Professional Documents

Culture Documents

Engaging Activity 1 Financial Analysis

Uploaded by

Catherine0 ratings0% found this document useful (0 votes)

7 views3 pagesFINANANCIAL MNAGEMENT

Original Title

Engaging activity 1 financial analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFINANANCIAL MNAGEMENT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesEngaging Activity 1 Financial Analysis

Uploaded by

CatherineFINANANCIAL MNAGEMENT

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Engaging Activity A-1 Unit 1 Financial Statement analysis

OZONE COMPANY

Income Statement

December 31, 2018, 2017 and 2016

2018 2017 2016

Sales 200,000.00 210,000.00 100,000.00

Sales returns and allowances 40,000.00 25,000.00 6,000.00

Net Sales 160,000.00 185,000.00 94,000.00

Cost of Good Sold 100,000.00 115,625.00 50,000.00

Gross Profit 60,000.00 69,375.00 44,000.00

Operating Expenses

Selling expenses 22,000.00 25,000.00 16,000.00

General expenses 8,000.00 12,000.00 8,000.00

Total operating expenses 30,000.00 37,000.00 24,000.00

Income from operations 30,000.00 32,375.00 20,000.00

Non-operating income 6,000.00 2,500.00 3,500.00

Income before interest expense and taxes 36,000.00 34,875.00 23,500.00

interest expense 4,000.00 3,500.00 3,000.00

Income before taxes 32,000.00 31,375.00 20,500.00

Income taxes ( 35% rate) 11,200.00 10,981.00 7,175.00

Net Income 20,800.00 20,394.00 13,325.00

OZONE COMPANY

BALANCE SHEET

December 31, 2018, 2017 and 2016

2018 2017 2016

ASSETS

Current assets

Cash 65,000.00 70,000.00 75,000.00

Accounts Receivable 40,000.00 35,000.00 20,000.00

Marketable Securities 40,000.00 35,000.00 10,000.00

Inventory 100,000.00 80,000.00 100,000.00

Total current assets 245,000.00 220,000.00 205,000.00

Plants assets 200,000.00 160,000.00 170,000.00

total Assets 445,000.00 380,000.00 375,000.00

LIABILITIES

Current liabilites 110,800.00 105,000.00 104,000.00

Long-term Liabilities 160,000.00 145,000.00 140,000.00

TotAL Liabilities 270,800.00 250,000.00 244,000.00

Stockholders Equity

Common stocks, P5 par value 100,000.00 100,000.00 100,000.00

20,000 shares

Retained earnings 74,200.00 30,000.00 31,000.00

Total stockholders equity 174,200.00 130,000.00 131,000.00

Total Liabilities and Stockholder Equity 445,000.00 380,000.00 375,000.00

A.Required: Based on the above Financial statement. You are required to make an analysis using the

following tools: In your analysis you will use the following format:

1. On horizontal Analysis

1.1 Horizontal analysis computation(2016 :2017) (2017:2018)

1.2 Analysis and interpretation of your finding

1.3 Conclusion

1.4 State your recommendation

2. On Trend Analysis

1.1 Trend Analysis computation

1.2 Analysis and interpretation of your finding

1.3 Conclusion

1.4 State your recommendation

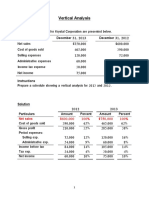

3. On Vertical Analysis

1.1 Vertical Analysis computation

1.2 Analysis and interpretation of your finding

1.3 Conclusion

1.4 State your recommendation

You might also like

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument8 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualChelseaPowelljscna100% (17)

- Sotalbo, Norhie Anne O. 3BSA-2Document11 pagesSotalbo, Norhie Anne O. 3BSA-2Acads PurpsNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementLizlee LaluanNo ratings yet

- Laurenz R. Patawe - Activity 1PART2 PDFDocument2 pagesLaurenz R. Patawe - Activity 1PART2 PDFJonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document2 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- IA8 Spreadsheet 09-CDocument6 pagesIA8 Spreadsheet 09-CLayNo ratings yet

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- Excel Project AssignmentDocument19 pagesExcel Project AssignmentMatha WriterNo ratings yet

- ABC Corporation's 2019 Financial Statement AnalysisDocument15 pagesABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoNo ratings yet

- Spring Day Company Statement of Financial Position For 20x1 and 20x2Document2 pagesSpring Day Company Statement of Financial Position For 20x1 and 20x2Printing PandaNo ratings yet

- Revenue and Expense Budgets with Cash Flow AnalysisDocument4 pagesRevenue and Expense Budgets with Cash Flow AnalysisAdrià BurgellNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Financial Ratio Horizontal and Vertical AnalysisDocument4 pagesFinancial Ratio Horizontal and Vertical AnalysisKyla SantosNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Analysis of Financial StatementsDocument11 pagesAnalysis of Financial StatementsBri CorpuzNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- BFIN400 GA One V3Document2 pagesBFIN400 GA One V3Mohammad Al AkoumNo ratings yet

- I Can Make It Corp financial performance 2020 vs 2019Document3 pagesI Can Make It Corp financial performance 2020 vs 2019Evan MiñozaNo ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Activity-1 Unit 2 Financial Analysis 3BSA-1Document4 pagesActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNo ratings yet

- Technopreneurship PPT Presentation Group 1Document57 pagesTechnopreneurship PPT Presentation Group 1Mia ElizabethNo ratings yet

- Consolidation of Foreign Subsidiaries UpdatedDocument9 pagesConsolidation of Foreign Subsidiaries UpdateddemolaojaomoNo ratings yet

- Sparky Inc Financial ReportsDocument8 pagesSparky Inc Financial ReportsDavon LopezNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Sample 5-Year-Financial-PlanDocument18 pagesSample 5-Year-Financial-PlanTesfalem LegeseNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- Chapter 2 and 3 and 5 WorksheetsDocument29 pagesChapter 2 and 3 and 5 WorksheetsM KishkNo ratings yet

- LQ3 FinalDocument6 pagesLQ3 FinalRaz MahariNo ratings yet

- Compare Financial Statements of Two CompaniesDocument9 pagesCompare Financial Statements of Two CompaniesLuvnica VermaNo ratings yet

- Financial Plan ProjectionsDocument31 pagesFinancial Plan ProjectionsHannah Lyn BasaNo ratings yet

- Classwork HorizontalVertical BusFinDocument3 pagesClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURANo ratings yet

- Classwork HorizontalVertical BusFinDocument3 pagesClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURANo ratings yet

- DVM Enterprises Financial Statements AnalysisDocument6 pagesDVM Enterprises Financial Statements AnalysisNicole AlexandraNo ratings yet

- 4.-Financial-Statement-Analysis-1 in FabmDocument46 pages4.-Financial-Statement-Analysis-1 in FabmJodalyn CasibangNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument36 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manualandrewnealobrayfksqe100% (23)

- Financial Plan: Important AssumptionsDocument15 pagesFinancial Plan: Important AssumptionsjehooniesunshineNo ratings yet

- P4-10 and P4-16 Cash Flow and Financial Statement AnalysisDocument12 pagesP4-10 and P4-16 Cash Flow and Financial Statement AnalysisElif TuncaNo ratings yet

- Tri-Star Company Financial Statement AnalysisDocument10 pagesTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNo ratings yet

- Gross Profit 200,000 Down Payment 100,000Document9 pagesGross Profit 200,000 Down Payment 100,000Marko JerichoNo ratings yet

- Revised Verti On SFP 2019Document2 pagesRevised Verti On SFP 2019cheesekuhNo ratings yet

- Profit and Loss Account For The Year Ended 31.03.2016 Particulars Amount Particulars Amount (Rs '000's) (Rs '000's)Document3 pagesProfit and Loss Account For The Year Ended 31.03.2016 Particulars Amount Particulars Amount (Rs '000's) (Rs '000's)Sushant SaxenaNo ratings yet

- Three Statement Model 14-07-2021 (F3)Document16 pagesThree Statement Model 14-07-2021 (F3)Vaibhav BorateNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Financing Daycare CenterDocument3 pagesFinancing Daycare CenterAngel CastilloNo ratings yet

- Analysis and Interpretation of Financial Statements: What's NewDocument16 pagesAnalysis and Interpretation of Financial Statements: What's NewJanna Gunio50% (2)

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Vertical Analysis of Financial StatementsDocument5 pagesVertical Analysis of Financial StatementsSamer IsmaelNo ratings yet

- CSS Ratio AnalysisDocument9 pagesCSS Ratio AnalysisMasood Ahmad AadamNo ratings yet

- Financial Statement Analysis of Jenny CompanyDocument5 pagesFinancial Statement Analysis of Jenny CompanyAshley Rouge Capati QuirozNo ratings yet

- Managerial Accounting - Final Project - Yahya Patanwala.12028Document4 pagesManagerial Accounting - Final Project - Yahya Patanwala.12028Yahya SaifuddinNo ratings yet

- Tan General Merchandise financial analysisDocument2 pagesTan General Merchandise financial analysisCatty Kiara RamirezNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Managerial Accounting FiDocument32 pagesManagerial Accounting FiJo Segismundo-JiaoNo ratings yet