Professional Documents

Culture Documents

33

Uploaded by

yes yesno0 ratings0% found this document useful (0 votes)

639 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

639 views2 pages33

Uploaded by

yes yesnoCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

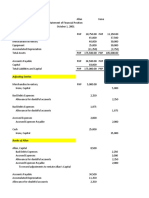

Carefree Company’s newly hired assistant prepared the following bank reconciliation on March

31, 2006:

Book balance 1,405,000

Add: March 31 deposit 750,000

Collected of note 2,500,000

Interest on note 150,000 3,400,000

Total 4,805,000

Less: Careless Company’s deposit to account 1,100,000

Bank service charge 45,000 1,145,000

Adjusted book balance 3,660,000

Bank balance 5,630,000

Add: Error on check No. 175 45,000

Total 5,675,000

Less: Preauthorized payments for water bill 205,000

NSF check 220,000

Outstanding check 1,650,000 2,075,000

Adjusted bank balance 3,600,000

Check No. 175 was made for the proper amount of P249,000 in payment of account. However

it was entered in the cash payments journal as P294,000. Carefree authorized the bank to

automatically pay its water bills as submitted directly to the bank.

8. the correct cash in bank balance is

The bookkeeper of Divine Company recently prepared the following bank reconciliation on

December 31, 2006:

Balance per bank statement 2,800,000

Add: Deposit in transit 195,000

Checkbook printing charge 5,000

Error made by Divine in recording check No.45

(issued in December)

35,000

NSF check 110,000 345,000

3,145,000

Less: Outstanding check 100,000

Note collected by bank

(includes P15,000 interest) 215,000 315,000

Balance per book 2,830,000

Divine Company has P200,000 cash on hand on December 31, 2006.

9. The amount to be reported by Divine Company as cash on the balance sheet as of December

31, 2006 should be

You might also like

- Bank Reconciliation PDFDocument3 pagesBank Reconciliation PDFEunjina MoNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- MiyawwDocument9 pagesMiyawwjessa mae zerdaNo ratings yet

- Inventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2ADocument18 pagesInventories (PROBLEM 10-6) : Allyna Rose V. Ojera BSA-2AOJERA, Allyna Rose V. BSA-1BNo ratings yet

- Romela Company (Gross Method)Document2 pagesRomela Company (Gross Method)AnonnNo ratings yet

- Cost Classification GuideDocument12 pagesCost Classification GuideAngelica NatanNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Intermediate Accounting - ReceivablesDocument3 pagesIntermediate Accounting - ReceivablesDos Buenos100% (1)

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsFrancine Thea M. Lantaya100% (1)

- ACT1104 Assignment 4Document5 pagesACT1104 Assignment 4cjorillosa2004No ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Bank Recon and PCFDocument2 pagesBank Recon and PCFAiza Ordoño0% (1)

- Opening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000Document3 pagesOpening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000AAAAANo ratings yet

- Arabian Company Reported The Following at YearDocument1 pageArabian Company Reported The Following at YearKatrina Dela CruzNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Cash & Cash Equivalent: If The Problem Is Silent, Daily, They Are Part of Cash and Cash EquivalentsDocument30 pagesCash & Cash Equivalent: If The Problem Is Silent, Daily, They Are Part of Cash and Cash EquivalentsKim Audrey JalalainNo ratings yet

- Diana May Company IssuedDocument1 pageDiana May Company IssuedQueen ValleNo ratings yet

- Depreciation Calculation for MachineryDocument1 pageDepreciation Calculation for MachineryKate Iannel VicenteNo ratings yet

- Revenue Cycle Trade DiscountsDocument50 pagesRevenue Cycle Trade DiscountsJean MaeNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- Ai-1 RM8Document5 pagesAi-1 RM8Sheena0% (1)

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- PDF Prac Acc Chapter 15 16docxdocx DDDocument37 pagesPDF Prac Acc Chapter 15 16docxdocx DDBetty SantiagoNo ratings yet

- Preparing The Reversing Entries, Problem #6Document1 pagePreparing The Reversing Entries, Problem #6Feiya LiuNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Inventory Cost Formulas LCNRV Fs DisclosuresDocument15 pagesInventory Cost Formulas LCNRV Fs DisclosuresKawhileonard LeonardNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- Bedlam Company December Cash Proof ReportDocument2 pagesBedlam Company December Cash Proof ReportChristy HabelNo ratings yet

- ACCT102 - A Alexis Bang CangDocument4 pagesACCT102 - A Alexis Bang CangAccounting 201No ratings yet

- ProblemDocument1 pageProblemGemmie Barsobia100% (2)

- Assignment and Quiz 2 Accounting For CashDocument5 pagesAssignment and Quiz 2 Accounting For CashGab BautroNo ratings yet

- Proof of Cash SolutionsDocument4 pagesProof of Cash SolutionsyowatdafrickNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Problem 6 1Document2 pagesProblem 6 1SerdenRoseNo ratings yet

- Prob Basic AcctDocument3 pagesProb Basic AcctSamuel Ferolino50% (2)

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Accounting for freight charges on sales and purchase transactions under different FOB termsDocument2 pagesAccounting for freight charges on sales and purchase transactions under different FOB termsJaybie John Palco Eralino100% (1)

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- CFAS Sample ProblemsDocument5 pagesCFAS Sample ProblemsChristian MartinNo ratings yet

- ACC 102.key Answer - Quiz 1.inventoriesDocument5 pagesACC 102.key Answer - Quiz 1.inventoriesMa. Lou Erika BALITENo ratings yet

- Group Activity Mina HanDocument4 pagesGroup Activity Mina HanLevi's DishwasherNo ratings yet

- Current Net Receivables December 2015 Total SEODocument1 pageCurrent Net Receivables December 2015 Total SEOpompomNo ratings yet

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDocument6 pagesPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaNo ratings yet

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- ProblemsDocument368 pagesProblemsAnne EstrellaNo ratings yet

- Bank ReconciliationDocument3 pagesBank Reconciliationalford sery Cammayo86% (7)

- Bank ReconciliationDocument3 pagesBank Reconciliationlucas lilaNo ratings yet

- Bank Reconciliation Problem 1Document1 pageBank Reconciliation Problem 1Ralph Ernest HulguinNo ratings yet

- Financial Statements of Nonprofit OrganizationsDocument4 pagesFinancial Statements of Nonprofit Organizationsyes yesnoNo ratings yet

- Contractual Adjustments A Portion of A Hospital's Revenue Is Collectible From Third Party Payors, Such As The Philhealth andDocument2 pagesContractual Adjustments A Portion of A Hospital's Revenue Is Collectible From Third Party Payors, Such As The Philhealth andyes yesnoNo ratings yet

- 5 GovaccDocument1 page5 Govaccyes yesnoNo ratings yet

- Financial Statements of Nonprofit OrganizationsDocument4 pagesFinancial Statements of Nonprofit Organizationsyes yesnoNo ratings yet

- Unrestricted FundDocument2 pagesUnrestricted Fundyes yesnoNo ratings yet

- 3 GovaccDocument1 page3 Govaccyes yesnoNo ratings yet

- Practice 4Document3 pagesPractice 4yes yesnoNo ratings yet

- AnswerDocument6 pagesAnsweryes yesnoNo ratings yet

- 4 GovaccDocument2 pages4 Govaccyes yesnoNo ratings yet

- Jackson CompanyDocument5 pagesJackson Companyyes yesnoNo ratings yet

- 1 GovaccDocument2 pages1 Govaccyes yesnoNo ratings yet

- 2 GovaccDocument1 page2 Govaccyes yesnoNo ratings yet

- CompletionDocument3 pagesCompletionyes yesnoNo ratings yet

- Practice 5Document3 pagesPractice 5yes yesnoNo ratings yet

- Camden CompanyDocument3 pagesCamden Companyyes yesnoNo ratings yet

- ProblemDocument3 pagesProblemyes yesnoNo ratings yet

- A1Document3 pagesA1yes yesnoNo ratings yet

- CHAPTER 4 - Job Order Costing: Learning ObjectivesDocument3 pagesCHAPTER 4 - Job Order Costing: Learning Objectivesyes yesnoNo ratings yet

- P4Document3 pagesP4yes yesnoNo ratings yet

- True/FalseDocument3 pagesTrue/Falseyes yesnoNo ratings yet

- M2Document4 pagesM2yes yesnoNo ratings yet

- La 2Document2 pagesLa 2yes yesnoNo ratings yet

- Yes No No No Yes Yes No No No Yes Yes YesDocument3 pagesYes No No No Yes Yes No No No Yes Yes Yesyes yesnoNo ratings yet

- Data Mining and Graph Design PrinciplesDocument5 pagesData Mining and Graph Design Principlesyes yesnoNo ratings yet

- La 4Document2 pagesLa 4yes yesnoNo ratings yet

- La 5Document2 pagesLa 5yes yesnoNo ratings yet

- Supporting Management'S Information NeedsDocument3 pagesSupporting Management'S Information Needsyes yesnoNo ratings yet

- A. B. Prepare The Entry To Revert The Helicopter To Lessor. Assume That The Fair Value The Asset On That Year Is Only P400, OOO. Problem 6Document2 pagesA. B. Prepare The Entry To Revert The Helicopter To Lessor. Assume That The Fair Value The Asset On That Year Is Only P400, OOO. Problem 6yes yesnoNo ratings yet

- Problem 1: Lessor AccountingDocument2 pagesProblem 1: Lessor Accountingyes yesnoNo ratings yet

- Prepare Financial StatementsDocument2 pagesPrepare Financial Statementsyes yesnoNo ratings yet

- Sales Meeting Playbook From HubSpot and Join - MeDocument2 pagesSales Meeting Playbook From HubSpot and Join - MeAbeedNo ratings yet

- Incentives and Control SystemDocument3 pagesIncentives and Control SystemEl Shaira RizzoNo ratings yet

- BibliografieDocument2 pagesBibliografieAndrei IonescuNo ratings yet

- On The Benefits of CPFR and VMI A Comparative PDFDocument12 pagesOn The Benefits of CPFR and VMI A Comparative PDFJose LaraNo ratings yet

- Mark Scheme (Results) January 2011: GCE Accounting (6002/01) Paper 01Document16 pagesMark Scheme (Results) January 2011: GCE Accounting (6002/01) Paper 01Nayeem Hasan AntuNo ratings yet

- January - June 2019 - Status of The Built Environment PDFDocument11 pagesJanuary - June 2019 - Status of The Built Environment PDFMichael LangatNo ratings yet

- 100 Facts About Investment BankingDocument37 pages100 Facts About Investment BankingOlena PetrosyukNo ratings yet

- Agricultural Development in India Since IndependenceDocument31 pagesAgricultural Development in India Since IndependencePravin NamokarNo ratings yet

- What Is A Financial InstitutionDocument3 pagesWhat Is A Financial InstitutionNivea SilvestreNo ratings yet

- Reminder: Use Your Official Answer Sheet: Universidad de ManilaDocument25 pagesReminder: Use Your Official Answer Sheet: Universidad de ManilaMarcellana ArianeNo ratings yet

- Applying The Supply-and-Demand ModelDocument47 pagesApplying The Supply-and-Demand ModelKARIMNo ratings yet

- Bianca Menedin ResumeDocument2 pagesBianca Menedin Resumeapi-309584153No ratings yet

- L1 R50 HY NotesDocument7 pagesL1 R50 HY Notesayesha ansariNo ratings yet

- Business Taxes and Transfer Taxes ExplainedDocument65 pagesBusiness Taxes and Transfer Taxes ExplainedPrincess LimNo ratings yet

- Institutional Contacts:: School InfoDocument79 pagesInstitutional Contacts:: School InfoMatt BrownNo ratings yet

- Retailing Management 9th Edition Michael Levy Solutions ManualDocument19 pagesRetailing Management 9th Edition Michael Levy Solutions Manualdavidphillipsmcyaqbeogf100% (25)

- 30 Ques KMBN302Document30 pages30 Ques KMBN302PREETI GUPTANo ratings yet

- 2021 Als Blue Notes Labor LawDocument304 pages2021 Als Blue Notes Labor LawPJ SLSR100% (16)

- Conceptual Framework Reviewer Chap. 1-4Document10 pagesConceptual Framework Reviewer Chap. 1-4Serge Ann Idiesca100% (9)

- A Comparative Analysis of University-Industry Linkage in Bangladesh and ChinaDocument19 pagesA Comparative Analysis of University-Industry Linkage in Bangladesh and Chinabayezid777No ratings yet

- Hard Currency & Soft CurrencyDocument2 pagesHard Currency & Soft CurrencyPratik PatilNo ratings yet

- B2B E-Commerce: Selling and Buying in Private E-MarketsDocument54 pagesB2B E-Commerce: Selling and Buying in Private E-MarketsKrisel IbanezNo ratings yet

- IDEA Project DharmenderDocument62 pagesIDEA Project Dharmendermss_sikarwar3812No ratings yet

- Case Study - Reaching The Summit and beyond-HKBN PDFDocument26 pagesCase Study - Reaching The Summit and beyond-HKBN PDFSitara Qadir100% (1)

- Accounting Information Systems and Smes PerformanceDocument13 pagesAccounting Information Systems and Smes PerformanceOrngu Benjamin ANo ratings yet

- Human Right Note For BCADocument2 pagesHuman Right Note For BCANitish Gurung100% (1)

- Top 10 Sample Papers Class 12 Accountancy With SolutionDocument110 pagesTop 10 Sample Papers Class 12 Accountancy With Solutionanagha0890% (1)

- 2010-09-13 Chartwell Announces Financial Results For The Three Months Ended July 31, 2010Document3 pages2010-09-13 Chartwell Announces Financial Results For The Three Months Ended July 31, 2010Amaya GamingNo ratings yet

- Scotia Base Metals ReviewDocument11 pagesScotia Base Metals ReviewForexliveNo ratings yet

- Maximising Returns From A Retail Network Nov 2009Document5 pagesMaximising Returns From A Retail Network Nov 2009jaiganeshan89No ratings yet