Professional Documents

Culture Documents

InvoiceReportP1 10367 22 23

InvoiceReportP1 10367 22 23

Uploaded by

Raj kundraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InvoiceReportP1 10367 22 23

InvoiceReportP1 10367 22 23

Uploaded by

Raj kundraCopyright:

Available Formats

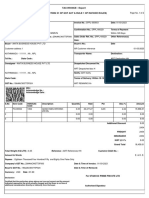

BALAJI EXTRUSIONS AND CABLES PVT. LTD.

Palsana Unit

Factory: Khata 754, Survey no. 313/2/P2 & 314, Village Palsana Pardi, Valsad, Gujarat - 396185

GSTIN: 24AABCB6376Q1Z6 CIN: U31300MH1998PTC113537 PAN: AABCB6376Q TAN: MUMB09923E

Buyer : ESS DEE INDUSTRIES, PUNE,,Gut no. 841 , plot no. C-41 Phase 1 , Consignee: ESS DEE INDUSTRIES, PUNE,,Gut no. 841 , plot no. C-41 Phase 1 ,

Mahalunge,Chakan Industrial area,Khed,PUNE,MAHARASHTRA Mahalunge,Chakan Industrial area,Khed,PUNE,MAHARASHTRA

Buyer GSTIN No : 27ACDPV1267F1ZI Consignee GSTIN No : 27ACDPV1267F1ZI

Buyer State Code : 27 Consignee State Code: 27

HSN CODE Invoice Number : P1-10367-22- Payment Terms: 60 days

PVC Insulated Cable 8544 1990 Invoice Date : 18/11/2022 Freight Terms : Freight Paid

QR SO No : S2210219 No. of packages : 1

ebb21f11a5cf9d299c903ab47e5d15cc337d1e12d1db75

IRN: dec0d249e973d3ee17 PO No : 222320686

Invoice No. : P1-10367-22-23 Page 1 of 1

No. of Total Rate per

Sl No. Item Description Customer Part no Total Assessable Value

Coils Quantity Unit

1 CB AVSS 19/.19MM Turquoise green -1.6 PVC0008030 1 1010.00 3.82 3858.20

2 CB AVSS 19/.19MM H BROWN -1.6 PVC0008029 2 2660.00 3.82 10161.20

Sub Total : 3 3670.00 14019.40

Date & time of Preparation of Invoice : 3.21 PM 18-Nov-22 IRN Details and QR Code NET SALES 14019

Transport details : Balaji Transport Packaging and Forwarding Charges 0

Mode Of Transport : BY ROAD-GJ-15/AT-8483 Net Sales with P&F 14019

CGST 0.0 % 0

TAX IS PAYABLE ON REVERSE CHARGE : NO IGST 18.0 % 2523

IRN: ebb21f11a5cf9d299c903ab47e5d15cc337d1e12d1db75dec0 SGST 0.0 % 0

d249e973d3ee17 TCS 0.1 % 0

TOTAL INVOICE VALUE IN RUPEES GROSS

16542

Sixteen Thousand Five Hundred and Forty Two Rupees TOTAL

Terms : Certified that the particulars given above are true and

1) All payments should be made by A/c payee cheques/bank transfer within the aforesaid payment correct and the amount indicated represents the price

terms. actually charged and there is no additional consideration

2) If payment is not received on due date interest @ 24% per annum shall be charged. flowing directly or indirectly from the buyer.

3) No complaints in respect of material supplied under this invoice will be entertained

unless the same is made in writing within ten days of dispatch.

4) Transactions covered under this Invoice are subject to jurisdiction of mumbai/daman courts.

5) Extra copy not for GST purposes.

Invoice No. : P1-10367-22-23 Page 1 of 1

You might also like

- Full Download Ebook PDF The Powerscore Digital Lsat Logical Reasoning Bible 2020th Edition PDFDocument47 pagesFull Download Ebook PDF The Powerscore Digital Lsat Logical Reasoning Bible 2020th Edition PDFkaren.mcomber18295% (42)

- CFEExam Prep CourseDocument28 pagesCFEExam Prep Coursejenny002457% (7)

- T1D-T178 Pin0000251357 - 1Document1 pageT1D-T178 Pin0000251357 - 1Gangadhar SakthiNo ratings yet

- Hukm Shar'iDocument11 pagesHukm Shar'iAhmad BasriNo ratings yet

- InvoiceReportP1 10343 22 23Document1 pageInvoiceReportP1 10343 22 23Raj kundraNo ratings yet

- Party Details:: Description of Goods Code QT Y. Unit List PriceDocument4 pagesParty Details:: Description of Goods Code QT Y. Unit List PriceShadab AhamadNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- Samsung Invoice 12357051967-7156716887-27W0I0234223Document1 pageSamsung Invoice 12357051967-7156716887-27W0I0234223BarunMondalNo ratings yet

- Ap Ele 230240Document1 pageAp Ele 230240Mohammad Azhar AliNo ratings yet

- PDFDocument1 pagePDFAjay SakatNo ratings yet

- PDFDocument1 pagePDFAjay SakatNo ratings yet

- Retail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)Document2 pagesRetail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)Linkan SarkarNo ratings yet

- TLC Nov22Document1 pageTLC Nov22ABhshekNo ratings yet

- Cremica Food Industries Limited: Tax InvoiceDocument1 pageCremica Food Industries Limited: Tax InvoiceKartik DhimanNo ratings yet

- Invoice CT-2232849Document3 pagesInvoice CT-2232849ABALUNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- InvoiceReportP1 8952 22 23Document1 pageInvoiceReportP1 8952 22 23Raj kundraNo ratings yet

- A.N Hussunally & Co. f09783Document1 pageA.N Hussunally & Co. f09783abhhijit1170No ratings yet

- Retail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)Document2 pagesRetail Invoice: Meghbela Cable & Broadband Services Pvt. Ltd. (An ISO 9001: 2015 Certified Company)riyachoursiabackupNo ratings yet

- Samsung Invoice 11368149082-7136589175-29S1I0155587Document1 pageSamsung Invoice 11368149082-7136589175-29S1I0155587bobbilipooliNo ratings yet

- OH2GRUKPODocument4 pagesOH2GRUKPO150819850No ratings yet

- Tax Invoice ExportDocument2 pagesTax Invoice ExportPrabhatNo ratings yet

- Invoice TG2301395716Document2 pagesInvoice TG2301395716kisanenterprises007No ratings yet

- 1306034446GUR212343254Document2 pages1306034446GUR212343254raom05495No ratings yet

- Indumoti Kumardubi 0950Document3 pagesIndumoti Kumardubi 0950souravsrkNo ratings yet

- Minar Plastic 0105 - 240329 - 151311Document3 pagesMinar Plastic 0105 - 240329 - 151311minarplastic200No ratings yet

- Minar Plastic 0104 - 240329 - 151232Document3 pagesMinar Plastic 0104 - 240329 - 151232minarplastic200No ratings yet

- Sensitivity: LNT Construction Internal UseDocument4 pagesSensitivity: LNT Construction Internal UseSanket KapadnisNo ratings yet

- Lum Inv Lum114 5600026405 SignedDocument2 pagesLum Inv Lum114 5600026405 SignedIrshad BilalNo ratings yet

- WiFi - AdapterDocument1 pageWiFi - AdapterManohar Singh KitawatNo ratings yet

- S7 Inv-2Document5 pagesS7 Inv-2M.TayyabNo ratings yet

- MaheshbiilDocument1 pageMaheshbiilSOURAAVNo ratings yet

- DEPREEDocument1 pageDEPREEAkhil DasNo ratings yet

- Sticker + CableDocument3 pagesSticker + CableRohan DesaiNo ratings yet

- GoldenDocument1 pageGoldenGOLDEN MOTORSNo ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax Invoicegeorgy wilsonNo ratings yet

- AuwmDocument1 pageAuwmNishanthNo ratings yet

- Honda Energhy MeterDocument2 pagesHonda Energhy MeterfinanceabsairtechNo ratings yet

- 8018033943Document1 page8018033943AnushaNo ratings yet

- Tax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024Document5 pagesTax Invoice: GST Invoice No: S12324018292 GST Invoice DT: 30.03.2024vishalhardwareandpaintsNo ratings yet

- PF Invoice - OhsDocument1 pagePF Invoice - OhsALOKE GANGULYNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Qusai KHNo ratings yet

- VVR Spices GST 22-23-65Document1 pageVVR Spices GST 22-23-65Usha Hasini VelagapudiNo ratings yet

- Tax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29Document1 pageTax Invoice: GSTIN/UIN: 29BISPK3225J1ZT State Name: Karnataka, Code: 29sudheer kulkarniNo ratings yet

- Invoice CT-2236894Document3 pagesInvoice CT-2236894ABALUNo ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- PDF FileDocument2 pagesPDF Filearjun duaNo ratings yet

- 9517309706Document2 pages9517309706Doita Dutta ChoudhuryNo ratings yet

- Jac JW 23241548Document3 pagesJac JW 23241548Jugal mahatoNo ratings yet

- Tally Doc 1Document4 pagesTally Doc 1Asok DasNo ratings yet

- Adobe Scan 7 Mar 2023Document1 pageAdobe Scan 7 Mar 2023Apurva KumarNo ratings yet

- Invoice Geyser 2Document2 pagesInvoice Geyser 2archisman gayenNo ratings yet

- Arihant Enterprise: OriginalDocument1 pageArihant Enterprise: OriginalManjeet SinghNo ratings yet

- Park Hospitals Tax Invoice Ra-01 Non ScheduleDocument2 pagesPark Hospitals Tax Invoice Ra-01 Non SchedulereddyrabadaNo ratings yet

- Under Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017Document1 pageUnder Section 34 of CGST Act Alongwith Rule 53 of CGST Rules, 2017rajnishNo ratings yet

- Samsung Invoice 11105923647-7144234991-27W6I0014459Document1 pageSamsung Invoice 11105923647-7144234991-27W6I0014459Abhinav ShrivastavaNo ratings yet

- 1e04ec40 1654smartDocument7 pages1e04ec40 1654smartlinwei.wNo ratings yet

- Sales Invoice-JUBILANT INGREVIA LIMITEDDocument1 pageSales Invoice-JUBILANT INGREVIA LIMITEDRs TiwariNo ratings yet

- Gail India Amc RevisedDocument1 pageGail India Amc RevisedAbhishek PatelNo ratings yet

- LEEBOY Quotation No-061 of Bansal BrothersDocument1 pageLEEBOY Quotation No-061 of Bansal BrothersBANSAL BROTHERSNo ratings yet

- Samsung Invoice 11036307428-7136600186-Z9NBI0032441Document1 pageSamsung Invoice 11036307428-7136600186-Z9NBI0032441mca2k15.manitNo ratings yet

- Value for Money in Public–Private Partnerships: An Infrastructure Governance ApproachFrom EverandValue for Money in Public–Private Partnerships: An Infrastructure Governance ApproachNo ratings yet

- Rural Bank of Anda Inc Vs Roman CatholicDocument3 pagesRural Bank of Anda Inc Vs Roman CatholicNikki Rose Laraga AgeroNo ratings yet

- NegoDocument4 pagesNegoAgatha de Castro100% (2)

- CIE Direct Electronic Statement of Entry June 2022 Series: British Council, Sialkot Private Candidates (PK850)Document2 pagesCIE Direct Electronic Statement of Entry June 2022 Series: British Council, Sialkot Private Candidates (PK850)Abdullah NineuNo ratings yet

- 4 Brgy - Resolution - AllowingDocument2 pages4 Brgy - Resolution - AllowingBarangay TaguiticNo ratings yet

- Chaseo: Beginning BalanceDocument1 pageChaseo: Beginning BalanceAvalina LindaNo ratings yet

- 2021 Annual ReportDocument232 pages2021 Annual Reportnawlen nawlenNo ratings yet

- The Need For A ChurchDocument4 pagesThe Need For A ChurchNoel AlgaraNo ratings yet

- Alex Baratta, Jacob Pepe, Jake WostmannDocument23 pagesAlex Baratta, Jacob Pepe, Jake WostmannAdriene Birndorf WostmannNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesMohd KhalidNo ratings yet

- Judgment Sheet in The Lahore High Court Multan Bench Multan Judicial DepartmentDocument27 pagesJudgment Sheet in The Lahore High Court Multan Bench Multan Judicial DepartmentApp SUgessterNo ratings yet

- Conservative Action Project MemoDocument7 pagesConservative Action Project MemoThe Heritage FoundationNo ratings yet

- 02 20 12editionDocument28 pages02 20 12editionSan Mateo Daily JournalNo ratings yet

- Ethical Communication in The WorkplaceDocument2 pagesEthical Communication in The WorkplaceMarydelNo ratings yet

- FAR 03-19 Loans and Receivables DiscussionDocument20 pagesFAR 03-19 Loans and Receivables DiscussionHana Grace MamangunNo ratings yet

- Starke County Indiana TimelineDocument51 pagesStarke County Indiana TimelineallenmoNo ratings yet

- Watson v. Caruso 424 F. Supp. 3d 231, 247 (D. Conn. 2019) Case NotesDocument10 pagesWatson v. Caruso 424 F. Supp. 3d 231, 247 (D. Conn. 2019) Case NotesSamuel RichardsonNo ratings yet

- Bail Application Format Under Section 439Document3 pagesBail Application Format Under Section 439SIMRAN PRADHANNo ratings yet

- Newton's Law of Motion: Law of Interaction: Quarter 1: Week 2Document3 pagesNewton's Law of Motion: Law of Interaction: Quarter 1: Week 2Lougene CastroNo ratings yet

- WI Tools Guide 19.1.0Document260 pagesWI Tools Guide 19.1.0Loganathan KarthickNo ratings yet

- Bid Document ItahariDocument330 pagesBid Document ItahariSarrows PrazzapatiNo ratings yet

- Invoice OD607234730047437000Document1 pageInvoice OD607234730047437000kramski india100% (1)

- 02 Annexure - II OLDocument75 pages02 Annexure - II OLshyam143225No ratings yet

- Notice Branch Traffic Enforcement SystemDocument2 pagesNotice Branch Traffic Enforcement SystemShankar BanrwalNo ratings yet

- Role of HR Professional in Dealing Disciplinary Proceedings Constructively - An OverviewDocument10 pagesRole of HR Professional in Dealing Disciplinary Proceedings Constructively - An OverviewSanthanamani CNo ratings yet

- James Holmes Order To Limit Pre Trial PublicityDocument4 pagesJames Holmes Order To Limit Pre Trial PublicityNickNo ratings yet

- CA Inter Chart Book Digital 1 Lyst4809Document82 pagesCA Inter Chart Book Digital 1 Lyst4809Ganesh SundarNo ratings yet

- Discussion Problems: FAR Ocampo/Cabarles/Soliman/Ocampo FAR.2902-Inventories OCTOBER 2020Document8 pagesDiscussion Problems: FAR Ocampo/Cabarles/Soliman/Ocampo FAR.2902-Inventories OCTOBER 2020music niNo ratings yet