Professional Documents

Culture Documents

Electricity Regulation in UK

Electricity Regulation in UK

Uploaded by

Adetunji Taiwo0 ratings0% found this document useful (0 votes)

11 views30 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views30 pagesElectricity Regulation in UK

Electricity Regulation in UK

Uploaded by

Adetunji TaiwoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 30

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A...

Electricity regulation in the United Kingdom: overview

by Kirsti Mass

and James England, Mayer Brown LLP

Country Q&A | Law stated as at 01-Jan-2021 |England, United Kingdom, Wales

A Q&A guide to electricity regulation in the UK.

The Q&A gives a high level overview of the domestic electricity market, including domestic electricity companies,

electricity generation and renewable energy, transmission, distribution, supply and tax issues. It covers the regulatory

structure; foreign ownership; import of electricity; authorisation and operating requirements; trading between

generators and suppliers; rates and conditions of sale and proposals for reform,

Overview

Electricity market

Regulatory framework

Electricity companies

Main companies

Foreign ownership

Insolvency

Import of electricity

Electricity generation and renewable energy

Sources of electricity generation

Imports

Authorisation and operating requirements

Electricity transmission

‘Authorisation and operating requirements

Transmission charges

System balancing

Electricity distribution

Authorisation and operating requirements

Distribution charges

Electricity supply

‘Authorisation and operating requirements

Trading between generators and suppliers

Electricity price and conditions of sale

Statutory powers

022 Thomson Reuters. All rights reserved. 1

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

Tax issues

Insurance

Reform

Contributor profiles

Kirsti Massie

James England

Overview

Electricity market

1. What is the role of the electricity market in your jurisdiction?

Overview

‘The UK clectricity market is a fully privatised and competitive electricity market organised around the following licensed

activites:

+ Generation

+ Transmission

+ Distibuton

+ Supply including smart metering),

+ Interconnection.

‘The Electricity Act 1989 provided forthe re-organisation of the UK's electricity industry and paved the way forthe privatisation

ofthe sector. The old Area Electricity Boards were superseded by the Regional Electricity Companies. The Central Electricity

Generating Board, which owned the UK's generating assets, was split into four new companies, which were subsequently

privatised. The UK's transmission assets were transferred to National Grid pl.

Since its privatisation, the electricity sector has grown to include a multiplicity of participants. Companies in the generation

sector range ftom multinational corporates to smaller independent generators operating a single generation plant, The UK

transmission network is owned and maintained by the following regional transmission companies:

2022 Thomson Rev

rs, All rights reserved. 2

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

+ National Grid Electricity Transmission ple (NGET).

+ Scottish Power Transmission Ltd,

+ Scottish Hydro Electric Transmission,

+ Norther Ireland Electricity Ltd,

Offshore transmission networks are subject to a separate competitive tender regime.

There are 14 licensed distribution network operators (DNOs) in Britain, Bach is responsible for a particular regional area, There

are also @ number of small networks contained within the areas covered by the DNOs. These smaller networks are owned and

operated by independent network operators,

Licensed suppliers are responsible for the supply and sale of electricity to end customers, Full competition was introduced into

Britain’s electricity retail market in 1999 with both domestic and industrial customers able to select and readily change their

electricity supplier.

While this Q&A addresses the electricity sector in the UK, the focus is primarily on the arrangements in England and Wales,

with limited references to specific arrangements in Scotland and Northern Ireland,

Government policy objectives

The Department for Business, Energy and Industrial Strategy (BEIS) is the governmental department responsible for policy

setting in the electricity sector. BEIS has three main policy goals

+ Ensuring the UK's energy system is reliable and secure.

+ Delivering affordable energy to households and businesses.

+ Supporting clean growth and promoting global action to tackle climate change.

Recent trends

Recent issues in the UK electricity sector inelude the following:

+ Climate change target. On 27 June 2019, the UK set a legally binding target to reduce emissions to net-zero by

2050 (as required under the Climate Change Act 2008, as amended by the Climate Change Act 2008 (2050 Target,

Amendment) Order 2019 (S1 2019/1056),

+ Energy White Paper. BEIS's much awaited UK Energy White Paper, which socks to address the transformation of

the UK electricity sector in line with the UK government’ climate goals for 2050, is set for publication in autumn

2020, having originally been scheduled for release in June 2019. There are currently no further details as to the likely

publication date.

+ UK Capacity Market. The UK Capacity Market is designed to ensure reliable capacity given projected increases

in demand, the imminent closure of a number of coal and nuclear power plants and the increased penetration of

intermittent renewable generation,

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

In 2018, questions arose as to the whether the EU Commission's decision that the UK Capacity Market complied with

BU state aid rules had been correctly made. The challenge fed to a temporary suspension of the UK Capacity Market,

‘The matter has been reconsidered and final confirmation received that the Capacity Market is compliant with EU state

aid rules, The scheme is now back in operation.

‘The legislation that implements the Capacity Market contains a requirement for the UK government to undertake a

five-yearly review of the scheme. BEIS's review, published in July 2019, concluded that the scheme has been working

‘well and no major changes were proposed. However, incremental changes to the Capacity Market going forward are

anticipated.

+ Brexit. Up until now, the EU has played a large role in UK energy policy. However, Britain’s imminent departure from

the EU

nn 1 January 2021 looks set to change that.

In preparation for 1 January 2021, interconnectors, code administrators and market participants in Great Britain have

been carrying out contingency planning for the end of the transition period. Depending on the outcome of free trade

agreement negotiations:

+ the administrators of the industry codes (the rules of the electricity system) will need to ensure that the codes are

updated;

+ imterconnectors will need to put in place altemative trading arrangements, as well as understand the processes for

potential reassessment of their Transmission System Operators certifications;

+ market participants in Great Britain will need to register with an EU regulatory authority under Regul:

1227/2011 on wholesale energy market integrity and transparency (REMIT),

mn (EU)

‘Much of the BU legislation applicable to the electricity sector has already been implemented into UK legislation and, as

‘a result, significant disruption on 1 January 2021 as a result of the UK leaving the EU is not anticipated.

+ Government response to the 2019 novel coronavirus disease (COVID-19) pandemie.In response to commercial

delays brought on by the COVID-19 pandemic, on 28 July 2020 the UK government made the Electricity (Individual

Exemptions from the Requirement for a Transmission Licence) (Coronavirus) Order 2020. The Electricity Order came

into force on 3 October 2020 and provides limited time exemptions from the obligation to hold a transmission licence

in tender round five and tender round six of the offshore transmission owner regime for certain named offshore wind

farms,

Regulatory structure

2. What is the regulatory framework for the electricity sector?

Regulatory framework

The main legislation regulating the electricity sector in the UK includes the:

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

+ Electricity Act 1989.

+ Competition Act 1998,

+ Utilities Act 2000.

+ Enterprise Act 2002.

+ Energy Acts of 2004, 2008, 2010, 2013 and 2016.

+ Climate Change Act 2008,

+ Directive 2010/75/EU on industrial emissions (Industrial Emission Directive).

+ Electricity and Gas (Market Integrity and Transparency) (Enforcement ete.) Regulations 2013 (S/ 2013/1389)

+ Domestic Gas and Electricity (Tariff Cap) Act 2018,

The Energy Act 2013 is the most significant recent legislation, implementing the UK government's electricity market reform

(EMR) plans. At its core, the Energy Act 2013 aims to ensure that, as older power plants are taken offline, the UK will remain

able to generate enough energy to meet increased demand, while also attracting the investment needed to decarbonise the sector,

which is essential ifthe UK government is to meet its net-zero carbon targets by 2050,

Two of the key mechanisms included in the Energy Act 2013 are the:

tracts for Difference (Cf) scheme, which introduced long-term contracts to provide stable and predictable pricing

to incentivise companies to invest in low-carbon generation (see Question 8%.

+ Capacity Market, designed to ensure adequate capacity for the purposes of security supply, including provisions to

allow electricity demand reduction to be delivered (see Question 1)

Regulatory authorities

The main authorities in the electricity sector are the:

+ Department for Business, Energy and Industrial Strategy (BEIS). BEIS is the governmental department

responsible for setting energy policy, including electricity. It is supported by 41 agencies and public bodies.

+ ‘The Gas and Electricity Markets Auth:

the:

(GEMA). GEMA's powers and duties are set out in statute, including in

+ Blectricity Act 1989;

+ Uilites Act 2000;

+ Competition Act 1998;

+ Enterprise Act 2002; and

+ Bhergy Acts of 2004, 2008, 2010 and 2011

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

GEMA also derives powers from EU legislation that has direct effect in respect of energy regulation, much of which

will be retained in UK law under the UK Withdrawal Act 2020 at the end of the transition period,

GEMA's stated purpose is to protect consumers now and in the future by working to deliver a greener, fairer energy

system. GEMA is comprised of non-executive and executive members, and a non-executive chair appointed by the

Secretary of State, who all meet at least ten times a year. GEMA delegates its day-to-day functions to Ofgem,

+ The Office of Gas and Electricity Markets (Ofgem). Ofgem is the regulator for clectrcity (and gas) markets in Great

Britain. Ofgem's primary responsibility is to implement government policy and to ensure that the electricity retail

‘market works in the interests of consumers by monitoring the market and, where necessary, taking action to strengthen

‘competition or to enforce the rules with which licensed participants must comply.

+ ‘The Competition and Markets Authority (CMA). The CMA is responsible for promoting competition for the benefit

of consumers within and outside the UK, The CMA has concurrent powers with Ofgem to prohibit anti-competitive

arrangements and the abuse of a dominant position in the electricity sector.

Electricity companies

Main companies

3. What are the main companies involved in electricity generation, transmission, distribution and supply?

Generation

The largest wholesale electricity generation companies in the UK are

+ EDF Energy.

+ Centrica

+ RWE,

+ EON.

+ SSE.

+ Scottish Power.

+ Drax.

+ Engie

+ Uniper.

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

Other large electricity generators include:

+ Intorgen

+ EPH

+ Vito

+ Orsted

+ ReR,

‘There are also a large number of smaller generators who own and operate single-site generating plants

Transmission

‘There are four companies that own the onshore transmission system in the UK:

+ National Grid, through its subsidiary NGET for England and Wales.

+ Scottish Power Transmission Ltd for southern Scotland.

+ Scottish Hydro-Electric Transmission ple for Northern Scotland.

+ Norther Ireland Electricity Ltd for Northern Ireland,

‘The transmission system in England, Wales and Scotland as a whole is operated by National Grid Electricity System Operator

(NGESO), which is responsible for ensuring the stable and secure operation of the national electricity transmission system,

Distribution

Ofgem grants licences to DNOs to distribute electricity for the purpose of supply to any premises in the UK. These companies

‘own and operate the system of cables and towers that connect the high-voltage transmission network to end users. There are 14

licensed DNOs in Great Britain, owned and maintained by six different operators:

+ Electricity North West Limited.

+ Northem Powergrid:

+ Powergrid (Yorkshire) ple;

+ Norther Powergrid (North East) Limited.

+ Scottish and Souther nergy:

+ Scottish Hydro Electric Power Distribution ple;

+ Southern Electric Power Distribution ple;

+ ScottishPower Energy Networks:

2022 Thomson Reuters, All rights reserved.

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

+ SP Distribution Lid;

+ SP Manweb ple

+ UK Power Networks:

+ London Power Networks ple;

+ South Eastern Power Networks ple;

+ Basten Power Networks pl.

+ Western Power Distribution:

+ Wester Power Distribution (East Midlands) ple;

+ Western Power Distribution (West Midlands) ple;

+ Westem Power Distribution (South West) ple;

+ Westem Power Distribution (South Wales) pl.

Supply

‘The UK's largest private energy suppliers are known collectively as the "Big Six” and comprise:

+ British Gas,

+ EON.

+ EDF Energy.

+ Npower:

+ Scottish Power.

+ SSE.

‘Between them they supply gas and electricity to over 50 million homes and businesses across the UK.

‘There are currently around 60 energy suppliers in total that provide gas and electricity in the UK. The number has reduced

slightly reduced since its peak in 2018, when there were more than 70 energy companies supplying domestic power, according

to Ofgem March to June 2018 staisties.

Unbundling requirements

In 2009, the EU Third Energy Package introduced provisions aimed at unbundling the electricity sector. The main objective of

‘the unbundling provisions is to ensure independence of electricity (and gas) transmission services from generation and supply,

thereby preventing the establishment of large vertically integrated entities, with the overall aim of increasing competition,

2022 Thomson Reuters, All rights reserved. 3

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

‘The unbundling requirements we

2011, which in turn amended section 6 of the Electricity Act 1989.

transposed into UK law through the Electricity and Gas (Internal Markets) Regulations

Foreign ownership

4, Are there any restrictions concerning the foreign ownership of electricity companies or assets?

In general, the UK government does not impose any foreign ownership restrictions on UK electricity companies or assets (the

cone exception potentially being the ownership of nuclear assets). However, Ofgem has an overriding responsibility to maintain

security of supply and so has the ability to review and scrutinise inbound foreign investment. Ofgem also has concurrent powers

with the CMA to assess competition in the energy market.

Insolvency

5.Are there any special insolvency regimes that apply to companies operating in this sector?

A special administration regime exists for "protected energy companies” (PECs) under section 154(5) of the Energy Act 2004.

In the UK electricity market, PECs are holders of a licence granted under section 6(1)(b) or (c) of the Electricity Act 1989 (in

other words, holders of electricity transmission or distribution licences),

Jims to ensure thal essential services to consumers remain secure and uninterrupted in the

's must provide Ofgem with financial health information on an ongoing basis to enable

Ofgem to identify potential financial difficultics at an carly stage. Interconnector licensees are not PECs and are consequently

not subject to the special administration regime.

The special administration regim«

event a PEC becomes insolvent. PE

A special insolveney regime known as "energy supply company administration” also applies to energy supply companies defined

in section 94(5) of the Energy Act 2011, which, for electricity, are companies that hold an electricity supply licence granted

under section 6(1)(d) of the Electricity Act 1989. The framework for the special insolvency regime applicable to electricity

supply companies is set out in Part 2 of Chapter 5 of the Energy Act 2011 with further detail provided in the Energy Supply

Company Administration Rules 2013.

An energy supply company administration is initiated through an application to court for an energy administration order. The

application is made either by the Secretary of State or the Gas and Electricity Markets Authority (GEMA). An insolvency

practitioner is then appointed as an energy administrator.

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

A “supplier of last resort” regime is also available to Ofgem and can be used as an alternative to appointing an energy supply

company administrator.

A special insolvency regime also applies to Smart Meter Licensees under the Smart Meters Act 2018 and the Smart Meter

Communication Licensee Administration (England and Wales) Rules 2020. This regime is based on the Energy Supply

Company Administration regime.

Import of electricity

6, To what extent is electricity imported andior exported?

Great Britain currently benefits from $ gigawatts (GW) of interconnector capacity:

+ 2GWto France (IFA),

+ 1GWto Netherlands (BritNed),

+ 1GW to Belgium (Nemo).

+ 500 megawatts (MW) to Northern Ireland (Moyle).

+ SQOMW to Republic of

land (East West)

A number of other interconnectors are planned o in the process of being developed with about 10GW of new interconnection

capacity proposed by 2025.

The GB regulatory regime applicable to interconnectors is largely designed to accommodate EU legislation and requirements.

There are two main regimes that apply to interconnectors:

+ ‘The "cap & floor" regime, which provides a regulated tariff route for developers.

+ ‘The “exemption basis" regime whereby developers seek exemptions from applicable provisions of the EU Third

Energy Package and relevant domestic legislation.

(Ownership and operation of an interconnector isa licensed activity,

Brexit clearly has important implications for interconnectors going forward and much will depend on the outcome of ongoing

trade negotiations,

Import of electricity

The UK has been a net importer of electricity since QI 2010.

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

In 2019, 24,556 gigawatt hours (GWh) of electricity were recorded by the UK government as having been imported into the UK.

Export of electricity

In 2019, total exports of electricity from the UK are recorded by the UK government as amounting to 3,385GWh.

Elects

'y generation and renewable energy

Sources of electricity generation

7. What are the main sourees of electricity generation?

Fossil fuels

In previous years, around 50% ofall electricity supplied in the UK was generated by fossil fuels, predominantly by natural gas.

However, in the second quarter of 2020, 35.1% of UK electricity was generated by fossil fuels (34.4% from natural gas, 0.5%

from coal and 2.9% from oil). This was only the second time that UK electricity generation by fossil fuel sources had dropped

below 40%, with the UK achieving its first coal-free month of electricity generation between April and June 2020.

Nuclear fission

The UK currently has 15 nuclear reactors producing around 21% of the UK's electricity, but the UK's existing nuclear plants will

close gradually over time, with 35% of existing nuclear generation capacity to close by 2030. Although plans for construction

of a generation of new reactors ate underway, political tensions around the use of nuclear generation and its cost have slowed

progress. I is anticipated that the UK's Energy White Paper scheduled to be published in 2020 will clarify the future of nuclear

energy generation in the UK,

cnergy represented 17.6% of the UK's electricity generation in the second quarter of 2020 according to UK government

Renewable energy

Between April and June 2020, renewable energy sources accounted for 44.6% of electricity generation in the UK, up from

35.6% for the same period in 2019. Wind accounted for the vast majority of renewable electricity generation, which saw a 53%

rise compared to the same period in 2019. February 2020 was the first month on record when more electricity was produced by

‘wind farms than by gas-fired power stations, Between April and June 2020, the UK also set a new record for the longest period

the UK grid has operated without coal. The increased prevalence of renewable generation in the UK energy mix has resulted

in the National Grid Electricity System Operator (NGESO) having to spend increased resources on balancing the network

Imports

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

The UK has also been a net importer of electricity since 2010 and imports electricity from Ireland, France, Belgium and the

Netherlands when economical to do so (see Question 6)

8, Are there any government policies, targets or incentives in place to encourage the use of renewable or low

carbon energy?

‘The UK's greenhouse gas emissions have fallen steadily over the last 30 years, In 2019, the UK's emissions were 435.2 metric

tonnes of carbon dioxide equivalent (45% below 1990 levels and 32% below 2008 levels). Recent falls in UK emissions ean

largely be attributed to progress in the power sector, with power cmissions falling 67% from 2008 to 2019.

The Contracts for Difference (CADs) scheme under the Energy Act 2013 is the UK government's m:

support low-carbon electricity generation, CfDs are long-term contracts that effectively provide a pricing hedge for renewable

generation. In 2019, the CfD auction in the UK contracted a total of 5.SGW, of which 5.2GW was attributable to offshore

‘wind, The sites contracted are expected to generate 29 terawatt hour of electricity per annum, which equates to roughly 9%

of the UK's electricity,

in mechanism to

Renewable energy targets

‘The Climate Change Act 2008 (2050 Target Amendment) Order 2019 amended the Climate Change Act 2008 by introducing

a target of at least a 100% reduction of greenhouse gas emissions (compared to 1990 levels) in the UK by 2050. In effect, net-

zero means that a level of emissions can continue, providing they are offset by appropriate mechanisms, including trading. The

Order came into force on 27 June 2019.

Government policies/incentives

The UK's March 2020 Budget included several green initiatives, including a pledge to invest a minimum of GBP800 million in

carbon capture and storage (CCS) infrastructure to establish CCS clusters in two UK sites by 2030 (the first by the mid-2020s).

(Changes tothe tax scheme for gas and clectricity were also proposed, which will in effect raise gas prices for certain commercial

and industrial consumers, and a new "green gas levy" on household gas consumption will be phased in over time.

In June 2020, the Climate Change Committee noted that Department for Business, Energy and Industrial Strategy (BEIS)'s

Energy White Paper (scheduled to be published in the Autumn 2020) should include clear steps to promote a resilient and

flexible energy system.

9, What are the main obstacles to the development of renewable energy?

Despite the fact that generating electricity from solar and wind is becoming increasingly cheaper, a number of obstacles remain

+0 developing renewable energy in the UK. The key challenges of moving toward a low carbon economy are:

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

+ Intermittency. From a technical standpoint, the intermittent nature of wind and solar power make it more diffieu!

balance supply and demand, The increased penetration of renewable generation into the UK energy mix requires the

‘market structure to evolve. This has led to grid modernisation, including a transition towards smart grids, together with

increased research and investment into energy storage systems.

+ Storage. Although advanced storage systems have the potential to create significant environmental and economic

benefits, outdated regulatory policy and a lack of standardisation in the market create challenges. Regulatory policy is,

lagging behind the energy storage technology that exists today, Wholesale market rules and retail rules will also need to

‘be updated to better accommodate storage and the full range of value-add benefits it provides.

+ Implementation of net-zero and changing societal behaviour. Implementation of the UK's commitment to net-zer0

will require significant and complicated changes. To achieve that target, electricity production and use would need

to increase substantially to meet heating and transport demands, as fossil fuels still account for about 80% of energy

used for heating and transport in the UK. National Grid has previously stated that it could be ready to implement a zero

‘emissions system as early as 2025, but that this would require significant investment.

10, Are there any plans to build new nuclear power stations?

In 2006, former British prime minister Tony Blair endorsed a new generation of nuclear power stations, whereby new reactors

‘would be built on existing nuclear sites, replacing those to be decommissioned over time,

In 2011, the National Policy Statements for Energy Infrastructure were approved. These contain the policies by which

applications for major energy projects are judged, which include new generation nuclear power facilities. New nuclear power

stations were subsequently proposed at:

+ Oldbury in South Gloucestershire.

+ Wylti on the island of Anglesey in Wales.

+ Moorside in Cumbria,

+ Bradwell B in Essex

+ Sizewell Cin Suffolk

+ Hinkley Point C in Somers.

Of the six sites originally identified as being potentially suitable for new nuclear facilites, only Hinkley Point C is under

construction. The Sizewell C and Bradwell B plants are awaiting approval. Oldbury, Wylfa and Moorside have either had plans

suspended or abandoned,

Hinkley Point C is a project to construct a 3.2GW nuclear power plant with two EPR reactors (a third-generation pressurised

water reactor). EDF Energy owns a 66% majority stake in the project with Chinese state-owned China General Nuclear Power

Electricity regulation in the United Kingdom: overview, Practical Law Country Q&A.

Corporation (CGN) the minority 33% stakeholder. After lengthy delays, construction on the site began on 11 December 2018.

‘The plant isnot expected to start generating power before 2025.

Sizewell C is also a project to build a 3.2GW power station with two EPR reactors. It is majority owned by EDF Energy,

with CGN holding a 20% stake in the development phase. Progress on the proposed site was severely stalled by planning

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working For The Future of Scotland: GFG AllianceDocument15 pagesWorking For The Future of Scotland: GFG AllianceAdetunji TaiwoNo ratings yet

- Installation Instructions: Door Control TS 981Document52 pagesInstallation Instructions: Door Control TS 981Adetunji TaiwoNo ratings yet

- Transaction Date: Reference Number: Sender: Transaction Amount: Amount in Words: Transaction Type: Receiver: Account Number: Receiving Bank: RemarksDocument1 pageTransaction Date: Reference Number: Sender: Transaction Amount: Amount in Words: Transaction Type: Receiver: Account Number: Receiving Bank: RemarksAdetunji TaiwoNo ratings yet

- Representative Vehicles For The Driving Test: Version July 2022Document2 pagesRepresentative Vehicles For The Driving Test: Version July 2022Adetunji TaiwoNo ratings yet

- Please Note Any Latecomers Risk Being Turned AwayDocument2 pagesPlease Note Any Latecomers Risk Being Turned AwayAdetunji TaiwoNo ratings yet

- New Salary ChatDocument1 pageNew Salary ChatAdetunji TaiwoNo ratings yet

- En 3rb2283-4aa1Document6 pagesEn 3rb2283-4aa1Adetunji TaiwoNo ratings yet

- Lagos State Building Control Agency (Lasbca) : Ministry of Physical Planning and Urban DevelopmentDocument27 pagesLagos State Building Control Agency (Lasbca) : Ministry of Physical Planning and Urban DevelopmentAdetunji TaiwoNo ratings yet

- Immigration Skills Charge: Page 1 of 13 Published For Home Office Staff On 08 February 2023Document13 pagesImmigration Skills Charge: Page 1 of 13 Published For Home Office Staff On 08 February 2023Adetunji TaiwoNo ratings yet

- Leicester 28 Sep 2022Document1 pageLeicester 28 Sep 2022Adetunji TaiwoNo ratings yet

- Rano RecruitmentDocument7 pagesRano RecruitmentAdetunji TaiwoNo ratings yet

- 2021.03.03 Job Offer Letter YetundeDocument1 page2021.03.03 Job Offer Letter YetundeAdetunji TaiwoNo ratings yet

- Afam Generator Output - Neutral Point CubicalDocument7 pagesAfam Generator Output - Neutral Point CubicalAdetunji TaiwoNo ratings yet

- FWC Own It Scheme - UpdatedDocument1 pageFWC Own It Scheme - UpdatedAdetunji TaiwoNo ratings yet

- Weekly Market Review 04062021Document2 pagesWeekly Market Review 04062021Adetunji TaiwoNo ratings yet

- Electrical Design Engineer JD (2) (1) - 1Document2 pagesElectrical Design Engineer JD (2) (1) - 1Adetunji TaiwoNo ratings yet

- Assembly Plan GeneratorDocument3 pagesAssembly Plan GeneratorAdetunji TaiwoNo ratings yet

- Job Description - Electrical Software Engineer Aug 2022 ST - GD Senior Software Engineer 29-9-2022 (3) - 1Document3 pagesJob Description - Electrical Software Engineer Aug 2022 ST - GD Senior Software Engineer 29-9-2022 (3) - 1Adetunji TaiwoNo ratings yet

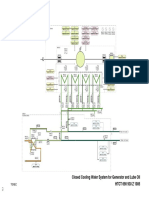

- CCWS For Generator and Lube OilDocument1 pageCCWS For Generator and Lube OilAdetunji TaiwoNo ratings yet

- Works InfarstructureDocument8 pagesWorks InfarstructureAdetunji TaiwoNo ratings yet

- Afam Cooler Operating Instruction For Generator Type WYDocument26 pagesAfam Cooler Operating Instruction For Generator Type WYAdetunji TaiwoNo ratings yet

- Water Treatment PanelDocument8 pagesWater Treatment PanelAdetunji TaiwoNo ratings yet

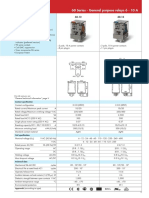

- Features: 60 Series - General Purpose Relays 6 - 10 ADocument6 pagesFeatures: 60 Series - General Purpose Relays 6 - 10 AAdetunji TaiwoNo ratings yet

- 270MVA Generator TransformerDocument310 pages270MVA Generator TransformerAdetunji TaiwoNo ratings yet

- Electrical Relay Maintenance ScheduleDocument14 pagesElectrical Relay Maintenance ScheduleAdetunji TaiwoNo ratings yet

- Nigeria KDR-1200D HMI ManualDocument27 pagesNigeria KDR-1200D HMI ManualAdetunji TaiwoNo ratings yet

- Circulating Water System and Station Alternative CoolingDocument6 pagesCirculating Water System and Station Alternative CoolingAdetunji TaiwoNo ratings yet

- Exciter AVR Gloryence Drawings For Unit 4Document43 pagesExciter AVR Gloryence Drawings For Unit 4Adetunji TaiwoNo ratings yet

- Unit5 6.6kV Switchgear DrawingsDocument51 pagesUnit5 6.6kV Switchgear DrawingsAdetunji TaiwoNo ratings yet

- LearDocument151 pagesLearAdetunji TaiwoNo ratings yet