Professional Documents

Culture Documents

CA Fodder - Batch 4 Lyst6060

Uploaded by

HARESHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Fodder - Batch 4 Lyst6060

Uploaded by

HARESHCopyright:

Available Formats

Fodder Material for RBI Grade B

2022- Phase 2 – English

Descriptive

1|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

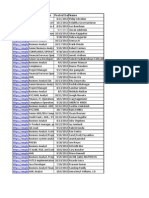

Contents

Topic 1: What is Bank Recapitalization and discuss the drivers and concerns associated with it? ......................... 3

Topic 2: What is e-RUPI and its significance in Indian economy? ............................................................................ 4

Topic 3: What is Sagarmala Program and its significance? ...................................................................................... 6

Topic 4: What is Payment System Operators (PSOs)? Discuss the RBI’s New Framework for Payment Systems

Topic 5: What is Current Account Deficit (CAD)? Also discuss the reasons and threats of increasing CAD. ........... 9

Topic 6: Discuss the India’s service sector export target of USD 1 trillion in brief? ...............................................10

Topic 7: What are derivatives? Discuss the SEBI ban on derivative trade in agriculture sector? ..........................12

Topic 8: What is Carbon Trading? Discuss the Significance of an efficient Carbon trading market in India? ........13

Topic 9: Discuss the status of NPAs in agriculture sector and scope of an ARC? ...................................................14

Topic 10: What is Informal Economy? Discuss the present scenario and challenges related to informal sector? 16

2|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

Topic 1: What is Bank Recapitalization? Discuss the drivers and concerns associated with

the same.

Introduction

• Bank recapitalization means infusing more capital in state-run banks so that they meet the

capital adequacy norms.

o Capital adequacy ratio (CAR) or capital to risk weighted assets ratio (CRAR) is the ratio

of regulatory capital funds to risk-weighted assets.

• Primary responsibility of recapitalization of PSBs often devolves on the Government, being the

majority shareholder in these banks.

• Recently, Centre has announced to recapitalize weak Public Sector Banks (PSB) as part of Rs

15000 crore capital infusions.

Drivers of Bank Recapitalization

• To meet regulatory requirements of capital adequacy: The regulatory architecture is globally

framed by the Basel Committee on Banking Supervision. So far, three sets of Basel norms have

been issued (refer box).

• Credit Growth: To create a virtuous cycle of investment and jobs, the banks should be healthy

enough to lend to healthy firms and borrowers.

• Tackling NPAs: Any recapitalization will strengthen the capital base of the banks. It will help

them write-off bad loans.

• Stimulus to Economy: It will pull down lending rates, spur aggregate demand, and put idle

factories to work, exhaust capacity and spark investment.

• Saving important banks: Bank bailouts, mainly via recapitalization, have historically been

undertaken to protect failing banks that are large and systemically important.

Concerns rose against recapitalization

• Fiscal deficit: Bailing out public-sector banks will either increase the fiscal deficit or lead to

cuts in welfare and capital expenditures. About Basel Norms

• No intrinsic change in governance: Public funds or taxpayer money is being provided year

after year to a set of intermediaries, without any intrinsic changes in the governance of these

lenders.

• Impact working culture: Banks will not take adequate precautions when they are lending

when they know that the government will step in to help if the loans turn sour.

• No Accountability: Neither linked to the banks’ performance nor efficiency, bank

recapitalization has been ad-hoc and without absence of any accountable policy guidelines.

Conclusion

• Structural Reforms: A key recommendation of the P.J. Nayak committee was that the

government should form a Bank Investment Company for professionalizing the running of

these banks and their boards.

• Criteria for infusion: Criteria for fund infusion, once finalized, may be consistently applied

across all PSBs, however in case of variation, reasons should be well documented.

3|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• Better Monitoring: There should be an effective monitoring system in place and this system

should ensure fulfillment of the intended objectives of fund infusion.

• Autonomy for banks: For a durable remedy to NPAs, PSBs must be given adequate functional

autonomy and operational flexibility and bureaucratic and political interference must be

consciously minimized.

• Modern HR management: Re-skilling the existing staff, along with direct recruitment of

specialists, is needed to address the talent issue, especially in domains like forex, treasury, IT,

data, and research etc.

Topic 2: What is e-RUPI and its significance in Indian economy?

Introduction

• The Indian government has recently launched an electronic voucher based digital payment

system e-RUPI.

• It is a cashless and contactless method for digital payment. It is a Quick Response (QR)

code or SMS string-based e-voucher, which is delivered to the mobile of the users.

o e-RUPI is backed by the existing Indian rupee as the underlying asset and specificity

of its purpose makes it different to a virtual currency and puts it closer to a voucher-

based payment system.

• Through this, user will be able to redeem the voucher without needing a card, digital

payments app, or internet banking access, at the service provider.

• It connects the sponsors of the services with the beneficiaries and service providers in a

digital mode without any physical interface.

• The system is pre-paid in nature and hence, assures timely payment to the service

provider without the involvement of any intermediary.

o The mechanism also ensures that the payment to the service provider is made only

after the transaction is completed.

• There are already many countries using the voucher system for example the US, Colombia,

Chile, Sweden, Hong Kong, etc.

Issuing Entities & Beneficiary Identification

• It has been developed by the National Payments Corporation of India on its Unified

Payments Interface (UPI) platform, in collaboration with the Department of Financial

Services, Ministry of Health & Family Welfare, and National Health Authority.

• It has boarded banks that will be the issuing entities.

o Any corporate or government agency will have to approach the partner banks, which

are both private and public-sector lenders, with the details of specific persons and the

purpose for which payments must be made.

• The beneficiaries will be identified using their mobile number and a voucher allocated by a

bank to the service provider in the name of a given person would only be delivered to that

person.

Expected Use and Benefits

4|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• In government sector it is expected to ensure a leak-proof delivery of welfare services and

can also be used for delivering services under schemes meant for providing drugs and

nutritional support under Mother and Child welfare schemes, drugs & diagnostics under

schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies etc.

o Even the private sector can leverage these digital vouchers as part of their

employee welfare and Corporate Social Responsibility (CSR) programmes.

Significance in Indian Economy

• The main objective and long-term vision behind e-RUPI is financial inclusion of unbanked

citizens and bridging the digital gap.

• The government is already working on developing a Central Bank Digital Currency and the

launch of e-RUPI could potentially highlight the gaps in digital payments

infrastructure that will be necessary for the success of the future digital currency.

• The Reserve Bank of India (RBI), has also mentioned that there are at least four reasons

why digital currencies are expected to do well in India:

o Increasing Penetration: There is increasing penetration of digital payments in the

country that exists alongside sustained interest in cash usage, especially for small

value transactions.

o High Currency to GDP Ratio: India’s high currency to Gross Domestic Product

(GDP) ratio holds out another benefit of CBDCs.

✓ Cash-to-GDP Ratio or Currency in Circulation (CIC) to GDP Ratio or simply

currency-to-GDP ratio shows the value of cash in circulation as a ratio of

GDP.

o Spread of Virtual Currencies: The spread of private virtual currencies such as

Bitcoin and Ethereum may be yet another reason why CBDCs become important

from the point of view of the central bank.

o Central bank digital currencies might also cushion the general public in an

environment of volatile private virtual currencies.

Conclusion

It will not only satisfy India’s increasing appetite for digital payments and crypto currencies like

Bitcoin, Ethereum, and more, along with it will also literate Indian people more about digital

currencies and digital system.

These types of digital currencies simply involve the nation’s current fiat currency, the rupee,

taking on a digital avatar. However, it would require a major legal overhaul since our current

system is built to deal only with physical currency but will help in setting a stage for the RBI’s

digital currency or CBDC.

5|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

Topic 3: What is Sagarmala Program? Discuss its significance.

Introduction

• The Sagarmala is a series of projects to leverage the country’s coastline and inland waterways

to drive industrial development.

• The concept of Sagarmala was approved by the Union Cabinet on March 25, 2015. As part of

the programme, a National Perspective Plan (NPP) for the comprehensive development of

India's 7,500 km coastline, 14,500 km of potentially navigable waterways and the maritime

sector was prepared which was released in April 2016, at the Maritime India Summit 2016.

• It aims to achieve

o Port modernization and new port development

o Port connectivity enhancement

o Port-led industrialization

o Coastal community development.

• Implementation of the projects identified under the Sagarmala Programme will be taken up

by the relevant Ports, State Governments / Maritime Boards, Central Ministries, mainly

through private or Public Private Partnership (PPP) mode.

• The financial assistance is provided to State Government and other MoPSW agencies for port

infrastructure projects, coastal berth projects, Road and Rail projects, fishing harbours, skill

development projects, cruise terminal and unique projects such as Ro-Pax ferry services etc.

• 802 projects worth Rs. 5.48 lakh Crore under the Sagarmala program targeted to be executed

by 2035 out of which 194 projects worth Rs. 99,000 Crore have been completed.

Significance of the program

• Reduce the logistic cost: The core vision of the Sagarmala programme is to reduce the

logistics cost for EXIM and domestic trade with minimal infrastructure investment.

o Under Sagarmala Programme, endeavor is to provide enhanced connectivity between

the ports and the domestic production/consumption centers.

• Increasing Efficiency

o Modern governance of major ports: A new era has begun for the administration of

major ports in India, in which they will have greater autonomy in decision making,

adopting the 'Landlord Model' of development and providing world class port

infrastructure.

o Ease of Doing Business (EODB) in Major Ports and Shipping Sector

✓ Seamless Cargo movement: It also aims at simplifying procedures used at ports

for cargo movement and promotes usage of electronic channels for

information exchange leading to quick, efficient, hassle-free and seamless

cargo movement.

✓ Improvement of operational efficiency: It aims to undertake business process

re-engineering to simplify processes and procedures in addition to

modernizing and upgrading the existing infrastructure and improved

mechanisation.

6|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• Aid Economy: Strong marine sector will aid economy. Sagarmala meets all the critical

elements of a Blue Economy – port efficiency and modernization, port connectivity, port-

linked industrialization, and coastal community development.

o Sagarmala could boost India’s merchandise exports to $110 billion by 2025 and create

an estimated 10 million new jobs (four million in direct employment).

o Development of port-based smart cities and other urban infrastructure to improve

standards of living.

• Aid Regional growth: India’s consolidation of strategic intent in the Indian Ocean region is a

signal to the global trade community that, as a member of the global comity, it will strive to

keep international shipping channels free from any threats.

o The Sagarmala initiative will also allow India to revive its old trade links with

traditional African, West Asian and South-east Asian entrepots.

• Coastal Community Development: Promoting sustainable development of coastal

communities through skill development & livelihood generation activities, fisheries

development, coastal tourism etc.

o It also aims to create a community development Fund to provide funding for such

projects and activities.

• Promote Skill development: Deen Dayal UpadhyayGrameen Kaushalya Yojna Sagarmala

Convergence Programme, under Ministry of Rural Development, to enable skilling of coastal

population, trained more than 1,900 candidates.

Conclusion

• India’s maritime sector is widely believed to be on the cusp of a revolution and is expected

to grow significantly with increases in international and domestic trade volumes.

• Modernizations of port infrastructure have been the focus of the Government under the

Sagarmala Programme and ports have taken several initiatives under it.

• Also, requisite technologies and laws are in place to promote the working of this sector, much

more needs to be done on both the cargo and cruise fronts to ensure continued progress in

this regard

Topic 4: What is Payment System Operators (PSOs)? Discuss the RBI’s New Framework

for Payment Systems Operators.

Introduction

• A payment system is a system used to settle financial transactions through the transfer of

monetary value and consist of the various mechanisms that facilitate the transfer of funds

from one party (the payer) to another (the payee).

• A payment system includes the participants (institutions) and the users (customers/clients),

the rules and regulations that guide its operation and the standards and technologies on

which the system operates.

7|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

o The Board for Regulation and Supervision of Payment and Settlement Systems (BPSS),

a sub-committee of the Central Board of the RBI is the highest policy making body on

payment systems in India.

Payment System Operators (PSOs)

• PSOs by virtue of services they provide and the construct of models on which they operate,

largely outsource their payment and settlement-related activities to various other entities.

• It is an institution which has been granted an authorisation for the operation of a payment

system.

RBI’s new framework for Payment Systems Operators

• Recently, the Reserve Bank of India (RBI) has issued a framework for payment and settlement

related activities by payment system operators.

o This framework is issued under provisions of Payment and Settlement Systems Act,

2007.

o The Payment and Settlement Systems Act, 2007 provides for the regulation and

supervision of payment systems in India and designates the RBI as the authority for that

purpose and all related matters.

• Key points to new framework:

o Its objective is to put in place minimum standards to manage risks in outsourcing of

payment and settlement-related activities including tasks such as on boarding

customers and IT-based services.

o Now the licensed non-bank Payment System Operators (PSOs), cannot outsource core

management functions.

✓ Core management functions include risk management and internal audit,

compliance, and decision-making functions such as determining compliance

with KYC norms.

o It will be applicable to all service providers, whether located in India or abroad.

• As per the framework, PSOs will have to exercise due diligence, put in place sound and

responsive risk management practices for effective oversight, and manage the risks arising

from such outsourcing of activities.

• It has been done as there is a potential area of operational risk associated with outsourcing

by payment system operators and participants of authorized payments systems.

Conclusion

• Since, India is the second-fastest digital adapter among 17 of the most-digital economies

globally, and rapid digitization does require forward-looking measures to boost cyber

security.

• It is important for the corporate or the respective government departments to find the gaps

in their organizations and address those gaps and create a layered security system, wherein

security threat intelligence sharing is happening between different layers.

8|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

Topic 5: What is Current Account Deficit (CAD)? Also discuss the reasons and threats of

increasing CAD.

Introduction

Current Account Deficit (CAD)

• Balance of Payments (BoP) records the transactions in goods, services, and assets between

residents of a country with the rest of the world for a specified time period typically a year.

o When viewed from the perspective of investment-savings dynamics, the current

account can also be expressed as the difference between national (both public and

private) savings and investment.

• One of the two main accounts in the Balance of Payments (BoP), CAD records exports and

imports in goods and services and transfer payments of a country.

o When exports exceed imports, there is a trade surplus and when imports exceed

exports there is a trade deficit.

o Transfer payments are receipts received by the residents ‘for free’, without any present

or future payments in return. It includes remittances, gifts and grants.

• Capital account is the second account, recording all international purchases and sales of assets

such as money, stocks, bonds, etc. for a specified time, usually a year

Primary reasons behind India’s CAD

• Increased domestic demand/consumer spending due to domestic economic growth which is

reflected in revival of imports post-pandemic recovery.

• Uncompetitive exports due to unfavorable policies, exchange rate or lack of essential goods

exports.

• Increased Energy imports due to increasing demand and lower domestic production. E.g., in

2021-22, India’s domestic crude oil production fell by 2.67%.

• Rise in Global Commodity Prices, especially high import commodities such as crude oil, gas,

coal, edible oils, gold, etc.

Potential threats from increasing CAD

• Based on historical perspective, India can sustain a CAD of 2.5-3.0% of GDP without getting

into an external sector crisis (Economic Survey 2021-22). But rising geo-political risks, elevated

global commodity prices, new Covid-19 variants fear and looming threat of US monetary policy

normalization can widen CAD with other threats such as:

o Pull out of foreign institutional investors or limited capital flow. E.g., the Taper Tantrum

of 2013.

o Costly macroeconomic adjustments due to free fall in currency exchange rate.

o Inflationary concerns leading to further reduction in domestic savings, leading to lower

investments or foreign borrowing to fund growth needs.

✓ In the short-term, such foreign borrowings may help a debtor but in the long-

term it is worrisome due to concerns over returns from investors and rise in debt

to GDP ratio.

9|P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• Payment imbalances, leading to BoP crisis as observed in the Asian Financial Crisis (1997) and

the recent Sri Lankan crisis.

• Recent contraction in Forex Reserves and import coverage are first signs of slowed or reversed

capital flows. Between October 2021 and March 2022, Forex reserves contracted from US$

642 billion to US$ 607 billion.

Conclusion

• To be prepared to face external shocks, India should build higher Forex Reserves and further

improve the external sector resilience through steps such as:

o Increase domestic production of oil and gas with faster adoption of renewable energy

fuels such as solar, hydrogen etc.

o Import substitution under Atma Nirbhar Bharat with increased exports through best

use of Free Trade Agreements.

✓ Fair valuation of Rupee can help in keeping the exports competitive. Also, steps

can be taken to curb nonessential imports such as gold, mobiles, and electronics.

• Maintain Capital inflows through continued Ease of Doing Business reforms and gain investors’

confidence through FDI reforms for ease of flow of foreign investments.

• Starting Fiscal Consolidation through tight monetary policy to control inflation and promote

savings to control CAD. For example, as suggested by the NK Singh Committee.

o For example, keep external debt to GDP ratio low, especially short-term debt due to

higher volatility.

Topic 6: Discuss the India’s service sector export target of USD 1 trillion in brief.

Introduction

• India is the world’s seventh-largest services exporter.

• The services sector is a key driver of India’s economic growth, providing employment to

nearly 26 million and contributing about 40% to India’s total global exports.

• The services sector has also been the largest recipient of foreign direct investment, making

up for 53% of the total inflows between 2000 and 2021.

• India’s services sector covers a wide variety of activities such as trade, hotel and restaurants,

transport, storage and communication, financing, insurance, real estate, business services,

community, social and personal services, and services associated with construction.

• Surplus in services trade has decreased the often-huge deficit in India’s merchandise

shipments. With renewed focus and targeted government intervention, services trade

surplus could rise further from as much as $89 billion in FY21 and almost wipe out the deficit

caused by merchandise exports.

• This sector is boosting India’s transition from an ‘assembly economy’ to a ‘knowledge-

based economy’.

Recent updates in service sector exports

• The services sector of India remains the engine of growth for India's economy and contributed

53% to India's Gross Value Added at current prices in FY22 (until January 2022).

10 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• India's services sector GVA increased at a CAGR of 11.43% to Rs. 101.47 trillion (US$ 1,439.48

billion) in FY20, from Rs. 68.81 trillion (US$ 1,005.30 billion) in FY16. Between FY16 and FY20,

financial, real estate and professional services augmented at a CAGR of 11.68% (in Rs. terms),

while trade, hotels, transport, communication, and services related to broadcasting rose at a

CAGR of 10.98% (in Rs. terms).

• India's IT and business services market is projected to reach US$ 19.93 billion by 2025.

Export target of USD 1 trillion

• Recently, the Ministry of Commerce and Industry announced that it is working on a plan to

reach a services export target of USD 1 trillion by 2030. This target is nearly five times of what

India exported last fiscal (FY 2020).

Government initiatives and expected plans to achieve this target

• There is a need to boost opportunities in high-growth segments beyond the dominant

information technology and IT-enabled services (ITeS).

o The opening up of the domestic legal services sector will benefit Indian lawyers as they

would get huge opportunities in countries such as Europe, Australia and America.

o Further, the need is to focus on promising areas like higher education, hospitality and

medical tourism.

• To support the services sector, the government has been actively pursuing market access

opportunities via Free-Trade Agreements (FTAs) with key economies (including the UK, the

EU, Australia and the UAE).

• The government is working on a programme that could replace the Service Exports from India

Scheme (SEIS) in its current form.

o According to the government, the services industry needs to shun the crutches of

government subsidies.

o This will encourage firms to raise competitiveness.

o Also, the subsidy amount can be utilised for those who need it more.

• Launch of a production linked incentive (PLI) scheme to boost manufacturing of telecom and

networking products in India.

o The scheme is expected to attract an investment of Rs. 3,345 crore over the next four

years and generate additional employment for >40,000 individuals.

• India and Australia has announced its collaboration in cyber-enabled critical technologies,

highlighting the requirement to boost the critical information security infrastructure such as

5G telecom networks.

• FDI limit for insurance companies has been raised from 49% to 74% and 100% for insurance

intermediates.

• In the next five years, the Ministry of Electronics and Information Technology is working to

increase the contribution of the digital economy to 20% of GDP.

Conclusion

• The government should consider something for the services sector, in line with

the production-linked incentive scheme.

11 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• India should be striving to embed itself in global value chains.

• If India wants to become a major exporter, it should specialize more in the areas of its

comparative advantage and achieve significant quantity expansion.

o Developing a dynamic business 2 business (B2B) portal, which can be used by service

providers to reach out to the markets abroad.

Topic 7: What are derivatives? Discuss the SEBI ban on derivative trade in agriculture

sector?

Introduction

• The term derivative refers to a type of financial contract whose value is dependent on

an underlying asset, group of assets, or benchmark.

• A derivative is set between two or more parties that can trade on an exchange or over the

counter (OTC).

• These contracts can be used to trade any number of assets and carry their own risks. Prices

for derivatives derive from fluctuations in the underlying asset.

o These financial securities are commonly used to access certain markets and may be

traded to hedge against risk.

• The derivatives market is the financial market for derivatives, financial instruments like

futures contracts or options, which are derived from other forms of assets.

o The market can be divided into two, that for exchange-traded derivatives and that

for over-the-counter derivatives.

SEBI ban on derivative trade in agriculture sector:

• Recently, the Securities and Exchange Board of India (SEBI) has banned the derivative trade

of seven agricultural commodities on the future’s platform of National Commodities and

Derivatives Exchange (NCDEX) for a year.

o The regulator has banned derivative contracts trade in chana, wheat, paddy (non-

basmati), soyabean and its derivatives, mustard seed and its derivatives, crude palm

oil and moong for a year with immediate effect.

o The commodity derivatives market has been prone to such sudden suspensions of

trading in agriculture items ever since it was introduced under the erstwhile Forward

Markets Commission (FMC).

Reason behind this ban

• India’s retail inflation rose to a three-month high of 4.91 % in November from 4.48 % in the

previous month primarily because of a rise in food inflation to 1.87 % from 0.85 % over this

period.

• Wholesale Price Index-based inflation has remained in double digits for eight consecutive

months beginning in April, mainly because of surging prices of food items.

o In November 2021, the wholesale price-based inflation surged to a record high of

14.23 % amid hardening of prices of mineral oils, basic metals, crude petroleum and

natural gas.

12 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• In view of agricultural output that might be affected morbidly because of fertiliser shortage

faced in many parts of the country.

o By banning future’s trade, the government is trying to insulate any price shock the

market might feel in the days to come in case the production is not up to par.

Impact of this ban

• The suspension comes ahead of the rabi crop, sown in winter, hitting the markets in a couple

of months. With no reference price, traders will be clueless on future sentiment.

• Importers, who hedge on the derivative market to safeguard themselves from price moves,

may be more vulnerable.

• Impact on prices initially, the outlook will be bearish as traders rush to square off open

positions on derivatives.

Topic 8: What is Carbon Trading? Discuss the Significance of an efficient Carbon trading

market in India?

What is carbon trading?

• Carbon trading, also referred to as carbon emissions trading, is a market-based system of

buying and selling permits and credits that allow the permit holder to emit carbon dioxide.

o The model used in most carbon trading schemes is called ‘cap and trade’.

• The carbon credits and the carbon trade are authorized by governments with the goal of

gradually reducing overall carbon emissions and mitigating their contribution to climate

change.

• The idea of applying a cap-and-trade solution to carbon emissions originated with the Kyoto

Protocol.

o Kyoto Protocol created three such “market mechanisms: Emissions Trading, Clean

Development Mechanism, Joint implementation.

o Under Article 6 of the Paris Agreement, parties agreed to create a new market

mechanism and a framework for non-market approaches mechanism.

• Carbon marketplaces associated with carbon trading can exist at international, national,

state or local level.

o For instance, in 2021, China launched the world's largest market for carbon emissions

trading.

Significance of an efficient Carbon trading market in India

• Financial gains: India is the largest exporter of carbon credits the country and could stand to

gain $11 trillion over 50 years by limiting rising global temperatures and realizing its potential

to 'export decarbonization' to the world.

• Help achieve India’s net zero targets: Carbon markets can help in reducing green-house gas

emissions by incentivizing the adoption of innovative low carbon technologies and assigning

financial accountability to high emitters to reduce emissions.

• Finance avenues for carbon transition: The market will let green plants and energy efficient

units estimate earnings through carbon trade. This will help boost and finance more such

projects.

13 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• Enhance private sector participation in climate actions: Giving voluntary players an

opportunity to trade in carbon instrument could enhance GHG emission reduction

commitments in the private sector.

Conclusion

• Examination of present trade of various environmental instruments to observe trading

trends.

• Calibration and effective management of demand and supply of instruments.

• Making the instrument more fungible: Developing a provision for fungibility of the unit

trading to emission reduction may attract voluntary buyers and lead to international

participation in the market.

• Adding more participants into the pool: like State Designated Agencies (SDAs), airlines

industry, Indian private companies participating in the Science-Based Targets initiative's

(SBTi) who have set targets under their 'Business Ambition for 1.5 C' campaign etc.

o This will require updating of PAT market rules to allow voluntary players to be part of

the buyer/seller pool.

• Regularizing trading period: For instance, in the EU-ETS system, auctioning of allowances

happens monthly on the European Energy Exchange (EEX).

• Supply of verifiable permits: by enabling project level registration and their proper validation,

verification, and issuance of emission reduction units (ERU).

• Developing Institutional and policy mechanisms for

o Fair and transparent price discovery.

o Linking other carbon trading market.

o Registry management and operation

o Participation protocol and methodology. o Monitoring and reporting of carbon

market performance.

o Gradually moving to moving to a cap-and-trade system wherein sectors and within

sectors specific companies are earmarked for only a specific amount of emissions.

Topic 9: Discuss the status of NPAs in agriculture sector and scope of an ARC?

Introduction

• Non-Performing Assets have been a bane for banks for a long time. There have been renewed

efforts on part of the Government of Indian and Reserve Bank of India to tackle the problem

of Non-Performing Assets.

• As per the Reserve Bank of India (RBI), an asset becomes non-performing when it stops to

generate income for the bank. The Non-Performing Assets in Public Banks are valued at

approximately $ 62 Billion, which represents 90% of total NPA in India.

• Based on different parameters the Non-Performing Assets are classified into different types.

o Substandard Assets: These are the assets which have remained NPA for a period of less

than or equal to 12 months

o Doubtful Assets: If the asset is in the substandard category for a period of 12 months

14 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

o Loss Assets: These assets are of little value; it can no longer continue as a bankable

asset, there could be some recovery value.

NPA’s in agriculture sector and other issues

• As per the RBI’s Financial Stability Report, bad loans (gross NPAs) for the agricultural sector

stood at 9.8% at the end of March 2021.

o In comparison, they were at 11.3% and 7.5% for the industry and services sectors

respectively.

• The announcement of farm loan waivers by states around elections leads to “deteriorating

credit culture”.

o Since 2014, at least 11 states have announced farm loan waivers including Rajasthan,

MP, Punjab, Chhattisgarh, Andhra Pradesh, Telangana, Maharashtra, Punjab and UP.

o It creates a concern among banks regarding the rise of NPAs in the farm sector

and leads to recovery challenges for the banks.

o Loan waivers stress the budgets of the waiving state or central government.

o Also, these waivers are poorly targeted, and eventually reduce the flow of credit

• At present, there is neither a unified mechanism to tackle NPAs in the farm sector nor a single

law that deals with enforcement of mortgages created on agricultural land.

o However, the recovery laws vary from state to state wherever agricultural land is

offered as collateral.

• While farmers in India are struggling to get bank loans, as formal sector lenders have become

even more risk averse amid the Covid-19 pandemic, the banks are challenged by huge Non-

Performing Assets (NPAs) as they’re unable to recover farm loans.

• In this context, the Indian Banks’ Association in a recently held meeting proposed the idea of

floating an Asset Reconstruction Company (ARC) to improve the recovery from bad loans in

the agricultural sector.

Proposed proposal for agricultural bad bank

• To improve recovery of bad loans in the agriculture sector, leading banks have made a pitch

for setting up an ARC specifically to deal with collections and recovery of farm loans.

o With a government-backed ARC having been recently set up to deal with bank NPAs to

the industry, this idea has acceptability among banks.

• As agricultural markets are dispersed, a single institution, as opposed to multiple banks, would

be more suited to deal with collections and recoveries from farm loans, optimising the costs

of the recovery.

o Considering the absence of a unified framework to deal with the enforcement of

mortgages created on agricultural land, there is a case for creating an effective

mechanism for the recovery of dues.

Associated Concerns with this proposal

• The requirement of the ARC is to have sufficient availability of funds to match the huge

amount of the NPA market.

o Even if sufficient funds are available with ARC, the price expectation mismatch

between selling bank (s) and buying ARC and agreement on an acceptable valuation

of the bad assets will also create a challenge for ARC.

15 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

• As local banks have far greater presence on the ground than a single ARC, they are likely to

be more capable of navigating the local terrain to recover their dues.

• As rural land markets are characterized by lack of clear titles and multiple stakeholders, ARCs

specifically the farm sector is not an as prudent approach.

• There is also a possibility that since agriculture is a state subject, such an approach could risk

being seen as encroaching on the rights of states.

Topic 10: What is Informal Economy? Discuss the present scenario and challenges related

to informal sector.

Introduction

• An Informal economy represents enterprises that are not registered, where employers do not

provide social security to employees.

• In many parts of the developing world, including India, informality has reduced at a very

sluggish pace, manifesting itself most visibly in urban squalor, poverty and unemployment.

• Despite witnessing rapid economic growth over the last two decades, 90% of workers in India

have remained informally employed, producing about half of Gross Domestic Product (GDP).

• Official Periodic Labor Force Survey (PLFS) data shows that 75% of informal workers are self-

employed and casual wage workers with average earnings lower than regular salaried workers.

o Combining the ILO’s widely agreed upon definition with India’s official definition (of

formal jobs as those providing at least one social security benefit — such as EPF), the

share of formal workers in India stood at only 9.7% (47.5 million).

Present scenario of Informal Sector Workers in India:

• Over 94% of 27.69 crore informal sector workers registered on the e-Shram portal have a

monthly income of Rs 10,000 or below and over 74% of the enrolled workforce belongs

to Scheduled Castes (SC), Scheduled Tribes (ST) and Other Backward Classes (OBC).

o The proportion of the General Category workers is 25.56%.

• The data showed that 94.11% of the registered informal workers have a monthly income

of Rs 10,000 or below, while 4.36% have a monthly income between Rs 10,001 and Rs

15,000.

• 61.72% of the registered workers on the portal are of the age from 18 years to 40 years,

while 22.12% are of the age from 40 years to 50 years.

• The proportion of the registered workers aged above 50 years is 13.23% while 2.93% of

workers are aged between 16 and 18 years.

• 52.81% of registered workers are female and 47.19 % are male.

• Top-5 States in Terms of Registration:

o Uttar Pradesh, Bihar, West Bengal, Madhya Pradesh, and Odisha.

• Agriculture is at the top with 52.11% of enrolments done by those related to the farm

sector followed by domestic and household workers at 9.93% and construction workers at

9.13%.

16 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

Challenges related to Informal Sector Workers:

• Labour Related Challenges: On dividing the large number of workforces between the rural

and the urban segment, although the large number is employed in the rural sector, the

bigger challenge is in the urban workforce in the informal sector.

o Long working hours, low pay & difficult working conditions.

o Low job security, high turnover, and low job satisfaction.

o Inadequate social security regulation.

o Difficulty in exercising rights.

o Child and forced labour and discrimination on basis of various factors.

o Vulnerable, low-paid, and undervalued jobs.

• Productivity: The informal sector basically comprises MSMEs and household businesses

which are not as big as firms like Reliance. They are unable to take advantage of economies

of scale.

• Inability to Raise Tax Revenue: As the businesses of the informal economy are not directly

regulated, they usually avoid one or more taxes by hiding incomes and expenses from the

regulatory framework. This poses a challenge for the government as a major chunk of the

economy remains out of the tax net.

• Lack of Control and Surveillance: The informal sector remains unmonitored by the

government.

o Further, no official statistics are available representing the true state of the economy,

which makes it difficult for the government to make policies regarding the informal

sector and the whole economy in general.

• Low-quality Products: Although the informal sector employs more than 75% of the Indian

population, the value-addition per employee is very low. This means that a major portion

of our human resource is under-utilized.

Conclusion

• Simpler regulatory framework: The transition of the informal sector to the formal sector can

only occur when the informal sector is given relief from the burden of regulatory

compliance and is given enough time to adjust with the modern, digitized formal system.

• Financial Support for Formalization: Giving financial support to help small-scale industries

stand on their own is a crucial step in bringing them to the organized sector.

o Schemes like MUDRA loans and Start-up India are helping the youth carve a niche in

the organized sector.

17 | P a g e W W W . E D U T A P . C O . I N QUERY? HELLO@EDUTAP.CO.IN/ 8146207241

You might also like

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- RBI's Reforms Strengthen Indian Banking SectorDocument6 pagesRBI's Reforms Strengthen Indian Banking Sectorproject mbaNo ratings yet

- Industry Reports - ISB Consulting Casebook 2021Document36 pagesIndustry Reports - ISB Consulting Casebook 2021BalajiNo ratings yet

- Jan Dhan Yojana Article Full PDFDocument4 pagesJan Dhan Yojana Article Full PDFAmitanshu VishalNo ratings yet

- Jan Dhan Yojana Article Full PDFDocument4 pagesJan Dhan Yojana Article Full PDFAmit KumarNo ratings yet

- Success Story of Fino A Role Model For Development of Financial InclusionDocument23 pagesSuccess Story of Fino A Role Model For Development of Financial InclusionSujith PillaiNo ratings yet

- Banking Sector in India - Challenges and OpportunitiesDocument6 pagesBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanNo ratings yet

- Bank of BarodaDocument12 pagesBank of BarodaRahul Panchigar0% (1)

- Presentation 2Document52 pagesPresentation 2moto mouliNo ratings yet

- UPSC Economy GS-3 SummaryDocument153 pagesUPSC Economy GS-3 SummaryAjay SinghNo ratings yet

- Financial InclusiionDocument37 pagesFinancial InclusiionPehoo ThakurNo ratings yet

- Financial Inclusion: A Road India Needs To TravelDocument40 pagesFinancial Inclusion: A Road India Needs To TravelGourav PattnaikNo ratings yet

- Banking Industry INDIANDocument26 pagesBanking Industry INDIANektapatelbmsNo ratings yet

- BFSI Sector Council Business Correspondent & Business Facilitator Occupational StandardDocument80 pagesBFSI Sector Council Business Correspondent & Business Facilitator Occupational StandardVaibhavNo ratings yet

- Financial Inclusion - A Road India Needs To TravelDocument8 pagesFinancial Inclusion - A Road India Needs To Traveliysverya9256No ratings yet

- Recent Developments in India's Banking IndustryDocument6 pagesRecent Developments in India's Banking IndustryCharu Saxena16No ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingAdalberto MacdonaldNo ratings yet

- 13 - Conclusion and SuggestionsDocument4 pages13 - Conclusion and SuggestionsjothiNo ratings yet

- Research Paper On Indian Banking SectorDocument7 pagesResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- Financial Inclusion 123Document4 pagesFinancial Inclusion 123janvidnavapriaNo ratings yet

- Financial inclusion key to reducing inequality in IndiaDocument12 pagesFinancial inclusion key to reducing inequality in IndiaNeerajNo ratings yet

- Financial InclusionDocument37 pagesFinancial Inclusionparvati anilkumarNo ratings yet

- Financial Inclusion in IndiaDocument7 pagesFinancial Inclusion in IndiaJessi MysNo ratings yet

- Indian Banking SectorDocument5 pagesIndian Banking Sector2612010No ratings yet

- PESTEL Analysis of Opportunities and Challenges in the Indian Banking SectorDocument4 pagesPESTEL Analysis of Opportunities and Challenges in the Indian Banking SectorVibhav Upadhyay100% (1)

- Chapter-1 Financial Inclusion - An Overview DefinitionDocument4 pagesChapter-1 Financial Inclusion - An Overview DefinitionKashish SharmaNo ratings yet

- BankingDocument7 pagesBankingAntony ThuruthelNo ratings yet

- Fodder Material For Phase 2 For SEBI Grade A 2020: WWW - Edutap.Co - in Hello@Edutap - Co.InDocument13 pagesFodder Material For Phase 2 For SEBI Grade A 2020: WWW - Edutap.Co - in Hello@Edutap - Co.InMega MindNo ratings yet

- Banking: Industries in IndiaDocument41 pagesBanking: Industries in IndiaManavNo ratings yet

- Presented by DR Jey at BIRD LucknowDocument16 pagesPresented by DR Jey at BIRD LucknowvijayjeyaseelanNo ratings yet

- Financeinclusion - ShilmaDocument24 pagesFinanceinclusion - ShilmaAnkur SrivastavaNo ratings yet

- Inclusion FinDocument4 pagesInclusion Finnikhil_mallikar2067No ratings yet

- Banking Sector AnalysisDocument17 pagesBanking Sector AnalysisKunal DesaiNo ratings yet

- Strategy Adopted For Financial InclusionDocument7 pagesStrategy Adopted For Financial Inclusionanmolsaini01No ratings yet

- Strategy and Efforts of A Public Sector Bank For Financial InclusionDocument10 pagesStrategy and Efforts of A Public Sector Bank For Financial InclusionKhushi PuriNo ratings yet

- Challenge Fund For Smes: State Bank of PakistanDocument8 pagesChallenge Fund For Smes: State Bank of PakistanMansoor InvoicemateNo ratings yet

- NPA EvalautiaonDocument7 pagesNPA EvalautiaonmgajenNo ratings yet

- Q1. Find A Few of The Pension Plans Offered by The Insurance CompanyDocument5 pagesQ1. Find A Few of The Pension Plans Offered by The Insurance CompanyHarit RustagiNo ratings yet

- Literature Review On Npa in Banks PDFDocument8 pagesLiterature Review On Npa in Banks PDFafmzvulgktflda100% (1)

- Banking - Positives NegativesDocument9 pagesBanking - Positives NegativesraviNo ratings yet

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingNeha bansalNo ratings yet

- Assignment FinancialSectorReforms1991Document4 pagesAssignment FinancialSectorReforms1991Swathi SriNo ratings yet

- Analysis On Payment in Banks in IndiaDocument3 pagesAnalysis On Payment in Banks in Indiadibangshu biswasNo ratings yet

- Nabard 1Document38 pagesNabard 1kapil_kaul91No ratings yet

- Financial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Document36 pagesFinancial Inclusion: The Need For All-Round Growth of The Economy of India Group 2Hubspot GroupNo ratings yet

- Pillars of Financial Inclusion: Remittances, Micro Insurance and Micro SavingsDocument27 pagesPillars of Financial Inclusion: Remittances, Micro Insurance and Micro SavingsDhara PatelNo ratings yet

- Financial ReformsDocument21 pagesFinancial ReformsKertik SinghNo ratings yet

- Banking IndustryDocument15 pagesBanking Industry20BBA137No ratings yet

- SBI's Role in Financial Inclusion InitiativesDocument5 pagesSBI's Role in Financial Inclusion InitiativesvmktptNo ratings yet

- Microfinance Assignment - BCMDocument9 pagesMicrofinance Assignment - BCMpoojaNo ratings yet

- Vision IAS Mains 2020 Test 15 English Solution PDFDocument20 pagesVision IAS Mains 2020 Test 15 English Solution PDFSrinivas JupalliNo ratings yet

- RBI Guidelines For Licensing of Small Finance Bank RBI Guidelines For Licensing of Payments BankDocument35 pagesRBI Guidelines For Licensing of Small Finance Bank RBI Guidelines For Licensing of Payments BankNovi KapoorNo ratings yet

- BANK Research ReportDocument12 pagesBANK Research ReportAntraNo ratings yet

- Summer Internship Report: The Credit ProcessDocument122 pagesSummer Internship Report: The Credit ProcessPandey SaurabhNo ratings yet

- Bank of MaharashtraDocument84 pagesBank of Maharashtrachakshyutgupta100% (5)

- "Management of Non Performing Assets": A Project Report ONDocument64 pages"Management of Non Performing Assets": A Project Report ONshivanimittal1737No ratings yet

- Champatiray and Agarwal - Kiosk Banking Study Final ReportDocument53 pagesChampatiray and Agarwal - Kiosk Banking Study Final ReportMd Alive LivingNo ratings yet

- Bank Led Initiative Product Led Approach: Approaches To Financial InclusionDocument3 pagesBank Led Initiative Product Led Approach: Approaches To Financial InclusionRohan DasNo ratings yet

- Payments BankDocument14 pagesPayments BankDurjoy BhattacharjeeNo ratings yet

- 07 - Chapter 2Document57 pages07 - Chapter 2sosteniblebusinessNo ratings yet

- DBMS Imp MCQsDocument22 pagesDBMS Imp MCQsHARESHNo ratings yet

- CrackIT OS Guide: Key Concepts in 40 CharactersDocument48 pagesCrackIT OS Guide: Key Concepts in 40 CharactersHARESHNo ratings yet

- Data Structures OverviewDocument49 pagesData Structures OverviewHARESHNo ratings yet

- OS NumericalsDocument22 pagesOS NumericalsHARESHNo ratings yet

- C LangDocument32 pagesC LangHARESHNo ratings yet

- DS NumericalsDocument17 pagesDS NumericalsHARESHNo ratings yet

- Os 1Document38 pagesOs 1HARESHNo ratings yet

- 5 Number Booster - Clear Your SectionalDocument1 page5 Number Booster - Clear Your SectionalHARESHNo ratings yet

- SampleDocument19 pagesSampleapi-226814324No ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- WWW Sebi Gov inDocument26 pagesWWW Sebi Gov inSuvojit DeshiNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Exam Centres Annexure IDocument2 pagesExam Centres Annexure IDilip KumarNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Data Warehouse Data Mining - 700MCQ'sDocument28 pagesData Warehouse Data Mining - 700MCQ'sTetelo Vincent78% (36)

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Sample PP TXDocument2 pagesSample PP TXsakisNo ratings yet

- Caye Bank BelizeDocument4 pagesCaye Bank Belizekshepard_182786911No ratings yet

- Final List Approved Valuers 2019-20 PDFDocument328 pagesFinal List Approved Valuers 2019-20 PDFMd Khaja67% (3)

- Unit 5 Electronic Payment SystemDocument17 pagesUnit 5 Electronic Payment SystemSatyam RajNo ratings yet

- MCB Communique To Customers - tcm55-44436Document1 pageMCB Communique To Customers - tcm55-44436MauriceNo ratings yet

- 6 BRS 08-2023 RegularDocument7 pages6 BRS 08-2023 RegularjahnaviNo ratings yet

- Eco 407Document4 pagesEco 407LUnweiNo ratings yet

- Reliance CapitalDocument32 pagesReliance CapitalBradford StanleyNo ratings yet

- 04 Priyanka Biswas (PW) TYBMSDocument91 pages04 Priyanka Biswas (PW) TYBMSmk khaniNo ratings yet

- DatabaseDocument4 pagesDatabaseMikey MessiNo ratings yet

- ROAD CHART TITLEDocument4 pagesROAD CHART TITLEPhani PitchikaNo ratings yet

- Statement SummaryDocument10 pagesStatement SummaryMuhammad IqbalNo ratings yet

- Chapter 7 Brief ExercisesDocument6 pagesChapter 7 Brief ExercisesPatrick YazbeckNo ratings yet

- RMBSDocument23 pagesRMBSapi-3848669No ratings yet

- Credit CardDocument5 pagesCredit Cardapi-372310429No ratings yet

- Wiki SCN Sap Com Wiki Display Locla Febraban PagamentoDocument5 pagesWiki SCN Sap Com Wiki Display Locla Febraban PagamentoJosemar MendesNo ratings yet

- Credit Rating Report of JP MorganDocument6 pagesCredit Rating Report of JP MorganPOOONIASAUMYANo ratings yet

- A Study On Determinants of Loan Repaymen PDFDocument14 pagesA Study On Determinants of Loan Repaymen PDFgetachewNo ratings yet

- Land Reforms in India Non-Governmental InitiativesDocument19 pagesLand Reforms in India Non-Governmental InitiativesMahesh Vanam100% (1)

- Payables Finance Technique GuideDocument18 pagesPayables Finance Technique GuideMaharaniNo ratings yet

- Er 670202Document11 pagesEr 670202Aye Boey07No ratings yet

- Lao v CA Digest: Junior Officer Acquitted for Signing Checks Without Knowledge of InsufficiencyDocument2 pagesLao v CA Digest: Junior Officer Acquitted for Signing Checks Without Knowledge of InsufficiencyR.A.MNo ratings yet

- Banking Industry Overview: History, Structure and Current ScenarioDocument77 pagesBanking Industry Overview: History, Structure and Current Scenarioprashant mhatreNo ratings yet

- Funds - Transfer V1 PDFDocument46 pagesFunds - Transfer V1 PDFTanaka MachanaNo ratings yet

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDocument7 pagesCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiqueNo ratings yet

- The Recording Process ExplainedDocument31 pagesThe Recording Process Explainedpiash246No ratings yet

- Mercantile Bank Pricing Guide 2022Document5 pagesMercantile Bank Pricing Guide 2022IQaba DyosiNo ratings yet

- NG Rtgiso20022Document131 pagesNG Rtgiso20022Jayant KayarkarNo ratings yet

- 11th Commerce Centum MaterialDocument4 pages11th Commerce Centum MaterialMylai Artz KumarrNo ratings yet

- Business Use Case: Airport Check-In and Security ScreeningDocument9 pagesBusiness Use Case: Airport Check-In and Security ScreeningMurat NurmatovNo ratings yet

- NISUS Final Report - July2014 PDFDocument251 pagesNISUS Final Report - July2014 PDFEm PeeNo ratings yet