Professional Documents

Culture Documents

Newsletter - Spicy September 2022

Newsletter - Spicy September 2022

Uploaded by

Vipasha SanghaviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Newsletter - Spicy September 2022

Newsletter - Spicy September 2022

Uploaded by

Vipasha SanghaviCopyright:

Available Formats

Foreword

Alone we are just a “Name”, but together we can build an “Identity”!

Many of us meet people externally, and proudly introduce ourselves as “OfBusiness”, “Oxyzo”. That’s

our “Identity” which we carry in any conversation, and the real sense of pride comes in living this

journey with each of us being either the torchbearers of building it and / or of custodians for

preserving it.

As I look back across my professional stint at OfBusiness through various roles and functions and

see teams that have demonstrated industry defining metrics, a theme that keeps ringing through –

Alone we are just a name with qualifications/ experience,

But, when we come together, we build an Identity.

We celebrate the collective success and milestones,

We dive in collectively, when we sense an issue.

Because OFBians are not just individuals chasing personal growth,

but collectively nurturing the Identities – OfBusiness / Oxyzo.

Build has always been a collective effort…

Nothing in OfBusiness can be attributed to just one person; whenever and wherever we have

scaled, it’s been a combination of people passionate about building ground-up, along with multiple

skill sets coming together to drive execution and make it happen. Whether it’s the growth of Steel or

Agri or Non-Ferrous or Energy (erstwhile Petroleum derivatives) as a category in Commerce or the

individual M&As done. Each category or acquisition is today known more as a team than individual

success stories. Each member in the team, not business alone, but support functions across

finance, collections, technology and other, goes all out for achieving the overall collective goals than

just personal milestones.

And such has been this power of this collective effort that despite sharp fall in raw material prices

globally and in India, OfBusiness continues to manufacture and sell more volumes than the last

month or last year with better margins. These outcomes were there to see in the OfBusiness

townhall this September where each team presented their achievements and future-plans with

great passion and pride towards collectively achieving a US$4 Bn ARR in Mar’23.

Spicy September Page 02

Foreword (continued)

The collective outcome is always sweeter than individual…

The month gone by also hosted the Oxyzo Premier League which was a classic example of how we

marched forward together - in pairs, in teams (across Sales, KAM, Underwriting, Finance, Tech,

Credit Ops, Corporate Finance, Collections) and collectively together as Oxyzo to achieve INR 310 Cr.

of net book addition in the month and breach the INR 3300 Cr.+ AUM milestone. Though there was a

daily league table with the competition having a photo finish in the end, however, the sweetest

feeling was that everyone came together to celebrate the outcome of the collective effort in

breaching that distant INR 3300 Cr. AUM mark, which we have now proudly and collectively

embraced as our new Identifier.

Collections and Legal had a best-in-class performance in store for the month and literally squared

off 94%+ overdue in the DPD 15-30 and 31-60 buckets. KAM teams relentlessly pursued each PF

customer to ensure that for the first time, there was a +ve net book from utilizations & rotations.

Finance and Credit Ops made INR 150 Cr. of disbursements on the last day of the month and INR

1100 Cr.+ during the month look like a cakewalk, all seamlessly aided by the Tech team. Corporate

Finance team raised INR 300 Cr.+ debt from leading private/ public sector banks and negotiated

heavily to push back rate hikes on existing lines in a tough market.

These proud moments jointly define us as a unit. Congrats to everyone for a fantastic month and

godspeed towards a 5600 Cr. AUM by Mar’23.

…and Nurturing this Identity has become everyone’s first and joint responsibility…

Each day at work, brings us with many decisions to make about business strategy, about people,

about transactions within our own ecosystem. Whenever in doubt, just thinking through what’s the

right thing to do to preserve and nurture our Identity often becomes the right guiding light. And in

such situations, it pushes us to do that extra bit - to get a bit higher interest rate, to get a bit higher

margin, to push a bit more on collections, letting go the misfit credit or acquisition deal, promoting

meritocracy in the system, investing in and appreciating our people.

Preserving this Identity has not only become our obligation at each level and at each function but

also a responsibility that every OFBian proudly fulfills today as it gives them the right to carry and

own this Identity.

- Prashant Roy Sharma

Spicy September Page 03

OFBian of the month

The sun shies away from

OFBians: A success story

– Y Ramachandra Reddy

South Sales- Hyderabad

Ram took the avatar of Lord Ram in OPL to steer his team towards victory.

53 Cr. net book add in September across 11 new clients and productivity greater

than 1 are some numbers unheard of in the history of APTS Sales.

Ram is looking forward to take APTS to greater heights under his leadership and

touch the coveted 750 Cr. book mark by March 2023.

Godspeed Ram and entire APTS!

Spicy September Page 04

- Ashvarya Abhishek

Risk, Hyderabad

This is continuation to my “Dil Ki Baat” Published in August 21 wherein I talked about Freedom to

Experiment, Multitasking, Mentoring, Taking up New Assignments, and Hustle… Amidst all of these,

one thing which has stayed very close to my heart is NUMBERS. We all live by numbers either in

professional or personal life. We might be part of unique professional domains like sales, risk,

finance, collection, corporate finance etc., but we are all working towards achieving that magical

number.

I connect with numbers strongly with 2 things - Firstly, way back in my childhood days when my

father used to give me large & complex calculations to solve at an early age and secondly, when I

studied Maths not as a 100 Marks subject but in the form of Intelligence test covering arithmetic,

LR etc. till 6th std at a top army school – I remember these 2 inflection points which got me

attracted towards ‘Numbers’ right in my childhood & on maximum occasions I calculated faster

than a calculator. Here’s why I had a constant affection towards ‘Numbers’ in my student life and

thereafter in professional life too.

When I started my career with a public sector bank, the first thing in the morning what I used to

see in dashboard was all the important numbers covering 7 parameters (Current, Saving, Term

Deposits, NII, Advances, NPA & Profit) in red, green and amber color codes with YTD, MTD and

DTD variations to understand how close or how far we are from the target. I felt excited and

made sure my assigned numbers were all green in most quarters.

At OfBusiness across OfCommerce, Agri and Oxyzo – We talk about numbers day and in day out

as this is the most important metric which needs to keep moving with scale & profitability.

Revenue, AUM, margins, working capital days across verticals, profitability, cash flow, ALM,

treasury, NPA, PAR etc. are all aligned towards achieving targeted numbers which are testimonies

to our performance, sustainable growth, and reflection of how we are moving towards our goals

There is a dialogue from a movie called “Raees” where Shahrukh says – “कोई धंधा छोटा नहीं होता और

धंधे से बड़ा धमर्म कोई नहीं होता” (No Business is small and there is no bigger religion than Business)...

Spicy September Page 05

- Ashvarya Abhishek

Risk, Hyderabad

I completely resonate with this thought. No number is small, every penny counts in our business

both in revenue and margins across verticals. In whatever way we all contribute towards

numbers, it will help us land in a different league altogether. In most of the podcasts & interviews,

you all might have heard Asish Sir pointing out that at OFB, we focus on month on month

numbers rather than YoY numbers as these short milestones are more critical & have to be

accomplished first in order to achieve yearly numbers. This is because you don’t know what

macro & micro economic factors /environment like covid, inflation, slow economic growth,

exports ban will bring as a challenge impacting our long term strategy.

Numbers again were the ‘King’ in recently concluded Oxyzo OPL, they kept swinging and dancing

every single day in last 15 days of the competition with no clarity on who shall get the podium

finish. But when the entire team came together, results were amazing something which we will

cherish for a long time. Some teams could outperform others only because the team members

were ready to put in that extra bit of effort and showed ownership to do something

extraordinary.

With close to 5.5 months left in this FY, we all will have to outperform our own numbers by a

distance across different business units and critical attributes. It is imperative to remain focussed

on targets, deliver less misses- more wins, get better market penetration, onboard new clients,

push for tech adoption and bring together all OFBians to deliver their best performance ever.

Wishing everyone all the very best , Let’s just kill it !!

Spicy September Page 06

Outstanding Performers

Ashish Baloni aka Super Cop is Mr. cool of the Fulfillment team.

He is the man behind number #1 lifting of materials from Nalco plant in

India, where lifting of material is bound by time and rate changes in a

friction of a second. His calm and composed attitude makes it look so easy!

Congratulations on being one of the best performers and all the best!

Kudos!

Ashish Baloni

(OfCommerce,

Gurugram)

Govind proved to be one of the most valuable members of the OPL team

Mighty Maharajas. He handles the Rajasthan region which ended up with 7

Cr. more net book than gross, leading them straight to victory in the OPL. he

is currently handling about 100 clients, and is one of the most hard working

guys. He also holds the record for having highest online disbursement

requests from his clients.

Congratulations to him on his achievement and #Onto10x from here!

Govind Sharma

(KAM, Gurugram)

Venkata is one of our star performers managing APTS. He is a very keen

observer and does things with perfection. He got one of the largest

foreclosure service fees of 12 L from a single client. He gets into everything

where there is a possibility of learning something new. He is a guy with

extreme hustle to get things done. He has his own unique way of giving

stories to the clients and convincing them for anything. He ended up with

4.5 Cr.+ utilisation this month.

M Venkata Pavan

(KAM, Hyderabad)

Spicy September Page 07

Outstanding Performers

Arvind took over Chandigarh region just before the pandemic and has been

driving both stability and growth in the region since then. He has built his

team from scratch which is growing leaps and bounds under his

mentorship. Arvind and his team have been consistently outperforming

their respective targets. The same was on display during the OPL in

September where the Chandigarh team contributed 16 Cr. to Net Book

add. That is some mighty performance from a region that was considered a

laggard sometime back and Arvind has been central to this performance

Arvind Tiwari and the redemption of the region.

(Sales, Chandigarh)

Nihil appears to be a quiet lad, but his secret sauce of success is that his

performance should speak louder than words. Nihil has stood by the same

since the outset at OFB. Despite being a lone warrior he has managed to

accomplish tasks that were thought to be impossible by one and all.

Cracking Dilip Buildcon as a secured customer on OXYZO is one of those.

Nihil’s consistent and solid performance during the OPL in September was

a shot in the arm for his team. His contribution enabled Mighty Maharajas

Nihil Chawla

(Supply Chain Finance, to win a Silver position in the competition.

Gurugram)

Chris single handedly contributed to 20% of the net book add of Karnataka

in September adding 8cr of net book across 2 new clients. As he expands

his wing to take over Dakshina Karnataka, we are looking forward for an

awesome H2 from Chris.

Congratulations on your brilliant performance and all the best for future

OPLs!

Chris Denver Moras

(Sales, Bengaluru)

Spicy September Page 08

Outstanding Performers

Shubham has been the cornerstone of the Rajasthan portfolio. With a

surgeon’s hand, he has built both his team and the book in the region.

Guiding his team out of a deadlock with clients, mentoring the new

members and aligning OfBians across departments has been his forte. This

came out even more so during the OPL in September where Shubham and

Mrinal together led the Mighty Maharajas to win a Silver position in the

competition with 139% achievement of target and the best part is Shubham

has just begun to unwind in his journey at OfBusiness and this is far from

Shubham Shah

(Sales, Gurugram) his brightest hour.

Sanapala popularly known as ‘Mowa’ has great resilience and is known for

his continuous follow-up with customers to close them and get them on

boarded onto Oxyzo. In September, he added a net book of almost 9cr

across 3 new clients. He was one of the front runners in making Deccan win

the OPL.

Kudos to him for his brilliant performance!

Srinivas Sanapala

(KAM, Hyderabad)

Pawan Sethia is an all-rounder of APTS team. He is known as Mr.

Gangadhar alias Shaktimaan of the Risk team. Apart from being fast, furious

& diligent on underwriting of his cases, his contributions across portfolio

monitoring for APTS+CG every single day by coordinating with KAM, Sales,

Collections is legendary. His contribution to Deccan Daredevils during

September OPL was truly exceptional, right from sharing leads to sales,

getting documents & delivering extraordinary 1-2 day TAT on cases, getting

Pawan Sethia

it sanctioned & making sure it was disbursed on time. He is an epitome of

(Risk, Hyderabad) brotherhood across functions & very close to each OFBian in APTS.

Spicy September Page 09

Outstanding Performers

“Man with a mission”, That’s what we call Ashok in our team. He knows all

the tricks of the trade whether it be managing the customer softly, being

assertive, or tracing the unknown addresses and details. He plans and

the executes the same to the tee. He leads by example and takes every

opportunity as a challenge. ”Never say No” and “Do and Die” are the

motto of his life.

Ashok has matured immensely in the last 3 years and has done well. He

manages maximum cases across India without any hassle. We are very

Ashok Kharb

(Collections & proud to have him in our team.

Recovery, Gurugram)

Vijay is a key member of the North Underwriting team. He is always

ready for take additional responsibility apart from BAU. He is the only

underwriter to have presented close to 50+ cases in CRC till now within

the shortest span of time since joining and have assessed close to 180+

cases in past 12 months. His dedication and way of analysis on cases is

inspiring for the team mates. He is extremely fast with respect to TAT

with great decision making skills. He has also taken additional

responsibility of UP and has started handling risk for UP location single

handedly. He has a ‘Never Say No’ attitude and is always there for the

Vijay Kumar Malhotra team to take up additional load to prioritize cases and help teammates.

(Risk, Gurugram)

He worked on the Design of our OxyV platform. Created all the flows

from scratch without any detailed wireframes and primarily only with the

problem description from Product Managers.

Vishal Kumar

(Product & Growth,

Gurugram)

Spicy September Page 10

Outstanding Performers

Finance Team

(Annual Audit and Consolidation)

This team of Rockstars, supported by their respective team members pulled off one of the

biggest and toughest targets of closing and consolidating the Financial Statements of 16

group companies. They not only successfully closed the FS, but also ensured that group

level closing practices & procedures are followed, and all the critical issues are addressed

upfront. It was such a humongous effort that none of them took any personal leave for

almost 4 months and burnt midnight oil for over 6 months, from April 2022 to Sept 2022.

This team has closed 16 standalone FS, prepared 40 types of separate FS as per IND AS,

prepared PPA valuation and PPE valuation reports for all new acquisitions (20 + reports),

addressed multiple tax and accounting complexities with little or no help, faced multiple

auditors, handled multiple complex accounting and disclosure issues. Apart from closing

the FS, they also ensured a no surprise audit, and got clean Audit Reports across all the

entities and at the Console level. Best part is that many of the team members were less

than three months old in the system when they started the field work and did such a

fantastic job.

Spicy September Page 11

Outstanding Performers

Central Revenue Assurance Team

CRA is a team of extremely young people with very less or no relevant domain experience,

yet they have been consistent performers over a significant period. After recent months of

below par performance, they came back in style and posted a very good score for the

company. They not only ensured good asset quality through direct coordination with

clients, but also pushed other teams to ensure overall good DPD number at the group

level. Countless examples are there to share about how they saved company’s money

through sincere and consistent efforts. In September 2022, the team not only beat all

previous records by achieving 95% efficiency in the early bucket, but also cleared 99%

of Principal At Risk (PAR) for cases under their direct ownership. This is the first time

they had achieved this kind of efficiency in the mid of a Financial Year.

Everyone in the team strives for excellence in terms of output and never hesitates in going

beyond their call of duty. This indomitable spirit has resulted in maintaining great portfolio

quality, keeping NPAs under check at almost industry best standards and timely

identification of potential risks. All this was done while maintaining exemplary

camaraderie with other teams and with utmost care for customer relations. Upwards and

onwards. All the best, team!

Spicy September Page 12

Spicy Recruitment Stories

Parul Arora’s recruitment of Vivek Srivastava

Hiring a perfect candidate for Risk & Management System team was a huge

challenge as it was a new area for us (not the typical underwriting risk role).

I scouted and conducted several interviews after taking a clear

understanding of the role from experts. We eventually finalized Vivek who

came with an experience of 11+ years in underwriting across large credit

oriented companies. But the struggle did not stop there, Vivek had to serve

a long notice period before joining OfBusiness which we couldn’t afford as

it would have delayed our business plans laid out for him/new team. We

had to had numerous discussions with him to reduce the same! Finally we

onboarded him smoothly within 35 days!

Thanks to the Ops team for their efforts!

Prabhat Shukla’s recruitment of Puneet Dhir

We wanted the best to join our litigation team & the initial ask was to hire

someone with solid experience in Corporate Litigation, with well polished

and excellent interpersonal skills to navigate the legal tussles. Beyond the

brief our requirement was more nuanced and it took a while to find a

candidate with ‘ALL’ the non-negotiable qualities. The 'Jugaad' factor was

essential ‘PLUS’ all other qualities.

I came to know that the candidate we need must have a robust personality

which can deal with our defaulting clients. After 2-3 months of finding and

grilling many candidates, we finally got our guy.. Puneet Dhir.

Spicy September Page 13

OPL Champions - Winners

Spicy September Page 15

OPL Champions - Winners

Spicy September Page 16

OPL Champions - Runner Ups

Spicy September Page 17

OfBusiness Manufacturing Stories

Spicy September Page 18

ANECDOTE

How do we plan when material

prices go down like crazy?

- Akhil Tripathi

When the world opened up after the Covid lockdown, governments all across rushed with financial

stimulus in order to boost the economy. Research says that commodity prices, specially Metals,

rebounded from the Covid crash much faster than their recovery post the Global Financial Crisis in

2008. The rebound from the post covid stimulus coupled with the Russia Ukraine war was so

strong that between July 2020 and March 2022, Aluminum prices increased by approx 138%, Zinc

by 127% and Copper by 88%. From a trader’s point of view, this was the golden period to trade for

each time they bought a stock, selling price was naturally more than the purchase price. Traditional

traders across India flourished because they were doing great without applying any risk

management technique.

No one thought to plan about the scenario in which material prices go down like crazy.

In May 2022, US inflation data painted a wary picture when it crossed its highest level in four

decades. Rising commodity and energy prices needed to be tamed to bring inflation levels back in

place, which gave way to the Fed tightening the monetary policy by rapidly increasing interest

rates. Since then commodity prices have taken a downward trend along with a steep bullishness in

the US dollar. Speculative bullish positions in metals across exchanges around the world have

dwindled to a historical low and have given way to the bears being in charge. Technical charts

suggest that such a situation is here to stay for quite some time.

While in the last two years, most of us at OfBusiness have seen such a rapid rise and fall in

commodity prices for the first time, volatility in commodities has been inherent since a long time.

So much so that modern risk management practices evolved in the 1970s and by the 1980s, use of

derivatives to “hedge” against price movements became widely prevalent.

Spicy September Page 20

Aluminum Price movement between 2020-2022

1. Price Risk Management: Risk management is, by far, the best way to plan for falling

prices. Since commodity prices are driven by external forces, little can be predicted about

their price movement, and all predictions can be accounted for as speculation because the

price driving factors are mostly out of our control. Effective management of our profitability

makes it vital for us to manage the impact of price fluctuation across our value chain. For

some commodities, India is a fragmented market, and is plagued by information

asymmetry and price discovery inefficiencies. For other cases, if the commodities are

traded on an exchange, the prices are more reliable and transparent. Also, for many

commodities, India is more of a “price taker”, i.e prices in India follow a global trend and we

have limited influence over market movements. When pricing benchmarks are transparent

and accepted all across the market, price risk can be managed through efficient hedging

techniques, by the use of exchange traded derivatives.

2. Hedging is a way of using financial instruments to offset adverse price movements. MCX

defines it as “taking equal and opposite positions in two different markets (such as physical

and futures market), with the objective of reducing or limiting risks associated with price

change. It is a two-step process, where a gain or loss in the physical position due to

changes in price will be offset by changes in the value on the futures platform, thereby

reducing or limiting risks associated with unpredictable changes in price.”

Spicy September Page 21

3. Grey area in the above figure illustrates what happens when material is unhedged and prices

fall. Green area represents the scenario in which material is unhedged but prices rise. These are

speculative calls, and have a high probability of resulting in losses, specially in a downtrending

market. Hedging enables us to lock our margins, and we earn a fix amount, in both rise and fall

situations. Essentially, after hedging, price volatility becomes a zero sum game. If prices rise,

material sells at a higher price and hedge results in a loss which cancel each other out. Opposite

happens when prices fall and a particular margin remains intact despite price fluctuations.

Example: Our manufacturing company, Laxmi Foils, needs 100 MT Aluminum Ingots to do

production. Price of RM will be fixed by the seller on the day of purchase. Processed material will

be ready to be sold in 2-3 weeks. Sale of FG will fetch rates as per the prevailing Aluminum

prices on the day of the sale. Objective is to lock value addition margins and be independent of

price fluctuations.

Spicy September Page 22

● Value addition margin on any day is Rs. 30 over ingot prices

● Aluminum market fell by Rs. 20 by the time some FG was ready to be sold

● FG was sold at a lesser price (Rs. 220) than the budgeted price (Rs. 240), hence incurring a

loss of Rs. 20

● This loss of Rs. 20 was covered through buying of 20 MT on the MCX futures market at

Rs. 183, which was sold at Rs. 203 earlier

This is the most basic example of how to plan when material prices are going down. More

complex use cases may also be derived as per our need.

The key is to identify a liquid contract of an asset on an exchange and hedge all products in

which we trade/manufacture through that contract. For example, MCX Aluminum contract

estimates the fair value of Ingots, but we use them to hedge Aluminum derived products as

well like Wire Rods, Billets, Value Added Products and Scrap. In yarns, we are trying to do a

similar benchmarking so that cotton based yarns may be hedged through the MCX Cotton

contract.

While Hedging in itself is a bit technical to be covered in its entirety through this article, it is

imperative to note that it is folly to be open on a stock for which prices might drop in the

future, and contracts should be identified in order to offset these risks. As we venture into

manufacturing and imports, risk management will prove to be much more important because

the time difference from procurement of raw materials to the time when the finished goods

are sold, will open us to much more volatility in prices.

Spicy September Page 23

How to manage an asset out and

out?

- Yatish Sachdev

As the story of manufacturing unfolded at OFB, I was fortunate enough to be one of the firsts to

be given the opportunity to run an asset. From loading a container to driving a 10 ton truck,

making 21000 kits in 3 nights, to picking stock from a supplier in my own car! You name it and I

have done it all!

Managing an asset involves delving into various processes like -

● Understanding the business

● Manpower Management and Hiring

● Capex Management

● Factory Compliances

● Procurement

● Setting up the Operational SOPs

● Financial Management

● Coordination between OFB and the Asset team

● Sales and Dispatches

Understanding the business-

The first step involves getting complete understanding of the overall business. This requires you

to get into the minutest details, understand the nitty gritties and observe the complete process

flow closely right from the vehicle entering the factory premises to the vehicle being dispatched.

Steps at every level include - procurement, material QA, fumigation, packing, storage,

compliances, and dispatches, to understanding the rationale behind the business, the

competitors, and the overall scope.

Manpower Management and hiring-

After understanding the complete process flow it is imperative to essentially understand the

manpower requirements for the factory and setting up various department owners.

Staffing requirements include-

● Administration (Finance, Procurement, Inventory, Billing, Operations, Human Resources,

Packaging, Design)

● Full-time employees/ Labours

● Contractual Labour

Spicy September Page 24

● Other support staff- (Guards, drivers, gardeners, cafeteria staff)

Capex Management-

As stated above in the first step, deep research is required in order to understand the current

plant and machinery and various methods are adopted to increase the overall productivity, such

as-

● Adopt automation

● Increase the overall efficiency

● Reduce the labour cost and manual efforts

● Increase plant capacity (if possible)

● Eliminate pilferage and scope of errors

Another key point is to ensure and set up a process for preventive maintenance of current

machinery to avoid any unnecessary breakdowns.

Factory Compliances-

This is another important step in running a plant, adhering to the legal compliances like licenses

and certifications -

● Understand the various certifications for Land, NOC, safety norms, insurance

● Liaisoning becomes very important (in the case of exports- custom clearances, govt

schemes, etc)

● Fulfil Labour Law related compliances- ESI, WC policy, minimum wages, and PF

● Fulfil certifications for new businesses and other auditory requirements

Procurement-

This is one of the most important aspects of running an asset.

Meeting every existing supplier, onboarding new suppliers, and building a relationship with them

is critical as it helps in understanding the overall supply chain and eventually increasing the

margins.

This includes 4 major steps-

● Demand Projections- Forecasting the demand based on the previous orders, seasonality,

elasticity, etc

● BOM Creation- Creating the bill of material for each SKU

● Inventory Management- Creating a process flow to keep track of the inventory, following

up FIFO, setting up zones

Spicy September Page 25

● Procurement- After the first 3 steps are completed, taking quotes from various suppliers

for the best margins and profitability, ensuring the quality checks and payment terms

For e.g, Today, at Dhara we have at least two to three suppliers for each SKU (we have over 500+

SKUs here) and intend to increase the supplier base in the current months, with bidding as the

long-term plan. This would also help us in ensuring that there are no fraudulent activities

involved at any step of the supply chain.

Setting up the SOPs

This is by far the toughest part of running an asset, as this requires all the asset stakeholders to

come out of their comfort zones.

● Shifting from manual processes to ERP based system

● Taking regular training sessions, making employees and workers understand the

importance of processes and implementing it

● Setting up various zones according to the requirement- For eg today the factory is set up

into 16 RM zones across 4 floors, and further divided into 3 main zones. (RM, WIP, and FGs)

(this was by far the toughest part), getting them to fill at least 10-12 sheets, getting them

into a regular habit of updating and communicating on official communication channel.

Ownership at every step by the management and the supervisors is critical to completion of this

step

Financial Management

Post setting up the ops, it is important to understand the finance side of the business as this is

where the actual money comes from. The steps include-

● WC Management- Understanding of the debtors, creditors, inventory aging, etc, the

requirement of additional capital, CC/ PCFC lines

● Margins- Setting up various trackers to see the actual margins being made

● Proper tax and regulatory filings- Checking the advance tax being paid, GST filing, daily

updating of tally, and right information being filled

● Collections- To maintain the right WC flow, it's important to get involved in the collections

● MIS- Maintaining and daily MIS to calculate, real-time EBITDA, GM levels and seeing the

scope for improvement

● Keeping a hawk eye on the payment being done daily and putting a complete stop to any

cash transitions

Spicy September Page 26

Coordination between OFB and Asset team-

This step is like a see-saw, as this requires you to balance out at each step!

Ensuring regular backups are being sent to the company, answering all queries in time, fulfilling

all compliances and taking all necessary approvals and most importantly making sure right

reporting is done to the company,

Sales and Dispatches-

Sales process includes various steps-

● Meeting the current buyers- Building a relationship with the existing buyers, getting them

to know about OFB, and ensuring regular visits to them, even if not regular, at least virtually.

● Hunting New Clients- Strategizing various new businesses, sending regular proposals, and

getting them onboarded

● Demand Generations- Increasing the current revenue levels with each buyer, increasing the

product mix and value-added products

Focusing on dispatches includes-

● Finished Goods Management- Ensuring the FGs are being stored correctly and dispatched

on time

● Proper Fulfilment- Ensuring the fill ratios are at 100 percent by making a regular Sales and

Dispatch order

● Fleet Management- Keeping a hawk-eye on the amount being paid for logistics, checking on

proper preventive maintenance for factory vehicles to avoid any breakdowns

To summarize, running an asset, requires you to take complete ownership of every process, run it

like your own company and keep learning every day!

With more challenges coming my way, the last year has been a beautiful learning curve and I am

more than excited to take on the other assets and keep trying, learning and growing both myself

and the company!

Spicy September Page 27

What are the top 5 things to watch

for in an operating MIS?

- Chandni Malhotra

There is a measurement for every inventory that businesses have. Sale of goods or services the

businesses do. The money (credit and cash) that comes in and goes out of the businesses, the assets

company possess. The Operational MIS is a science to collect and possess the data of business which

could help the business to quantify all these inventories to know where they stand in the market.

Operating MIS is not just about the financial position of business, but it also speaks about the

efficiency of the business operations.

As doctors typically check several measurements/tests to gauge how our health has progressed over

the past year, a business analyst uses various analysis tools as a measurement to check business

health.

“The only way you will ever permanently take control of your business is to dig deep and fix

the root problem.” And for digging a root problem in business one should know what to watch

for in an operating MIS. Everyone look in MIS with a different motive and different prospective,

but there are some important things which everyone should watch for in an MIS.

1. Horizontal analysis: The principle behind horizontal analysis of financial statements is very

simple. You analyze the evolution of the reported numbers (trends) over different periods of

reporting. This allows you to see if there are big differences month over month and, if you cannot

explain those differences from what you know of the company, this invites you to investigate

further.

For instance, if you see jump of 70% in sales volume between one period to another. This would

invite you to investigate further like did they increase their prices? Did they receive a bulk order?

Are there any major movements in market? There is reason for every change but when you see an

unexplained difference like this, you need to find an explanation of what's going on.

On the other hand, if numbers are stable but you expected a big difference, you need to find an

explanation for that too.

The horizontal analysis should be made on each line item of MIS information (either value

or volume/ Customers or suppliers).

Spicy September Page 28

2. Vertical Analysis: Vertical Analysis can become a more potent tool when used in conjunction

with horizontal analysis, which considers the finances of certain period. Vertical analysis makes it

easier to understand the correlation between single line items of MIS with the base line, expressed

in a percentage. In this way one can see numbers as a percentage of base figure within the MIS to

compare previous periods for time series analysis, in which percentages are compared over several

periods, to gain a picture of whether performance metrics are improving or deteriorating.

By seeing the various expense line items in the income statement as a percentage of sales, one can

see how these are contributing to profit margins. It helps to take control on excessive increase in

operating expenses which can be control. It’s good to see if you can reduce any ongoing costs or if

they were necessary for that period.

3. Ratio Analysis: The power of ratios lies in the fact that the numbers in the income statements

by themselves don’t reveal the whole story. We all are aware of financials ratio but along with

financial ratios there are some productivity ratios one should look for both in operating MIS as

these ratios speak how efficiently company is making product and money.

The productivity ratio is a quantifiable number that measures production during a specific period

This ratio considers both input and output (Output/Input Ratio) and measures aspects of

business-like labor, materials, and production cost. One should use productivity ratios to measure

efficiency and evaluate their business model.

If these ratios are not in line with industries standards and companies’ expectations, then one

should dig more into weakness in production process.

Some of the ratios one should watch are Profitability Ratios/Working Capital Ratio/ Turnover

Ratios /Material Usage Ratio and Labor Productivity Ratio etc.

4. Variances: variances provide an explanation for deviations between standards/predictions v/s

actual. By Breaking down these deviations into various drivers (such as

sales/productivity/volume/prices/usage/product cost) and these breakdowns can serve as a hint

regarding the components and reasons of these deviations and then once can easily know causes

of problems and can improve performance. This information can provide insight into what actions

should be taken to meet forecasted targets. Some variances we should always check are Sales

Variance/Cost Variance/ Usage and Price Variance.

Spicy September Page 29

5. Cash Flow analysis: I don’t look at all the Cash Flow Ratios, so much as understand how the

Cash Flows happen. The basic requirement is, of course, a positive Cash Flow from Operations

along with from investment and finance activities. Cash flow from operation should more or less

be in line with Net Profits. I’d say about 70–75% is the minimum requirement (70%-75% of total

cash flow should be from operations). If it’s lower than that, it means that the company struggles

to convert its Book Profits into Cash. Ultimately, Cash is the reality of any business. So, this is

very importance to keep an eye on operating cash flows of business.

“Numbers have an important story to tell, they rely on you to give them a clear and convincing

voice.”: Stephen Few

Spicy September Page 30

Offbeat locations around Gurugram

(For all the travel buffs)

1. Sultanpur Bird Sanctuary

This beautiful bird sanctuary is located only 15 km from Gurgaon, so it is a perfect destination for a

day trip. Winter is the best time to visit the sanctuary because of a large number of migratory birds

that fly into the sanctuary. This is a heaven for bird watchers and nature lovers alike. You can go on

top of one of the four watchtowers constructed in the sanctuary for some peaceful bird watching.

2. Camp Wild

What if you discovered a place that had rocky mountains, forests and starry nights all within an hour’s

distance from Gurgaon? Well that’s just where Camp Wild Dhauj steps in. It’s an eco-forest with the

Aravallis as a backdrop in Mangar Village. The place offers everything for adventure lovers as well

nature lovers. From cycling to hikes to rappelling and an obstacle park, there are loads of activities to

keep you busy. There are eco-lodges and lovely tents for the weekenders.

Spicy September Page 32

Shutterbug

OFB’S stall in AMEA (Asia Middle East Africa) Bitumen

and Base Oil Conference

HSE Training in OFB

Kosi

Spicy September Page 33

Shutterbug

Abhishek Kaushik was the speaker in one of the

commodity pricing session organised together by MCX

and CNBC.

Mega legal moment for all: FIR quashing in Udaipur.

Daksh, Varun, Brij, Yash, Rashi

Spicy September Page 34

Shutterbug

Meeting with Country Delight -> start of a long term

partnership

The beginning of OFB's biggest capex to date - DRI and

Power Plant in SMW, Wardha

Spicy September Page 35

Shutterbug

Promotional scheme run by our distributor (Sunlight

Industries) in Jaipur

Sree Varshan with DK Goyal (Founder of FIITJEE)

Spicy September Page 36

Campus Engagement at

OfBusiness

FMS

IIM Kashipur

Spicy September Page 37

Campus Engagement at

OfBusiness

IIM Udaipur

IMT Ghaziabad

Spicy September Page 38

Campus Engagement at

OfBusiness

IIM Indore

IIM Kashipur

Spicy September Page 39

Campus Engagement at

OfBusiness

IIM Trichy

Spicy September Page 40

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- GSTR3B - July Sep 23Document3 pagesGSTR3B - July Sep 23Vipasha SanghaviNo ratings yet

- Form - PDF - ITR FY 22-23Document73 pagesForm - PDF - ITR FY 22-23Vipasha SanghaviNo ratings yet

- Fund and Non Fund Utilisation SheetDocument11 pagesFund and Non Fund Utilisation SheetVipasha SanghaviNo ratings yet

- Form 3CB-3CD - ARNDocument1 pageForm 3CB-3CD - ARNVipasha SanghaviNo ratings yet

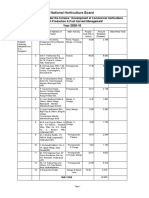

- National Horticulture Board: Year 2009-10Document231 pagesNational Horticulture Board: Year 2009-10Vipasha SanghaviNo ratings yet

- GSTR3B March-24Document3 pagesGSTR3B March-24Vipasha SanghaviNo ratings yet

- 6.2.2.c Annexure IV - H1 FY15Document6 pages6.2.2.c Annexure IV - H1 FY15Vipasha SanghaviNo ratings yet

- Suman Jade Renewal Notice 2022Document2 pagesSuman Jade Renewal Notice 2022Vipasha SanghaviNo ratings yet

- Dhatarwal Construction Company Private LimitedDocument3 pagesDhatarwal Construction Company Private LimitedVipasha SanghaviNo ratings yet

- WorkorderDocument2 pagesWorkorderVipasha SanghaviNo ratings yet

- Policy Schedule - Endorsed Copy: My: Health Medisure Super Top Up InsuranceDocument1 pagePolicy Schedule - Endorsed Copy: My: Health Medisure Super Top Up InsuranceVipasha SanghaviNo ratings yet

- Suman Jade Policy 21-22Document5 pagesSuman Jade Policy 21-22Vipasha SanghaviNo ratings yet

- HDFC ERGO General Insurance Company Limited: Chandramani Wamanrao KhandareDocument6 pagesHDFC ERGO General Insurance Company Limited: Chandramani Wamanrao KhandareVipasha SanghaviNo ratings yet

- Code IdDocument4 pagesCode IdVipasha SanghaviNo ratings yet

- E Class Contractors Enlisted With CWE (Subs) MumbaiDocument23 pagesE Class Contractors Enlisted With CWE (Subs) MumbaiVipasha SanghaviNo ratings yet