Professional Documents

Culture Documents

Kelompok 2 MG322D Tugas 3

Uploaded by

Tunggul Wibisono PriambudiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kelompok 2 MG322D Tugas 3

Uploaded by

Tunggul Wibisono PriambudiCopyright:

Available Formats

Kelas (MG322D)

KELOMPOK 2:

1. Tunggul Wibisono Priambudi 212020160

2. Trada Vernanda 212018062

3. Jerry A. Tjluku 212019189

4. Rut Mersy Bonay 212018403

5. Yanti Uamang 212018401

6. Javed Marthzarian Matte 212020233

1 Januari (actual) 20.000

February (actual) 24.000

March (actual) 28.000

April 35.000

May 45.000

June 60.000

July 40.000

August 35.000

September 32.000

Assets

Cash 14.000

Account Receivable ($48,000 February sales; $168,000 March sal 216.000

Inventory (31,500 units) 157.500

Prepaid insurance 14.400

Fixed assets, net of depreciation 172.700

Total assets 574.600

Liabilities and Stockholders Equity

Account payable 85.750

Dividends payable 12.000

Capital stock 300.000

Retained earnings 176.850

Total liabilities and stockholders equity 574.600

a. Sales budget

April May June Quarter

Budgets sales in units 35000 45000 60000 140000

Selling process per unit $8 $8 $8 $8

Total sales $280.000 $360.000 $480.000 $1,120,000

b. Schedule of expected cash collection

February sales $48.000 $48.000

March sales 112.000 $56,000 168.000

April sales 70.000 140.000 70.000 280.000

May sales 90.000 180.000 270.000

June sales 120.000 120.000

Total cash collection $230,000 $286.000 $370.000 $886,000

c. Merchandise purchase budget

Budgeted sales in units 35.000 45.000 60.000 140.000

Add budgeted ending

Inventory* 40.500 54.000 36.000 36.000

Total needs 75.500 99.000 96.000 176.000

Less beginning 31.500 40.500 54.000 31.500

Required unit purchases 44.000 58.500 42.000 144.500

Units cost $5 $5 $5 $5

Required dollar purchases $220,000 $293 $210,000 $722,500

90% of next month's sales in units

d. Budgeted cash disbursement for merchandise purchases

April May June Quarter

March purchases $85,750 $85,750

April purchases 110.000 $110,000 220.000

May purchases 146.250 146.250 292.500

June purchases 105.000 105.000

Total cash disbursement $195,750 $256,250 $251,250 $703,250

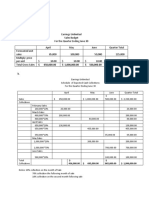

2 For the Three Months Ending June 30

April May June Quarter

Cash balance

beginning $14.000 $10.250 $10.000 $14.000

Add receipts from 0

customer (Part 1b) 230.000 286.000 370.000 886.000

Total cash available 244.000 296.250 380.000 920.250

Less disbursements:

Purchase of inventory (Part 1d) 195.750 256.250 251.250 703.250

Sales commissions 35.000 45.000 60.000 140.000

Salaries and wages 22.000 22.000 22.000 66.000

Utilities 14.000 14.000 14.000 42.000

3.000 3.000 3.000 9.000

12.000 0.000 0.000 12.000

Land purchases 0.000 25.000 0.000 25.000

Total disbursements 281.750 365.250 350.250 997.250

Excess (deficiency) of receipts over disburs -37.750 -69.000 29.750 -97.250

Financing:

Borrowings 48.000 79.000 127.000

Repayments* 0.000 0.000 -16.000 -16.000

Interest 0.000 0.000 -3.020 -3.020

Total Financing 48.000 79.000 -19.020 107.980

Cash balance, ending 10.250 10.000 10.730 10.730

*This is the maximum amount (in increments of $1,000) that the company could repay to the bank and still have at least a $10,000 ending balance.

48000 x 1% x 3 = $1.440

79000 x 1% x 2 = $1.580

Total interest = $3.020

3 Budgeted Income Statement For the Three Months Ended June 30

Sales Revenue $1,120,000

Variable Expenses:

Cost of Good Sold $700.000

Commissions $140.000 $840.000

Contribution Margin $280.000

Fixed Expenses:

Wages and Salaries $66.000

Utilities $42.000

Insurance Expired $3.600

Depreciation $4.500

Miscellaneous $9.000

$125.100

Net Operating Income $154.900

Less Interest Expense $3.020

Net Income $151.880

4 Cravat Sales Company

Budgeted Balance Sheet

June 30

Assets

Cash (Part 2) $10.730

Accounts receivable (see blow) $450.000

Inventory (36,000 ties @5 per tie) $180.000

Unexpired insurance ($14,400-$3,600) $10.800

Fixed assets, net of depreciation ($172,700 + $25,000 - $4,500) $193.200

Total Assets $844.730

Liabilities and Equity

Accounts payable, purchase (50%*$210,000 from part 1c) $105.000

Dividends payable $12.000

Loans payable, bank (Part 2; $127,000 - $16,000) $111.000

Capital stock, no par $300.000

Retained earnings (see below) $316.730

Total liabilites and equity $844.730

Accounts receivable at june 30:

25% x May sales of $360,000 $90.000

75% x June sales of $480,000 $360.000

Total $450.000

Retained earnings at June 30:

Balance, March 31 $176.850

Add net income (Part 3) $151.880

Total $328.730

Less dividends declared $12.000

Balance, June 31 $316.730

You might also like

- Strat Cost 8-24Document4 pagesStrat Cost 8-24Vivienne Rozenn LaytoNo ratings yet

- Pilaps & VilsDocument15 pagesPilaps & VilsGwendolyn PansoyNo ratings yet

- G 12 Fabm 2 Q1 G. BruanDocument33 pagesG 12 Fabm 2 Q1 G. BruanDark SideNo ratings yet

- SuperbudDocument50 pagesSuperbudapi-4578794210% (1)

- ACC111 Activity 22Document8 pagesACC111 Activity 22Triquesha Marriette Romero Rabi100% (1)

- Project Case 9-30 Master BudgetDocument6 pagesProject Case 9-30 Master Budgetleizalm29% (7)

- Master Budgeting (Sample Problems With Answers)Document11 pagesMaster Budgeting (Sample Problems With Answers)Jonalyn TaboNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- 08 Task PerformanceDocument3 pages08 Task PerformanceBetchang AquinoNo ratings yet

- Master BudgetDocument6 pagesMaster BudgetLandon GalenskiNo ratings yet

- 08 TP - Evangelista Angela - 501PDocument9 pages08 TP - Evangelista Angela - 501PBetchang AquinoNo ratings yet

- Earrings UnlimitedDocument6 pagesEarrings Unlimitedabigail franciscoNo ratings yet

- Corminal TPDocument7 pagesCorminal TPBetchang AquinoNo ratings yet

- Bigbud 4th Ed Womack BaileyDocument26 pagesBigbud 4th Ed Womack Baileyapi-356759536No ratings yet

- 08 TP 1-ArgDocument3 pages08 TP 1-ArgAlthea ObinaNo ratings yet

- Managerial Accounting Chapter 7Document4 pagesManagerial Accounting Chapter 7Neema MarkNo ratings yet

- Earrings UnlimitedDocument7 pagesEarrings Unlimitedabigail franciscoNo ratings yet

- Quiz 3.1 BudgetingDocument6 pagesQuiz 3.1 BudgetingMaxine ConstantinoNo ratings yet

- Group Managerial AccountingDocument9 pagesGroup Managerial AccountingSlamet SalimNo ratings yet

- 3 - Solution Guide - Short Term Budgeting AssignmentDocument3 pages3 - Solution Guide - Short Term Budgeting AssignmentEdward Glenn BaguiNo ratings yet

- Homework Submission Point For Lecture Date 15 - 8Document8 pagesHomework Submission Point For Lecture Date 15 - 8Hạ Phạm NhậtNo ratings yet

- 08 Activity 1Document4 pages08 Activity 1Althea ObinaNo ratings yet

- BigbudhunterkaarlsenDocument25 pagesBigbudhunterkaarlsenapi-356428418No ratings yet

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GNo ratings yet

- Budgeting 30 NOvDocument8 pagesBudgeting 30 NOvHaris HasanNo ratings yet

- Pasicolan - Case Study Budgeting PDFDocument4 pagesPasicolan - Case Study Budgeting PDFMark Joshua PasicolanNo ratings yet

- Exercise 1 Margarett Company: Sales BudgetDocument4 pagesExercise 1 Margarett Company: Sales BudgetHannaniah PabicoNo ratings yet

- Cash Is King HWDocument16 pagesCash Is King HWkuanishalua24No ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- Financial Accounting - Final Case StudyDocument13 pagesFinancial Accounting - Final Case StudyAhmad ZakariaNo ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- Earrings Suggested SolutionsDocument4 pagesEarrings Suggested Solutions9ry5gsghybNo ratings yet

- Pasicolan - Case StudybedgetingDocument5 pagesPasicolan - Case StudybedgetingMark Joshua PasicolanNo ratings yet

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- BudgetDocument8 pagesBudgetvaibhavpratapsingh910No ratings yet

- BT Ke Toan Quan TriDocument39 pagesBT Ke Toan Quan TriTram NguyenNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Cash Receipts March April May June JulyDocument1 pageCash Receipts March April May June JulyJPNo ratings yet

- Accounting ExilDocument8 pagesAccounting ExilCyrille Rica G. TianchonNo ratings yet

- MAS ExerciseDocument9 pagesMAS ExerciseAlaine Milka GosycoNo ratings yet

- 21 (6) - 4A 12e SDocument5 pages21 (6) - 4A 12e SashibhallauNo ratings yet

- SQUACKERSDocument27 pagesSQUACKERSPhilip LarozaNo ratings yet

- Standard Material Cost R$ 46.68: Nyclyn R$ 17.40 Salex R$ 17.28 Protet R$ 12.00Document10 pagesStandard Material Cost R$ 46.68: Nyclyn R$ 17.40 Salex R$ 17.28 Protet R$ 12.00zZl3Ul2NNINGZzNo ratings yet

- Financial-Statements-excel-format (Entrep LP 4Q)Document55 pagesFinancial-Statements-excel-format (Entrep LP 4Q)DaCorn 2CobNo ratings yet

- FM - Master BudgetDocument5 pagesFM - Master BudgetChristine Angeli AritaNo ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - ChaseDocument6 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - ChaseJason RobillardNo ratings yet

- Bai Tap KTQT 2Document12 pagesBai Tap KTQT 2Tram NguyenNo ratings yet

- Business Math (Excel)Document6 pagesBusiness Math (Excel)mobinil1No ratings yet

- SQUACKERSDocument25 pagesSQUACKERSPhilip LarozaNo ratings yet

- Akuntansi Manajemen 8-24Document8 pagesAkuntansi Manajemen 8-24Chika Slalubahagia SlamanyaNo ratings yet

- Marsh AnswersDocument6 pagesMarsh AnswersVhertotNo ratings yet

- Sales Budget: Mar April MayDocument3 pagesSales Budget: Mar April MayMuhammad KashifNo ratings yet

- Proj 2Document15 pagesProj 2Shahan AsifNo ratings yet

- Asistensi 2Document2 pagesAsistensi 2CatherineNo ratings yet

- The Answer For The Exercise of Trading Company The ABC StoreDocument6 pagesThe Answer For The Exercise of Trading Company The ABC StoreSajakul SornNo ratings yet

- Imanuel Xaverdino - 01804220010 - Homework 06Document3 pagesImanuel Xaverdino - 01804220010 - Homework 06Imanuel XaverdinoNo ratings yet

- Ain20190418028 ModifiedDocument5 pagesAin20190418028 ModifiedNiomi GolraiNo ratings yet

- Advanced Audit and AssuranceDocument7 pagesAdvanced Audit and AssurancePrasad DilrukshanaNo ratings yet

- Fs Analysis Quizzer PDF FreeDocument22 pagesFs Analysis Quizzer PDF FreeXela Mae BigorniaNo ratings yet

- Nazari Electrical Services Has An August 31 Fiscal Year EndDocument2 pagesNazari Electrical Services Has An August 31 Fiscal Year EndCharlotteNo ratings yet

- Ambit - Strategy - Thematic - Ten Baggers 8 - A Relook at The Past For Progress - 28jan2019 PDFDocument29 pagesAmbit - Strategy - Thematic - Ten Baggers 8 - A Relook at The Past For Progress - 28jan2019 PDFAadi GalaNo ratings yet

- Financial Management Source #6Document12 pagesFinancial Management Source #6EDPSENPAI100% (1)

- Fs Analysis - SampleDocument7 pagesFs Analysis - SampleRui ManaloNo ratings yet

- AFM NotesDocument4 pagesAFM NotesPhotos Back up 2No ratings yet

- Putting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018Document38 pagesPutting IFRS 9 Into Practice Presentation By: CPA Stephen Obock February 2018syed younasNo ratings yet

- Acc 107 Finals Quiz 3Document1 pageAcc 107 Finals Quiz 3Jezz CulangNo ratings yet

- (123doc) - De-Thi-He-Thong-Thong-Tin-Kinh-DoanhDocument8 pages(123doc) - De-Thi-He-Thong-Thong-Tin-Kinh-DoanhTrần Minh HoàngNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- Group Reporting KDSDocument86 pagesGroup Reporting KDSA V SrikanthNo ratings yet

- Ambuja Cements 2Document26 pagesAmbuja Cements 2gayatri suryakanthanNo ratings yet

- CS As A ValuerDocument67 pagesCS As A ValuerGAURAVNo ratings yet

- Consalidated Statement of Profit and LossDocument40 pagesConsalidated Statement of Profit and LossG. DhanyaNo ratings yet

- Business Plan-Checked and EditedDocument30 pagesBusiness Plan-Checked and EditedDemn SangaNo ratings yet

- Bajaj AutoDocument2 pagesBajaj AutoRinku RajpootNo ratings yet

- Sources of Financing A ProjectDocument8 pagesSources of Financing A ProjectAbhijith PaiNo ratings yet

- Tutorial Questions 2 - CHP 3 4 10th EdtDocument3 pagesTutorial Questions 2 - CHP 3 4 10th EdtShayal ChandNo ratings yet

- Week 7 NotesDocument6 pagesWeek 7 NotescalebNo ratings yet

- Associate Co. QuestionsDocument3 pagesAssociate Co. QuestionsSigei Leonard100% (2)

- Determine MaterialityDocument10 pagesDetermine MaterialityOwolabi CorneliusNo ratings yet

- Debt Service Coverage Ratio (DSCR) : ValuationDocument17 pagesDebt Service Coverage Ratio (DSCR) : ValuationRh MeNo ratings yet

- Presentation On Compromise ArrangementDocument75 pagesPresentation On Compromise ArrangementPalakVermaNo ratings yet

- ACCOUNTING - Definition, Phases, Importance With SpeechDocument6 pagesACCOUNTING - Definition, Phases, Importance With SpeechCaryl Anne MagalongNo ratings yet

- Live Test Issue of Share YTDocument2 pagesLive Test Issue of Share YTmishrapratham169No ratings yet

- Cases in Finance Assignment FinalDocument22 pagesCases in Finance Assignment FinalIbrahimNo ratings yet

- FAR.3030 Share-Based PaymentDocument8 pagesFAR.3030 Share-Based PaymentTatianaNo ratings yet