Professional Documents

Culture Documents

RMC 92-2020

Uploaded by

kokatuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC 92-2020

Uploaded by

kokatuCopyright:

Available Formats

BLIC OF TH E PHILIPPIN ES

REPI.J

DEPARTMENT OF ITINANCE

BURE,AU OF INTERNAL RE,VEI{TJE

Quezon City

September I,202A

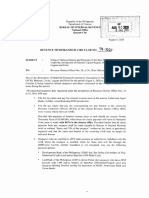

REVENUE MEMORANDUM CIRCULAR NO. Qe- %oLo

SU BJ ECT Further Extending the Deadline for Business Registration of those into Digital

Transactions under Revenue Memorandum Circular (RMC) Nos. 60-2020 and

75-2020

TO All Revenue Officers, Employees and Others Concerned

The deadline for the registration of those into digital transactions discussed under RMC No.

60-2020 was extended thru the issuance of RMC No. 75-2020, which extension is only up to this day.

It was noted, however, that there is a surge of registrants in various revenue district offices that are

trying to beat the deadline. Considering this and the Bureau's resource constraints at this time of

quarantine protocols due to the COVID L9 pandemic, the deadline is further extended to September

30,2020.

All those already into digital or online transactions are advised to register their business

activity on or before the stated date and no penalty shall be imposed for late registration. These

taxpayers who have prior transactions subject to pertinent taxes are also encouraged to voluntarily

declare the same and pay the taxes due thereon, with no penalty for late filing and late payment,

provided the same is done on or before the extended due date above

It is reminded that all those who will be found later doing business without complying with

the registration/update requirements, and those who failed to declare past due taxes/unpaid taxes

shall be imposed with the applicable penalties under the law, and existing revenue rules and

regulations.

All internal revenue officers are enjoined to give this Circular a wide publicity as possible.

BUREAI"' C}F INTERNAL Rf VE

lr-ill-f,ff T:W iYar\q

CAESAR R. DULAY

D p. 14. lt

rffi Comrnissioner of lnternal Revenue

RECORDS MGT. DIVISIO

I

3.

,b 036518

You might also like

- Trading Strategies Used by Hedge FundsDocument177 pagesTrading Strategies Used by Hedge Fundsbrijendra singhNo ratings yet

- Street of Walls - Private Equity Training GuideDocument54 pagesStreet of Walls - Private Equity Training GuideJamesNo ratings yet

- Money Market and Capital MarketDocument36 pagesMoney Market and Capital Marketmisakisakura1102No ratings yet

- Visa Debit Cards - HMBDocument12 pagesVisa Debit Cards - HMBYasser AnwarNo ratings yet

- Circular Entitled RN Lax And: LocalDocument6 pagesCircular Entitled RN Lax And: Localjoseph iii goNo ratings yet

- Tax ClearanceDocument1 pageTax ClearanceliuNo ratings yet

- Land Banks and Land BankingDocument120 pagesLand Banks and Land BankingPUSTAKA Virtual Tata Ruang dan Pertanahan (Pusvir TRP)No ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Responsibility AccountingDocument10 pagesResponsibility AccountingCheny MabiniNo ratings yet

- Bank StatementDocument7 pagesBank Statementrajprince26460No ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Basic Finance Major OutputDocument3 pagesBasic Finance Major OutputKazia PerinoNo ratings yet

- RMC No. 62-2018 Estate TaxDocument2 pagesRMC No. 62-2018 Estate TaxJade MarkNo ratings yet

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- RMC No. 78-2020Document2 pagesRMC No. 78-2020lara.zestoNo ratings yet

- RR No. 6-2022Document3 pagesRR No. 6-2022chato law officeNo ratings yet

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaNo ratings yet

- gL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalDocument2 pagesgL.,!IO2I.: RE) UBL/CO) T//E) ///L//,) /NES InternalKe VinNo ratings yet

- RMC No. 7-2021Document1 pageRMC No. 7-2021nathalie velasquezNo ratings yet

- RMC No. 5-2021Document3 pagesRMC No. 5-2021Jose Mari AguilaNo ratings yet

- RMC No. 125-2020Document1 pageRMC No. 125-2020Raine Buenaventura-EleazarNo ratings yet

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonNo ratings yet

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- RR 5-2016Document3 pagesRR 5-2016McrislbNo ratings yet

- RMC No. 117-2020-MergedDocument15 pagesRMC No. 117-2020-Mergednathalie velasquezNo ratings yet

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinNo ratings yet

- RMC No. 133-2020Document2 pagesRMC No. 133-2020nathalie velasquezNo ratings yet

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezNo ratings yet

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon City July 17, 2018Document1 pageBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon City July 17, 2018Ramon EldonoNo ratings yet

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocument1 pageflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresNo ratings yet

- 1 STP Q E, 0: MemorandumDocument1 page1 STP Q E, 0: MemorandumQuinciano MorilloNo ratings yet

- RMC No. 5 2021 - W - AttachmentsDocument21 pagesRMC No. 5 2021 - W - Attachmentsjamdan15092704No ratings yet

- RR No. 23-2018Document2 pagesRR No. 23-2018nathalie velasquezNo ratings yet

- RR No. 33-2020Document2 pagesRR No. 33-2020JejomarNo ratings yet

- RMC No. 9-2024Document1 pageRMC No. 9-2024Anostasia NemusNo ratings yet

- Rmo No.45-2019Document2 pagesRmo No.45-2019Earl PatrickNo ratings yet

- RMC No. 138-2020Document2 pagesRMC No. 138-2020nathalie velasquezNo ratings yet

- Zojd: A Key Cy Revenue EmployeesDocument1 pageZojd: A Key Cy Revenue EmployeesCliff DaquioagNo ratings yet

- Revenue MC 63-2018 - DTI DAO 16-01Document8 pagesRevenue MC 63-2018 - DTI DAO 16-01Angel BacaniNo ratings yet

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyNo ratings yet

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonNo ratings yet

- Fficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Document1 pageFficd$T: "' F, Ffi::Ijlff:Hhffj:Illtlhfil',I:J." ::'"Maureen PascualNo ratings yet

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagNo ratings yet

- Memorandum Circular: InternalDocument1 pageMemorandum Circular: InternalJhenny Ann P. SalemNo ratings yet

- RMO No. 1-2024Document3 pagesRMO No. 1-2024Anostasia NemusNo ratings yet

- 4?' of For All: NO. AODocument1 page4?' of For All: NO. AOKythkatNo ratings yet

- RMO No. 34-2020Document1 pageRMO No. 34-2020Joel SyNo ratings yet

- RR No. 6-2018Document2 pagesRR No. 6-2018Andrew Benedict PardilloNo ratings yet

- Neg Syo: Trabah Kon Yum RDocument3 pagesNeg Syo: Trabah Kon Yum REngiemar Barbasa TupasNo ratings yet

- Revenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinanceDocument3 pagesRevenue Regulations No. 6 ' 9.0 2 2: Muauc Ofthe Philippines Department or FinancerodrigoNo ratings yet

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadNo ratings yet

- No. Ei) : Internal RevenueDocument1 pageNo. Ei) : Internal Revenuejohn paolo josonNo ratings yet

- Regional Memo No. 172, S. 2023 - Modification On The Payslip Message For March 2023 PayrollDocument3 pagesRegional Memo No. 172, S. 2023 - Modification On The Payslip Message For March 2023 PayrollGayl Ignacio TolentinoNo ratings yet

- March: Republic Philippines Department of Finance OI-RevenueDocument2 pagesMarch: Republic Philippines Department of Finance OI-Revenueantonio espirituNo ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNo ratings yet

- BIR RMC No. 61-2020Document1 pageBIR RMC No. 61-2020pollyNo ratings yet

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonNo ratings yet

- RMC No 42-2018 PDFDocument1 pageRMC No 42-2018 PDFAna DocallosNo ratings yet

- RMC No. 79-2020Document2 pagesRMC No. 79-2020Lulu Adaro VillanuevaNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- 2 Smo0304111t0 - Cfdi - D126797 - 20230116Document1 page2 Smo0304111t0 - Cfdi - D126797 - 20230116MaricarmenNo ratings yet

- Ra, XG TR-FZ: Stejgo+.R@F, EDocument1 pageRa, XG TR-FZ: Stejgo+.R@F, ECliff DaquioagNo ratings yet

- Uprii ,: Memorandum Circular Clarifies CertainDocument9 pagesUprii ,: Memorandum Circular Clarifies CertainBert AslorNo ratings yet

- RR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018Document2 pagesRR No. 14-2018 Bureau of Internal Revenue Revenue Regulation No. 14, Series of 2018sdysangcoNo ratings yet

- In Re DavidDocument2 pagesIn Re DavidBrian TomasNo ratings yet

- Dacanay V Baker & MckenzieDocument1 pageDacanay V Baker & MckenzieRuab PlosNo ratings yet

- De Gracia V Warden of MakatiDocument2 pagesDe Gracia V Warden of MakatiBrian TomasNo ratings yet

- In Re de GuzmanDocument3 pagesIn Re de GuzmanBrian TomasNo ratings yet

- Tanada V CuencoDocument16 pagesTanada V CuencoBrian TomasNo ratings yet

- Collado V HernandoDocument4 pagesCollado V HernandoBrian TomasNo ratings yet

- City Sheriff V FortunadoDocument3 pagesCity Sheriff V FortunadoBrian TomasNo ratings yet

- Chavez V SandiganbayanDocument5 pagesChavez V SandiganbayanBrian TomasNo ratings yet

- Cobb-Perez v. LantinDocument7 pagesCobb-Perez v. LantinN.V.No ratings yet

- Cham V Paita-Moya PDFDocument5 pagesCham V Paita-Moya PDFBrian TomasNo ratings yet

- Casals V CusiDocument4 pagesCasals V CusiBrian TomasNo ratings yet

- Cambaliza V TenorioDocument6 pagesCambaliza V TenorioBrian TomasNo ratings yet

- Canlas V CADocument9 pagesCanlas V CABrian TomasNo ratings yet

- BM 2012Document6 pagesBM 2012Brian TomasNo ratings yet

- Corporate Laws IDocument9 pagesCorporate Laws IAshwanth M.SNo ratings yet

- SWOT Analysis Federal ExpressDocument26 pagesSWOT Analysis Federal Expressawalemje0% (1)

- RWA Tokenization - The Next Generation of Capital MarketsDocument47 pagesRWA Tokenization - The Next Generation of Capital Marketssriharsha.vellanki.nitieNo ratings yet

- Allied Banking Corp Vs Lim Sio Wan GR133179Document2 pagesAllied Banking Corp Vs Lim Sio Wan GR133179Atheena MondidoNo ratings yet

- LCCI Level 1 Certificate in Bookkeeping ASE20091 Nov 2019 QPDocument20 pagesLCCI Level 1 Certificate in Bookkeeping ASE20091 Nov 2019 QPringotgNo ratings yet

- US Internal Revenue Service: I1040aDocument80 pagesUS Internal Revenue Service: I1040aIRS100% (1)

- Buyer Back Side 2Nd Floor Roshpa Tower Main Road Gstin/Uin: 20BXXPP6350D1ZC State Name: Jharkhand, Code: 20 Terms of DeliveryDocument1 pageBuyer Back Side 2Nd Floor Roshpa Tower Main Road Gstin/Uin: 20BXXPP6350D1ZC State Name: Jharkhand, Code: 20 Terms of DeliveryDashing DealNo ratings yet

- P-1. &. I Clubs Law and Practice - CHAPTER 2 Structure of A Modern P&I ClubDocument1 pageP-1. &. I Clubs Law and Practice - CHAPTER 2 Structure of A Modern P&I ClublostnfndNo ratings yet

- Tender NoticeDocument1 pageTender NoticeAshar OpNo ratings yet

- Performance AppraisalsDocument91 pagesPerformance AppraisalsPradeep BhatiaNo ratings yet

- 8db6 - ING Insurance - Asia-PacificDocument16 pages8db6 - ING Insurance - Asia-PacificJessica LopezNo ratings yet

- 1.1) Introduction To Indian Financial SystemDocument34 pages1.1) Introduction To Indian Financial SystemrssishereNo ratings yet

- Intermediate Accounting 1Document8 pagesIntermediate Accounting 1Margielyn SuniNo ratings yet

- Adobe Scan 02-Jul-2022Document4 pagesAdobe Scan 02-Jul-2022Akshita SethiNo ratings yet

- Difference Between Trust and SocietyDocument2 pagesDifference Between Trust and SocietyNancy GirdherNo ratings yet

- Embee's Audit Questionnaire (002) VIKASDocument1 pageEmbee's Audit Questionnaire (002) VIKASAsep SofyanNo ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- Estates and TrustsDocument2 pagesEstates and TrustsMCNo ratings yet

- AUTO - 0ar Aop 2014 PDFDocument276 pagesAUTO - 0ar Aop 2014 PDFAndro BonerezNo ratings yet

- Mergers and AcquisitionsDocument4 pagesMergers and AcquisitionsSamin SakibNo ratings yet

- O-Train Confederation Line PA Feb 14 2018Document3 pagesO-Train Confederation Line PA Feb 14 2018Jon WillingNo ratings yet