Professional Documents

Culture Documents

Volume A& b492

Volume A& b492

Uploaded by

battuarun0 ratings0% found this document useful (0 votes)

15 views7 pagesOriginal Title

20261-volume-a&-b492

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views7 pagesVolume A& b492

Volume A& b492

Uploaded by

battuarunCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 7

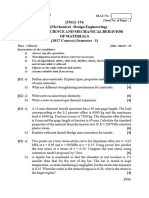

LIST OF Di ME!

(The original/ true copies of documents to be submitted by the college/institute in

the form of a hard copy of the proposal seeking upward revision of fees for the

academic year 2023-24)

INDEX

Fi Challan/Receipt showing proof of payment of processing fee

paid to the Fees Regulating Authority.

Affidavit in the prescribed format (as per the proforma

2 published) duly verified and attested by the person duly

| authorised in terms of section 2(I) of the FRA Act,

3 | Computation sheet for the acader

4 Depreciation Chart for the academic year 2023-2024

5 _| Proposal Form in Prescribed Proforma A, B, C, D, and E

6 | Proposal Form in Prescribed Proforma of Income and

Expenditure

| The Audited Financial Statements for the Financial Year

| 2021-22 of the Institute and Hospital (for Health and Science

Courses) duly signed by the Chartered Accountant &

countersigned by the person authorised in terms of

_ section 2 (I) of the FRA Act, 2015. |

The audited financial statements must be accompanied by---

(i) Audit Report,

| (il) Receipt & Payment Account,

(lil) Income & Expenditure Account, and

(iv) Balance Sheet.

7 (v) All the financial statements as mentioned above should

be accompanied by detailed Schedules and Notes to

Accounts.

vi) The Auditor's Report must be accompanied by Form No.

‘Al & A2 (Annexure - A) as prescribed by the FRA and

same to be duly signed by the Auditor along with particulars

such as Name of Auditor/Firm, firm registration number,

name of signing partner or proprietor with particulars his/her

| Membership Number, UDIN and seal of the Firm. Each page

of Form No. Ai and A2 must bear the signature of the

Auditor.

Copies of Form No. 16 in respect of Teaching and Non-

Teaching staff

10

TDS return/statement for Salary (teaching and non-teaching)

in Form No. 24 for All Quarters along with Annexure II

(i.e. Annual Salary Details) duly certified by the Auditor or

Principal of the college/institute

TDS return/ quarterly statements for Non-Salary in Form

No. 26Q along with details of deductee, nature of payment,

amount, etc, in an excel sheet duly certified by the Auditor or

Principal of the college/institute

rey

Copy of the Audited Financial Statements of the

Trust/Society for the Financial Year 2021-22 along with all

the Schedules and Notes to Accounts.

12

3B

Copy of Income Tax return filed by the Trust and/or college/

institute for the Financial Year 2021-22 (i.e. the Assessment

Year 2022-23) duly attested by the Auditor/Principal of the

college/institute.

Budget of the college/institute for the financial year 2023-24

duly signed by the President/Secretary of the Trust or the

Principal of the college/institute.

“4

Certified copies of all the Bank Account Statement(s) of the

Institute /college for the Financial Year 2021-22 showing

debits entries of the salary paid to Teaching and Non-

Teaching staff through cheque/NEFT.

| Note: 1. The original copy of the Bank Statements must be

attested as ‘True Copy’ by the Branch Manager of the Bank.

2. All the relevant entries showing payment of salary made

through the Bank and claimed as an expenditure be distinctly

| marked and highlighted.

15

16

Certified copy of Bank Account Statement(s) of the college/

institute for the Financial Year 2021-22 showing debits

entries of payments made as Non-Salary expenditures.

Note: 1. The original copy of the Bank Statements must be

attested as ‘True Copy’ by the Branch Manager of the Bank

2. All the relevant entries showing payment of non-salary

made through the Bank and claimed as an expenditure be

distinctly marked and highlighted.

Letters of approval of teaching staff issued by the approving

Authority duly attested by the Principal of the

institute/college.

1

Letters showing the sanctioned intake capacty approved by

the Competent Authority for the academic year 2018-19,

2019-20, 2020-21, 2021-22 & 2022-23 duly attested as a

“True Copy’ by the Principal of the institute/college (as per

| the course duration).

Sr.No. | Particular Documents to be submitted

Page

No.

Office

Remark

Accreditation Committee.

Copy of fees structure approved by the Fees Regulating

19 | Authority for the academic year 2019-20, 2020-21, 2021-22,

| 2022-23 (as per the course duration).

Certified copy of the property card and/or 7/12 extract

20 | showing the ownership of the land owned by the

institute/trust.

Accreditation Certificate duly attested by the Principal of the |

18 | Institute/College if the institute claim to be accredited by the |

tax.

Statement of Fees collected from the students admitted

22 | under Management/ Institutional and NRI quota in the

prescribed proforma as per Annexure - B

Certified copy of the extract of Property Assessment Register

issued by the Municipal Corporation /Municipal Council/ Gram

Panchayat assessing the property for the purpose of property |

the examination (as per the course duration).

Statement showing the number of students admitted and

23 | appeared in the examiniation and no. of students passed in

Place: / Signature

Date:

\ Levy Name, Designation

* Seal of the Person duly authorized in

terms of section 2(I) of the Act, 2015.

List of Visiting faculties, Qualification, Amount Paid to

individual & Mode of Payment (Cash/ Cheque/Bank).

List of Guest lecturers, Qualification, Subject, Amount Paid to

individual & Mode of Payment (Cash/ Cheque/Bank)..

‘The Receipt(s) showing acknowledgement of Affiliation Fees

Paid to the Affiliating Authority.

‘The Receipt(s) showing acknowledgement of Inspection Fees

paid to the Affiliating Authority.

‘The Receipt(s) showing acknowledgement of Affiliation Fees |

paid to the University.

The Receipt(s) of payment of Eligibility fees paid to the |

University. |

The Receipt(s) of payment of Exam Fees paid to the |

University.

Item wise List of expenses claimed towards ‘Other Repairs &

‘The Receipt(s) of payment of Enrollment Fees paid to the

University,

Tem wise List of expenses claimed towards ‘Repairs &

Maintenance of College Building’ with course wise bifurcation.

Item wise List of expenses claimed towards ‘Repairs and

Maintenance expenditure towards Furniture, Equipment,

Vehicle, Computers, Electrification, etc.’ with course-wise

bifurcation.

Maintenance’ with course-wise bifurcation

|

|

}

|

|

9

10

iL

12

Bills and receipts of expenses claimed towards Advertisement

with copies of the advertisement published in the newspaper.

Copy of sanction letter from the Bank/Financial Institution for

which interest expenditure is claimed as a deduction on cash

credit/ overdraft/ working capital facilties/ TEQIP Loan,

14

Itemwise list of expenditure claimed under Professional

Charges -Other/ Consultancy fees-legal / Consultancy Fees -

Other with documentary proof f payment made towards

professional with copy of TDS decducted and challan of

deosite made

15

The item-wise list of Other Expenses relating to students’

activities claimed under the head of "Expenses related to

students i.e. any other expenses relating to students’ activity

not specifically covered under other heads provided for

“Expenses Related to Students’,

Copies of bills and receipts of payment made to the service

provider towards Internet Charges/Services

Copies of bills and receipts of payments made towards

electricity charges with course-wise bifurcation claimed as an

‘expenditure in the proposal form.

Copies of bills and receipts of payments made towards water

charges with course-wise bifurcation claimed as an

expenditure in the proposal form.

Copy of the agreement(s) of the college/institute with the

transporter to provide free transport service to the students.

‘The Receipt(s) of payment made to the Transporter towards

free transport service to the students.

Item wise list of expenditure with receipt(s) of payment made |

towards amount claimed under the head of “Training and |

Placement”. |

22

| Item wise list of expenditure with receipt(s) of payment made

‘towards amount claimed under the head of "Conference and

| Seminar of Faculties”.

3

Item wise list of expenditure with receipt(s) of payment made

‘towards amount claimed under the head of "Conference and

Seminar of Students”

Sr. ic Page | Office

No, Particular Documents to be submitted Re es

Copy of agreement providing manpower in lieu of non-

24 | teaching staff if engaged by the institute/college with copies

of TDS returns. |

Copy of agreement providing manpower in lieu of sweeping

25 _| and/or cleaning staff/gardening if engaged by the |

institute/college with copies of TDS returns.

| Ttemwise list of expenditure with proof of payment made

|g _| towards amount claimed under the head of Gardening

7

material

Copy of agreement providing manpower in lieu of security

and/or watchman if engaged by the institute/college with

copies of TDS returns.

Item wise list of expenditure with receipt(s) of payment made

towards amount claimed under the head of "Laboratory

Expenses, Demonstration Material and Chemicals,

Consumable etc. expenses”

‘The processing fee paid to NAC / NBA / NIRF /NABH/NABL

etc. for accreditation (if applicable).

Ttem-wise list of other expenses claimed under the head of

All other expenses not categorise / not grouped in any

heads/subheads given above”.

Copies of bills and receipts for addition to the fixed asset

| colleges/institutes

31 | during the Financial Year 2021-22.

Iter-wise list, bills and receipts of expenses aimed as the

purchase of seeds, manure, fertilizer, insecticide, pesticide,

32 | and Nursery expenses in the case of

sr. i Page | Office

No, _ Particular Documents to be submitted Meee leek

Ttem-wise list, bills and receipts of expenses claimed as the

| 33, | Purchase of Cate feed, fodder, medicine, etc. in respect of

| courses conducted by Agriculture colleges/ institutes. |

| |

| Proof of online proposal for approval of fees for A.Y. 2023-2024 | .

34 displayed on the website and notice-board of the Institute/

College.

Place: Signature

me, Designation

Date: na se

Seal of the Person duly authorized

in terms of section 2(I) of the Act,

2015.

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BE Mechanical Engineering 2019 Course Structure and SyllabusDocument111 pagesBE Mechanical Engineering 2019 Course Structure and SyllabusbattuarunNo ratings yet

- MSMBM Oct 2018Document2 pagesMSMBM Oct 2018battuarunNo ratings yet

- MSMBM Oct 2022 - 2Document2 pagesMSMBM Oct 2022 - 2battuarunNo ratings yet

- ME Mech Heat Power 2013Document23 pagesME Mech Heat Power 2013battuarunNo ratings yet

- MSMBM April 2022Document2 pagesMSMBM April 2022battuarunNo ratings yet

- Unit 4 AssignmentsDocument5 pagesUnit 4 AssignmentsbattuarunNo ratings yet

- D Y Patil College of Engineering, Akurdi, PuneDocument2 pagesD Y Patil College of Engineering, Akurdi, PunebattuarunNo ratings yet

- SM - TSET 4 of 12Document2 pagesSM - TSET 4 of 12battuarunNo ratings yet