Professional Documents

Culture Documents

Lesson 2 The Statement of Comprehensive Income (Part 1 of 2)

Uploaded by

Franchesca CalmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 2 The Statement of Comprehensive Income (Part 1 of 2)

Uploaded by

Franchesca CalmaCopyright:

Available Formats

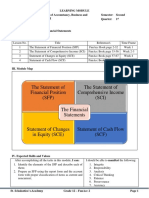

Lesson 2 Statement of Comprehensive Income (SCI)

A statement of comprehensive income is a structured financial statement that shows the financial

performance of a business entity for a given period. It summarizes all the income and expenses in an

operating cycle. Thus, the for the period ended is used in the heading to indicate its cut-off date. The SCI

contains the two remaining accounting elements – income and expenses. The difference between the two

can either be profit or loss.

Income refers to a transaction that increases assets and/or decreases liabilities leading to increase in

equity resulting from the operations of the business and not from the owner’s contribution. There are two

kinds of income – revenue and gains.

➢ Revenues are income generated from the normal course of business or from the primary

operations of the business. It varies depending on the type of business e.g. sales for merchandising

business, service income/revenue for service business, and/or both for hybrid business.

➢ Gains are income derive from other activities of the business such as interest income, gains from

disposition of an asset, dividend shares, commissions, referrals and etc.

Expenses on the hand are the transactions that decreases the assets and/or increase liabilities leading to

decrease in equity resulting from the operations of the business and not because of distributions to owners.

Just like the income, there are also two kinds of expenses – expenses and losses.

➢ Expenses area related to the primary operations of the business. It includes cost of sales/service

and operating expenses.

➢ Losses are expenses from other activities of the business other than the aforementioned.

Examples are interest from loans and loss from disposition of an asset.

Note that accrual is one of the fundamental concepts of accounting that dictates when an item must be

reported on the SCI. Accrual states that revenue must be recognized on the accounting period that it was

earned regardless when it was collected. Same goes with the expenses, expenses must be reported during

the accounting period they were incurred irrespective of the payment date. Now the question is, when is

income earned and expenses incurred?

Generally, revenue is earned upon delivery of goods and services, not when payment is received from

the customer. We can say that there is already a revenue when goods are already handed over to the customer

or when services are already rendered. Following the same concept, expense is recognized when an item is

used to generate revenue. Regardless of the payment date, expense is recorded when an account loses its

economic value.

✓ Fast Check!

Let’s see what has been learned by answering the following questions:

1. Why does SCI use for the period ended in its heading?

2. What is the accrual concept of accounting?

3. When is revenue reported on the SCI?

St. Scholastica’s Academy Grade 12 – FunAcc 2 Page 13

Elements of the Statement of Comprehensive Income

From the earlier part of this lesson, we learned that SCI has two components – income and expenses. In

this part of our lesson we will be learning more details each components and the various accounts names

under revenues.

Revenue

Service Income account is generally used to describe any revenue derived for rendering services. A

more specific account may be used to identify the type of service rendered such as Rental Income,

Professional Fee and Tuition Fee Revenue.

Sales is the account used to record revenue obtained from selling of goods. Just like the service income,

we can also use more specific accounts to identify the type of sales that occurred especially if the business

is selling multiple items like a general merchandise store. It can use Office Supplies Sales, Home Décor

Sales and many more.

In preparing the SCI, Net Sales is identified and is report on the face of the SCI. Net sales refers to the

sales after the Sales Discount and Sales Return and Allowance. (Net Sale = Gross Sales – Sales Discount –

Sales Return and Allowances)

➢ Sales Discount is the reduction in the price of a product or service. Three are two common

discounts granted to customers – trade discount and cash discounts.

❖ Trade discount is a percentage reduction from the price that is being granted to retailers or

wholesalers who usually buys in large quantities and/or who regularly patronizes the

business (suki).

❖ Cash discounts are given to the customers who purchased on account to encourage them to

pay immediately. A credit term is identified and appears on the invoice. The usual credit

term is 2/10, n/30 which means the account is payable within 30 days from the point of sale

(n/30) and a 2% discount is given when paid within 10 days from the point of sale (2/10).

➢ Sales Return and Allowances are instances when a customer returned a merchandise that is

damaged or defective. When a customer returns an item to the company it is a sales return.

A sales allowance occurs when the company reduces the price paid by a customer because the

customer received defective merchandise.

Both sales discount and sales return and allowances are contra-revenue accounts that have a debit normal

debit balances and reduces the sales. Let’s have the following scenario to illustrate the computation of net

sales.

Illustration: Sales Revenue

On July 14, 2019 Giean Montemayor, owner of a novelty store, sold 12 boxes of marker to

Reann Saddi for ₱3,000 on account with a term 2/10, n/30. A box marker cost ₱250 and

St. Scholastica’s Academy Grade 12 – FunAcc 2 Page 14

contains 10 markers each. On July 20 Reann returned four defective markers and paid the

amount to Giean.

Determine the amount of sales return, sales discount, and net sales for the above transaction.

Answer

Sales ₱250 x 12 box ₱3,000.00

Sales Return and (₱250/10 marker) x 4 returned (100.00)

Allowances marker

Amount Due to Giean 2,900.00

Sales Discount 2,900 x 2% (58.00)

Net Sales ₱2,842.00

Take note that sales discount is taken from the sales after the sales returns. This is because

the returned markers are no longer part of the sales and will be excluded from the computation

of the discount. Using the gross sales in computing for the discount will result to overstating

stating the sales discount and understating the net sales.

✓ Fast Check!

Let’s see what has been learned by answering the following questions:

1. What is the account name used to record revenues in a service business? ___________

2. What are the two contra sales accounts? ___________

3. What is the normal account balance of a contra-sales account? ___________

4. What is meant by 2/10, n/30? ___________

Expenses

Cost of Goods Sold (COGS)/Cost of Sales is an account specifically used by a merchandising type of

business or any business ventured in selling products. The COGS summarizes the cost of the merchandise

sold in a period of time. It is composed of the purchase price of inventory, brokerage, and shipment cost to

bring the goods to the premises of the company – Freight-In.

The COGS is part of inventory accounting. It is recorded in two ways – perpetual and periodic inventory

system. Perpetual inventory system increases the inventory account when there is an acquisition of goods

for sale and decreases when the goods are sold. The COGS account is updated when there’s a sale of goods.

On the other hand, periodic inventory system updates the inventory account only at the end of the month

or end of the year. Since this method post updates the inventory account periodically, it collects the cost of

merchandise in an account called Purchases. Just like the Sales account, Purchases has it contra-purchase

accounts as well. Discounts given by the suppliers are recorded in Purchase Discounts account. Return of

defective or damaged goods are reported under the Purchase Return and Allowances. The two contra-

purchase accounts have credit normal balances. The use of periodic inventory system calls for the

computation of Net Purchases using the formula Purchases + Freight-In – Purchase Return and Allowances

– Purchase Discounts. This is similar to the accounting treatment for sales.

St. Scholastica’s Academy Grade 12 – FunAcc 2 Page 15

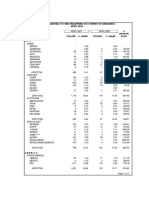

In the periodic inventory system, COGS is computed using the following formula:

Beginning inventory XXX

Add: Net Purchases (Purchases + Freight-In – Purchase Return and Allowances – XXX

Purchase Discounts) XXX

Total Goods Available for Sale (TGAS) (XXX)

Less: Ending Inventory XXX

Cost of Goods Sold (COGS)

A physical count of the merchandise owned by the company determines the beginning and ending

inventory. The ending inventory of the prior-period serves as the beginning inventory of the current period.

The periodic adjustment updates the inventory account to reconcile the balance based on year-end physical

count.

To illustrate the aforementioned concepts, let’s try this example

Illustration: Cost of Goods Sold

Giean Montemayor purchased eight boxes of legal size bond paper from the NBS on April

30, 2020. The purchase invoices revealed that each box cost ₱1,600 each and has five reams

of bond paper each. The items are in a term of 3/10, n30. A delivery fee of ₱250 was paid

upon receipt of the items. On May 15, one box was returned due to incorrect paper size and

paid the amounts due to NBS. Compute for the net purchase.

Answer

Purchases ₱1,600 x 8 box ₱12,800.00

Freight-in 250.00

Purchase Return and 1 box x ₱1,600 (1,600.00)

Allowances

Amount Due to NBS 11,450.00

*Purchase Discount -

Net Purchases ₱11,450.00

* Why do you think that there is no amount for the purchase discount? This is due to the

fact that Giean settled the amount account to NBS on May 15 which is already 15 days from

the point of sale and is already beyond the discount period.

Giean’s prior-period inventory count revealed that there are still six reams of bond paper

valued at ₱1,920 in the inventory account and there are three reams in the year-end physical

count. Compute for the COGS.

Answer

Beginning Inventory ₱1,920.00

Purchases ₱1,600 x 8 box ₱12,800.00

Freight-in 250.00

Purchase Return and Allowances 1 box x ₱1,600 (1,600.00)

Purchase Discount -

Net Purchases 11,450.00

Total Goods Available for Sale 13,370.00

Ending Inventory (based on the (₱1,600/5reams) x 3 960.00

physical count) reams

Cost of Goods Sold ₱14,330.00

St. Scholastica’s Academy Grade 12 – FunAcc 2 Page 16

The accurate computation of the Net Purchase is a requisite to arrive at the correct amount of

the COGS.

Operating Expenses are those expenses that are directly attributable to the operation of the business.

These includes salaries of employees, supplies, utilities (electricity, telephone, and water bill), delivery

expense (freight-out), rent, insurance, repairs and maintenance, bad debts, depreciation, and amortization.

Other Income and Other Expenses

After the operation section of the SCI, the gains and other income as well as losses and other expenses

are reported on the face of the SCI. Interest income from investments of excess cash, interest expense for

borrowings, and gain or loss from the sale of asset (proceeds from selling price less the book value of the

asset the date of disposition) are the line items included in this section.

✓ Fast Check!

Let’s see what has been learned by answering the following questions:

1. What are the components of net purchase? ___________

2. What is freight-in? ___________

3. Differentiate periodic and perpetual method of inventory system. ______________________

4. What are the contra-purchase accounts? ___________

St. Scholastica’s Academy Grade 12 – FunAcc 2 Page 17

You might also like

- 2019 Mock Exam A - Afternoon Session PDFDocument23 pages2019 Mock Exam A - Afternoon Session PDFDhruva Sareen Consultancy100% (1)

- Fix Asset&Intangible AssetDocument7 pagesFix Asset&Intangible AssetAdinda0% (1)

- Chapter 2 Accounting Review: Income Statements and Balance SheetsDocument50 pagesChapter 2 Accounting Review: Income Statements and Balance SheetsnajmulNo ratings yet

- Company Analysis Report On DR - REDDY'SDocument49 pagesCompany Analysis Report On DR - REDDY'Ssirisha100% (3)

- Accounts of The Sole Trader: Unit 1Document10 pagesAccounts of The Sole Trader: Unit 1Beverly Carballo - Moguel100% (1)

- CHAPTER 2-Statement of Comprehensive IncomeDocument4 pagesCHAPTER 2-Statement of Comprehensive IncomeDan GalvezNo ratings yet

- Fundamentals of Accountancy Income StatementsDocument7 pagesFundamentals of Accountancy Income StatementsJonabed PobadoraNo ratings yet

- Funda 2Document20 pagesFunda 2Lorraine Miralles67% (3)

- Lecture, Chap. 5Document5 pagesLecture, Chap. 5Moshe FarzanNo ratings yet

- ACCOUNTING-ACTIVITY-OF-MERCHANDISING-OPERATIONSDocument20 pagesACCOUNTING-ACTIVITY-OF-MERCHANDISING-OPERATIONSAndrew Jamerich PlatillaNo ratings yet

- Topic 3 - Statement of Comprehensive IncomeDocument8 pagesTopic 3 - Statement of Comprehensive Incomesab lightningNo ratings yet

- Fabm Lesson 2 SCIDocument9 pagesFabm Lesson 2 SCIEivie SonioNo ratings yet

- Fundamentals of Accountancy, Business and Management 1: Module No. 3: Week 3: Second QuarterDocument6 pagesFundamentals of Accountancy, Business and Management 1: Module No. 3: Week 3: Second QuarterCrestina Chu BagsitNo ratings yet

- Week 006 - Module Statement of Comprehensive Income Part IIDocument7 pagesWeek 006 - Module Statement of Comprehensive Income Part IIJulia AcostaNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Document10 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Tumamudtamud, JenaNo ratings yet

- Describe Merchandising Operations and Inventory SystemsDocument4 pagesDescribe Merchandising Operations and Inventory SystemsSadia RahmanNo ratings yet

- Accounting for Merchandising Firms: Income Statement and Cost of Goods SoldDocument15 pagesAccounting for Merchandising Firms: Income Statement and Cost of Goods SoldRose Marie Recorte100% (1)

- ACCT 101 Chapter 4 HandoutDocument5 pagesACCT 101 Chapter 4 Handoutchienna.mercadoNo ratings yet

- Chapter 3 - Profit and Loss StatementDocument6 pagesChapter 3 - Profit and Loss StatementrtohattonNo ratings yet

- CH2 Fabm2Document27 pagesCH2 Fabm2Crisson FermalinoNo ratings yet

- ABM5 NOTES (1st QUARTER)Document16 pagesABM5 NOTES (1st QUARTER)Adrianne Mae Almalvez Rodrigo100% (1)

- Fundamentals of Accountancy Income StatementsDocument22 pagesFundamentals of Accountancy Income Statementskhaizer matias100% (1)

- Fabm 1: Accounting For Merchandising ConcernDocument29 pagesFabm 1: Accounting For Merchandising ConcernJan Vincent A. LadresNo ratings yet

- Week4 Handout WORKEDDocument14 pagesWeek4 Handout WORKEDLecia Lebby CNo ratings yet

- Unit 11Document30 pagesUnit 11FantayNo ratings yet

- CHAPTER 1 Account ReciavableDocument41 pagesCHAPTER 1 Account Reciavablegm29No ratings yet

- Statement of Comprehensive Income Part 1Document24 pagesStatement of Comprehensive Income Part 1Millare, PrincessNo ratings yet

- Reporting InventoryDocument22 pagesReporting InventoryNguyen LauraNo ratings yet

- Part 2 - Module 7 - The Nature of Merchandising Business 1Document13 pagesPart 2 - Module 7 - The Nature of Merchandising Business 1jevieconsultaaquino2003No ratings yet

- CombinepdfDocument226 pagesCombinepdfjed rolluque decena100% (1)

- Q1 LAS 3 FABM2 12 Week 2 3Document7 pagesQ1 LAS 3 FABM2 12 Week 2 3Flare ColterizoNo ratings yet

- Statement of Comprehensive Income - FABM 2 Grade 12Document36 pagesStatement of Comprehensive Income - FABM 2 Grade 12Abegail BoqueNo ratings yet

- Accounting for Merchandising OperationsDocument6 pagesAccounting for Merchandising OperationsKenya LevyNo ratings yet

- SG Accounting & Finance GlossaryDocument8 pagesSG Accounting & Finance GlossaryFauTahudAmparoNo ratings yet

- Principles of Accounting I Chapter 5 Discussion GuideDocument7 pagesPrinciples of Accounting I Chapter 5 Discussion GuideKhoi NguyenNo ratings yet

- Class Note 2Document18 pagesClass Note 2Abdallah HassanNo ratings yet

- Periodic PerpetualDocument25 pagesPeriodic PerpetualNunung Nurul100% (1)

- Income Statement & Capital Statement GuideDocument7 pagesIncome Statement & Capital Statement GuideIsabelleDynahE.GuillenaNo ratings yet

- LAS ABM - FABM12 Ic D 7 Week 3Document9 pagesLAS ABM - FABM12 Ic D 7 Week 3ROMMEL RABONo ratings yet

- Reporting and Analyzing Operating AssetsDocument59 pagesReporting and Analyzing Operating AssetsronyNo ratings yet

- Short Notes: Invoice Credit TermsDocument26 pagesShort Notes: Invoice Credit TermsTushar M. Tareq100% (1)

- Understand SCI FundamentalsDocument27 pagesUnderstand SCI FundamentalsMichael Lalim Jr.No ratings yet

- E-Management Analysis Is Aided. The Special Journal Can Be Useful To Management inDocument14 pagesE-Management Analysis Is Aided. The Special Journal Can Be Useful To Management inTIZITAW MASRESHANo ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingPrasad SurveNo ratings yet

- Accounting For Non-Accounting Students - Summary Chapter 4Document4 pagesAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- FABM 2 Lesson2Document11 pagesFABM 2 Lesson2---No ratings yet

- Matching Definitions ConceptsDocument3 pagesMatching Definitions Conceptscinthia guelNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Far 1-5Document32 pagesFar 1-5Lisel SalibioNo ratings yet

- AccountingDocument8 pagesAccountingShafqat WassanNo ratings yet

- Establish & Maintain An Accural Accounting SystemDocument34 pagesEstablish & Maintain An Accural Accounting SystemMagarsaa Hirphaa100% (2)

- 2 Template PPT2Document16 pages2 Template PPT2ダイ アンNo ratings yet

- Working Capital ManagementDocument78 pagesWorking Capital ManagementJoan Marie100% (1)

- Trading AccountDocument10 pagesTrading AccountAviral Pratap Singh -4 CNo ratings yet

- Lo 4Document11 pagesLo 4Omar El-TalNo ratings yet

- Introduction to Accounting FundamentalsDocument73 pagesIntroduction to Accounting FundamentalsSneha ChhabraNo ratings yet

- Abm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesDocument8 pagesAbm 2 Topic 1: Statement of Comprehensive Income Learning ObjectivesJUDITH PIANONo ratings yet

- Lesson 2: Statement of Comprehensive Income Statement of Comprehensive Income Is A Statement That Reports The Results of Operations of TheDocument10 pagesLesson 2: Statement of Comprehensive Income Statement of Comprehensive Income Is A Statement That Reports The Results of Operations of TheMae Joy EscanillasNo ratings yet

- Chapter Five: Special Issues For MerchantsDocument26 pagesChapter Five: Special Issues For Merchantswww_jeffersoncruz008No ratings yet

- AssesmentDocument14 pagesAssesmentbhumi shuklaNo ratings yet

- Introduction To Income Statement 1Document13 pagesIntroduction To Income Statement 1Yuj Cuares Cervantes100% (1)

- Formula: Working Capital Current Assets Current LiabilitiesDocument15 pagesFormula: Working Capital Current Assets Current LiabilitiesbugsbugsNo ratings yet

- Financial Statements BreakdownDocument11 pagesFinancial Statements BreakdownFranchesca Calma100% (1)

- Lesson 2 The Statement of Comprehensive Income (Part 2 of 2)Document4 pagesLesson 2 The Statement of Comprehensive Income (Part 2 of 2)Franchesca CalmaNo ratings yet

- Lesson 5 Financial Statement Analysis Part 1Document2 pagesLesson 5 Financial Statement Analysis Part 1Franchesca CalmaNo ratings yet

- FUN ACC Basic Accounting Concepts and PrinciplesDocument2 pagesFUN ACC Basic Accounting Concepts and PrinciplesFranchesca CalmaNo ratings yet

- FUN ACC Analysis of Business TransactionsDocument2 pagesFUN ACC Analysis of Business TransactionsFranchesca CalmaNo ratings yet

- Slides Topic 12 BhoDocument51 pagesSlides Topic 12 BhoFranchesca CalmaNo ratings yet

- FUN ACC AccountingDocument2 pagesFUN ACC AccountingFranchesca CalmaNo ratings yet

- Aggregate Supply: MacroeconomicsDocument39 pagesAggregate Supply: Macroeconomicsmoshiul129No ratings yet

- Apr 2021Document3 pagesApr 2021Franchesca CalmaNo ratings yet

- Cash FlowDocument5 pagesCash FlowFranchesca CalmaNo ratings yet

- Tourism Development and Politics in TheDocument15 pagesTourism Development and Politics in TheFranchesca CalmaNo ratings yet

- Characteristics of LiteratureDocument12 pagesCharacteristics of LiteratureFranchesca CalmaNo ratings yet

- The Sense of Being Community in The Early ChurchDocument6 pagesThe Sense of Being Community in The Early ChurchFranchesca CalmaNo ratings yet

- Toshiba 30 Year Balance SheetDocument24 pagesToshiba 30 Year Balance SheetBronteCapitalNo ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Soal Advanced 2 Mid 2018 2019Document2 pagesSoal Advanced 2 Mid 2018 2019dwi davisNo ratings yet

- Corporate Finance NotesDocument24 pagesCorporate Finance NotesAkash Gupta100% (1)

- Torrent PowerDocument8 pagesTorrent PowerSudhir SinghNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosaastha goelNo ratings yet

- Cash and Cash Equivalents DefinitionDocument10 pagesCash and Cash Equivalents DefinitionRica Lei N. DomingoNo ratings yet

- GTBO LKKInterim 30sept2019Document73 pagesGTBO LKKInterim 30sept2019Arief Noven IdNo ratings yet

- Ias 16 Property Plant and EquipmentDocument28 pagesIas 16 Property Plant and EquipmentEminnece O. OlusegunNo ratings yet

- IBM's capital structure and financing policiesDocument17 pagesIBM's capital structure and financing policiesJenny Zulay SUAREZ SOLANONo ratings yet

- Dissolution of Partnership FirmDocument35 pagesDissolution of Partnership FirmRanjit SinghNo ratings yet

- Business ValuationDocument11 pagesBusiness ValuationAhmed Raza100% (1)

- DocxDocument10 pagesDocxJohnnoff BagacinaNo ratings yet

- Accounting Fundamentals QuizThe title "TITLEAccounting Fundamentals QuizDocument34 pagesAccounting Fundamentals QuizThe title "TITLEAccounting Fundamentals QuizDarwin Competente LagranNo ratings yet

- Inter Milan 2018Document34 pagesInter Milan 2018mujana mujanaNo ratings yet

- AxisBank financial performance 2015-2016Document9 pagesAxisBank financial performance 2015-2016Debanjan MukherjeeNo ratings yet

- Wey Fin 11e SM Ch06Document66 pagesWey Fin 11e SM Ch06Muhammad Farhan AliNo ratings yet

- Quiz 2 Investments - QuestionsDocument1 pageQuiz 2 Investments - QuestionsJessica Marie MigrasoNo ratings yet

- Darwin Melendez - Ledger Accounts 1Document4 pagesDarwin Melendez - Ledger Accounts 1Darwin MelendezNo ratings yet

- Annual Report 2019: Net Profit RMB 57.6 BillionDocument214 pagesAnnual Report 2019: Net Profit RMB 57.6 BillionRehan RaufNo ratings yet

- SDM439 GPIO Configuration For QRD439+PMI632Document33 pagesSDM439 GPIO Configuration For QRD439+PMI632Jhonny B. S SarmientoNo ratings yet

- Glossary of Important Business TermsDocument44 pagesGlossary of Important Business TermsJkNo ratings yet

- Financial Statement Analysis 11th Edition Subramanyam Test BankDocument48 pagesFinancial Statement Analysis 11th Edition Subramanyam Test Bankgarrotewrongerzxxo100% (27)

- Latihan Statement of Financial PositionDocument7 pagesLatihan Statement of Financial PositionWindy Fartika100% (1)

- Fa S23 Introduction To Consolidated Financial StatementsDocument9 pagesFa S23 Introduction To Consolidated Financial StatementsCharisma CharlesNo ratings yet

- Final Business PlanDocument27 pagesFinal Business PlanAnkit Kalra100% (1)

- BBPW3103 Financial Management I - Smay19 (RS & MREP)Document397 pagesBBPW3103 Financial Management I - Smay19 (RS & MREP)donmakemesad100% (1)