Professional Documents

Culture Documents

Problem 8

Uploaded by

Coleen Lara Sedilles0 ratings0% found this document useful (0 votes)

179 views3 pagesAnswers to problem 8

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnswers to problem 8

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

179 views3 pagesProblem 8

Uploaded by

Coleen Lara SedillesAnswers to problem 8

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

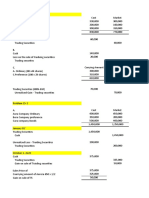

Problem 8-5

July 1 Accounts receivable – assigned 500 000

Accounts receivable 500 000

Cash 390 000

Service charge 10 000

Note payable – bank 400 000

Aug 1 Cash 330 000

Accounts receivable – assigned 330 000

Note payable – bank 326 000

Interest expense (400 000 x 1%) 4 000

Cash 330 000

Sept 1 Cash 170 000

Accounts receivable – assigned 170 000

Note payable – bank 70 000

Interest expense ( 000 x 1%) 4 000

Cash 000

Problem 8-6

Dec. 1 Accounts receivable – assigned 1 500 000

Accounts receivable 1 500 000

Cash 1 250 000

Service charge 50 000

Note payable – bank 1 300 000

31 Cash 970 000

Sales discount 30 000

Accounts receivable – assigned 1 000 000

31 Note payable – bank 957 000

Interest expense (1 300 000 x 1%) 13 000

Cash 970 000

Problem 8-7

Jul 1 Accounts receivable – assigned 800 000

Accounts receivable 800 000

Cash 616 000

Service charge 24 000

Notes payable – bank 640 000

Aug 1 Note payable – bank 413 600

Interest expense (640 000 x 1%) 6 400

Accounts receivable – assigned 420 000

Loan from bank 640 000

Less: August collection by bank 413 600

Balance due the bank 226 400

September collection by bank 320 000

Less: Loan balance 226 400

Interest (226 400 x 1%) 2 264 228 664

Remittance from bank 91 336

Sept 1 Cash 91 336

Interest expense (226 400 x 1%) 2 264

Note payable – bank 226 400

Accounts receivable – assigned 320 000

Problem 8-8

Accounts receivable 6 000 000

Factor’s holdback (6 000 000 x 10%) (600 000)

Commission (6 000 000 x 15%) (900 000)

Cash received from factoring 4 500 000

Accounts receivable 6 000 000

Commission (6 000 000 x 15%) (900 000)

Net sales price 5 100 000

Carrying amount of A/R 5 800 000

Total loss on factoring (700 000)

Cash 4 500 000

Receivable from factor 600 000

Allowance for doubtful accounts 200 000

Loss from factoring 700 000

Accounts receivable 6 000 000

Problem 8-9

Gross amount 800 000

Less: Factor’s holdback (800 000 x 10%) (80 000)

Factoring fee (800 000 x 5%) (40 000) 120 000

Cash received from factoring 680 000

Jul 1 Cash 680 000

Receivable from factor 80 000

Factoring fee 40 000

Accounts receivable 800 000

Jul 15 Sales return and allowance 20 000

Receivable from factor 20 000

Cash (80 000 – 20 000) 60 000

Receivable from factor 60 000

Problem 8-10

Gross amount 500 000

Less: Factor’s holdback (500 000 x 25%) (125 000)

Commission (500 000 x 5%) (25 000)

Sales discount (500 000 x 2%) (10 000) 160 000

Cash received from factoring 340 000

Jun 1 Accounts receivable 500 000

Sale 500 000

Jun 3 Cash 340 000

Receivable from factor 125 000

Commission 25 000

Sales discount 10 000

Accounts receivable 500 000

Jun 9 Sales return and allowance 50 000

Sales discount (50 000 x 2%) 1 000

Receivable from factor 49 000

Jun 11 no entry

Jun 15 Cash (125 000 - 49 000) 76 000

Receivable from factor 76 000

You might also like

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument23 pagesPittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Accounting - Prob.3Document2 pagesAccounting - Prob.3Dellosa, Jierstine Shaney R.No ratings yet

- Vain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditDocument1 pageVain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditAnonnNo ratings yet

- Bleak Company Requirement A Debit Credit Requirement BDocument2 pagesBleak Company Requirement A Debit Credit Requirement BAnonn100% (1)

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Walleye Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageWalleye Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Quiz No. 1: Intermediate Accounting, Part 4Document3 pagesQuiz No. 1: Intermediate Accounting, Part 4Paula BautistaNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDocument6 pagesPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Mythical Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMythical Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000No ratings yet

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- PARCOR Quiz Chapter 6Document2 pagesPARCOR Quiz Chapter 6Angelica ShaneNo ratings yet

- Machete Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageMachete Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Present Value of Principal (8,000,000 X 0.6756) 5,404,800 Jan-01 Present Value of Semi Annual Interest (400,000 X 8.11) 3,244,000 Purchase Price 8,648,800 Jul-01Document2 pagesPresent Value of Principal (8,000,000 X 0.6756) 5,404,800 Jan-01 Present Value of Semi Annual Interest (400,000 X 8.11) 3,244,000 Purchase Price 8,648,800 Jul-01AnonnNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- 6-4 Gullible Company Req 1Document2 pages6-4 Gullible Company Req 1mercyvienhoNo ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Accounts Receivable and Estimation of AFBDDocument1 pageAccounts Receivable and Estimation of AFBDeia aieNo ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Accounts Receivable: Notwithstanding, Are Classified As Current AssetsDocument13 pagesAccounts Receivable: Notwithstanding, Are Classified As Current AssetsAdyangNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- ACCT102 - A Alexis Bang CangDocument4 pagesACCT102 - A Alexis Bang CangAccounting 201No ratings yet

- Notes Payable and Debt Restructuring (Ruma, Jamaica)Document14 pagesNotes Payable and Debt Restructuring (Ruma, Jamaica)Jamaica RumaNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Assignment 14Document4 pagesAssignment 14Sova ShockdartNo ratings yet

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument1 pagePittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- Problem 2 8Document6 pagesProblem 2 8Carl Jaime Dela CruzNo ratings yet

- IA Problem 17 4Document8 pagesIA Problem 17 4nenzzmariaNo ratings yet

- Affectionate CompanyDocument1 pageAffectionate CompanyAnonnNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Final SLP Accounting For ReceivablesDocument26 pagesFinal SLP Accounting For ReceivablesLovely Joy SantiagoNo ratings yet

- Financial Accounting Reviewer - Chapter 28Document9 pagesFinancial Accounting Reviewer - Chapter 28Coursehero PremiumNo ratings yet

- Problem 23-7 and 23-8Document2 pagesProblem 23-7 and 23-8Maria LicuananNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Receivable Financing Pledge Assignment ADocument34 pagesReceivable Financing Pledge Assignment AJoy UyNo ratings yet

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- Fifo MethodDocument1 pageFifo MethodRegina Mae CatamponganNo ratings yet

- Acct Project Question 4Document15 pagesAcct Project Question 4graceNo ratings yet

- Accounts ReceivableDocument34 pagesAccounts ReceivableRose Aubrey A Cordova100% (1)

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- GROUP2 AE105 Chp.11 14Document26 pagesGROUP2 AE105 Chp.11 14Isabelle CandelariaNo ratings yet

- Trade and Nontrade Receivables FM561Document25 pagesTrade and Nontrade Receivables FM561Rose Aubrey A CordovaNo ratings yet

- Periodic or Perpetual (Same) : Specific IdentificationDocument10 pagesPeriodic or Perpetual (Same) : Specific Identificationhoneyjoy salapantanNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- Module 1 Notes and Loans ReceivableDocument21 pagesModule 1 Notes and Loans ReceivableEryn GabrielleNo ratings yet

- Final Instruction ACC 111 Competency Assessment 3Document3 pagesFinal Instruction ACC 111 Competency Assessment 3Jennylyn Angela PatarataNo ratings yet

- Chapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Document9 pagesChapter 8 - Receivable Financing (Pledge, Assignment, and Factoring)Lorence IbañezNo ratings yet

- 07 Receivable Financing 2 SolvingDocument3 pages07 Receivable Financing 2 Solvingkyle mandaresioNo ratings yet

- CF - Presentation and Disclosure Concepts of CapitalDocument2 pagesCF - Presentation and Disclosure Concepts of CapitalColeen Lara SedillesNo ratings yet

- Accounting Policies, Estimate and ErrorsDocument2 pagesAccounting Policies, Estimate and ErrorsColeen Lara SedillesNo ratings yet

- CH 03 S02 Obligations With A PeriodDocument3 pagesCH 03 S02 Obligations With A PeriodColeen Lara SedillesNo ratings yet

- CH 03 S04 Joint and Solidary ObligationsDocument4 pagesCH 03 S04 Joint and Solidary ObligationsColeen Lara SedillesNo ratings yet

- CF - Elements of Financial StatementsDocument2 pagesCF - Elements of Financial StatementsColeen Lara SedillesNo ratings yet

- CF - Financial Statements and Reporting Entity Underlying AssumptionsDocument2 pagesCF - Financial Statements and Reporting Entity Underlying AssumptionsColeen Lara SedillesNo ratings yet

- 7-Approaches/Methods in Counseling Solution-Focused Brief Counseling (SFBC) 3. Miracle QuestionDocument11 pages7-Approaches/Methods in Counseling Solution-Focused Brief Counseling (SFBC) 3. Miracle QuestionColeen Lara SedillesNo ratings yet

- CF - Objective of Financial ReportingDocument3 pagesCF - Objective of Financial ReportingColeen Lara SedillesNo ratings yet

- CH 03 S03 Alternative ObligationsDocument3 pagesCH 03 S03 Alternative ObligationsColeen Lara SedillesNo ratings yet

- Chapter 03: Elasticity and Demand: Points A - FDocument2 pagesChapter 03: Elasticity and Demand: Points A - FColeen Lara SedillesNo ratings yet

- CH 02 Nature and Effect of ObligationsDocument1 pageCH 02 Nature and Effect of ObligationsColeen Lara SedillesNo ratings yet

- Nations (Or Why The Division: How To Read The Wealth of of Labor Is More Important Than Competition in Adam Smith)Document23 pagesNations (Or Why The Division: How To Read The Wealth of of Labor Is More Important Than Competition in Adam Smith)Motivational QuotesNo ratings yet

- CH 03 S01 Different Kinds of ObligationsDocument6 pagesCH 03 S01 Different Kinds of ObligationsColeen Lara SedillesNo ratings yet

- Title I: Obligations: Chapter 1: General ProvisionsDocument2 pagesTitle I: Obligations: Chapter 1: General ProvisionsColeen Lara SedillesNo ratings yet

- CH 03 Marginal Analysis For Optimal DecisionsDocument6 pagesCH 03 Marginal Analysis For Optimal DecisionsColeen Lara SedillesNo ratings yet

- 02 Consumer Behavior Theory HomeworkDocument1 page02 Consumer Behavior Theory HomeworkColeen Lara SedillesNo ratings yet

- Human Cloning SpeechDocument2 pagesHuman Cloning SpeechColeen Lara SedillesNo ratings yet

- Creative Writing 5Document2 pagesCreative Writing 5Coleen Lara SedillesNo ratings yet

- Creative Writing 1.original PDFDocument2 pagesCreative Writing 1.original PDFkeinneth jorolanNo ratings yet

- Chapter 01: Evolution: Rank, Radio, Etc.) Are Fearful. They Fear To Engage The World Without Defenses." in My OpinionDocument2 pagesChapter 01: Evolution: Rank, Radio, Etc.) Are Fearful. They Fear To Engage The World Without Defenses." in My OpinionColeen Lara SedillesNo ratings yet

- 01 Managerial Economics HomeworkDocument2 pages01 Managerial Economics HomeworkColeen Lara SedillesNo ratings yet

- Creative Writing Week 2Document4 pagesCreative Writing Week 2Coleen Lara SedillesNo ratings yet

- The Russwole Program Vol. 2 - Spreadsheet PDFDocument1 pageThe Russwole Program Vol. 2 - Spreadsheet PDFayecim83% (6)

- Deck Officer Ebook PDFDocument30 pagesDeck Officer Ebook PDFTrịnh Minh Khoa100% (3)

- Region7-Centralvisayasdivisonofdumaguete Citysen IorhighschoolDocument9 pagesRegion7-Centralvisayasdivisonofdumaguete Citysen IorhighschoolColeen Lara SedillesNo ratings yet

- Media and Information Literacy 3Document4 pagesMedia and Information Literacy 3Coleen Lara SedillesNo ratings yet

- Creative Writing 3Document2 pagesCreative Writing 3Coleen Lara SedillesNo ratings yet

- Creative Writing 4Document2 pagesCreative Writing 4Coleen Lara SedillesNo ratings yet

- Creative Writing 1.original PDFDocument2 pagesCreative Writing 1.original PDFkeinneth jorolanNo ratings yet

- Creative Writing Week 2Document4 pagesCreative Writing Week 2Coleen Lara SedillesNo ratings yet

- Cbse Questions Adm RetirementDocument19 pagesCbse Questions Adm RetirementDeepanshu kaushikNo ratings yet

- Solution Manual of Financial Management by Cabrera PDFDocument2 pagesSolution Manual of Financial Management by Cabrera PDFMaria Diane Almeyda100% (2)

- Invoice 1139421221 I0136P2000267596Document1 pageInvoice 1139421221 I0136P2000267596Thanish GattuNo ratings yet

- Capital Budgeting Practice Question With Solution (EXAM)Document10 pagesCapital Budgeting Practice Question With Solution (EXAM)imfondofNo ratings yet

- WCM EstimationDocument3 pagesWCM Estimationtanya.p23No ratings yet

- Chapter NineDocument10 pagesChapter NineAsif HossainNo ratings yet

- Chapter 4 - Post Merger ReorganisationDocument16 pagesChapter 4 - Post Merger ReorganisationAbhishek SinghNo ratings yet

- Module 3Document29 pagesModule 3Jiane SanicoNo ratings yet

- Albany Vacant Building Report September 14 2012Document180 pagesAlbany Vacant Building Report September 14 2012alloveralbanyNo ratings yet

- Course Syl Lab UsDocument4 pagesCourse Syl Lab UsMohammed AdelNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- Landl Co vs. Metropolitan Bank & Trust CompanyDocument1 pageLandl Co vs. Metropolitan Bank & Trust Companyvallie21No ratings yet

- Standard Costing EditedDocument13 pagesStandard Costing Editedking justinNo ratings yet

- Admin1, 1102 Edt v1 303-319Document17 pagesAdmin1, 1102 Edt v1 303-319Jessica AnggiNo ratings yet

- IDN Times - Taskforce - Media & HomelessDocument1 pageIDN Times - Taskforce - Media & HomelessHanan Rananta ArbiNo ratings yet

- Hotel IndustryDocument9 pagesHotel IndustryRaghu Citech N SjecNo ratings yet

- Bill HotelDocument54 pagesBill Hotelidhul bram sakti100% (1)

- Translation Exposure Management PDFDocument13 pagesTranslation Exposure Management PDFpilotNo ratings yet

- Strategic ManagenmentDocument51 pagesStrategic ManagenmentRaushni BoseNo ratings yet

- The 15th Malaysian Capital Market Summit - ASLI - AgendaDocument3 pagesThe 15th Malaysian Capital Market Summit - ASLI - Agendameor_ayobNo ratings yet

- Report LI at BSNDocument8 pagesReport LI at BSNSitie Fatima ElaniNo ratings yet

- Closure of NPA PVT Bks 16.10Document2 pagesClosure of NPA PVT Bks 16.10Divnain SinghNo ratings yet

- The Impact of Taxation On Profit Levels of Small Scale Business EnterprisesDocument5 pagesThe Impact of Taxation On Profit Levels of Small Scale Business Enterprisespankaj baviskarNo ratings yet

- 0678XXXXXXX167017 09 202311Document9 pages0678XXXXXXX167017 09 202311bhupesh pandeyNo ratings yet

- HW On Cash BDocument6 pagesHW On Cash BAngelo123No ratings yet

- Revolut LTD Annual Report YE 2020Document81 pagesRevolut LTD Annual Report YE 2020ForkLogNo ratings yet

- Health Financing Strategy Period 2016-2025 - EN - Copy 1Document47 pagesHealth Financing Strategy Period 2016-2025 - EN - Copy 1Indah ShofiyahNo ratings yet

- Decision Making PSA CaseDocument3 pagesDecision Making PSA CaseAriq LoupiasNo ratings yet

- Vdocuments - MX Internship Report 58bd59f3d6a33Document68 pagesVdocuments - MX Internship Report 58bd59f3d6a33Eyuael SolomonNo ratings yet