Professional Documents

Culture Documents

Prob. 1 Audit 4

Uploaded by

Annalyn AlmarioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prob. 1 Audit 4

Uploaded by

Annalyn AlmarioCopyright:

Available Formats

Basic audit procedures that should be performed in gathering evidence in support of each item (a)

through (f) of Concrete Products bank reconciliation are as follows:

a. Balance per bank

▪ Confirmation by direct written communication with a bank (see Standard Bank Confirmation)

▪ Obtain and inspect a January cutoff bank statement obtained directly from the bank (examine

opening balance)

b. Deposit in transit

▪ Verify that the deposit was listed in the January cutoff bank statement on a timely basis

▪ Trace to the cash receipt journal

▪ Inspect the auditee’s copy of the deposit slip for the date of the deposit

c. Outstanding cheques

▪ Examine cheques accompanying the January cutoff bank statement and trace all 20x3, or prior,

cheques to the outstanding cheque list.

▪ Trace outstanding cheques to the cash disbursements journal

▪ Examine all supporting documents for those outstanding cheques that were not returned with

the cutoff bank statement

▪ Ascertain why cheque number 837 has been outstanding for so long

d. NSF cheque return

▪ Follow up on the ultimate disposition of the NSF cheques

▪ Examine all supporting documents

e. Note collected

▪ Examine the bank credit memo

▪ Trace to accounting records

f. Balance per books

▪ Foot the bank reconciliation to this total and compare it with the general ledger balance

Problem 2

Actions taken by the auditor

1. The auditor must investigate the discrepancies and examine the bank statement of

successive weeks for determining if the deposits have been credited to Toyco account.

2. The auditor must assess the standing of the deposits by observing the bank statement of the

successive week to regulate if the deposits were suitably submitted again and credited to

the appropriate account. The auditor must assess the regularity of worthless deposits and

suggest that the corporation reinforce controls in this particular area.

3. The bank charge must be elucidated and conversed with the customer.

4. The auditor must inspect the customer’s accounting proceedings to notice and then regulate

that why the cash transfer made from Bank B to the depository bank account was not being

recorded in the corporation’s books of account.

5. The auditor must authenticate the Bank B charges of the services they provide and must

also authenticate why Bank A does not have to pay any charge.

6. The auditor must find the causes why recording of control backs for the stolen cards are

incomplete, and must inspect the control internally over the support of the credit cards.

7. The auditor must inspect the bank statements of the successive week to regulate if all

returns from the sales for the previous week have been documented by the banks. The

auditor must regulate that the amounts which are unadjusted reach a decision with the

account balances of general ledger.

You might also like

- Audit Program - CashDocument1 pageAudit Program - CashJoseph Pamaong100% (6)

- Internal Audit Department Audit Program For Cash: Audit Scope: Audit ObjectivesDocument3 pagesInternal Audit Department Audit Program For Cash: Audit Scope: Audit ObjectivesRijo Jacob75% (4)

- Ap-1402 CashDocument22 pagesAp-1402 Cashjulie anne mae mendozaNo ratings yet

- Cash Audit ProgramDocument7 pagesCash Audit Program구니타67% (3)

- Audit ProgramDocument16 pagesAudit Programanon_806011137100% (4)

- Accounts Receivable 2Document10 pagesAccounts Receivable 2jade rotiaNo ratings yet

- Bank Audit ProgramDocument6 pagesBank Audit Programramu9999100% (1)

- 2 Notes Lecture Audit of Cash 2021Document1 page2 Notes Lecture Audit of Cash 2021JoyluxxiNo ratings yet

- E-Handout On Audit of Cash and Cash EquivalentsDocument12 pagesE-Handout On Audit of Cash and Cash EquivalentsAsnifah AlinorNo ratings yet

- AFS 2023 - Lecture 10 - CashDocument28 pagesAFS 2023 - Lecture 10 - CashKiều TrangNo ratings yet

- Case 030615Document2 pagesCase 030615Claude PeñaNo ratings yet

- AUDIT OF CASH AND BANKDocument9 pagesAUDIT OF CASH AND BANKkadama abubakarNo ratings yet

- Cash Substantive TestingDocument4 pagesCash Substantive TestingJoshua SolayaoNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- Auditing Cash and ReceivablesDocument7 pagesAuditing Cash and ReceivablesMarie Fe SarioNo ratings yet

- Acc 415-s6Document11 pagesAcc 415-s6194098 194098No ratings yet

- Audit ProgramDocument2 pagesAudit ProgramMocs Macaraya MamowalasNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- Audit of Cash and Cash Equivalents: Problem No. 20Document6 pagesAudit of Cash and Cash Equivalents: Problem No. 20Robel MurilloNo ratings yet

- Current AssetsDocument3 pagesCurrent AssetsAshish DhingraNo ratings yet

- APDocument38 pagesAPCyvee Joy Hongayo OcheaNo ratings yet

- Cash and BankDocument19 pagesCash and BankJatinNo ratings yet

- Audit ProgrammeDocument12 pagesAudit ProgrammeCA Nagendranadh TadikondaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsElla Mae TuratoNo ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsBusiness MatterNo ratings yet

- Audit of Cash and Marketable SecuritiesDocument21 pagesAudit of Cash and Marketable Securitiesዝምታ ተሻለNo ratings yet

- Audit Cash Controls ProceduresDocument7 pagesAudit Cash Controls ProceduresEirene Joy VillanuevaNo ratings yet

- Audit of Cash and Cash EquivalentsDocument10 pagesAudit of Cash and Cash EquivalentsVel JuneNo ratings yet

- Cash ProgramDocument13 pagesCash Programapi-3828505No ratings yet

- Q 029 We 4 UDocument11 pagesQ 029 We 4 UxjammerNo ratings yet

- 19283198237Document11 pages19283198237xjammerNo ratings yet

- Chapter 2 Audit Cash PDFDocument6 pagesChapter 2 Audit Cash PDFalemayehu100% (2)

- Audit Cash and Accounts ReceivableDocument9 pagesAudit Cash and Accounts Receivablejanyanjanyan67% (3)

- Substantive Test of CashDocument16 pagesSubstantive Test of CashmanuelaristotleNo ratings yet

- Portfolio in Applied Auditing: Kenneth Adrian S. BrunoDocument14 pagesPortfolio in Applied Auditing: Kenneth Adrian S. BrunoAngel Dela Cruz CoNo ratings yet

- Audit of CashDocument14 pagesAudit of CashMarah ArcederaNo ratings yet

- Audit ProgramDocument9 pagesAudit ProgramChris Ian TagsipNo ratings yet

- SUBSTANTIVE AUDIT PROCEDURES CASE STUDYDocument2 pagesSUBSTANTIVE AUDIT PROCEDURES CASE STUDYClaude PeñaNo ratings yet

- Audit Program Group 2-Sales and Receivables or R2RDocument8 pagesAudit Program Group 2-Sales and Receivables or R2RJaneth Navales0% (1)

- Audit of Cash and Cash Equivalents PDFDocument4 pagesAudit of Cash and Cash Equivalents PDFRandyNo ratings yet

- DocxDocument16 pagesDocxLeah Mae NolascoNo ratings yet

- Audit 2 - TheoriesDocument2 pagesAudit 2 - TheoriesJoy ConsigeneNo ratings yet

- Self-Test AUD 3Document2 pagesSelf-Test AUD 3Debbie Grace Latiban LinazaNo ratings yet

- The Check Signing Must Be Vested in Persons at Appropriately High Levels in The OrganizationDocument1 pageThe Check Signing Must Be Vested in Persons at Appropriately High Levels in The OrganizationLJ AbancoNo ratings yet

- Unit 7. Cash 6.0 Aims & ObjectivesDocument10 pagesUnit 7. Cash 6.0 Aims & ObjectivesKaleab TesfayeNo ratings yet

- Accounting For CashDocument6 pagesAccounting For CashAsnake YohanisNo ratings yet

- Auditing Lecture Notes 04172022Document16 pagesAuditing Lecture Notes 04172022Abegail Cadacio100% (2)

- Audit of Cash and Financial InstrumentsDocument4 pagesAudit of Cash and Financial Instrumentsmrs leeNo ratings yet

- Bank Reconciliation: AccountingtoolsDocument1 pageBank Reconciliation: AccountingtoolsQuenie De la CruzNo ratings yet

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Accounting for Goodwill and Other Intangible AssetsFrom EverandAccounting for Goodwill and Other Intangible AssetsRating: 4 out of 5 stars4/5 (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- REPORTDocument1 pageREPORTAnnalyn AlmarioNo ratings yet

- ASS#1Document5 pagesASS#1Annalyn AlmarioNo ratings yet

- SOLUTIONDocument2 pagesSOLUTIONAnnalyn AlmarioNo ratings yet

- EssayDocument1 pageEssayAnnalyn AlmarioNo ratings yet

- Strategic ManagementDocument8 pagesStrategic ManagementAnnalyn AlmarioNo ratings yet

- Draft SurveyDocument2 pagesDraft SurveyAnnalyn AlmarioNo ratings yet

- 4.1 Partnership DissolutionDocument18 pages4.1 Partnership DissolutionAnnalyn AlmarioNo ratings yet

- 4.2 Partnership LiquidationDocument13 pages4.2 Partnership LiquidationAnnalyn AlmarioNo ratings yet

- 3.2 Partnerhsip FormationDocument13 pages3.2 Partnerhsip FormationAnnalyn AlmarioNo ratings yet

- FAR 09 Income Tax 1 PDFDocument5 pagesFAR 09 Income Tax 1 PDFAnnalyn AlmarioNo ratings yet

- Faith Surah RefutationDocument9 pagesFaith Surah RefutationKhairul Anuar Mohd IsaNo ratings yet

- 1 HeterogenitasDocument46 pages1 HeterogenitasRani JuliariniNo ratings yet

- azezew(1)Document48 pagesazezew(1)temesgen AsmamawNo ratings yet

- Levitator Ino - InoDocument2 pagesLevitator Ino - InoSUBHANKAR BAGNo ratings yet

- KF2.5-200 - With-M-C - GB - 03-15 KRACHT Bomba PDFDocument8 pagesKF2.5-200 - With-M-C - GB - 03-15 KRACHT Bomba PDFJairo Andrés FA100% (1)

- A Meta Analysis of Effectiveness of Interventions To I - 2018 - International JoDocument12 pagesA Meta Analysis of Effectiveness of Interventions To I - 2018 - International JoSansa LauraNo ratings yet

- Developmental Screening Using The: Philippine Early Childhood Development ChecklistDocument30 pagesDevelopmental Screening Using The: Philippine Early Childhood Development ChecklistGene BonBonNo ratings yet

- FisheryDocument2 pagesFisheryKyle GalangueNo ratings yet

- Bobcat Sambron Telescopics Handler Tec3070 3092 Spare Parts Catalog 63902 1Document15 pagesBobcat Sambron Telescopics Handler Tec3070 3092 Spare Parts Catalog 63902 1elijahmitchellmd220597jrpNo ratings yet

- Polysemy Types ExplainedDocument13 pagesPolysemy Types ExplainedнастяNo ratings yet

- Well Plug and Abandonment Using HwuDocument1 pageWell Plug and Abandonment Using HwuJuan Pablo CassanelliNo ratings yet

- HR Interview QuestionsDocument6 pagesHR Interview QuestionsnavneetjadonNo ratings yet

- Unit 2 GEC 106Document132 pagesUnit 2 GEC 106fernando.gl559No ratings yet

- PDMS JauharManualDocument13 pagesPDMS JauharManualarifhisam100% (2)

- 2D TransformationDocument38 pages2D TransformationSarvodhya Bahri0% (1)

- From Verse Into A Prose, English Translations of Louis Labe (Gerard Sharpling)Document22 pagesFrom Verse Into A Prose, English Translations of Louis Labe (Gerard Sharpling)billypilgrim_sfeNo ratings yet

- D820-93 (2009) Standard Test Methods For ChemicalDocument10 pagesD820-93 (2009) Standard Test Methods For Chemicalobis8053No ratings yet

- Yu Gi Oh Card DetailDocument112 pagesYu Gi Oh Card DetailLandel SmithNo ratings yet

- Information Pack: Creative Media EducationDocument26 pagesInformation Pack: Creative Media EducationDaniel VladimirovNo ratings yet

- Cengage Advantage Books Essentials of Business Law 5th Edition Beatty Solutions ManualDocument16 pagesCengage Advantage Books Essentials of Business Law 5th Edition Beatty Solutions Manualladonnaaidanm5s100% (28)

- Business Research Study Material - Calicut UniversityDocument50 pagesBusiness Research Study Material - Calicut UniversityDr Linda Mary SimonNo ratings yet

- Appointment Slip: 2 X 2 ID PictureDocument1 pageAppointment Slip: 2 X 2 ID PictureDarwin Competente LagranNo ratings yet

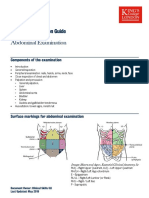

- Abdominal Exam Guide: Palpation, Inspection & Surface MarkingsDocument4 pagesAbdominal Exam Guide: Palpation, Inspection & Surface MarkingsPhysician AssociateNo ratings yet

- Between Empire and GlobalizationDocument5 pagesBetween Empire and Globalizationazert yuiopNo ratings yet

- Solution of A Subclass of Lane Emden Differential Equation by Variational Iteration MethodDocument14 pagesSolution of A Subclass of Lane Emden Differential Equation by Variational Iteration MethodAlexander DeckerNo ratings yet

- DS - 20190709 - E2 - E2 198S-264S Datasheet - V10 - ENDocument13 pagesDS - 20190709 - E2 - E2 198S-264S Datasheet - V10 - ENCristina CorfaNo ratings yet

- Overcoming ChallengesDocument28 pagesOvercoming ChallengesDeutsche Mark CuynoNo ratings yet

- En Eco-Drive Panel ConnectionDocument4 pagesEn Eco-Drive Panel ConnectionElectroventica ElectroventicaNo ratings yet

- Bekkersdal Business Hive Close Out ReportDocument19 pagesBekkersdal Business Hive Close Out ReportMichael Benhura100% (2)

- Ruibal & Shoemaker 1984 - Osteoders in AnuransDocument17 pagesRuibal & Shoemaker 1984 - Osteoders in AnuransRuivo LucasNo ratings yet