Professional Documents

Culture Documents

112.BankReconciliation and Proof of Cash

Uploaded by

Princess EscovidalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

112.BankReconciliation and Proof of Cash

Uploaded by

Princess EscovidalCopyright:

Available Formats

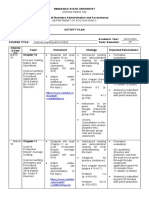

BANK RECONCILIATION AND PROOF OF CASH

(THE FOLLOWING INFORMATION IS INTENDED FOR THE NEXT 2 ITEMS: )

ABC Company provided the following information:

Balance per bank statement – May 31 P2,600,000

Deposits outstanding 300,000

Checks outstanding (100,000)

Correct bank balance – May 31 2,800,000

Balance per book – May 31 2,810,000

Bank service charge (10,000)

Correct book balance – May 31 2,800,000

June data are as follows:

Bank Book

Checks recorded 2,200,000 2,500,000

Deposits recorded 1,600,000 1,800,000

Service charges recorded 50,000 -

Note collected by bank, P500,000 plus interest 550,000

NSF check returned with June 30 statement 100,000

Balances 2,400,000 2,100,000

1. What is the amount of outstanding checks on June 30?

2. What is the amount of deposit in transit on June 30?

3. ABC prepared the following bank reconciliation on November 30:

Balance per bank statement P2,100,000

Deposits outstanding 300,000

Checks outstanding (30,000)

Correct cash balance 2,370,000

Balance per book 2,372,000

Bank service charge (2,000)

Correct book balance – May 31 2,370,000

December data

Bank Book

Checks recorded 2,300,000 2,360,000

Deposits recorded 1,620,000 1,800,000

Collection by bank, P400,000 note plus interest 420,000 -

NSF check returned 10,000

Balances 1,830,000 1,810,000

What is the adjusted cash in bank balance on December 31?

On May 31, 2016, the Herson Amolo Fabricators had a cash balance per books of P57,815. The May bank statement from

the Katipunan Development Bank reported a balance of P68,586. A comparison of the statement with the cash account

revealved the following facts:

The statement included a debit memo of P300 for the cost of two checkbooks.

Cash sales of P8,361.50 on May 12 were deposited in the bank. The cash receipts journal entry and the deposit

slip were incorrectly made for P8,461.50. the bank credited Herson Amolo Fabricators for the correct amount.

Outstanding checks at May 31 totaled P12,762.50, and deposits in transit were P9,361.50.

On May 18, the company issued check no. 1181 for P6,580 to Citra Steel on account. The check which cleared the

bank in May, was incorrectly journalized and posted by Herson Amolo Fabricators for P6,850.

A P20,000 note receivable was collected by the bank for Herson Amolo Fabricators on May 31 plus P800 interest.

The bank charged a collection fee of P200. The only entry made in May by the company for the note was to accrue

interest through May 31.

Included with the cancelled check issued by the Garcia Company to E. Flores for P6,000 that was incorrectly

charged to the Herson Amolo Fabricators.

On May 31, the bank statement showed an DAIF charge of P7,100 for a check issued by Gomez Realty, a customer

to the Herson Amolo Fabricators on account.

4. Adjusted balance of cash in bank

You might also like

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- 6 AccountingDocument5 pages6 AccountingRenz MoralesNo ratings yet

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- Quiz 1 For SendingDocument10 pagesQuiz 1 For SendingTyrelle Dela CruzNo ratings yet

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- Group Quiz 1Document3 pagesGroup Quiz 1Joselito Marane Jr.No ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Martinez, Althea E. Abm 12-1 (Accounting 2)Document13 pagesMartinez, Althea E. Abm 12-1 (Accounting 2)Althea Escarpe MartinezNo ratings yet

- Ipil Grocery T AccountsDocument5 pagesIpil Grocery T AccountsJelaina Alimansa100% (1)

- Cash QuizDocument6 pagesCash QuizGwen Cabarse PansoyNo ratings yet

- $RMJJZ4MDocument5 pages$RMJJZ4MAdam CuencaNo ratings yet

- BSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Document15 pagesBSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Trisha AlmiranteNo ratings yet

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- All Lets - Check - Ulo First SimDocument8 pagesAll Lets - Check - Ulo First SimWennonah Vallerie LabeNo ratings yet

- Financial Transaction Worksheet, Luca ProblemDocument3 pagesFinancial Transaction Worksheet, Luca ProblemFeiya LiuNo ratings yet

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDocument1 pageBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNo ratings yet

- College of Accountancy Final Examination Acctg 206A InstructionsDocument4 pagesCollege of Accountancy Final Examination Acctg 206A InstructionsCarmela TolinganNo ratings yet

- Intermediate Accounting I - Cash and Cash EquivalentsDocument2 pagesIntermediate Accounting I - Cash and Cash EquivalentsJoovs Joovho0% (1)

- Jay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFDocument4 pagesJay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFAdam CuencaNo ratings yet

- AC 1 2 Final Exam 1Document7 pagesAC 1 2 Final Exam 1christine anglaNo ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- FAR-Midterm ExamDocument19 pagesFAR-Midterm ExamTxos Vaj100% (1)

- ACCBP 100 - FINALS - 1stT - 1stS - 2019-2020Document4 pagesACCBP 100 - FINALS - 1stT - 1stS - 2019-2020Jazel Mae Celerinos100% (1)

- This Study Resource WasDocument2 pagesThis Study Resource WasErika Repedro0% (1)

- Module 10 (Accounting)Document8 pagesModule 10 (Accounting)Jasmine ActaNo ratings yet

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDocument31 pagesAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- ACCBP100 - ULOcdefg Lets Check ActivityDocument2 pagesACCBP100 - ULOcdefg Lets Check ActivityWennonah Vallerie LabeNo ratings yet

- Accounting 106 Mr. Allan Leo T. Paran, Cpa Assignment No. 4.1 - Biological AssetsDocument2 pagesAccounting 106 Mr. Allan Leo T. Paran, Cpa Assignment No. 4.1 - Biological AssetsRaprapNo ratings yet

- Cash EquivalentDocument9 pagesCash EquivalentMaria G. BernardinoNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- Big Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You AreDocument51 pagesBig Picture: Week 1-3: Unit Learning Outcomes (ULO) : at The End of The Unit, You Arekakao50% (2)

- My Company Unadjusted Trial Balance December 31, 2018 Debit CreditDocument9 pagesMy Company Unadjusted Trial Balance December 31, 2018 Debit CreditRey Joyce AbuelNo ratings yet

- ACC111 - Activity 15Document5 pagesACC111 - Activity 15Triquesha Marriette Romero RabiNo ratings yet

- Discussion Questions On Partnership FormationDocument2 pagesDiscussion Questions On Partnership FormationUchiha GokuNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Auditing - MIDTERM EXAMDocument9 pagesAuditing - MIDTERM EXAMmoNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Activity No. 3 - Principles of Accounting: AnswersDocument2 pagesActivity No. 3 - Principles of Accounting: AnswersLagasca Iris100% (1)

- Abm 005 2Q Week 12 PDFDocument10 pagesAbm 005 2Q Week 12 PDFJoel Vasquez MalunesNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- Additional InformationDocument2 pagesAdditional InformationKailaNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- Proof of Cash Illustrative Example - DiscussionDocument11 pagesProof of Cash Illustrative Example - DiscussionAdyangNo ratings yet

- Chapter 13-Cash ControlDocument25 pagesChapter 13-Cash ControlShaila MarceloNo ratings yet

- Arce - Chan Accounting FirmDocument38 pagesArce - Chan Accounting FirmshaneNo ratings yet

- Quiz VIII - ARDocument3 pagesQuiz VIII - ARBLACKPINKLisaRoseJisooJennieNo ratings yet

- PS-2 (Proof of Cash)Document1 pagePS-2 (Proof of Cash)jazonvaleraNo ratings yet

- Bak ReconDocument1 pageBak ReconFlorimar Lagda100% (1)

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Accounting TermsDocument1 pageAccounting TermsPrincess EscovidalNo ratings yet

- 01 CBA or Cost Behavior Analysis PDFDocument4 pages01 CBA or Cost Behavior Analysis PDFPrincess EscovidalNo ratings yet

- Infographics UsefulDocument2 pagesInfographics UsefulPrincess Escovidal100% (1)

- Toga Rental LetterDocument1 pageToga Rental LetterPrincess EscovidalNo ratings yet

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDocument1 pageBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNo ratings yet

- 01 CBA or Cost Behavior Analysis PDFDocument4 pages01 CBA or Cost Behavior Analysis PDFPrincess EscovidalNo ratings yet

- CFS GSCNHSDocument3 pagesCFS GSCNHSPrincess EscovidalNo ratings yet

- Mindanao State University: M/Watch? V GJGKLGGBCZWDocument2 pagesMindanao State University: M/Watch? V GJGKLGGBCZWPrincess EscovidalNo ratings yet

- Cost Chapter 15Document13 pagesCost Chapter 15Marica Shane100% (3)

- Chapter 11Document22 pagesChapter 11Christian Jay S. de la CruzNo ratings yet

- Chapter 11Document22 pagesChapter 11Christian Jay S. de la CruzNo ratings yet

- Civil Law - Obligations & Contracts - Soriano Notes (Uribe Civil Law Review)Document133 pagesCivil Law - Obligations & Contracts - Soriano Notes (Uribe Civil Law Review)freegalado95% (21)

- Bank Reconciliation: Date (2020) Item Checks Deposits BalanceDocument1 pageBank Reconciliation: Date (2020) Item Checks Deposits BalancePrincess EscovidalNo ratings yet

- ACT112 Quiz Series ScheduleDocument1 pageACT112 Quiz Series SchedulePrincess EscovidalNo ratings yet

- 01 ETHICS and PRINCIPLESDocument8 pages01 ETHICS and PRINCIPLESPrincess EscovidalNo ratings yet

- Health WorldDocument22 pagesHealth WorldPrincess EscovidalNo ratings yet

- 01 ETHICS and PRINCIPLESDocument8 pages01 ETHICS and PRINCIPLESPrincess EscovidalNo ratings yet

- 02 Counterfeited Shoes Chapter-IIDocument9 pages02 Counterfeited Shoes Chapter-IIPrincess EscovidalNo ratings yet

- 02 Counterfeited Shoes Chapter-IIDocument9 pages02 Counterfeited Shoes Chapter-IIPrincess EscovidalNo ratings yet

- 01 ETHICS and PRINCIPLESDocument8 pages01 ETHICS and PRINCIPLESPrincess EscovidalNo ratings yet

- 01 Counterfeited Shoes Chapter-IVDocument9 pages01 Counterfeited Shoes Chapter-IVPrincess EscovidalNo ratings yet

- 2019 2020 Msu Rotc HandoutsDocument10 pages2019 2020 Msu Rotc HandoutsIsaiahRiveraNo ratings yet

- ROTC AssessmentDocument14 pagesROTC AssessmentPrincess EscovidalNo ratings yet

- 01 CBA or Cost Behavior Analysis PDFDocument4 pages01 CBA or Cost Behavior Analysis PDFPrincess EscovidalNo ratings yet

- 01 ETHICS and PRINCIPLESDocument8 pages01 ETHICS and PRINCIPLESPrincess EscovidalNo ratings yet

- 02 Counterfeited Shoes Chapter-IIDocument9 pages02 Counterfeited Shoes Chapter-IIPrincess EscovidalNo ratings yet

- MAS 1 Cost Behavior Analysis PDFDocument4 pagesMAS 1 Cost Behavior Analysis PDFPrincess EscovidalNo ratings yet

- CBA or Cost Behavior Analysis PDFDocument4 pagesCBA or Cost Behavior Analysis PDFPrincess EscovidalNo ratings yet

- Chapter 1Document46 pagesChapter 1J Camille Mangundaya Lacsamana77% (30)

- Ethics and Principle of CommunicationDocument5 pagesEthics and Principle of CommunicationPrincess EscovidalNo ratings yet

- Quiz 5Document5 pagesQuiz 5asaad5299No ratings yet

- Um Tagum CollegeDocument12 pagesUm Tagum Collegeneil0522No ratings yet

- Account Statement 2012 August RONDocument5 pagesAccount Statement 2012 August RONAna-Maria DincaNo ratings yet

- Policies Toward Monopolies and Oligopolies Privatization and DeregulationDocument10 pagesPolicies Toward Monopolies and Oligopolies Privatization and DeregulationJamaica RamosNo ratings yet

- Wa0256.Document3 pagesWa0256.Daniela Daza HernándezNo ratings yet

- Criticism of DAT SutherlandDocument2 pagesCriticism of DAT SutherlandBabarNo ratings yet

- DhakalDinesh AgricultureDocument364 pagesDhakalDinesh AgriculturekendraNo ratings yet

- Power Quality Improvement in Distribution Networks Containing DistributedDocument6 pagesPower Quality Improvement in Distribution Networks Containing DistributedsmruthiNo ratings yet

- EGYPTIAN LITERA-WPS OfficeDocument14 pagesEGYPTIAN LITERA-WPS OfficeLemoj CombiNo ratings yet

- S.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesDocument8 pagesS.No. Deo Ack. No Appl - No Emp Name Empcode: School Assistant Telugu Physical SciencesNarasimha SastryNo ratings yet

- Case Study No. 8-Managing Floods in Metro ManilaDocument22 pagesCase Study No. 8-Managing Floods in Metro ManilapicefeatiNo ratings yet

- OneSumX IFRS9 ECL Impairments Produc SheetDocument2 pagesOneSumX IFRS9 ECL Impairments Produc SheetRaju KaliperumalNo ratings yet

- Lon L. Fuller The Problem of The Grudge InformerDocument9 pagesLon L. Fuller The Problem of The Grudge InformerNikko SarateNo ratings yet

- LAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticeDocument15 pagesLAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticenkwetoNo ratings yet

- Historical Allusions in The Book of Habakkuk: Aron PinkerDocument10 pagesHistorical Allusions in The Book of Habakkuk: Aron Pinkerstefa74No ratings yet

- Risk Management ProcessDocument17 pagesRisk Management ProcessUntuk Kegiatan100% (1)

- PDF Challenge Project ReportDocument323 pagesPDF Challenge Project Reportkyliah87No ratings yet

- Food Product Proposal Letter SampleDocument20 pagesFood Product Proposal Letter Sampleusama100% (1)

- Tesco Vs Asda - EditedDocument15 pagesTesco Vs Asda - EditedAshley WoodNo ratings yet

- Company Profile PDFDocument3 pagesCompany Profile PDFAbhay HarkanchiNo ratings yet

- SAHANA Disaster Management System and Tracking Disaster VictimsDocument30 pagesSAHANA Disaster Management System and Tracking Disaster VictimsAmalkrishnaNo ratings yet

- HSEMS PresentationDocument21 pagesHSEMS PresentationVeera RagavanNo ratings yet

- HBL IPG FAQs PDFDocument5 pagesHBL IPG FAQs PDFAbbas HussainNo ratings yet

- Research Paper On RapunzelDocument8 pagesResearch Paper On RapunzelfvgcaatdNo ratings yet

- H-05Document11 pagesH-05lincoln9003198No ratings yet

- Quotation 017-2019 - 01-07-2019Document8 pagesQuotation 017-2019 - 01-07-2019Venkatesan ManikandanNo ratings yet

- Unconstituted Praxis PDFDocument115 pagesUnconstituted Praxis PDFGerardo AlbatrosNo ratings yet

- The History of Sewing MachinesDocument5 pagesThe History of Sewing Machinesizza_joen143100% (2)

- FM - Amreli Nagrik Bank - 2Document84 pagesFM - Amreli Nagrik Bank - 2jagrutisolanki01No ratings yet