Professional Documents

Culture Documents

Classroom Exercises

Uploaded by

Janielle NaveOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classroom Exercises

Uploaded by

Janielle NaveCopyright:

Available Formats

Classroom Exercises: Transfer Pricing in Multinational Corporations (MNC)

1. Inter-Land, Inc., transfers a product between its U.S. Division and its Danish division. The product sells

for $45 in the United States. The cost of shipping to Denmark is $3.20, and Danish duty is $9. The U.S.

division pays approximately $4.50 per unit for advertising and related selling expenses. Using the

comparable uncontrolled price method, calculate the transfer price.

2. The U.S. division of Inter-Land, Inc., purchases a product from the Danish division, which sells for $80

per unit in the United States. The U.S. division typically has a 25 percent markup on goods. Calculate the

transfer price under the resale price method.

3. Howell Company has a division in the United States that produces computerized thermostats for heating

units. These thermostats are transferred to a division in Luxembourg. The thermostats can be (and are)

sold externally in the United States for $30 each. It costs $2.35 per thermostat for shipping and $2.70 per

thermostat for import duties. When the thermostats are sold externally, Howell spends $3 per thermostat

for commissions and an average of $1 per thermostat for advertising.

a. Which Section 482 method should be used to calculate the allowable transfer price?

b. Using the appropriate Section 482 method, calculate the transfer price.

4. Assume that Valley Electronics transfers a component from a U.S. division to a German division for

$11.70. The landing costs are $2.50 per unit, and the avoidable commissions and advertising total $0.50

per unit. The component has a market price within the United States of $10. Is the company complying

with the comparable uncontrolled price method? Would the IRS be concerned if the transfer price is

greater than the market price after adjustments? Why or why not?

5. Assume that a manufacturing division in the United States transfers a component to a marketing division

for resale. The resale price is $8, the gross profit percentage (gross profit divided by sales) is 25 percent,

the landing costs total $1.20 per unit. Suppose that the actual transfer price (excluding landing costs) is

$4.50. Should the company continue transferring at $4.50?

6. Suppose that a U.S. division has excess capacity. A European division has offered to buy a component

that would increase the U.S. division’s utilization of its capacity. The component has an outside market in

the United States with a unit selling price of $12. The variable costs of production for the component are

$6. Landing costs total $2 per unit, and an internal transfer avoids $1.25 per unit of marketing costs. The

European division can purchase the component locally for $12.

a. Ignoring income taxes, what is the minimum price that the European division should pay for the

component (including landing costs)? The maximum price?

b. Assuming that the joint benefit is split equally, what is the transfer price?

7. Sprint, Inc., has a Pennsylvania-based division that produces electronic components, with a very strong

domestic market for circuit no. 222. The variable production cost is $140, and the division can sell its

entire output for $190. Sprint is subject to a 30% income tax rate.

Alternatively, the Pennsylvania division can ship the circuit to a division that is located in Mississippi, to

be used in the manufacture of a global positioning system (GPS). Information about the global positioning

system and Mississippi's costs follow.

Selling price: $380

Circuit shipping and handling fees to Mississippi: $10

Labor, overhead, and additional material costs of GPS: $120

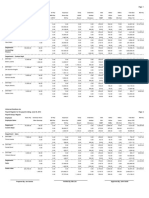

a. Assume that the transfer price for the circuit was $160. How would Pennsylvania's divisional

manager likely react to a corporate decision to transfer the circuits to Mississippi? Why?

b. Calculate Pennsylvania income, Mississippi income, and income for the company as a whole if

the transfer took place at $160 per circuit.

c. Assuming that transfers took place at a price higher than $160, would the revised price increase,

decrease, or have no effect on Sprint's income? Briefly explain.

d. Assume that Sprint moved its GPS production facility to a division located in Germany, which is

subject to a 45% tax rate. The transfer took place at $180. Shipping fees (absorbed by the

overseas division) doubled to $20; the German division paid an import duty equal to 10% of the

transfer price; and labor, overhead, and additional material costs were $150 per GPS. If the

German selling price of the GPS amounted to $450, calculate Pennsylvania income, German

income, and income for Sprint as a whole.

e. Suppose that U.S. and German tax authorities allowed some discretion in how transfer prices were

set. Given the difference in tax rates, should Sprint attempt to generate the majority of its income

in Pennsylvania or Germany? Why?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Practice Problem SetDocument22 pagesPractice Problem SetJanielle NaveNo ratings yet

- ScriptDocument4 pagesScriptJanielle NaveNo ratings yet

- Practice Exercise - Journalizing Government Accounting Transactions-NAVEDocument12 pagesPractice Exercise - Journalizing Government Accounting Transactions-NAVEJanielle NaveNo ratings yet

- Govt Acctg Practice ExcercisesDocument13 pagesGovt Acctg Practice ExcercisesJanielle NaveNo ratings yet

- Lecture Notes On Earnings Quality and ManagementDocument7 pagesLecture Notes On Earnings Quality and ManagementJanielle Nave100% (1)

- BUS COM NotesDocument15 pagesBUS COM NotesJanielle NaveNo ratings yet

- LPDocument1 pageLPJanielle NaveNo ratings yet

- LP 2Document8 pagesLP 2Janielle NaveNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Problems On Operating CostingDocument2 pagesProblems On Operating Costingcoolstuf4uNo ratings yet

- Entrepreneurship: Managing Your Personal FinancesDocument38 pagesEntrepreneurship: Managing Your Personal FinancesRamon BrionesNo ratings yet

- SmartPlant Spoolgen Plus White Paper March 2012 PDFDocument40 pagesSmartPlant Spoolgen Plus White Paper March 2012 PDFrkarthikmtmrNo ratings yet

- Technopreneurship - EthicsDocument10 pagesTechnopreneurship - EthicsCamilogs100% (1)

- Outline 7eDocument37 pagesOutline 7eAbigail LeronNo ratings yet

- WorkScheduleAsgmnt ExcelRT BeforeUploadDocument11 pagesWorkScheduleAsgmnt ExcelRT BeforeUploadDhinakaranNo ratings yet

- March Month Bill PDFDocument1 pageMarch Month Bill PDFPronceNo ratings yet

- Studi Kasus LorealDocument3 pagesStudi Kasus LorealDesni0% (1)

- Business FinanceDocument5 pagesBusiness FinanceJojie Mae GabunilasNo ratings yet

- Arthur Meidan (Auth.) - Marketing Financial Services-Macmillan Education UK (1996) PDFDocument343 pagesArthur Meidan (Auth.) - Marketing Financial Services-Macmillan Education UK (1996) PDFUmesh Karn100% (1)

- COMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpDocument5 pagesCOMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpAustin Viel Lagman MedinaNo ratings yet

- Marketing Case Study-Southwest Airlines Write-UpDocument7 pagesMarketing Case Study-Southwest Airlines Write-UpShardonay ReneeNo ratings yet

- Nestle Corporate StrategyDocument6 pagesNestle Corporate Strategyayema kashifNo ratings yet

- Payroll RegisterDocument2 pagesPayroll RegisterqueensophiaNo ratings yet

- Class Exercise Final Accounts and End of Year AdjusmentsDocument1 pageClass Exercise Final Accounts and End of Year AdjusmentsJoshua OtienoNo ratings yet

- Majid Project Latest2Document18 pagesMajid Project Latest2kit katNo ratings yet

- Executive Track: Week No CourseDocument4 pagesExecutive Track: Week No CoursebullworthinNo ratings yet

- Section D ACCA PM NotesDocument9 pagesSection D ACCA PM NotesCorrinaNo ratings yet

- MOADocument26 pagesMOAShubhi SrivastavaNo ratings yet

- Gonzales - Assignment 2 (BSMA 3-8) ANSWERSDocument6 pagesGonzales - Assignment 2 (BSMA 3-8) ANSWERSGONZALES, IAN ROGEL L.No ratings yet

- Clicks IAR2023 Integrated+ReportDocument84 pagesClicks IAR2023 Integrated+Reporttf9wgz2ysdNo ratings yet

- 4 Pillars of Corporate Gov.Document3 pages4 Pillars of Corporate Gov.Anita Khan76% (17)

- Organizational Structure of YahooDocument1 pageOrganizational Structure of Yahoofatemajan100% (1)

- Project in MarketingDocument10 pagesProject in Marketingdrea gayleNo ratings yet

- Code of EthicsDocument1 pageCode of EthicsEdelman100% (4)

- Programme HR ConclaveDocument7 pagesProgramme HR ConclaveFiras AjmalNo ratings yet

- CASE STUDY SHRMDocument4 pagesCASE STUDY SHRMAshita Singla100% (2)

- Mis Test 2Document72 pagesMis Test 2Keno GrantNo ratings yet

- Bread Is The Staff of Life : Krendel' BakeryDocument19 pagesBread Is The Staff of Life : Krendel' BakeryMehboob AhmedNo ratings yet

- Introduction of EmigallDocument2 pagesIntroduction of EmigallJetNo ratings yet