor's Name and Contact InformationDocument6 pagesAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonNo ratings yet

- FAF Session 1 Introduction To AccountingDocument98 pagesFAF Session 1 Introduction To AccountingJennifer Mae LangamanNo ratings yet

- Nefas Silk Poly Technic College: Learning GuideDocument43 pagesNefas Silk Poly Technic College: Learning GuideNigussie BerhanuNo ratings yet

- Module Acctg1Document49 pagesModule Acctg1Belle TurredaNo ratings yet

- BI Cia 2 - 2128343Document13 pagesBI Cia 2 - 2128343LIZA GOYAL 2128343No ratings yet

- SAS#1-ACC104 With AnwerDocument6 pagesSAS#1-ACC104 With AnwerartificerrrrNo ratings yet

- Initial Assignment L3 - .Document3 pagesInitial Assignment L3 - .sasdadNo ratings yet

- M4 Assign No 1 Qtn-1Document2 pagesM4 Assign No 1 Qtn-1Aliah RomeroNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument14 pagesLearning Guide: Accounts and Budget ServicerameNo ratings yet

- Fabm 2Document19 pagesFabm 2leiNo ratings yet

- AIS 1 ModuleDocument58 pagesAIS 1 Modulefrancis dungcaNo ratings yet

- Acb3 02Document42 pagesAcb3 02gizachew alekaNo ratings yet

- Salesforce Quip How-To Guide Sales Process Transformation EbookDocument20 pagesSalesforce Quip How-To Guide Sales Process Transformation EbookBayCreativeNo ratings yet

- Far Module Prelim Complete Chapter 1 To 5docx CompressDocument40 pagesFar Module Prelim Complete Chapter 1 To 5docx CompressKorra SamiNo ratings yet

- Computerised AccountingDocument54 pagesComputerised AccountingsuezanwarNo ratings yet

- FY19 - QBDT Client - Lesson-5 - Use Other Accounts - BDB - v2Document29 pagesFY19 - QBDT Client - Lesson-5 - Use Other Accounts - BDB - v2Nyasha MakoreNo ratings yet

- Syll Fin Acc MBADocument3 pagesSyll Fin Acc MBAmakNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 (FABM1)Document9 pagesFundamentals of Accountancy, Business and Management 1 (FABM1)A.No ratings yet

- Accounting Cycle Assignment HelpDocument6 pagesAccounting Cycle Assignment Helpfpxmfxvlf100% (1)

- Accounting Information System DissertationDocument6 pagesAccounting Information System DissertationDltkCustomWritingPaperMurfreesboro100% (1)

- Unit 3 Accounting Information and Its Applications: ObjectivesDocument12 pagesUnit 3 Accounting Information and Its Applications: ObjectivesRushi RoyNo ratings yet

- Unit of Competence Module Title LG Code: TTLM Code: Learning GuideDocument34 pagesUnit of Competence Module Title LG Code: TTLM Code: Learning GuideNigussie Berhanu100% (1)

- Pindi Yulinar Rosita - 008201905023 - Session 1Document4 pagesPindi Yulinar Rosita - 008201905023 - Session 1Pindi YulinarNo ratings yet

- Rolo Company - Comprehensive Accounting ProblemDocument29 pagesRolo Company - Comprehensive Accounting ProblemFaith SindanumNo ratings yet

- Financial Accounting CourseworkDocument7 pagesFinancial Accounting Courseworkafjyadcjesbdwl100% (2)

- Business and Transfer TaxationDocument16 pagesBusiness and Transfer TaxationEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - ProblemsDocument3 pagesBusiness and Transfer Taxation - ProblemsEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - Multiple ChoiceDocument7 pagesBusiness and Transfer Taxation - Multiple ChoiceEuli Mae SomeraNo ratings yet

- Business and Transfer Taxation - T or FDocument3 pagesBusiness and Transfer Taxation - T or FEuli Mae SomeraNo ratings yet

- ACC 100 Test BanksDocument15 pagesACC 100 Test BanksEuli Mae SomeraNo ratings yet

- MODULE 14 The Conversion CycleDocument4 pagesMODULE 14 The Conversion CycleEuli Mae SomeraNo ratings yet

- MODULE 16 Financial Reporting and ManagementDocument7 pagesMODULE 16 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- MODEL 13 The Conversion CycleDocument4 pagesMODEL 13 The Conversion CycleEuli Mae SomeraNo ratings yet

- MODULE 15 Financial Reporting and ManagementDocument5 pagesMODULE 15 Financial Reporting and ManagementEuli Mae SomeraNo ratings yet

- BAM 031 Part 1 - HandoutDocument25 pagesBAM 031 Part 1 - HandoutEuli Mae SomeraNo ratings yet

- MODULE 12 The Conversion CycleDocument6 pagesMODULE 12 The Conversion CycleEuli Mae SomeraNo ratings yet

- Somera Sas#5Document2 pagesSomera Sas#5Euli Mae SomeraNo ratings yet

- Somera Sas#8Document3 pagesSomera Sas#8Euli Mae SomeraNo ratings yet

- Somera Sas#6Document3 pagesSomera Sas#6Euli Mae SomeraNo ratings yet

- p2 Exam With AnsDocument8 pagesp2 Exam With AnsEuli Mae SomeraNo ratings yet

- Somera Sas#7Document3 pagesSomera Sas#7Euli Mae SomeraNo ratings yet

- Module 1-4Document3 pagesModule 1-4Euli Mae SomeraNo ratings yet

- Bituminous CoalDocument93 pagesBituminous CoalDSGNo ratings yet

- FINACC1 - Cash and Cash Equivalents + ReceivablesDocument3 pagesFINACC1 - Cash and Cash Equivalents + ReceivablesJerico DungcaNo ratings yet

- Change in Developer Policy PF-51A 18.02.2015Document3 pagesChange in Developer Policy PF-51A 18.02.2015Vijay ManjrekarNo ratings yet

- Bank Management SystemDocument5 pagesBank Management SystemShreenath SrivastavaNo ratings yet

- Types of Financial InnovationsDocument16 pagesTypes of Financial InnovationsrameNo ratings yet

- Code 5: Project 1: Bank Reconciliation Statement and Transaction (Level III V5)Document7 pagesCode 5: Project 1: Bank Reconciliation Statement and Transaction (Level III V5)Aye Tube100% (2)

- Business Regulatory Framework (M. Law) (Regular)Document127 pagesBusiness Regulatory Framework (M. Law) (Regular)Yogesh SaindaneNo ratings yet

- Prnciples of Banking JAIIB 4Document91 pagesPrnciples of Banking JAIIB 4Poovizhi RajaNo ratings yet

- Q. 16 Functions of A Merchant BankerDocument3 pagesQ. 16 Functions of A Merchant BankerMAHENDRA SHIVAJI DHENAKNo ratings yet

- Ofsdw Ug E29494 01Document242 pagesOfsdw Ug E29494 01ganeshsrinivasan3191No ratings yet

- Sukuk Market in Saudi ArabiaDocument19 pagesSukuk Market in Saudi ArabiafathalbabNo ratings yet

- Article On Deposits-Vinod Kothari ConsultantsDocument9 pagesArticle On Deposits-Vinod Kothari ConsultantsNishant JainNo ratings yet

- Capital Markets - Module 1 - Week 1Document3 pagesCapital Markets - Module 1 - Week 1Jha Jha CaLvez100% (3)

- Verbally-Abusive Wal-Mart Staff Misinformed Public and Misrepresented "Return PolicyDocument20 pagesVerbally-Abusive Wal-Mart Staff Misinformed Public and Misrepresented "Return Policyadvnprj1No ratings yet

- Iso 20022 Migration and Interoperability Considerations v1Document9 pagesIso 20022 Migration and Interoperability Considerations v1shanrimazNo ratings yet

- Personal Selling Presentation: Presented By: Rumsha Suhail Sanjana Sumaira Khaliq Muhammad NehalDocument38 pagesPersonal Selling Presentation: Presented By: Rumsha Suhail Sanjana Sumaira Khaliq Muhammad NehalSpamsong onwTwiceNo ratings yet

- Fema CDocument5 pagesFema Capi-3712367No ratings yet

- Fee Structure: 2015 - 2016 IntakeDocument23 pagesFee Structure: 2015 - 2016 IntakeAsad RazaNo ratings yet

- Corporate GovernanceDocument9 pagesCorporate GovernanceRajiv LamichhaneNo ratings yet

- Bankruptcy Accounts For IndividualsDocument5 pagesBankruptcy Accounts For Individualskennedy100% (1)

- Financial Analysis and Reporting ModuleDocument163 pagesFinancial Analysis and Reporting ModuleMarc JeromeNo ratings yet

- LTOADocument21 pagesLTOAvijay sagar ReddyNo ratings yet

- QUIZ FinanceDocument39 pagesQUIZ FinanceAbhishek YadavNo ratings yet

- 8889 20221031 StatementDocument4 pages8889 20221031 Statementacftravel23No ratings yet

- Mico Metals Vs CADocument27 pagesMico Metals Vs CAEarl LarroderNo ratings yet

- Unit - 3 Technical AnalysisDocument24 pagesUnit - 3 Technical AnalysisNishant SharmaNo ratings yet

- New Product DevelopmentDocument5 pagesNew Product DevelopmentMd Maruf HasanNo ratings yet

- ENG Merchant 4275Document7 pagesENG Merchant 4275thirdNo ratings yet

- Order in Respect of Greater Kolkata Infrastructure LimitedDocument19 pagesOrder in Respect of Greater Kolkata Infrastructure LimitedShyam SunderNo ratings yet

- Memo Announcements To Continuing Students - First Semester of 2024 Academic Year - All StudentsDocument6 pagesMemo Announcements To Continuing Students - First Semester of 2024 Academic Year - All Studentsdennis silumbuNo ratings yet