Professional Documents

Culture Documents

Cash Flow Reconciliation Template

Uploaded by

ali iqbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Reconciliation Template

Uploaded by

ali iqbalCopyright:

Available Formats

Cash Flow Reconciliation Template Strictly Confidential

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and trademark laws.

No part of this publication may be modified, manipulated, reproduced, distributed, or transmitted in any form by any means, including photocopying, recording, or other electronic or mechanical methods,

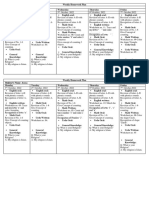

INCOME STATEMENT

Year ended December 31,

(in millions) 2018 2017 2016 2015 2014

Revenue $22,000 $20,000 $18,000 $15,000 $10,000

COGS (3,200) (3,200) (3,000) (3,000) (2,500)

Gross Profit 18,800 16,800 15,000 12,000 7,500

Depreciation (500) (500) (500) (450) (400)

SG&A (300) (300) (300) (300) (300)

Interest (50) (50) (50) (50) (50)

Earnings Before Tax 17,950 15,950 14,150 11,200 6,750

Tax (3,590) (3,190) (2,830) (2,240) (1,350)

Net Earnings 14,360 12,760 11,320 8,960 5,400

CASH FLOW STATEMENT

Year ended December 31,

(in millions) 2018 2017 2016 2015 2014

Cash from Operations

Net Income $14,360 $12,760 $11,320 $8,960 $5,400

Adjusted for:

Depreciation 500 500 500 450 400

Stock based compensation 0 0 0 0 0

Change in accounts receivable (200) 500 900 (1,500) (1,000)

Change in inventory 1,000 (3,000) 1,300 2,000 (14,000)

Change in accounts payable 500 (500) (500) 500 1,000

Cash from Operations $16,160 $10,260 $13,520 $10,410 ($8,200)

Cash from Investing

Purchase of PP&E ($500) ($5,500) ($1,200) ($5,450) ($40,400)

Acquisition of businesses 0 0 0 0 0

Cash from Investing ($500) ($5,500) ($1,200) ($5,450) ($40,400)

Cash from Financing

Issuance (repayment) of debt 0 6,000 5,000 3,500 18,500

Issuance (repayment) of equity 0 0 0 0 30,000

Dividends 0 0 0 0 0

Cash from Financing 0 6,000 5,000 3,500 48,500

Net Change in Cash $15,660 $10,760 $17,320 $8,460 ($100)

Cash at beginning of period 49,190 38,430 21,110 12,650 12,750

Cash at end of period $64,850 $49,190 $38,430 $21,110 $12,650

EBITDA $18,500 $16,500 $14,700 $11,700 $7,200

Cash Flow (CF) $16,160 $10,260 $13,520 $10,410 ($8,200)

Free Cash Flow (FCF) $15,660 $4,760 $12,320 $4,960 ($48,600)

Free Cash Flow to Equity (FCFE) $15,660 $10,760 $17,320 $8,460 ($30,100)

Free Cash Flow to Firm (FCFF) $15,700 $4,800 $12,360 $5,000 ($48,560)

Free Cash Flow to Firm (FCFF) a.k.a. Unlevered Free Cash Flow

EBIT $18,000 $16,000 $14,200 $11,250 $6,800

Tax (3,600) (3,200) (2,840) (2,250) (1,360)

D&A 500 500 500 450 400

Chang in NWC 1,300 (3,000) 1,700 1,000 (14,000)

Capex (500) (5,500) (1,200) (5,450) (40,400)

Free Cash Flow to the Firm $15,700 $4,800 $12,360 $5,000 ($48,560)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Accounting Entries LCM ORACLE R12Document4 pagesAccounting Entries LCM ORACLE R12ali iqbalNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Radio One Inc: M&A Case StudyDocument11 pagesRadio One Inc: M&A Case StudyRishav AgarwalNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- R12 - EB-Tax Setup - Different ScenariosDocument25 pagesR12 - EB-Tax Setup - Different Scenariosali iqbalNo ratings yet

- Financial Analysis Automobile IndustryDocument38 pagesFinancial Analysis Automobile Industryali iqbalNo ratings yet

- Priyanka Arvind PathakDocument11 pagesPriyanka Arvind Pathakravi newaseNo ratings yet

- Dictionary of EconomicsDocument225 pagesDictionary of EconomicsMushtak Shaikh100% (1)

- Encumbrance Accounting in Oracle EBS R12Document34 pagesEncumbrance Accounting in Oracle EBS R12ali iqbalNo ratings yet

- Anwar Ibrahim and The Money MachineDocument13 pagesAnwar Ibrahim and The Money MachineMalaysia_PoliticsNo ratings yet

- Consolidated Mines, Inc Vs Cta and CirDocument3 pagesConsolidated Mines, Inc Vs Cta and CirKirs Tie100% (3)

- 14c CashManagementDocument76 pages14c CashManagementali iqbalNo ratings yet

- HW5 SolnDocument7 pagesHW5 SolnZhaohui Chen100% (1)

- Weekly Homework Plan PDFDocument6 pagesWeekly Homework Plan PDFali iqbalNo ratings yet

- 05d AllocationsDocument23 pages05d Allocationsali iqbalNo ratings yet

- Overview and Key Features of Oracle Isupplier Portal - iBizSoft KnowledgeDocument20 pagesOverview and Key Features of Oracle Isupplier Portal - iBizSoft Knowledgeali iqbalNo ratings yet

- CHP 5Document14 pagesCHP 5ali iqbalNo ratings yet

- CHP 2Document9 pagesCHP 2ali iqbalNo ratings yet

- Oracle Application's Blog - Printer Profile Option in Oracle AppsDocument5 pagesOracle Application's Blog - Printer Profile Option in Oracle Appsali iqbalNo ratings yet

- LCM SetupDocument35 pagesLCM Setupali iqbalNo ratings yet

- AP ACcountingn Entries (Oracle)Document15 pagesAP ACcountingn Entries (Oracle)ali iqbalNo ratings yet

- LCM FDDocument13 pagesLCM FDali iqbalNo ratings yet

- Oracle Apps - R12 Payment Document Setup - Oracle Apps TechnicalDocument2 pagesOracle Apps - R12 Payment Document Setup - Oracle Apps Technicalali iqbalNo ratings yet

- Example With AccountingDocument4 pagesExample With Accountingali iqbalNo ratings yet

- Pathways Guidance From The Examiners (ICAEW)Document13 pagesPathways Guidance From The Examiners (ICAEW)ali iqbalNo ratings yet

- General Ledger Encumbrance Accounting - OracleUGDocument4 pagesGeneral Ledger Encumbrance Accounting - OracleUGali iqbalNo ratings yet

- Encumbrance Setup ListDocument3 pagesEncumbrance Setup Listali iqbalNo ratings yet

- Spring Sales BrochureDocument13 pagesSpring Sales BrochureGuy SparkesNo ratings yet

- Rites Ltd. Update: January 2021 EditionDocument6 pagesRites Ltd. Update: January 2021 EditionjageshwariNo ratings yet

- The Oxford Business Report Djibouti 2016Document155 pagesThe Oxford Business Report Djibouti 2016Mahad AbdiNo ratings yet

- Invoice: Invoice From Invoice To Customer InformationDocument1 pageInvoice: Invoice From Invoice To Customer Informationnarsampet stcNo ratings yet

- 2017 18 - S1 24894 15 Andreia - BichoDocument33 pages2017 18 - S1 24894 15 Andreia - BichotalithatiffNo ratings yet

- 6.5 Present and Future Value of A Continuous Income StreamDocument3 pages6.5 Present and Future Value of A Continuous Income StreamPoppycortanaNo ratings yet

- Meaning and Concept of Capital MarketDocument11 pagesMeaning and Concept of Capital Marketmanyasingh100% (1)

- Gold Purchase PlanDocument4 pagesGold Purchase PlanRohit MishraNo ratings yet

- Transmission Corporation of Andhra Pradesh LimitedDocument35 pagesTransmission Corporation of Andhra Pradesh LimitedTender 247No ratings yet

- Ratio Analysis - Ashok LeylandDocument18 pagesRatio Analysis - Ashok Leylandgunjan02060% (1)

- 6 Advanced Accounting 2DDocument3 pages6 Advanced Accounting 2DRizky Nugroho SantosoNo ratings yet

- Pre Test Q4Document3 pagesPre Test Q4Joy NavalesNo ratings yet

- Basic Facts About ESOPs2Document20 pagesBasic Facts About ESOPs2Quant TradingNo ratings yet

- Cost Management Problems CA FinalDocument266 pagesCost Management Problems CA Finalksaqib89100% (1)

- Factors Affecting Land ValueDocument3 pagesFactors Affecting Land ValueBGSSAP 2017100% (1)

- Unit 4 Accounting Standards: StructureDocument16 pagesUnit 4 Accounting Standards: StructurefunwackyfunNo ratings yet

- Analysis of Balancesheet ItlDocument78 pagesAnalysis of Balancesheet Itlnational coursesNo ratings yet

- EVA Momentum The One Ratio That Tells The Whole StoryDocument15 pagesEVA Momentum The One Ratio That Tells The Whole StorySiYuan ZhangNo ratings yet

- FRA Endterm QP-Term 1 - PGDM 2023-25Document4 pagesFRA Endterm QP-Term 1 - PGDM 2023-25elitesquad9432No ratings yet

- Icici: Broad Objectives of The ICICI AreDocument7 pagesIcici: Broad Objectives of The ICICI Aremanya jayasiNo ratings yet

- DBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018Document10 pagesDBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018barangay08 can-avidesamarNo ratings yet

- LCCI Level 3 Certificate in Accounting ASE20104 Resource Booklet Sep 2018Document8 pagesLCCI Level 3 Certificate in Accounting ASE20104 Resource Booklet Sep 2018Musthari KhanNo ratings yet

- Market Outlook 13th January 2012Document6 pagesMarket Outlook 13th January 2012Angel BrokingNo ratings yet

- The Price Revolution of The Sixteenth Century - BarkanDocument27 pagesThe Price Revolution of The Sixteenth Century - BarkanhalobinNo ratings yet