100% found this document useful (1 vote)

482 views5 pagesAdjusting Journal Entries Guide

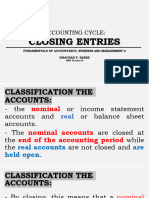

The document discusses various adjusting journal entries needed at the end of an accounting period. It outlines 6 accounts that typically require adjustment: 1) prepaid expenses, 2) unearned income, 3) accrued expenses, 4) accrued income, 5) allowance for bad debts, and 6) depreciation. For each type of adjustment, the document provides the accounting entry to record the adjustment, including debits and credits, and includes illustrations with numerical examples.

Uploaded by

Danny LeonenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

482 views5 pagesAdjusting Journal Entries Guide

The document discusses various adjusting journal entries needed at the end of an accounting period. It outlines 6 accounts that typically require adjustment: 1) prepaid expenses, 2) unearned income, 3) accrued expenses, 4) accrued income, 5) allowance for bad debts, and 6) depreciation. For each type of adjustment, the document provides the accounting entry to record the adjustment, including debits and credits, and includes illustrations with numerical examples.

Uploaded by

Danny LeonenCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd