Professional Documents

Culture Documents

Kategori Pelatihan Akuntansi Keuangan

Kategori Pelatihan Akuntansi Keuangan

Uploaded by

Awie Adicandra0 ratings0% found this document useful (0 votes)

7 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesKategori Pelatihan Akuntansi Keuangan

Kategori Pelatihan Akuntansi Keuangan

Uploaded by

Awie AdicandraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

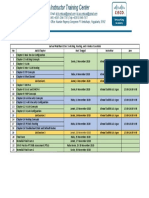

Kategori Pelatihan Akuntansi Keuangan

Dibawah ini adalah beberapa menu pelatihan akuntansi keuangan yang dapat anda

pilih sesuai dengan kebutuhan anda.

1. Account Receivables Management

2. Accounting And Finance For Manager

3. Activity Based Costing

4. Activity Based Costing for Product Pricing Decision

5. Advanced Accounting

6. Akuntansi Pajak untuk Jasa Konstruksi

7. Analisa Restrukturisasi Keuangan Perusahaan

8. Analisis Laporan Keuangan

9. Asset Liability Management

10. Asset Management

11. Audit Pengadaan Barang dan Jasa

12. Basic Accounting

13. Basic Audit for the New Auditors

14. Best Practices for Internal Auditor

15. Brevet Perpajakan

16. Budgeting : Planning, Controlling & Analyzing

17. Capital Budgeting

18. Cash Flow & Credit Management

19. Cash Flow & Risk Analysis

20. Cash Flow Forecasting

21. Closing and Handover Project

22. Corporate Cash Management

23. Corporate Finance Management

24. Cost Control Management

25. Cost Reduction Strategy

26. Creative Accounting Vs Tax Planning

27. Effective Business Development Strategy

28. Finance & Accounting For Non Finance

29. Finance for Non-Finance Manager

30. Financial Auditing for Internal Auditor

31. Financial Control Management

32. Financial Crime Risk: Mengapa Pencegahan Fraud Tidak Efektif?

33. Financial Forecasting

34. Financial Management & Decision Making

35. Financial Shenanigans

36. Forensic Accounting and Investigation Audit

37. Fraud Auditing Prevention & Detection

38. Fraud In Procurement

39. Fraud in Purchasing

40. Fraud Prevention & Detection for Non-Auditor

41. Grey-Area Accounting

42. Information Technology Financial Management

43. Intermediate Accounting

44. International Financial Reporting Standard (IFRS)

45. Investment Analysis And Portfolio Theory

46. Investment Feasibility Study (Studi kelayakan investasi)

47. Laporan Keuangan Konsolidasi

48. Life Cycle Costing (LCC)

49. Managing Account Payable

50. Microsoft Excel For Accounting Functions

51. Penyusunan HPS atas pengadaan barang dan jasa

52. Perencanaan & Audit Perpajakan

53. Perhitungan Aktuaria Sesuai PSAK 24

54. Pernyataan Standar Akuntansi Keuangan (PSAK) Terkini

55. Project Accounting

56. Project Financing

57. Purchasing Fraud Preventing, Detecting and Investigating

58. Risk Based Audit

59. Risk Based Management

60. Strategic Business And Financial Analysis

61. Tax Planning and Tax Management

62. Laporan Keuangan Untuk Organisasi Nirlaba

63. The New Paradigm of Internal Auditing

64. Treasury Management

65. Witholding Tax (PPh Pasal 21,22, 23, 26 dan Pasal 4 ayat (2))

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Offer LetterDocument5 pagesOffer Letterzig zack3999No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Stock Watson 4E Exercisesolutions Chapter5 InstructorsDocument18 pagesStock Watson 4E Exercisesolutions Chapter5 InstructorsRodrigo PassosNo ratings yet

- Store Management System (MS Access)Document20 pagesStore Management System (MS Access)Muhammad Umer33% (3)

- Twisted Tape InsertsDocument8 pagesTwisted Tape InsertsAlok YadavNo ratings yet

- Zoho Workplace - Plan ComparisonDocument4 pagesZoho Workplace - Plan Comparisonaditya_dugNo ratings yet

- Market Timing Performance of The Open enDocument10 pagesMarket Timing Performance of The Open enAli NadafNo ratings yet

- Windows Repair Setup LogDocument50 pagesWindows Repair Setup LogRuchi SharmaNo ratings yet

- Third Party.......... LogisticsDocument6 pagesThird Party.......... LogisticsApurve PatilNo ratings yet

- DACA Cover Letter TemplateDocument2 pagesDACA Cover Letter TemplateElrandomhero100% (1)

- Frequently Asked Questions FinalDocument15 pagesFrequently Asked Questions FinalPURUSHOTTAM KUMAR0% (1)

- Project REPORTDocument15 pagesProject REPORTShamim AkhtarNo ratings yet

- YASKAWA NX100 INFORM II USER Manual PDFDocument312 pagesYASKAWA NX100 INFORM II USER Manual PDFRafaelNo ratings yet

- Jadwal CCNA-Switching, Routing, Wireless Essentials PDFDocument1 pageJadwal CCNA-Switching, Routing, Wireless Essentials PDFmutia faridaNo ratings yet

- 3.1.1 Materials Schedule of FinishingDocument4 pages3.1.1 Materials Schedule of FinishingWatchara ThepjanNo ratings yet

- Jha Hirarc SampleDocument6 pagesJha Hirarc SampleMildy EduinNo ratings yet

- As ISO 16103-2007 Transport Packaging For Dangerous Goods - Recycled Plastics MaterialDocument8 pagesAs ISO 16103-2007 Transport Packaging For Dangerous Goods - Recycled Plastics MaterialSAI Global - APACNo ratings yet

- NFT in BrazilDocument8 pagesNFT in BrazilAndré FerreiraNo ratings yet

- Curr Mob VoucherDocument4 pagesCurr Mob VoucherSanjay SinghNo ratings yet

- Iot Based Smart Farm Monitoring System: R.Mythili, Meenakshi Kumari, Apoorv Tripathi, Neha PalDocument5 pagesIot Based Smart Farm Monitoring System: R.Mythili, Meenakshi Kumari, Apoorv Tripathi, Neha Palحسين سعيد حسنNo ratings yet

- Integration of Project Management Software/Application To 888 Acy EnterprisesDocument27 pagesIntegration of Project Management Software/Application To 888 Acy EnterprisesCymon ConcepcionNo ratings yet

- Chandler LetterDocument4 pagesChandler LetterDealBookNo ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!BISHAN DASSNo ratings yet

- Student Assessment Submission and DeclarationDocument22 pagesStudent Assessment Submission and DeclarationiampetesteinNo ratings yet

- LogcatDocument482 pagesLogcatYolanda Stefanía Morales HernándezNo ratings yet

- The Emergence of Food TrucksDocument10 pagesThe Emergence of Food TrucksSophia JungingerNo ratings yet

- FCIP Keep Alive Timeout PDFDocument2 pagesFCIP Keep Alive Timeout PDFsushant_beuraNo ratings yet

- ANSWER TO AGEC 562 Lab #2Document6 pagesANSWER TO AGEC 562 Lab #2wondater MulunehNo ratings yet

- Business English BrochureDocument12 pagesBusiness English BrochureGer Brenner100% (1)

- GD535 Front Front Axle (Housing)Document1 pageGD535 Front Front Axle (Housing)plant plannerNo ratings yet

- Javier v. SandiganbayanDocument1 pageJavier v. SandiganbayanSean HinolanNo ratings yet