Professional Documents

Culture Documents

IA Activity

Uploaded by

CASTRO, JHONLY ROEL C.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IA Activity

Uploaded by

CASTRO, JHONLY ROEL C.Copyright:

Available Formats

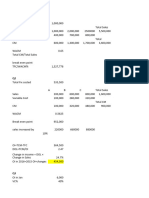

INTERMEDIATE ACCOUNTING 1

AVERAGE COST METHOD

Cost Retail Amount

Purchases 1,180,000 1,500,000 Sales 1,428,000

Freight In 30,000 Sales Returns (56,000)

Purchase Discount (150,000) Employee discounts 2,600

Purchase Returns (4,000) (5,000) Normal Spoilage 400

Net Purchases 1,056,000 1,495,000 Net Sales 1,375,000

Cost Retail

Inventory, beg. 300,000 375,000

Net Purchases 1,056,000 1,495,000

Departmental Transfers In 2,000 3,000

Net Markups 18,000

Net Markdowns (5,000)

Abnormal Spoilage (8,000) (11,000)

TGAS 1,350,000 1,875,000

Net Sales (1,375,000)

1.) Ending Inventory @retail 500,000

TGAS @ COST

Average cost Ratio=

TGAS @ RETAIL

1,350,000

=

1,875,000

Average cost Ratio= 72%

COST OF SALES:

Ending Inventory @ retail 500,000 TGAS @ Cost 1,350,000

Multiply by: Average cost ratio 72% Ending Inventory @ cost (360,000)

1.) Ending Inventory @ cost 360,000 2.) COGS 990,000

Optional Reconciliation:

Net Sales 1,375,000

Multiply by: Average cost ratio 72%

COGS 990,000

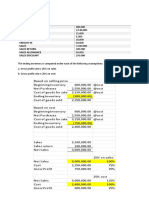

FIFO COST METHOD

TGAS−BEG . INVENTORY @COST

FIFO cost Ratio=

TGAS−BEG . INVENTORY @ RETAIL

1,350,000−300,000

= 1,875,000−375,000

FIFO cost Ratio= 70%

Ending Inventory @ retail 500,000

Multiply by: Average cost ratio 70%

1.) Ending Inventory @ cost 30,000

COST OF SALES:

TGAS @ Cost 1,350,000

Ending Inventory @ cost (360,000)

2.) COGS 1,000,000

Optional Reconciliation:

Net Sales 1,375,000

Less: Beg. Inventory @ retail (375,000)

Total 1,000,000

Multiply by: FIFO cost ratio 70%

Total 700,000

Add back: Beg. Inventory @ cost 300,000

COGS 1,000,000

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Inventory EstimationDocument11 pagesInventory EstimationTrace ReyesNo ratings yet

- IA1 ActivityDocument3 pagesIA1 ActivityCzarhiena SantiagoNo ratings yet

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaNo ratings yet

- Gross Profit & Retail Method ProblemsDocument2 pagesGross Profit & Retail Method ProblemsMary Dale Joie Bocala0% (1)

- Chapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Document15 pagesChapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Kimberly Claire Atienza83% (6)

- Proforma Computation Cost Ratio and Inventory Shortage CalculationDocument6 pagesProforma Computation Cost Ratio and Inventory Shortage CalculationKelsey VersaceNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaGuinevereNo ratings yet

- Date Received Issued Quantity Unit Cost Amount Quantity Unit CostDocument6 pagesDate Received Issued Quantity Unit Cost Amount Quantity Unit CostLeslyne Love C. NograNo ratings yet

- Calculating GPR under different assumptionsDocument4 pagesCalculating GPR under different assumptionsLily of the ValleyNo ratings yet

- Chapter 14 AnswersevenDocument4 pagesChapter 14 AnswersevenJulianne Mejia100% (1)

- Income Statement - MerchandisingDocument1 pageIncome Statement - MerchandisingSharrah San MiguelNo ratings yet

- Forda Reviewer IA - PrelimDocument12 pagesForda Reviewer IA - PrelimAltessa Lyn ContigaNo ratings yet

- Retail Method and Biological AssetDocument3 pagesRetail Method and Biological AssetLuiNo ratings yet

- Unrealized Mark-Up: Best CoDocument4 pagesUnrealized Mark-Up: Best CoPalos DoseNo ratings yet

- Retail Method: Problem 20-1 (AICPA Adapted)Document9 pagesRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNo ratings yet

- Retail Inventory Method CalculationDocument5 pagesRetail Inventory Method CalculationaprilNo ratings yet

- Drey Midterm 1st Quiz On Audit of InventoryDocument8 pagesDrey Midterm 1st Quiz On Audit of InventoryDrey StudyingNo ratings yet

- Variable Costing AnalysisDocument23 pagesVariable Costing AnalysisKenneth PimentelNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Chapter 9 Exercises: Exercise 9 1Document8 pagesChapter 9 Exercises: Exercise 9 1karenmae intangNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Inventory Cost and Retail ReportDocument3 pagesInventory Cost and Retail ReportChuckay SealedNo ratings yet

- Chapter 8 Inventory EstimationDocument5 pagesChapter 8 Inventory EstimationJharam TolentinoNo ratings yet

- Problems - Inventory Estimation: Retail Inventory MethodDocument13 pagesProblems - Inventory Estimation: Retail Inventory MethodKez MaxNo ratings yet

- Managerial Accounting - Final Project - Yahya Patanwala.12028Document4 pagesManagerial Accounting - Final Project - Yahya Patanwala.12028Yahya SaifuddinNo ratings yet

- 4 Gross and Profit Method Retail Inventory MethodDocument6 pages4 Gross and Profit Method Retail Inventory MethodSilverly Batisla-ongNo ratings yet

- Chapter 13 - Gross Profit MethodDocument2 pagesChapter 13 - Gross Profit MethodBena CubillasNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Calculating Average Inventory, Payables and Receivables PeriodsDocument10 pagesCalculating Average Inventory, Payables and Receivables PeriodssajedulNo ratings yet

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- TUT 3 - Relevant Information&decision MakingDocument10 pagesTUT 3 - Relevant Information&decision MakingKim Chi LeNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Problems - Inventory Estimation: Gross Profit MethodDocument13 pagesProblems - Inventory Estimation: Gross Profit MethodmercyvienhoNo ratings yet

- Module 8 - Inventory EstimationDocument10 pagesModule 8 - Inventory Estimationmarvy AndayaNo ratings yet

- Marginal Costing Values Inventory at The Total Variable Production Cost of A UnitDocument3 pagesMarginal Costing Values Inventory at The Total Variable Production Cost of A UnitNiomi GolraiNo ratings yet

- Gross Profit 9,000,000: Net Profit For The YearDocument5 pagesGross Profit 9,000,000: Net Profit For The Yearzizo zozNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Prob9 4 PDFDocument1 pageProb9 4 PDFirma cahyani kawiNo ratings yet

- LCNRV - SolutionDocument3 pagesLCNRV - SolutionMagadia Mark JeffNo ratings yet

- AccountingDocument5 pagesAccountingMarinie CabagbagNo ratings yet

- Accounting ExerciseDocument2 pagesAccounting Exercisejolingui0511No ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Chapter13 - Gross Profit MethodDocument21 pagesChapter13 - Gross Profit MethodPatrick Jayson VillademosaNo ratings yet

- Bco114 Accounting - Inventory ValuationDocument9 pagesBco114 Accounting - Inventory ValuationGloryNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- CHEER UP Chapter 13 Gross Profit MethodDocument7 pagesCHEER UP Chapter 13 Gross Profit MethodaprilNo ratings yet

- Cost Analysis of Coca-Cola Company - by HakimzadDocument18 pagesCost Analysis of Coca-Cola Company - by HakimzadHakimzad9001 Faisal9001100% (1)

- Equipment Purchased Impact on Break Even SalesDocument2 pagesEquipment Purchased Impact on Break Even SalesKalai ArasanNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- Calculating manufacturing overhead rate and cost of goods soldDocument7 pagesCalculating manufacturing overhead rate and cost of goods soldOmar SoussaNo ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- Problem 14-7Document2 pagesProblem 14-7Angelita Dela cruzNo ratings yet

- Module 5.1 - Sample ProblemsDocument5 pagesModule 5.1 - Sample ProblemsRafols AnnabelleNo ratings yet

- FA Assignment, Section 3 Group 1Document17 pagesFA Assignment, Section 3 Group 1Raja RaviNo ratings yet

- Economic DevDocument5 pagesEconomic DevCASTRO, JHONLY ROEL C.No ratings yet

- Russian and Ukraine War... View of GermanyDocument2 pagesRussian and Ukraine War... View of GermanyCASTRO, JHONLY ROEL C.No ratings yet

- UKRAINE DEMOGRAPHICS AND ECONOMIC INDICATORS (2006-2022Document8 pagesUKRAINE DEMOGRAPHICS AND ECONOMIC INDICATORS (2006-2022CASTRO, JHONLY ROEL C.No ratings yet

- Lecture 10 Share SplitDocument1 pageLecture 10 Share SplitCASTRO, JHONLY ROEL C.No ratings yet

- Lecture 15 Book Value Per ShareDocument1 pageLecture 15 Book Value Per ShareCASTRO, JHONLY ROEL C.No ratings yet

- Word Search PuzzleDocument1 pageWord Search PuzzleCASTRO, JHONLY ROEL C.No ratings yet

- Lecture 13 Stock DividendsDocument1 pageLecture 13 Stock DividendsCASTRO, JHONLY ROEL C.No ratings yet

- IMRa DDocument4 pagesIMRa DCASTRO, JHONLY ROEL C.No ratings yet

- CHRISTIAN LIVING IS NOT A CHALLENGE BUT TO EMULATE JESUSDocument1 pageCHRISTIAN LIVING IS NOT A CHALLENGE BUT TO EMULATE JESUSCASTRO, JHONLY ROEL C.No ratings yet

- Lecture 11 DividendsDocument1 pageLecture 11 DividendsCASTRO, JHONLY ROEL C.No ratings yet

- Plant Layout Factors and PrinciplesDocument7 pagesPlant Layout Factors and PrinciplesCASTRO, JHONLY ROEL C.No ratings yet

- To Print LyricsDocument7 pagesTo Print LyricsCASTRO, JHONLY ROEL C.No ratings yet

- NSTPDocument11 pagesNSTPCASTRO, JHONLY ROEL C.No ratings yet

- Crossword PuzzleDocument2 pagesCrossword PuzzleCASTRO, JHONLY ROEL C.No ratings yet

- Word Search Puzzle 2Document2 pagesWord Search Puzzle 2CASTRO, JHONLY ROEL C.No ratings yet

- History ProjectDocument8 pagesHistory ProjectCASTRO, JHONLY ROEL C.No ratings yet

- NSTP ProjectDocument1 pageNSTP ProjectCASTRO, JHONLY ROEL C.No ratings yet

- Solos Lyrics To EditDocument13 pagesSolos Lyrics To EditCASTRO, JHONLY ROEL C.No ratings yet

- Final ListDocument1 pageFinal ListCASTRO, JHONLY ROEL C.No ratings yet

- Denmark FlagDocument1 pageDenmark FlagCASTRO, JHONLY ROEL C.No ratings yet

- Lyrics of Songs For Music SerenadeDocument20 pagesLyrics of Songs For Music SerenadeCASTRO, JHONLY ROEL C.No ratings yet

- Duet Lyrics To EditDocument8 pagesDuet Lyrics To EditCASTRO, JHONLY ROEL C.No ratings yet

- We Are The ReasonDocument1 pageWe Are The ReasonCASTRO, JHONLY ROEL C.No ratings yet

- Wedding Songs LyricsDocument4 pagesWedding Songs LyricsCASTRO, JHONLY ROEL C.No ratings yet

- Aug 7 Line UpDocument9 pagesAug 7 Line UpCASTRO, JHONLY ROEL C.No ratings yet

- Send MeDocument1 pageSend MeCASTRO, JHONLY ROEL C.No ratings yet

- Variable Costing: A Decision-Making Perspective: Summary of Questions by Objectives and Bloom'S TaxonomyDocument35 pagesVariable Costing: A Decision-Making Perspective: Summary of Questions by Objectives and Bloom'S Taxonomym6030038No ratings yet

- Marketing PlanDocument16 pagesMarketing PlanROMEO RIONo ratings yet

- Supacolour Ebook NZDocument13 pagesSupacolour Ebook NZwaimana222No ratings yet

- Indian Airline Industry Case StudyDocument26 pagesIndian Airline Industry Case StudyBrijesh Kumar Singh100% (1)

- Minimizing Provider Gaps in Services MarketingDocument10 pagesMinimizing Provider Gaps in Services MarketingShamol EuNo ratings yet

- WondercubeDocument19 pagesWondercubeapi-35523690760% (5)

- February 12 - CH 7 & 8 - MGMT 4000Document7 pagesFebruary 12 - CH 7 & 8 - MGMT 4000Raquel VandermeulenNo ratings yet

- Malliga Marimuthu - Marketing and Management - Defined, Explained and Applied-Pearson (2022)Document828 pagesMalliga Marimuthu - Marketing and Management - Defined, Explained and Applied-Pearson (2022)urooj ahmedNo ratings yet

- 17 TPSP 1G Direct Payment Carriers v11.2Document42 pages17 TPSP 1G Direct Payment Carriers v11.2kdovgodkoNo ratings yet

- Tut 5 - Group 2 - VINAMILKDocument33 pagesTut 5 - Group 2 - VINAMILKmai linhNo ratings yet

- Busmath ExamplesDocument18 pagesBusmath ExamplesChris Tin100% (2)

- Hov Pod SPX LM Frequently Asked QuestionsDocument3 pagesHov Pod SPX LM Frequently Asked Questionshovpod6214No ratings yet

- Microeconomics exam questions on monopoly and perfect competitionDocument2 pagesMicroeconomics exam questions on monopoly and perfect competitionLâm VũNo ratings yet

- Essay - Hecheng ZhongDocument12 pagesEssay - Hecheng ZhongCosmic ZhongNo ratings yet

- 10 Practice Problems Monopoly Price DiscrimDocument12 pages10 Practice Problems Monopoly Price Discrimphineas12345678910ferbNo ratings yet

- MKT1Document9 pagesMKT1Code GeekNo ratings yet

- Agricultural Marketing StrategiesDocument11 pagesAgricultural Marketing StrategiesHoven Santos IINo ratings yet

- Seven Billion BanksDocument12 pagesSeven Billion BanksmatijatransNo ratings yet

- Netflix: Submitted By:-Avinash Kumar 19022 Core 1Document11 pagesNetflix: Submitted By:-Avinash Kumar 19022 Core 1Aastha GiriNo ratings yet

- A Sample Go Kart Business Plan TemplateDocument15 pagesA Sample Go Kart Business Plan TemplateMahirezqiNo ratings yet

- 20 Market Research Questions To Ask in Your Customer Survey - QuestionProDocument16 pages20 Market Research Questions To Ask in Your Customer Survey - QuestionProShailendra RajputNo ratings yet

- WT - Inspire (Dec 2020)Document47 pagesWT - Inspire (Dec 2020)Rural Marketing Association of IndiaNo ratings yet

- Internet Marketing and Digital Marketing MixDocument181 pagesInternet Marketing and Digital Marketing MixPrachi Asawa100% (1)

- Fdocuments - in Padi Business Padi Business Academy A Program For Padi Dive Centre and Resort OwnersDocument4 pagesFdocuments - in Padi Business Padi Business Academy A Program For Padi Dive Centre and Resort OwnersAhmadNo ratings yet

- The Western Outfitters Store Specializes in Denim Jeans The Variable Cost of The Jeans Varies PDFDocument3 pagesThe Western Outfitters Store Specializes in Denim Jeans The Variable Cost of The Jeans Varies PDFCharlotteNo ratings yet

- SRQ780 - Week 5 - Contract Payment Options and Tendering ProcessDocument93 pagesSRQ780 - Week 5 - Contract Payment Options and Tendering ProcessSean RoseNo ratings yet

- New Suis JK Coffee Bar Marketing PlanDocument12 pagesNew Suis JK Coffee Bar Marketing Planapi-719198358No ratings yet

- Course Syllabus in Revenue ManagementDocument8 pagesCourse Syllabus in Revenue ManagementArBie FranciscoNo ratings yet

- Rural Marketing: Marketing Consists of Marketing of Inputs (Products or Services) To TheDocument8 pagesRural Marketing: Marketing Consists of Marketing of Inputs (Products or Services) To TheRathin BanerjeeNo ratings yet

- SAP MM - Success ItDocument14 pagesSAP MM - Success ItDeepanarendraNo ratings yet