Professional Documents

Culture Documents

Mythical Company Provided The Following Transactions:: University - Year 2 Accounting

Uploaded by

collegestudent2000Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mythical Company Provided The Following Transactions:: University - Year 2 Accounting

Uploaded by

collegestudent2000Copyright:

Available Formats

University - Year 2

Accounting

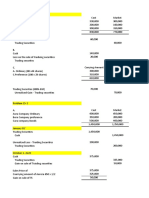

EXERCISE 9

Mythical Company provided the following transactions:

APR 5 Received from A, a customer, P500,000, 60-day, 12% note, dated April

4, in 'payment of an account.

Apr-05 Notes receivable 500,000

Accounts receivable 500,000

APR 15 The note of A was discounted with the bank at 14%.

Apr-19 Cash 501,075

Loss on note discounting 1,425

Notes receivable discounted 500,000

Interest income 2,500

Principal 500,000

Add: Interest (500,000 x 12% x 60/360) 10,000

Maturity value 510,000

Less: Discount (510,000 x 14% x 45,360) -8925

Net proceeds 501,075

Principal 500,000

Accrued interest receivable (500,000 x 12% x 15/360) 2,500

Carrying amount of N/R 502,500

Net proceeds 501,075

Loss: Carrying amount of N/R -502,500

Loss on discounting -1,425

MAY 3 Received a P1,000,000, 30-day noninterest bearing note dated May 1

from B, in payment of an account.

30-day Non-Interest Bearing Note

May-03 Notes receivable 1,000,000

Accounts receivable 1,000,000

MAY 16 The note of B was discounted with the bank at 12%.

May-

16 Cash 995,000

Loss on discounting 5,000

1,000,00

Notes receivable discounted 0

Principal 1,000,000

Less: Discount (1,000,000 x 12% x 15/360) - 5,000

Net proceeds 995,000

MAY 25 Received from C, a customer, a P1,500,000, 60-day 12% note dated May

15 and made by Company X. Gave the customer credit for the maturity

value of the note less discount at 12%.

60-day Interest Bearing Note

May-25 Notes receivable 1,500,000

Interest income 4,500

Accounts receivable 1,504,500

Principal 1,500,000

Add: Interest (1,500,000 x 12% x 60/360) 30,000

Maturity value 1,530,000

Less: Discount (1,530,000 x 12% x 50/360) - 25,500

Net credit 1,504,500

JUN 7 Received notice from the bank that the note of A Was not paid on maturity.

Paid bank the amount due plus protest fee and other charges of P20,000.

*dishonored

Jun-07 Accounts receivable (510,000 + 20,000) 530,000 note

Cash 530,000

Notes receivable discounted 500,000

Notes receivable 500,000

JUN 15 Received a 60-day, 12% note, P800,000, dated June 15, from D, a customer

for sale of merchandise.

Jun-15 Notes receivable 800,000

Sales 800,000

JUN 18 Received full payment from A including interest of 12% on total amount

due from maturity date of original note.

Jun-18 Cash 532,650

Accounts receivable 530,000

Interest income (530,000 x 12% x 15/360) 2,650

Required: Prepare journal entries to record the transactions assuming any discounting

of note receivable is accounted for as conditional sale with recognition of a

contingent liability.

Adjusting Entries

1.) Accrued interest receivable 4,000

Interest income (800,000 x 12% x 15/360) 4,000

(Accrued interest on D's note)

2.) Notes receivable discounted 1,000,000

Notes receivable 1,000,000

(To cancel the contingent liability on B's note. This note matured on

May 31. Since there is no notice of dishonor, it is assumed that the

said note is paid on the date of maturity.)

Required: Prepare the necessary adjustments on June 30.

You might also like

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument23 pagesPittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- Walleye Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageWalleye Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Chameleon Company Requirement1 Debit CreditDocument3 pagesChameleon Company Requirement1 Debit CreditAnonnNo ratings yet

- Vain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditDocument1 pageVain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditAnonnNo ratings yet

- 6-4 Gullible Company Req 1Document2 pages6-4 Gullible Company Req 1mercyvienhoNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Affectionate CompanyDocument1 pageAffectionate CompanyAnonnNo ratings yet

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Bleak Company Requirement A Debit Credit Requirement BDocument2 pagesBleak Company Requirement A Debit Credit Requirement BAnonn100% (1)

- Problem 8Document3 pagesProblem 8Coleen Lara SedillesNo ratings yet

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Problem 4-2 (IAA)Document6 pagesProblem 4-2 (IAA)Rose Aubrey A CordovaNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- ACFAR 1231 - Cash and Cash Equivalents AssignmentDocument2 pagesACFAR 1231 - Cash and Cash Equivalents AssignmentkakaoNo ratings yet

- Problem 1-3 and Problem 1-4 CarinoDocument2 pagesProblem 1-3 and Problem 1-4 Carinoschool worksNo ratings yet

- Bedlam Company December Cash Proof ReportDocument2 pagesBedlam Company December Cash Proof ReportChristy HabelNo ratings yet

- Accounting - Prob.3Document2 pagesAccounting - Prob.3Dellosa, Jierstine Shaney R.No ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- ValixDocument12 pagesValixJESTONI RAMOSNo ratings yet

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument1 pagePittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- IA Activity 3 Chapter 6Document2 pagesIA Activity 3 Chapter 6Sunghoon SsiNo ratings yet

- Docile Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDocile Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- Generous Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageGenerous Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- Module 2d Loan ReceivableDocument24 pagesModule 2d Loan ReceivableChen HaoNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- Bigotry Company Proof of CashDocument4 pagesBigotry Company Proof of CashGee Lysa Pascua VilbarNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Zodiac Company: Balance Per Book, April 30Document5 pagesZodiac Company: Balance Per Book, April 30Rhea Sismo-anNo ratings yet

- Practice Set Acc124 Lady Charmaine CorporationDocument10 pagesPractice Set Acc124 Lady Charmaine CorporationRose DetaloNo ratings yet

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- EQUIVALENTSDocument5 pagesEQUIVALENTSAlly JeongNo ratings yet

- ACC 101 - NR Assignment SolutionDocument6 pagesACC 101 - NR Assignment SolutionAdyangNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Cash and Cash EquivalentsDocument7 pagesCash and Cash EquivalentsDianna DayawonNo ratings yet

- Problem 5-4 5-5Document4 pagesProblem 5-4 5-5Jicelle MendozaNo ratings yet

- PDFDocument7 pagesPDFAbegail AdoraNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Adjusting Entries for Petty Cash Fund TransactionsDocument29 pagesAdjusting Entries for Petty Cash Fund TransactionsENCARNACION Princess MarieNo ratings yet

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDocument6 pagesPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNo ratings yet

- Final SLP Accounting For ReceivablesDocument26 pagesFinal SLP Accounting For ReceivablesLovely Joy SantiagoNo ratings yet

- Income Statement-Mcq ProblemsDocument3 pagesIncome Statement-Mcq Problemschey dabestNo ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- Total Cash 8,050,000: Additional InformationDocument10 pagesTotal Cash 8,050,000: Additional Informationeia aieNo ratings yet

- Untitled Document 6Document7 pagesUntitled Document 6lee doroNo ratings yet

- Notes ReceivablesDocument5 pagesNotes ReceivablesDianna DayawonNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Computation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditDocument2 pagesComputation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditAnonn100% (1)

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Receivable FinancingDocument5 pagesReceivable FinancingAphol Joyce MortelNo ratings yet

- University - Year 2 Accounting TheoriesDocument1 pageUniversity - Year 2 Accounting Theoriescollegestudent2000No ratings yet

- Morale Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMorale Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000No ratings yet

- University - Year 2 Accounting TheoriesDocument1 pageUniversity - Year 2 Accounting Theoriescollegestudent2000No ratings yet

- 0201 AccountingDocument1 page0201 Accountingcollegestudent2000No ratings yet

- University - Year 2 Accounting Factoring Exercise 5Document1 pageUniversity - Year 2 Accounting Factoring Exercise 5collegestudent2000No ratings yet

- University - Year 2 AccountingDocument1 pageUniversity - Year 2 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument2 pages0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument3 pages0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument1 page0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument1 page0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument2 pages0201 Accountingcollegestudent2000No ratings yet

- University - Year 2 Accounting Exercise 4Document1 pageUniversity - Year 2 Accounting Exercise 4collegestudent2000No ratings yet

- 0102-Operations ManagementDocument2 pages0102-Operations Managementcollegestudent2000No ratings yet

- 0201 AccountingDocument2 pages0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument2 pages0201 Accountingcollegestudent2000No ratings yet

- 0201 AccountingDocument1 page0201 Accountingcollegestudent2000No ratings yet

- University - Year 2 Accounting Exercise 3Document1 pageUniversity - Year 2 Accounting Exercise 3collegestudent2000No ratings yet

- 0102-Operations ManagementDocument1 page0102-Operations Managementcollegestudent2000No ratings yet

- University - Year 1 Operations Management Notes-4Document2 pagesUniversity - Year 1 Operations Management Notes-4collegestudent2000No ratings yet

- 0102-Operations ManagementDocument2 pages0102-Operations Managementcollegestudent2000No ratings yet

- 0201 AccountingDocument1 page0201 Accountingcollegestudent2000No ratings yet

- 0102-Operations ManagementDocument1 page0102-Operations Managementcollegestudent2000No ratings yet

- 0201 AccountingDocument2 pages0201 Accountingcollegestudent2000No ratings yet

- Science, Technology, and SocietyDocument3 pagesScience, Technology, and Societycollegestudent2000No ratings yet

- 0102-Operations ManagementDocument1 page0102-Operations Managementcollegestudent2000No ratings yet

- 0102-Operations ManagementDocument2 pages0102-Operations Managementcollegestudent2000No ratings yet

- Science, Technology, and SocietyDocument1 pageScience, Technology, and Societycollegestudent2000No ratings yet

- 0102-Operations ManagementDocument1 page0102-Operations Managementcollegestudent2000No ratings yet

- 0102-Operations ManagementDocument1 page0102-Operations Managementcollegestudent2000No ratings yet

- Bid Document of Jimma PT & CT 2023 l-344wDocument228 pagesBid Document of Jimma PT & CT 2023 l-344wEsmael DawudNo ratings yet

- BSP Published Circulars 2017Document2 pagesBSP Published Circulars 2017Remson OrasNo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Project Charter TemplateDocument3 pagesProject Charter TemplateOsiris FriendNo ratings yet

- Presentation of Dabur and Fem CareDocument15 pagesPresentation of Dabur and Fem Carekhansharful786No ratings yet

- AEM Senior ConsultantDocument4 pagesAEM Senior ConsultantNaveen PeramalasettyNo ratings yet

- Dubai Islamic BankDocument3 pagesDubai Islamic Bankumair20062010100% (1)

- HR Assignment 1 PDFDocument6 pagesHR Assignment 1 PDFRuban CharmNo ratings yet

- Acc 202 Special Financial AccountingDocument74 pagesAcc 202 Special Financial Accountingfred-yusuff tomiwaNo ratings yet

- Accenture High Performance in Procurement Risk Management (Lo-Res)Document24 pagesAccenture High Performance in Procurement Risk Management (Lo-Res)andianisalsaNo ratings yet

- Tarlac - San Filipe - Business Permit - NewDocument2 pagesTarlac - San Filipe - Business Permit - Newarjhay llaveNo ratings yet

- ISO 14001 Administrative Flowchart ExamplesDocument17 pagesISO 14001 Administrative Flowchart ExamplesPercy MphulanyaneNo ratings yet

- Kelompok FGD GPTP 14 Batch 2 (Responses)Document16 pagesKelompok FGD GPTP 14 Batch 2 (Responses)Tia AgustinnNo ratings yet

- Olson Sala Company Combination Journal For The Month Ended June 30, 2018Document5 pagesOlson Sala Company Combination Journal For The Month Ended June 30, 2018Zein GonzalezNo ratings yet

- Wahyu Gunawan - NAVA BHARAT CASE - Financial MGT - ENEMBA7Document14 pagesWahyu Gunawan - NAVA BHARAT CASE - Financial MGT - ENEMBA7Rydo PrastariNo ratings yet

- BigData Research PaperDocument22 pagesBigData Research PaperRuta TakalkarNo ratings yet

- Oracle UPK Demo 101708Document23 pagesOracle UPK Demo 101708Sharan Shankar100% (2)

- Tyre Industry Performance AnalysisDocument15 pagesTyre Industry Performance AnalysisJubin RoyNo ratings yet

- Barclays India 2021 - MBA GradDocument3 pagesBarclays India 2021 - MBA GradHARSH MATHURNo ratings yet

- Section2 - Tender Data Sheet (TDS)Document3 pagesSection2 - Tender Data Sheet (TDS)istiakNo ratings yet

- Week 7 Intellectual Property RightsDocument21 pagesWeek 7 Intellectual Property RightsHussainNo ratings yet

- Datawarehouse PPTDocument39 pagesDatawarehouse PPTLakshmiNarasaiah_MNo ratings yet

- Student Entrepreneur Profile Sourrav MishraDocument1 pageStudent Entrepreneur Profile Sourrav MishraSarthak Om MishraNo ratings yet

- The 20 Minute: 1 Page Business Plan For App StartupsDocument31 pagesThe 20 Minute: 1 Page Business Plan For App StartupsMohammed Ashour100% (1)

- Southeast Bank Annual Report 2016 PDFDocument446 pagesSoutheast Bank Annual Report 2016 PDFAnonymous XarIeNlgL6No ratings yet

- Fwel2203 Bid SummaryDocument1 pageFwel2203 Bid SummaryArchie Joseph LlanaNo ratings yet

- Accounting Principle Kieso 8e - Ch09Document47 pagesAccounting Principle Kieso 8e - Ch09Sania M. JayantiNo ratings yet

- Tesco's Motivational Theories in PracticeDocument7 pagesTesco's Motivational Theories in PracticeArindam RayNo ratings yet

- StaffingDocument12 pagesStaffingsudhakar80No ratings yet

- Final Customer Proje TDocument18 pagesFinal Customer Proje Tpreetiarora891No ratings yet