Professional Documents

Culture Documents

01 Activity 2 Costing and Pricing

Uploaded by

Ashley EsquivelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01 Activity 2 Costing and Pricing

Uploaded by

Ashley EsquivelCopyright:

Available Formats

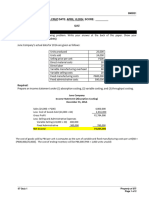

BM2209

Name Ashley Esquivel Section BSBA 302 Date 10/01/22

ACTIVITY

1. Leaveland Merchandising has the following account balances at the end of their production cycle for

December:

Direct Labor P240,000

Direct Materials 162,000

Manufacturing Overhead 35,000

Compute the total actual cost using the actual costing system. (1 item x 5 points)

Actual Cost = (Direct Labor + Direct Materials) + Actual Overhead Cost

= (240,000 + 162,000) + 35,000 = 402,000 + 35,000 = P 437,000.00

2. Leaveland Merchandising has the following account balances at the end of their production cycle for

November:

Fixed Cost P3,000,000

Variable Cost per Direct Labor Hours (DLH) 30

Budgeted annual Direct Labor Hours (DLH) 120,000

Actual Direct Labor Hours utilized 180,000

Solve for the following using normal costing system: (2 items x 5 points)

A. Predetermined Overhead Rate

Budgeted manufacturing overhead

Predetermined Overhead Rate =

Budgeted production activity

= 3,000,000 + (120,000 x 30) = 3,000,000 + 3,600,000 = 6,600,000

= 55 per DLH

120,000 DLH 120,000 DLH 120,000 DLH

B. Normal Cost

Normal Cost = Predetermined overhead rate x Actual Direct Labor Hours Utilized

55 x 180,000 = 9,900,000

Rubric for grading:

CRITERIA POINTS

Complete solution with the correct answer 5

Last two (2) major steps of the solution are incorrect 4

Half of the solution is correct 3

First two (2) major steps of the solution are correct 2

First major step of the solution is correct 1

01 Activity 2 *Property of

STI

Page 1 of 1

You might also like

- PREPARE FOR EXAM WITH CVP AND COST FLOW PROBLEMSDocument29 pagesPREPARE FOR EXAM WITH CVP AND COST FLOW PROBLEMSEnciong Goes Tiu100% (2)

- Halstead JewlersDocument8 pagesHalstead JewlersZeeshan Ali100% (1)

- MGMT 027Document10 pagesMGMT 027Muhammad Umer FarooqNo ratings yet

- Income Statements for June CompanyDocument3 pagesIncome Statements for June CompanyGoose ChanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Assignment 1 Brief GuidanceDocument24 pagesAssignment 1 Brief GuidanceNguyễn Quốc AnhNo ratings yet

- Consolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryDocument24 pagesConsolidated Financial Statements (Part 2) : Problem 1: Multiple Choice - TheoryKeith Alison ArellanoNo ratings yet

- Abe ManualDocument320 pagesAbe ManualNicole Taylor100% (2)

- Should XYZ Company Make or Buy WidgetsDocument8 pagesShould XYZ Company Make or Buy WidgetsPui YanNo ratings yet

- Management Accounting Exam Paper August 2012Document23 pagesManagement Accounting Exam Paper August 2012MahmozNo ratings yet

- Let's Practise: Maths Workbook Coursebook 8From EverandLet's Practise: Maths Workbook Coursebook 8No ratings yet

- Soln SSP S1Document12 pagesSoln SSP S1Marjorie PalmaNo ratings yet

- Let's Practise: Maths Workbook Coursebook 7From EverandLet's Practise: Maths Workbook Coursebook 7No ratings yet

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- 01 Activity 26Document1 page01 Activity 26Aldrin John HiposNo ratings yet

- Section (2) Jop CostingDocument17 pagesSection (2) Jop Costingnadaa.mhmd2002No ratings yet

- Solutions Additional ExercisesDocument87 pagesSolutions Additional Exercisesapi-3767414No ratings yet

- 05 Activity 1Document1 page05 Activity 1Skuksy BillieNo ratings yet

- Accounting and Financial Management 1B Sample ExamDocument7 pagesAccounting and Financial Management 1B Sample ExamS MNo ratings yet

- Examples FMA7aDocument6 pagesExamples FMA7aDaddyNo ratings yet

- Chapter 21 Job Costing: RequiredDocument20 pagesChapter 21 Job Costing: RequiredMuhammad ZakirNo ratings yet

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- Modeling ExampleDocument66 pagesModeling ExampleBibe ChuchuNo ratings yet

- Kunci Jawaban Lab Chapter 3 OverheadDocument3 pagesKunci Jawaban Lab Chapter 3 OverheadRantiyaniNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingDocument8 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingHarshawardhan GuptaNo ratings yet

- Home Assignments, Week 1, 2023Document4 pagesHome Assignments, Week 1, 2023jovanaNo ratings yet

- Chapter 2 Homework4 PDFDocument3 pagesChapter 2 Homework4 PDFMarjorie PalmaNo ratings yet

- YC1234Document21 pagesYC1234JanakiRamanNo ratings yet

- Assignment No.2 206Document5 pagesAssignment No.2 206Halimah SheikhNo ratings yet

- TP6265Document23 pagesTP6265Daniel NemiNo ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

- 06 Activity 1Document2 pages06 Activity 1Skuksy BillieNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- Variable costing and segment reporting solutionsDocument14 pagesVariable costing and segment reporting solutionsThanawat PHURISIRUNGROJNo ratings yet

- Cost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyDocument16 pagesCost Accounting & Financial Management Solved Paper Nov 2009, Chartered AccountancyAnkit2020No ratings yet

- Chapter 2 SolutionsDocument27 pagesChapter 2 SolutionsKaweesha GayathNo ratings yet

- COMPREHENSIVE PROBLEMS-lordyDocument8 pagesCOMPREHENSIVE PROBLEMS-lordyLordCelene C MagyayaNo ratings yet

- Exam 1 MBA 631Document12 pagesExam 1 MBA 631Rakesh PatelNo ratings yet

- 01 Activity 1Document2 pages01 Activity 1Emperor SavageNo ratings yet

- SCM QUIZ7Document2 pagesSCM QUIZ7Krisha Mae Guirigay Dela CruzNo ratings yet

- BFA312: Management Accounting: Week 7 - Cost Volume Profit AnalysisDocument48 pagesBFA312: Management Accounting: Week 7 - Cost Volume Profit AnalysisAlia ShabbirNo ratings yet

- Module 4 Problem Set - GodinezDocument3 pagesModule 4 Problem Set - GodinezmareagodinezNo ratings yet

- MIM2022 - Group AssignmentDocument8 pagesMIM2022 - Group AssignmentTianshu GaoNo ratings yet

- June Company Income StatementsDocument3 pagesJune Company Income StatementsGoose ChanNo ratings yet

- JOC (Discussion)Document10 pagesJOC (Discussion)Luisa ColumbinoNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- Analyze costs and profitability of a companyDocument5 pagesAnalyze costs and profitability of a companyMd AlimNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Absorption and Marginal Costing ExamplesDocument2 pagesAbsorption and Marginal Costing ExamplesDavilla CuptaNo ratings yet

- 02 ELMS Activity 2Document1 page02 ELMS Activity 2Kevin PanioNo ratings yet

- 06 Task Performance 1Document4 pages06 Task Performance 1Bryan BristolNo ratings yet

- 1819 Isib1bp-Fma2Document8 pages1819 Isib1bp-Fma2MyNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- Accounting Principles: Plant Assets, Natural Resources, and Intangible AssetsDocument40 pagesAccounting Principles: Plant Assets, Natural Resources, and Intangible AssetsMd. Saadman Sakib 2115420660No ratings yet

- C.A-I Chapter-5Document4 pagesC.A-I Chapter-5Tariku KolchaNo ratings yet

- Busi 1002 RDocument11 pagesBusi 1002 RHarry HamiltonNo ratings yet

- Solution of Chapter 6Document7 pagesSolution of Chapter 6Ahmed RaeisiNo ratings yet

- 4 2 Sma 2017Document5 pages4 2 Sma 2017Nawoda SamarasingheNo ratings yet

- Class Activity Exercises Problem 1: InstructionsDocument3 pagesClass Activity Exercises Problem 1: InstructionsTrine De LeonNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- Quiz 2Document4 pagesQuiz 2VAIBHAV RAJNo ratings yet

- Tutorial 4 SolutionsDocument14 pagesTutorial 4 Solutionss11186706No ratings yet

- Problems: Set B: Type of Inventory January 1 April 1 July 1Document3 pagesProblems: Set B: Type of Inventory January 1 April 1 July 1Iffat AftabNo ratings yet

- Chapters 5-6 Classroom Discussion Answer KeyDocument12 pagesChapters 5-6 Classroom Discussion Answer KeyJeeramel TorresNo ratings yet

- BACC 200 Chapter 6 Questions & AnswersDocument18 pagesBACC 200 Chapter 6 Questions & AnswersMoe BuisiniessNo ratings yet

- Chapter 6 ReviewDocument13 pagesChapter 6 Reviewkwathom1No ratings yet

- Chapter 13 Relevant Costs For Decision Making: True/False QuestionsDocument140 pagesChapter 13 Relevant Costs For Decision Making: True/False QuestionsexgayssNo ratings yet

- Job Costing: Mcgraw-Hill/IrwinDocument17 pagesJob Costing: Mcgraw-Hill/Irwinimran_chaudhryNo ratings yet

- Strategic Cost Management Midterm ExaminationDocument9 pagesStrategic Cost Management Midterm ExaminationJohn FloresNo ratings yet

- Budgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDocument5 pagesBudgeting and Budgetary Control As Tools For Accountability in Government ParastatalsDineshNo ratings yet

- BBA LL.B. Course Structure and SyllabusDocument33 pagesBBA LL.B. Course Structure and SyllabusAkshatNo ratings yet

- Master Budget: Comprehensive Financial PlanDocument2 pagesMaster Budget: Comprehensive Financial PlanvvNo ratings yet

- M. Faraz Alvi CVDocument2 pagesM. Faraz Alvi CVMubashar NawazNo ratings yet

- Drilling AkmenDocument9 pagesDrilling AkmenMICHAEL WIDIANDRA PNo ratings yet

- Solution Manual For Introduction To Managerial Accounting 8th EditionDocument24 pagesSolution Manual For Introduction To Managerial Accounting 8th EditionJonathonHernandezxmsf100% (34)

- ACC416 Tutorial 2A Materials - Stock Level QtnsDocument2 pagesACC416 Tutorial 2A Materials - Stock Level QtnsEdrizz RizNo ratings yet

- Chap 20Document23 pagesChap 20Usama KhanNo ratings yet

- CMA Part 2 Financial Decision Making: CVP Analysis and Marginal AnalysisDocument85 pagesCMA Part 2 Financial Decision Making: CVP Analysis and Marginal AnalysisNEERAJ GUPTANo ratings yet

- ACC 321 Final Exam ReviewDocument6 pagesACC 321 Final Exam ReviewLauren KlaassenNo ratings yet

- BACOSTMX - Module 2Document3 pagesBACOSTMX - Module 2LauNo ratings yet

- Unit 3 - Discussion Assignment (Final)Document2 pagesUnit 3 - Discussion Assignment (Final)LeslieNo ratings yet

- Management Accounting ThesisDocument8 pagesManagement Accounting Thesisafkogsfea100% (2)

- Wipro QuestionnaireDocument6 pagesWipro QuestionnairehkgjNo ratings yet

- Variable and semi-variable costs explained with examples (39Document4 pagesVariable and semi-variable costs explained with examples (39Maria G. BernardinoNo ratings yet

- Process Costing Part 2.1Document3 pagesProcess Costing Part 2.1Francis Matthew JimenezNo ratings yet

- Chapter 5 - Exercises - Managerial Accounting PDFDocument1 pageChapter 5 - Exercises - Managerial Accounting PDFgetahun huligizieNo ratings yet

- Transfer PricingDocument13 pagesTransfer PricingRianne NavidadNo ratings yet

- Session 7Document20 pagesSession 7Hamza BennisNo ratings yet