Professional Documents

Culture Documents

Chapter 3 (IA Proof Od Cash) PDF

Uploaded by

Baby MushroomOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3 (IA Proof Od Cash) PDF

Uploaded by

Baby MushroomCopyright:

Available Formats

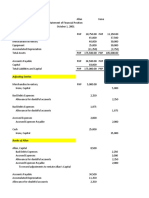

Mar. 31 Receipt Disbursement Apr.

30

Balance per book 200,000 800,000 720,000 280,000

Note collected by bank

March 60,000 (60,000)

April 100,000 100,000

Service Charge

March (8,000) (8,000)

April 2,000 (2,000)

NSF Check

March (20,000) (20,000)

April 30,000 (30,000)

DT

March (80,000) 80,000

April (220,000) (220,000)

OC

March 178,000 178,000

April (372,000) 372,000

Balance per bank 330,000 700,000 530,000 500,000

Bank-beg 232,000

Add: book debit 800,000

Collection (60,000) 740,000

Total 972,000

less: book credit 720,000

NSF (20,000)

Srvice cahrge (8,000) (692,000)

Bank balance-end 280,000

44,043 Receipts Disbursements 44,074

Book Balance 800,000 5,000,000 3,940,000 1,860,000

Book error on collection (180,000) (180,000)

Book error on payment (540,000) 540,000

Bank error on deposit (200,000) (200,000)

Bank error on payment (400,000) 400,000

NSF Check:

July 100,000 100,000

August (50,000) 50,000

Note collected by bank:

July (200,000) 200,000

August (300,000) (300,000)

Deposit in Transit:

July 600,000 (600,000)

August 480,000 480,000

Outstanding Checks:

July (100,000) (100,000)

August 650,000 (650,000)

Book Balance 1,200,000 4,400,000 3,600,000 2,000,000

Nov. 30 Receipts Disbursements 44,196

Book balance 2,032,000 2,568,000 1,440,000 3,160,000

Bank service charge

44,165 (2,000) (2,000)

44,196 4,000 (4,000)

Collection of note

44,165 (200,000) 200,000

44,196 (300,000) (300,000)

Adjusted book balance 1,830,000 2,468,000 1,442,000 2,856,000

Bank Balance 1,890,000 2,090,000 1,080,000 2,900,000

Outstanding Checks

44,165 (180,000) (180,000)

44,196 592,000 (592,000)

Deposit in transit

44,165 80,000 (80,000)

44,196 498,000 498,000

Check erroneuos charged by bank

44,165 40,000 (40,000)

44,196 (50,000) 50,000

Adjusted bank balance 1,830,000 2,468,000 1,442,000 2,856,000

Book Balance 1,900,000 1,400,000 2,400,000 900,000

NSF-Check:

44,104 (60,000) (60,000)

44,135 40,000 (40,000)

Collection of accounts recievable

44,104 30,000 (30,000)

44,135 50,000 50,000

Overstatement of Check

44,104 90,000 (90,000)

44,135 (120,000) 120,000

Adjusted balance 1,960,000 1,330,000 2,260,000 1,030,000

Bank Balance 2,100,000 1,200,000 2,500,000 800,000

Deposit in transit

44,104 130,000 (130,000)

44,135 260,000 260,000

Outstanding checks

44,104 (270,000) (270,000)

44,135 30,000 (30,000)

Adjusted balance 1,960,000 1,330,000 2,260,000 1,030,000

You might also like

- Solution Manual Ch. 1 19Document55 pagesSolution Manual Ch. 1 19Aira Mae TaborNo ratings yet

- Ia1.activity 3Document1 pageIa1.activity 3kathie alegarme100% (1)

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- Cash AssignmentDocument2 pagesCash AssignmentRocelyn OrdoñezNo ratings yet

- Vain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditDocument1 pageVain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditAnonnNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDocument6 pagesPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNo ratings yet

- Revenue Cycle Trade DiscountsDocument50 pagesRevenue Cycle Trade DiscountsJean MaeNo ratings yet

- Cash & Cash EquivalentsDocument5 pagesCash & Cash EquivalentsJenna BanganNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- ACC 111 Answer KeyDocument7 pagesACC 111 Answer KeyMAXINE CLAIRE CUTINGNo ratings yet

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- BSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentDocument2 pagesBSA 7 - Interest Income and Impairment of Held-to-Maturity InvestmentGray JavierNo ratings yet

- Cash and Cash Equivalents Reconciliation ProblemsDocument50 pagesCash and Cash Equivalents Reconciliation ProblemsAnne EstrellaNo ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- Problem 7 - 28Document2 pagesProblem 7 - 28Jao FloresNo ratings yet

- Chapter 5 (Estimation of Doubtful Accounts)Document8 pagesChapter 5 (Estimation of Doubtful Accounts)Joan LeonorNo ratings yet

- HW On Cash ADocument7 pagesHW On Cash ARedNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Accounts Receivable: Notwithstanding, Are Classified As Current AssetsDocument13 pagesAccounts Receivable: Notwithstanding, Are Classified As Current AssetsAdyangNo ratings yet

- Accounts ReceivableDocument34 pagesAccounts ReceivableRose Aubrey A Cordova100% (1)

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Problem 8Document3 pagesProblem 8Coleen Lara SedillesNo ratings yet

- Saviour Exam 2Document1 pageSaviour Exam 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- SEO-optimized title for accounting exam review documentDocument8 pagesSEO-optimized title for accounting exam review documentWennonah Vallerie LabeNo ratings yet

- Periodic or Perpetual (Same) : Specific IdentificationDocument10 pagesPeriodic or Perpetual (Same) : Specific Identificationhoneyjoy salapantanNo ratings yet

- Cash and Cash EquivalentsDocument7 pagesCash and Cash EquivalentsDianna DayawonNo ratings yet

- Included in December 31 Checkbook BalanceDocument1 pageIncluded in December 31 Checkbook BalanceXI MonteroNo ratings yet

- Mle02 Far 1 Answer KeyDocument9 pagesMle02 Far 1 Answer KeyCarNo ratings yet

- ACCT102 - A Alexis Bang CangDocument4 pagesACCT102 - A Alexis Bang CangAccounting 201No ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Financial reporting of cash and cash equivalentsDocument8 pagesFinancial reporting of cash and cash equivalentsSamantha Suan CatambingNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- Tigg Mortgage's Accrued Interest Receivable on $200K LoanDocument4 pagesTigg Mortgage's Accrued Interest Receivable on $200K LoanMelody BautistaNo ratings yet

- Practice Problems - Notes and Loans Receivable: General InstructionsDocument2 pagesPractice Problems - Notes and Loans Receivable: General Instructionseia aieNo ratings yet

- AFAR-First-Preboard-May-2023-BatchDocument14 pagesAFAR-First-Preboard-May-2023-BatchRhea Mae CarantoNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- Bank ReconciliationDocument6 pagesBank Reconciliationclarisse jaramillaNo ratings yet

- Bank Recon Solutions Exercise 2 3Document7 pagesBank Recon Solutions Exercise 2 3Kevin James Sedurifa OledanNo ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Accounts ReceivableDocument2 pagesAccounts ReceivableMike MikeNo ratings yet

- 33Document2 pages33yes yesnoNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- ProblemsDocument368 pagesProblemsAnne EstrellaNo ratings yet

- Final Instruction ACC 111 Competency Assessment 3Document3 pagesFinal Instruction ACC 111 Competency Assessment 3Jennylyn Angela PatarataNo ratings yet

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- Accounting for Cash, Receivables and InventoriesDocument12 pagesAccounting for Cash, Receivables and InventoriesPaupau100% (1)

- Intermediate Accounting - Petty Cash Journal EntriesDocument2 pagesIntermediate Accounting - Petty Cash Journal EntriesSean Lester S. NombradoNo ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- Chapter 3-5Document6 pagesChapter 3-5XENA LOPEZNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Proof of Cash ProblemDocument3 pagesProof of Cash ProblemKathleen Frondozo67% (6)

- Chapter 5 (Exercise 1-7) CabreraDocument17 pagesChapter 5 (Exercise 1-7) CabreraBaby MushroomNo ratings yet

- What Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodDocument2 pagesWhat Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodBaby MushroomNo ratings yet

- Cooking Methods CategoryDocument1 pageCooking Methods CategoryBaby MushroomNo ratings yet

- Management Accounting by CabreraDocument21 pagesManagement Accounting by CabrerachahunayNo ratings yet

- Chapter 5 (Exercise 1-7) CabreraDocument17 pagesChapter 5 (Exercise 1-7) CabreraBaby MushroomNo ratings yet

- Cooking Methods CategoryDocument1 pageCooking Methods CategoryBaby MushroomNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- Proof of CashDocument2 pagesProof of CashBaby MushroomNo ratings yet

- 10 Essential Cooking MethodDocument4 pages10 Essential Cooking MethodBaby MushroomNo ratings yet

- Cost Accounting Chapter 10 Exercise 1 6Document5 pagesCost Accounting Chapter 10 Exercise 1 6Baby MushroomNo ratings yet

- What Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodDocument2 pagesWhat Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodBaby MushroomNo ratings yet

- 10 Essential Cooking MethodDocument4 pages10 Essential Cooking MethodBaby MushroomNo ratings yet

- 14 Tips For Best SteakDocument4 pages14 Tips For Best SteakBaby MushroomNo ratings yet

- Chapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaDocument49 pagesChapter 1 - Succession & Transfer Taxes: Solutions Manual Transfer & Business Taxation, 2018 Edition By: Tabag & GarciaLanceNo ratings yet

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Garlic Butter ShrimpDocument4 pagesGarlic Butter ShrimpBaby MushroomNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- 101 Tips For CookingDocument8 pages101 Tips For CookingBaby MushroomNo ratings yet

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- 15 Surprising Cooking TipsDocument3 pages15 Surprising Cooking TipsBaby MushroomNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- Cost Accounting Exercise2 3Document2 pagesCost Accounting Exercise2 3Baby MushroomNo ratings yet

- Cost Accounting Exercise2 3Document2 pagesCost Accounting Exercise2 3Baby MushroomNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- Cost Accounting Exercise2 3Document2 pagesCost Accounting Exercise2 3Baby MushroomNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- Cost Accounting Chapter 10 Exercise 1 6Document5 pagesCost Accounting Chapter 10 Exercise 1 6Baby MushroomNo ratings yet

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Cost Accounting Chapter 10 Exercise 1 6Document5 pagesCost Accounting Chapter 10 Exercise 1 6Baby MushroomNo ratings yet

- Dendrite International: Group No-5 Alok Pratap Singh (23NMP05) Mohan Murari (23NMP19) Sudhansu Senapati (23NMP31)Document7 pagesDendrite International: Group No-5 Alok Pratap Singh (23NMP05) Mohan Murari (23NMP19) Sudhansu Senapati (23NMP31)Rahul NiranwalNo ratings yet

- Shreya Sarwade - 23-1632Document23 pagesShreya Sarwade - 23-1632beharenbNo ratings yet

- Bankruptcy Removal Procedure KitDocument7 pagesBankruptcy Removal Procedure Kitduvard purdue100% (1)

- Module 7: Financials: ENTPLA1 - Thalia AtendidoDocument17 pagesModule 7: Financials: ENTPLA1 - Thalia AtendidoNevan NovaNo ratings yet

- Demo Teaching SHS ABMDocument30 pagesDemo Teaching SHS ABMPhil-Wave Boat Builder Co. Ltd.No ratings yet

- Chapter 1 BpoDocument12 pagesChapter 1 BpogkzunigaNo ratings yet

- Tender - BQ Ecd Construction of ClassroomsDocument64 pagesTender - BQ Ecd Construction of ClassroomsMutai KiprotichNo ratings yet

- Strategic Planning - BMW Strategic PlanningDocument26 pagesStrategic Planning - BMW Strategic Planningyasir_irshad100% (4)

- Bank Reconciliation: Match Books to BankDocument5 pagesBank Reconciliation: Match Books to BankJireh RiveraNo ratings yet

- Green Supply Chain Management Complete ProjectDocument28 pagesGreen Supply Chain Management Complete ProjectDEEPIKA BOTHRANo ratings yet

- Request For ProposalDocument40 pagesRequest For ProposalTender infoNo ratings yet

- Job DiscerptionDocument3 pagesJob Discerptionblissblock27No ratings yet

- 11th Accountancy EM WWW - Tntextbooks.inDocument352 pages11th Accountancy EM WWW - Tntextbooks.inRamesh RengarajanNo ratings yet

- Accoun1 SpaceDocument25 pagesAccoun1 SpacePerlas Flordeliza100% (1)

- VAT Invoice - 2024-01-31 - 00000007031318-2401-18359960Document2 pagesVAT Invoice - 2024-01-31 - 00000007031318-2401-18359960mhzp4ckj47No ratings yet

- RPT Sanction EPayment DetailsDocument4 pagesRPT Sanction EPayment DetailsTYCS35 SIDDHESH PENDURKARNo ratings yet

- Workshop 1. Bill of LadingDocument10 pagesWorkshop 1. Bill of LadingAbraham PerezNo ratings yet

- R11Document2 pagesR11Felileo BeltranNo ratings yet

- WAYSEGDocument3 pagesWAYSEGTokkiNo ratings yet

- SITARAM JINDAL FOUNDATION DONATION APPLICATIONDocument2 pagesSITARAM JINDAL FOUNDATION DONATION APPLICATIONRs WsNo ratings yet

- Air India - Indian Airlines MergerDocument14 pagesAir India - Indian Airlines MergerMridu ChadhaNo ratings yet

- Time Impact Analysis - Window AnalysisDocument10 pagesTime Impact Analysis - Window AnalysisJeezan AzikNo ratings yet

- France en Dec. 2022 v3Document37 pagesFrance en Dec. 2022 v3Tarek OsmanNo ratings yet

- 12th Economics Question Papers 2023Document8 pages12th Economics Question Papers 2023Renuka ManeNo ratings yet

- Price Sheet of Luxor Jan'23Document1 pagePrice Sheet of Luxor Jan'23tsasidharNo ratings yet

- Ebook PDF Supply Chain Finance Risk Management Resilience and Supplier Management PDFDocument46 pagesEbook PDF Supply Chain Finance Risk Management Resilience and Supplier Management PDFrobert.wymer101100% (30)

- Walmart's Global Strategies CaseDocument9 pagesWalmart's Global Strategies CaseRandolph LeroyNo ratings yet

- Correspondence Address and Career ObjectivesDocument2 pagesCorrespondence Address and Career Objectives19478800No ratings yet

- Chapter 4 Real Property Gain Tax - StudentDocument33 pagesChapter 4 Real Property Gain Tax - StudentAng ZhitingNo ratings yet

- Sherin - CV UpdatedDocument5 pagesSherin - CV Updatedanon_333386456No ratings yet