Professional Documents

Culture Documents

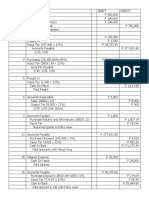

Solution VAT JE Problem 2

Uploaded by

Kristine Ivy0 ratings0% found this document useful (0 votes)

17 views5 pagesThe document records various transactions for Lopez Capital from January 1-30. It records initial investments, purchases and sales of inventory, payments to suppliers, cash sales, salaries paid, and other expenses. Major events include the initial recording of cash, inventory and capital; purchases of inventory from suppliers in Hong Kong and Folks Wear; sales to customers; payment of suppliers with discounts; and payment of rent, utilities and salaries expenses.

Original Description:

VAT COMPUTATION

Original Title

Solution-VAT-JE-Problem-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document records various transactions for Lopez Capital from January 1-30. It records initial investments, purchases and sales of inventory, payments to suppliers, cash sales, salaries paid, and other expenses. Major events include the initial recording of cash, inventory and capital; purchases of inventory from suppliers in Hong Kong and Folks Wear; sales to customers; payment of suppliers with discounts; and payment of rent, utilities and salaries expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views5 pagesSolution VAT JE Problem 2

Uploaded by

Kristine IvyThe document records various transactions for Lopez Capital from January 1-30. It records initial investments, purchases and sales of inventory, payments to suppliers, cash sales, salaries paid, and other expenses. Major events include the initial recording of cash, inventory and capital; purchases of inventory from suppliers in Hong Kong and Folks Wear; sales to customers; payment of suppliers with discounts; and payment of rent, utilities and salaries expenses.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

January Date Accounts Titles and Explanation Debit Credit

1 Merchandise Inventory 200,000

Cash in Bank 400,000

Cash on Hand 100,000

Lopez Capital 700,000

to record initial investment of inventory, and cash

2 Prepaid Rent 25,000

Cash in Bank 25,000

issued a check for rent deposit

3 Merchandise Inventory ($44,800+280) x 5.50 247,940

Input VAT (247,940x 12% 29,753

Accounts Payable 277,693

to record the purchase of inventory in HK distributor

4 Merchandise Inventory (39,200 x98%x99%) 38,032

Input VAT (38,032x 12%) 4,564

Accounts Payable 42,596

to record the purchase of inventory from Folks

5 Mechandise Inventory (1,440x100/112) 1,286

Input VAT (1,440812/112) 154

Cash on Hand 1,440

to record the freight payment for Folks Wear

6 Accounts Receivable 8,960

Sales (8,960 x 100/112) 8,000

Output VAT (8,960x12/112) 960

to record the sale to Sari store

Cost of Sales

Merchandise Inventory

Freight Out 504

Cash on Hand 504

to recor freight charges - freight collect

7 Accounts Payable (1,800 x1.12) 2,016

Input VAT (1,800 x 12%) 216

Merchandise Inventory 1,800

to record the merchandise return to Folks Wear

11 Accounts Payable 277,693

Cash in Bank (277,693x98%) 272,139

Merchandise Inventory (277,693x2%) 5,554

to record payment to HK distributor with discount

14 Cash in Bank 15,680

Sales (15,680x100/112) 14,000

Output VAT (15,680x12/112) 1,680

to records cash sales

15 Salaries Expense 14,000

Cash on Hand (14,000 x 95%) 13,300

Taxes Payable (14,000x5%) 700

to record salaries with tax withheld

16 Accounts Payable (42,596-2,016) 40,580

Cash (40,580 x 99%) 40,174

Merchandise Inventory (40,580x1%) 406

to record the payment to Folks Wear with 1% discount

17 Cash on Hand 8,960

Accounts Receivable 8,960

to record the collection of Sari Account

Cash in Bank 8,960

Cash on Hand 8,960

to record the deposit to Citibank

18 Cash on Hand 16,800

Sales (16,800 x 100/112) 15,000

Output VAT 1,800

to record the cash sales

Cost of Sales

Merchandise Inventory

Cash in Bank 16,800

Cash on Hand 16,800

to record the deposit to Citibank

19 Sales Return (12,320 x 100/112) 11,000

Output VAT (12,320 x 12/112) 1,320

Cash on hand 12,320

to record the cash refund

Merchandise Inventory

Cost of Sale

20 Accounts Receivable (33,600+1,456) 35,056

Sales (33,600 x 100/112) 30,000

Output Tax (35,056 x 12/112) 3,756

Cash (1,456x100/112) 1,300

to record cash sales and prepaid freight

Accounts Receivable 33,600

Sales (33,600 x 100/112) 30,000

Output Tax (33,600 x 12/112) 3,600

Accounts Recievable 1,456

Cash (1,456 x100/112) 1,300

Output Tax (1,456x12/112) 156

Cost of sales

Merchandise Inventory

21 Cash in Bank 9,520

Sales (9,520x100/112) 8,500

Output VAT (9,520x12/112) 1,020

to records cash sales

Cost of Sales

Merchandise Inventory

22 Sales Returns (4,704 x 100/112) 4,200

Output VAT (4,704 x12/112) 504

Accounts Receivable 4,704

To record the return from Robinsons

Merchandise Inventory

Cost of sAles

22 Bank Service Charge 1,125

Cash in Bank 1,125

to record the bank service charge

24 Utilities Expense 5,650

Cash on Hand 5,650

to record payment for utilities

25 Salaries Expense 14,000

SSS Payable 420

Taxes Payable 700

PHIC Payable 210

HDMF payable 280

Cash on Hand 12,390

to record payment for salaries and contributions

28 Rent Expense 12,500

Cash in Bank 12,500

to record the payment for rent

30 ENDING inventory per physical count

Freight In 1300

Input VAT 156

Accounts Payable 1456

You might also like

- Kashato Practice Set - 2020-10thedDocument84 pagesKashato Practice Set - 2020-10thedMary Jhiezael Pascual83% (12)

- Sol. Man. - Chapter 9 - Investments - Ia Part 1aDocument8 pagesSol. Man. - Chapter 9 - Investments - Ia Part 1aJennica Maquilang100% (1)

- 2 Ratio Analysis Problems and SolutionsDocument30 pages2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Perpetual Answer KeyDocument15 pagesPerpetual Answer KeyAngel AmbrosioNo ratings yet

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- Answers To Inventories (12-1 To 18)Document10 pagesAnswers To Inventories (12-1 To 18)sadorzon50% (2)

- KASHATODocument39 pagesKASHATOUser 101No ratings yet

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- 18-3-SA-V1-S1 Solved Problems RaDocument34 pages18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiNo ratings yet

- Kashato Shirts Practice SetFS 1Document100 pagesKashato Shirts Practice SetFS 1Raven Ann DimapilisNo ratings yet

- Ias 2 Questions and AnswersDocument3 pagesIas 2 Questions and AnswersShameel Irshad75% (8)

- Sample Company Profile For Cleaning Supplies Business PDFDocument18 pagesSample Company Profile For Cleaning Supplies Business PDFY.P SuastikaNo ratings yet

- Having 5+years Experince in Sap Fico ConsultantDocument5 pagesHaving 5+years Experince in Sap Fico Consultantkolluri rajaNo ratings yet

- Auditing 10e SM CH 7Document35 pagesAuditing 10e SM CH 7rivafin100% (1)

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Entrep Module 9 - Managing The Human Resource P2Document4 pagesEntrep Module 9 - Managing The Human Resource P2JOHN PAUL LAGAONo ratings yet

- Merchandising BusinessDocument11 pagesMerchandising BusinessABM-AKRISTINE DELA CRUZNo ratings yet

- Compute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyDocument83 pagesCompute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyIrish SungcangNo ratings yet

- Week 7 Tutorial SolutionsDocument6 pagesWeek 7 Tutorial SolutionsFarah PatelNo ratings yet

- Final Exam Part 2 Merch.Document7 pagesFinal Exam Part 2 Merch.Maribel Ticnang100% (1)

- Assignment #13Document3 pagesAssignment #13Soleil AsierNo ratings yet

- ASEU TEACHERFILE WEB 9838997178145661950.docx 1618394464Document7 pagesASEU TEACHERFILE WEB 9838997178145661950.docx 1618394464Hikmət Rüstəmov100% (1)

- Xyz Company JournalDocument3 pagesXyz Company JournalLearning MaterialsNo ratings yet

- Sol Man 17Document7 pagesSol Man 17samsungacerNo ratings yet

- Class Exercise 4Document3 pagesClass Exercise 4NUR FARRAH SYAKIRAH AMRANNo ratings yet

- Journal I ZingDocument8 pagesJournal I ZingKeziah VenturaNo ratings yet

- Value Added Tax EntriesDocument3 pagesValue Added Tax EntriesRan CañeteNo ratings yet

- BAC 211 Assignment 2018Document4 pagesBAC 211 Assignment 2018vincentNo ratings yet

- Chapter 9Document5 pagesChapter 9syraNo ratings yet

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedNo ratings yet

- Toaz - Info Adjusting Journal Entries Exercises3xlsx PRDocument22 pagesToaz - Info Adjusting Journal Entries Exercises3xlsx PRpau mejaresNo ratings yet

- Ratio Analysis Solved ProblemsDocument34 pagesRatio Analysis Solved ProblemsHaroon KhanNo ratings yet

- A 4.1 FAR1 AngelineDocument16 pagesA 4.1 FAR1 Angelinelain slngNo ratings yet

- Rosalinda's Boutique Chart of Accounts Assets Current AssetsDocument8 pagesRosalinda's Boutique Chart of Accounts Assets Current AssetsRechelleRuthM.DeiparineNo ratings yet

- Assignment - Cash FlowsDocument9 pagesAssignment - Cash FlowsArshad ChaudharyNo ratings yet

- PA10 Nguyen Ngoc Thanh Nhi HW CH5Document4 pagesPA10 Nguyen Ngoc Thanh Nhi HW CH5Minh Anh NguyễnNo ratings yet

- Solution:: Investments: Problem 6: For Classroom DiscussionDocument21 pagesSolution:: Investments: Problem 6: For Classroom DiscussionMarie Frances SaysonNo ratings yet

- Chapter19 BuenaventuraIntermediate Accounting1Document13 pagesChapter19 BuenaventuraIntermediate Accounting1AnonnNo ratings yet

- UntitledDocument5 pagesUntitledKrizia CruzNo ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- Cash Accounts Receivable: Date Particulars Debit CreditDocument13 pagesCash Accounts Receivable: Date Particulars Debit CreditJasmine ActaNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- Value Added Tax EntriesDocument4 pagesValue Added Tax EntrieserilNo ratings yet

- Reporting & Interpreting Investments in Other CorporationsDocument12 pagesReporting & Interpreting Investments in Other CorporationslelydiNo ratings yet

- Akuntan P5-1aDocument8 pagesAkuntan P5-1a2310102052.refatNo ratings yet

- The Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyDocument5 pagesThe Following Information For CLH Company Is Available On June 30, 2018, The End of A MonthlyJel SanNo ratings yet

- Problem II-Analysis of AlternativesDocument6 pagesProblem II-Analysis of AlternativesChau Minh NguyenNo ratings yet

- Joel Amos Periodic InventoryDocument7 pagesJoel Amos Periodic InventoryJasmine P. Manlungat - EMERALDNo ratings yet

- CASE 7 For PrintDocument3 pagesCASE 7 For PrintRichardDinongPascualNo ratings yet

- Statement of Kamran Establishment C o DFDocument4 pagesStatement of Kamran Establishment C o DFRazaAmin100% (1)

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- ConsignmentDocument21 pagesConsignmentsantbaksmishra6145No ratings yet

- Tutorial 4 Q and ADocument7 pagesTutorial 4 Q and ASwee Yi LeeNo ratings yet

- Everr Greene CorrectDocument12 pagesEverr Greene CorrectRonNo ratings yet

- Riverdale Mechanical Supply Chart of Accounts Includes The FollowingDocument15 pagesRiverdale Mechanical Supply Chart of Accounts Includes The FollowingJames Benedict BantilingNo ratings yet

- Tutorial Test 8 Solution Requirement 1Document3 pagesTutorial Test 8 Solution Requirement 1Minh HiềnNo ratings yet

- DocxDocument6 pagesDocxVịt HoàngNo ratings yet

- FS MerchandisingDocument14 pagesFS MerchandisingDesirre TransonaNo ratings yet

- Cash Flows PAS7Document10 pagesCash Flows PAS7Jenyl Mae NobleNo ratings yet

- AKL 2 Jawban Lat UTSDocument14 pagesAKL 2 Jawban Lat UTSSUGYANTO SUGYANTONo ratings yet

- Sample ProblemDocument4 pagesSample ProblemENIDNo ratings yet

- Verb TenseDocument24 pagesVerb TenseKristine IvyNo ratings yet

- 9 - PrepositionsDocument41 pages9 - PrepositionsKristine IvyNo ratings yet

- 8 - AdverbsDocument21 pages8 - AdverbsKristine IvyNo ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- Angela Dion ResumeDocument1 pageAngela Dion ResumeangelamiaNo ratings yet

- Weighing Rules No. 123: Effective For Contracts Dated From 1 January 2022Document4 pagesWeighing Rules No. 123: Effective For Contracts Dated From 1 January 2022Javier GrilloNo ratings yet

- Orientation To Quality Management System (QMS)Document20 pagesOrientation To Quality Management System (QMS)Roel P. Dolaypan Jr.No ratings yet

- MARK 1115 Marketing Plan Assignments-NW Fall 2018Document13 pagesMARK 1115 Marketing Plan Assignments-NW Fall 2018raymondNo ratings yet

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- Analysis of Ratio Bank BcaDocument6 pagesAnalysis of Ratio Bank BcaArya SingaNo ratings yet

- Bad News MessagesDocument13 pagesBad News MessagesHamza KhalidNo ratings yet

- Cash and Bank BalancesDocument4 pagesCash and Bank BalancesAung Zaw HtweNo ratings yet

- Risk Assessment and Management in Construction: Project Guide Thesis byDocument16 pagesRisk Assessment and Management in Construction: Project Guide Thesis byshijin rameshNo ratings yet

- Rflib Chap3Document7 pagesRflib Chap3jhoana morenoNo ratings yet

- Board Question Paper: September 2021: Book Keeping & AccountancyDocument5 pagesBoard Question Paper: September 2021: Book Keeping & AccountancyPriyansh ShahNo ratings yet

- Companies (Ind AS) Amendment Rules, 2021Document31 pagesCompanies (Ind AS) Amendment Rules, 2021Basava ShankarNo ratings yet

- Pirelli Tyres Romania: SlatinaDocument3 pagesPirelli Tyres Romania: SlatinaMihaela VoineaNo ratings yet

- PS Prods. v. ContextLogic - ComplaintDocument21 pagesPS Prods. v. ContextLogic - ComplaintSarah BursteinNo ratings yet

- 2 Bul 506Document12 pages2 Bul 506taiwo22110No ratings yet

- Supply Chain Coordination and Collaboration For Enhanced Efficiency and Customer Satisfaction.Document56 pagesSupply Chain Coordination and Collaboration For Enhanced Efficiency and Customer Satisfaction.jamessabraham2No ratings yet

- Marina Mall Work Permit (20369)Document1 pageMarina Mall Work Permit (20369)Shahid FarooqNo ratings yet

- Foreign Direct Investment (FDI) : Purchase of Physical Assets or Significant Amount of OwnershipDocument13 pagesForeign Direct Investment (FDI) : Purchase of Physical Assets or Significant Amount of OwnershipAurelia RijiNo ratings yet

- Survey QuestionsDocument3 pagesSurvey QuestionsAsif Rahman RahatNo ratings yet

- CSR 2Document6 pagesCSR 2Ricci De CastroNo ratings yet

- Quotation: 184304 MENAGASHA CLINKER/08968Document30 pagesQuotation: 184304 MENAGASHA CLINKER/08968Diriba GobenaNo ratings yet

- Bafna Suggested Answers CDocument25 pagesBafna Suggested Answers CsizantuNo ratings yet

- TM 4-Pengantar Industri PariwisataDocument26 pagesTM 4-Pengantar Industri PariwisataNabila SyahraniNo ratings yet

- TradeJournal3.0 - EmptyDocument199 pagesTradeJournal3.0 - EmptySigit KNo ratings yet

- Payment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621Document3 pagesPayment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621spraju1947No ratings yet