0% found this document useful (0 votes)

299 views1 pageLeave Encashment Exemption Declaration

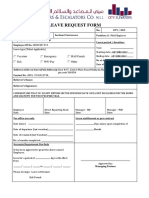

The employee, Sahil Sudhir Khanna, is requesting exemption on leave encashment paid as part of his full and final settlement from the company on April 29, 2022. He confirms that he has previously availed exemption of an unspecified amount during prior assessment years, with the current exemption ceiling being Rs. 300,000. The differential amount available for exemption is the maximum ceiling minus any amount already availed. The employee understands the exemption is granted based on his declaration and agrees to indemnify any losses that may arise for the employer due to incorrect information.

Uploaded by

Sahil KhannaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

299 views1 pageLeave Encashment Exemption Declaration

The employee, Sahil Sudhir Khanna, is requesting exemption on leave encashment paid as part of his full and final settlement from the company on April 29, 2022. He confirms that he has previously availed exemption of an unspecified amount during prior assessment years, with the current exemption ceiling being Rs. 300,000. The differential amount available for exemption is the maximum ceiling minus any amount already availed. The employee understands the exemption is granted based on his declaration and agrees to indemnify any losses that may arise for the employer due to incorrect information.

Uploaded by

Sahil KhannaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd