Professional Documents

Culture Documents

Demas Taufik - TASK 5

Uploaded by

DemastaufiqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demas Taufik - TASK 5

Uploaded by

DemastaufiqCopyright:

Available Formats

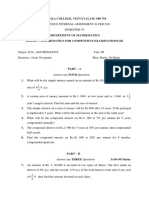

INTERMEDIATE FINANCIAL ACCOUNTING 2

Odd Semester Academic Year 2020/2021

Class: FA

Lecturer: Sari Atmini

Student : Demas Taufik Suganda

NON-CURRENT LIABILITIES

1. Non-current liabilities (sometimes referred to as long-term debt) consist of an expected

outflow of resources arising from present obligations that are not payable within a year or

the operating cycle of the company, whichever is longer. Bonds payable, long-term notes

payable, mortgages payable, pension liabilities, and lease liabilities are examples of non-

current liabilities..

2. The issuer of bonds makes a formal promise/agreement to pay interest usually every six

months (semiannually) and to pay the principal or maturity amount at a specified date

some years in the future.

Types of Bonds

-Secured and Unsecured Bonds. Secured bonds are backed by a pledge of some sort of

collateral.

-Bond issues that mature on a single date are called term bonds

-issues that mature in installments are called serial bonds

-Callable bonds give the issuer the right to call and retire the bonds prior to maturity

-If bonds are convertible into other securities of the company for a specified time after

issuance, they are convertible bonds

-Commodity-backed bonds (also called asset-linked bonds) are redeemable in measures

of a commodity, such as barrels of oil, tons of coal, or ounces of rare metal.

-Deep-discount bonds, also referred to as zero-interest debenture bonds, are sold at a

discount that provides the buyer's total interest payoff at maturity.

-Registered and Bearer (Coupon) Bonds. Bonds issued in the name of the owner are

registered bonds and require surrender of the certificate and issuance of a new certificate

to complete a sale. A bearer or coupon bond, however, is not recorded in the name of the

owner and may be transferred from one owner to another by mere delivery.

- Revenue bonds, so called because the interest on them is paid from specified revenue

sources, are most frequently issued by airports, school districts, counties, toll-road

authorities, and governmental bodies

Issuing Bonds

A bond arises from a contract known as a bond indenture. A bond represents a promise

to pay (1) a sum of money at a designated maturity date, plus (2) periodic interest at a

specified rate on the maturity amount (face value)

3. The interest rate written in the terms of the bond indenture (and often printed on the bond

certificate) is known as the stated, coupon, or nominal rate.

The effective yield is a measure of the coupon rate, which is the interest rate stated on a

bond and expressed as a percentage of the face value.

4. Evidence of a long-term debt, by which the bond issuer (the borrower) is obliged to pay

interest when due, and repay the principal at maturity, as specified on the face of the bond

certificate

5. When bonds sell at less than face value, it means that investors demand a rate of interest

higher than the stated rate. When bonds sells at more than fave value, it means that

investors demand a rate of interest lower than the stated rate.

6. Ignoring Interest Rate Moves Interest rates and bond prices have an inverse relationship.

Not Noting the Claim Status Not all bonds are created equal. There are senior notes,

which are often backed by collateral (such as equipment) that are given the first claim to

company asset in case of bankruptcy and liquidation Assuming a Company Is Sound Just

because you own a bond or because it is highly regarded in the investment community

doesn't guarantee that you will earn a dividend payment, or that you will ever see the

bond redeemed.

7. The amortization of the premium on bonds payable is the systematic movement of the

aount of premium received when the corporation issued the bonds. The premium was

received because the bonds' stated interest rate was greater than the market interest rate.

he amount of the premium is recorded in a separate bond-related liability account. Over

the life of the bonds the premium amount will be systematically moved to the income

statement as a reduction of Bond Interest Expense.

Example of Amortization of Premium on Bonds Payable

Assume that a corporation issues bonds payable having a maturity value of $1,000,000

and receives a premium of $60,000. The bonds mature in 20 years and there was no

accrued interest at the time the bonds are issued.

The corporation will record the bonds as follows:

Debit Cash for $1,060,000 (the amount received from investors)

Credit Bonds Payable for $1,000,000 (the face, par, and maturity amount)

Credit Premium on Bonds Payable for $60,000 (the amount to be amortized)

Since the premium of $60,000 is related to the interest rates when the bonds were issued,

the amortization of the premium will involve the account Interest Expense or Bond

Interest Expense. Since the bonds mature in 20 years, the $60,000 of premium on bonds

payable will mean an annual amortization of $3,000 ($60,000/20 year). The entry for the

annual amortization will be the following:

Debit Premium on Bonds Payable for $3,000

Credit Interest Expense for $3,000

Reducing the balance in the account Premium on Bonds Payable by the same amount each

period is known as the straight-line method of amortization. A more precise method, the

effective interest rate method of amortization, is preferred when the amount of the

premium is a large amount.

8. Yes. There is something that must be adjusted first in December, more details about the

payment of interest. In the written question, the company must pay bond interest every

March 31 and September 30, but there must be records every 31 December. For example

the interest payment on September 30 is 24 million (per month 2 million), the next

payment will be made in March. So the company will pass December so they have to

make adjustments first. Interest payable from September to December must be

recognized first by writing down the interest expense on the interest payable amounting

to 6 million

9. In my opinion, bonds would be better if they were issued on the interest date. This is so

that companies that buy bonds can be better prepared to pay the interest. If the company

that issued the bond demanded interest payments from the company that bought their

bond, but not on the interest date, they are more likely to be unable to pay it.

10. When a company issues bonds at a premium or discount, the amount of bond interest

expense recorded each period differs from bond interest payments. . it will amortize the

discount using the straight-line method meaning we will take the total amount of the

discount and divide by the total number of interest payments.

11. A company may add to the attractiveness of its bonds by giving the bondholders the

option to convert the bonds to shares of the issuer’s common stock. In accounting for the

conversions of convertible bonds, a company treats the carrying value of bonds surrendered

as the capital contributed for shares issued.

12. . It is sometimes desirable to reduce bond indebtedness in order to take advantage of

lower prevailing interest rates. Also the company may not want to make a very large cash

outlay all at once when the bonds mature. Bond indebtedness may be reduced by either

issuing bonds callable after a certain date and then calling some or all of them, or by

purchasing bonds on the open market and then retiring them. When a portion of bonds

outstanding is going to be retired, it is necessary for the accountant to make sure any

corresponding discount or premium is properly amortized. When the bonds are extinguished,

any gain or loss should be reported in income

13. The debt restructuring process typically involves reducing the interest rates on loans,

extending the dates when the company’s liabilities are due to be paid, or both. These steps

improve the firm’s chances of paying back the obligations. Creditors understand that they

would receive even less should the company be forced into bankruptcy or liquidation.

Debt restructuring can be a win-win for both entities because the business avoids bankruptcy,

and the lenders typically receive more than what they would through a bankruptcy

proceeding.

You might also like

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- Bonds Payable: Types, Accounting, and ValuationDocument12 pagesBonds Payable: Types, Accounting, and ValuationJohn Kenneth Escober BentirNo ratings yet

- Long Term Debt EditedDocument16 pagesLong Term Debt EditedAdugnaNo ratings yet

- Chapter Two: Non - Current LiabilitiesDocument10 pagesChapter Two: Non - Current LiabilitiesJuan KermaNo ratings yet

- Understanding Long-Term Debt FinancingDocument22 pagesUnderstanding Long-Term Debt FinancingBlack boxNo ratings yet

- Faii Chapter Vi - 0Document16 pagesFaii Chapter Vi - 0chuchuNo ratings yet

- Long-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaDocument10 pagesLong-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaghostbooNo ratings yet

- MODULE 1 2 Bonds PayableDocument10 pagesMODULE 1 2 Bonds PayableFujoshi BeeNo ratings yet

- Long-Term Debt: Bonds PayableDocument18 pagesLong-Term Debt: Bonds PayableDesiree GalletoNo ratings yet

- Chapter 13 OutlineDocument6 pagesChapter 13 OutlineShella FrankeraNo ratings yet

- Basics of Bond With Types & FeaturesDocument10 pagesBasics of Bond With Types & FeaturesradhikaNo ratings yet

- DebentureDocument9 pagesDebenturedrsurendrakumarNo ratings yet

- Non-current Liabilities ExplainedDocument11 pagesNon-current Liabilities ExplainedabelNo ratings yet

- What Is An 'Amortized Bond'Document11 pagesWhat Is An 'Amortized Bond'Christian Roi ElamparoNo ratings yet

- Non-Current LiabilityDocument9 pagesNon-Current Liabilityjameson EbuñaNo ratings yet

- Chapter 3 Intermediate AccountingDocument56 pagesChapter 3 Intermediate AccountingMae Ann RaquinNo ratings yet

- Everything You Need to Know About BondsDocument6 pagesEverything You Need to Know About BondsHemant GaikwadNo ratings yet

- Non-Current Liabilities - : Learning ObjectivesDocument18 pagesNon-Current Liabilities - : Learning ObjectivesJiddah0% (1)

- Bonds PayableDocument12 pagesBonds PayableAbid NaeemNo ratings yet

- Non-Current Liabilities ChapterDocument11 pagesNon-Current Liabilities ChapterHussen AbdulkadirNo ratings yet

- Chapter Three: Fixed Income Securities: BondDocument11 pagesChapter Three: Fixed Income Securities: BondGemechisNo ratings yet

- ch12 - Debt FinancingDocument60 pagesch12 - Debt Financingsongvuthy100% (1)

- Debentures - Meaning, Types, Features, Accounting ExamplesDocument6 pagesDebentures - Meaning, Types, Features, Accounting Examplesfarhadcse30No ratings yet

- Chapter Four IvestmetDocument9 pagesChapter Four IvestmetMoti BekeleNo ratings yet

- Non Current LiabilitiesDocument18 pagesNon Current LiabilitiesMuhammad Titan PermanaNo ratings yet

- Money Market InstrumentsDocument3 pagesMoney Market InstrumentsAniqa AshrafNo ratings yet

- First Slide:: Independent Agencies Such As Moody's, Fitch, and Standard & Poor's Evaluates BondsDocument16 pagesFirst Slide:: Independent Agencies Such As Moody's, Fitch, and Standard & Poor's Evaluates BondsMavis LunaNo ratings yet

- Chapter 10 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Document118 pagesChapter 10 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi100% (2)

- Bonds and Stocks GuideDocument61 pagesBonds and Stocks GuideJulie Mae Caling MalitNo ratings yet

- Chapter 3Document19 pagesChapter 3Tofik SalmanNo ratings yet

- Learning Material 5Document15 pagesLearning Material 5jdNo ratings yet

- FINMANDocument50 pagesFINMANJanna Hazel Villarino VillanuevaNo ratings yet

- Chapter 3Document8 pagesChapter 3yosef mechalNo ratings yet

- Sources of FinanceDocument12 pagesSources of FinanceNirmal ShresthaNo ratings yet

- Introduction To Bonds PayableDocument2 pagesIntroduction To Bonds PayableMarko Zero FourNo ratings yet

- ACG 2021 – Chapter 9 Notes on Bonds PayableDocument2 pagesACG 2021 – Chapter 9 Notes on Bonds PayablemakaylaxbooksNo ratings yet

- Bond Valuation Final FinalDocument40 pagesBond Valuation Final FinalkafiNo ratings yet

- Valuation and Types of BondsDocument53 pagesValuation and Types of BondsShantanu ChoudhuryNo ratings yet

- 9 Debt SecuritiesDocument32 pages9 Debt SecuritiesSami BitarNo ratings yet

- 9 Debt Securities PDFDocument32 pages9 Debt Securities PDFKing is KingNo ratings yet

- Assignment Bonds PayableDocument5 pagesAssignment Bonds PayableLourdios EdullantesNo ratings yet

- Bonds: Here Are Some Benefits They Can ProvideDocument7 pagesBonds: Here Are Some Benefits They Can ProvidefaqehaNo ratings yet

- Chapter 9-Bond and Stock Valuation (Revised)Document51 pagesChapter 9-Bond and Stock Valuation (Revised)Md. Nazmul Kabir100% (2)

- Debt Securities: by Lee M. Dunham, PHD, Cfa, and Vijay Singal, PHD, CfaDocument25 pagesDebt Securities: by Lee M. Dunham, PHD, Cfa, and Vijay Singal, PHD, CfaDouglas ZimunyaNo ratings yet

- Unit CDocument46 pagesUnit CKarl Lincoln TemporosaNo ratings yet

- Finmar Week 12Document8 pagesFinmar Week 12Joleen DoniegoNo ratings yet

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- Real Options A New Way To ThinkDocument20 pagesReal Options A New Way To ThinkAjay TahilramaniNo ratings yet

- Bonds Payable SummaryDocument16 pagesBonds Payable SummaryJovel DiazNo ratings yet

- A4 Chapter 5 - Bonds PayableDocument8 pagesA4 Chapter 5 - Bonds PayableMa Jhenelle De Leon100% (1)

- Ch2 Non Current Liabilities 1Document79 pagesCh2 Non Current Liabilities 1Tahir KayoNo ratings yet

- Liabilities Chapter 09Document66 pagesLiabilities Chapter 09Rupesh PolNo ratings yet

- Compound-Financial-Instruments-NotesDocument19 pagesCompound-Financial-Instruments-NotesJames R JunioNo ratings yet

- Inv. Portfolio MGT Midterm LecturesDocument40 pagesInv. Portfolio MGT Midterm Lecturesocampojohnoliver1901182No ratings yet

- Valuation of Debt and EquityDocument8 pagesValuation of Debt and EquityhelloNo ratings yet

- Finals Week 1Document6 pagesFinals Week 1Mark Angelo BustosNo ratings yet

- Corporate Bonds ExplainedDocument10 pagesCorporate Bonds ExplainedNathan Kurt LeeNo ratings yet

- Chapter 12 Senior SecurityDocument23 pagesChapter 12 Senior SecuritySumonNo ratings yet

- 1.kieso 2020-1118-1183Document66 pages1.kieso 2020-1118-1183dindaNo ratings yet

- Demas Taufik - Task 13Document8 pagesDemas Taufik - Task 13DemastaufiqNo ratings yet

- Demas - Kieso CH 13Document5 pagesDemas - Kieso CH 13DemastaufiqNo ratings yet

- Demas - Audit - Chapter 12Document9 pagesDemas - Audit - Chapter 12DemastaufiqNo ratings yet

- Homework Audit DemasDocument3 pagesHomework Audit DemasDemastaufiqNo ratings yet

- UB Auditing 2 Midterm Exam ReviewDocument5 pagesUB Auditing 2 Midterm Exam ReviewDemastaufiqNo ratings yet

- Demas Task11Document17 pagesDemas Task11DemastaufiqNo ratings yet

- Grup - Task 4Document6 pagesGrup - Task 4DemastaufiqNo ratings yet

- 139 20210602014221 Kieso Inter Ch20 - IfRS (Pensions)Document47 pages139 20210602014221 Kieso Inter Ch20 - IfRS (Pensions)DemastaufiqNo ratings yet

- Demas - Task 5Document5 pagesDemas - Task 5DemastaufiqNo ratings yet

- Demas Task8Document6 pagesDemas Task8DemastaufiqNo ratings yet

- DEmas-quiz 2Document1 pageDEmas-quiz 2DemastaufiqNo ratings yet

- Demas Task10Document2 pagesDemas Task10DemastaufiqNo ratings yet

- Demas - Task 2Document7 pagesDemas - Task 2DemastaufiqNo ratings yet

- Demas Task 1Document1 pageDemas Task 1DemastaufiqNo ratings yet

- Pre-Test Basic FinanceDocument3 pagesPre-Test Basic FinanceMoraya P. CacliniNo ratings yet

- Comprehensive Case 2 A201 H3 PDFDocument6 pagesComprehensive Case 2 A201 H3 PDFdini sofiaNo ratings yet

- Module 01 (Q1-Week 1): SFP Elements & FormsDocument7 pagesModule 01 (Q1-Week 1): SFP Elements & FormsChristian ZebuaNo ratings yet

- The Origin of Barclays BankDocument6 pagesThe Origin of Barclays BankSonia ChopraNo ratings yet

- FinancialAnalysis - EQUIPOS DEL NORTEDocument6 pagesFinancialAnalysis - EQUIPOS DEL NORTEOscar TrujilloNo ratings yet

- Purchasing Power Parity and Covered Interest ArbitrageDocument2 pagesPurchasing Power Parity and Covered Interest ArbitragegerardoNo ratings yet

- Money Market TECDocument80 pagesMoney Market TECFerjani RiahiNo ratings yet

- Insurance CasesDocument2 pagesInsurance CasesMikes FloresNo ratings yet

- Bsma67 - Mathematics For Competitive Examinations-IIIDocument2 pagesBsma67 - Mathematics For Competitive Examinations-IIIKannadhasanNo ratings yet

- AMANX FactSheetDocument2 pagesAMANX FactSheetamnoman17No ratings yet

- T1-FRM-3-Ch3-Governance-v3.1 - Study NotesDocument12 pagesT1-FRM-3-Ch3-Governance-v3.1 - Study NotescristianoNo ratings yet

- New Claim Form For Normal and Family PensionDocument4 pagesNew Claim Form For Normal and Family PensionVishal SharmaNo ratings yet

- UPI: Understanding India's Unified Payments InterfaceDocument23 pagesUPI: Understanding India's Unified Payments InterfaceRITIK YADAVNo ratings yet

- Insurance Sector Responses To COVID 19 by Governments Supervisors and IndustryDocument23 pagesInsurance Sector Responses To COVID 19 by Governments Supervisors and IndustryNydiaNo ratings yet

- BOOKKEPPING Week 7-9Document10 pagesBOOKKEPPING Week 7-9Estioso Jessah Nina PantojanNo ratings yet

- Financial Accounting IV Conceptual FrameworkDocument4 pagesFinancial Accounting IV Conceptual Framework猪mongNo ratings yet

- Korean Vocab Builder S1 #169 Bank: Lesson NotesDocument3 pagesKorean Vocab Builder S1 #169 Bank: Lesson NotesCaitlinNo ratings yet

- Lesson 8 Installment SalesDocument9 pagesLesson 8 Installment SalesheyheyNo ratings yet

- Mod Vignesh City Union BankDocument5 pagesMod Vignesh City Union Banksumathi aranganathanNo ratings yet

- S - Arrangement Architecture - Core - TM - R15Document163 pagesS - Arrangement Architecture - Core - TM - R15sangaviNo ratings yet

- 002 Initial Letter To Lender1Document9 pages002 Initial Letter To Lender1Armond TrakarianNo ratings yet

- ECO724 Nigerian Financial SystemDocument187 pagesECO724 Nigerian Financial SystemTimi MarquisNo ratings yet

- ABDUL SAMAD (Union Fabrics) (Naz)Document3 pagesABDUL SAMAD (Union Fabrics) (Naz)AtherNo ratings yet

- 3 Completing The Accounting CycleDocument6 pages3 Completing The Accounting CycleJuan Dela CruzNo ratings yet

- QuickBooks For BeginnersDocument3 pagesQuickBooks For BeginnersZain U Ddin0% (1)

- Investor Perception Study of Mutual FundsDocument6 pagesInvestor Perception Study of Mutual FundsVenkateswaran SNo ratings yet

- Chapter 1 Running Your Own MNCDocument4 pagesChapter 1 Running Your Own MNCMotasem adnan0% (1)

- Retail Banking in Japan The New Strategic FocusDocument2 pagesRetail Banking in Japan The New Strategic FocusSandeep MishraNo ratings yet

- Innovation or Stagnation: Assessing Bangladesh's Microfinance SectorDocument102 pagesInnovation or Stagnation: Assessing Bangladesh's Microfinance Sectorjamal0182005No ratings yet

- L1 - ABFA1173 POA (Lecturer)Document19 pagesL1 - ABFA1173 POA (Lecturer)Tan SiewsiewNo ratings yet