Professional Documents

Culture Documents

Ala Claud Allyn G. Intacc 189 Activity 4

Uploaded by

Elc Elc Elc0 ratings0% found this document useful (0 votes)

12 views4 pagesOriginal Title

Ala Claud Allyn g. Intacc 189 Activity 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views4 pagesAla Claud Allyn G. Intacc 189 Activity 4

Uploaded by

Elc Elc ElcCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

ALA, CLAUD ALLYN G.

BSA-1

INTACC 189

ACTIVITY 4 (A04) PROOF OF CASH

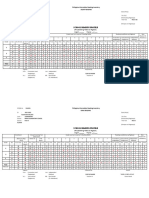

Problem 1 – (Answers and solutions)

1. Compute the June deposit in transit.

Deposit in Transit – May 31 ₱ 300,000

Add: Cash receipts per book per record ₱ 1,800,000

Total deposits to be acknowledge by the bank ₱ 2,100,000

Less: Deposit acknowledge by the bank – June ₱ 1,600,000

Deposit in Transit - June ₱ 500,000

2. Compute for June outstanding checks.

Outstanding Check – May 31 ₱ 100,000

Add: Cash disbursement per book per record ₱ 2,500,000

Total checks to be acknowledge by the bank ₱ 2,600,000

Less: Checks cleared by the bank ₱ 2,200,000

Outstanding Checks - June ₱ 400,000

3. Compute for June adjusted cash in bank.

Balance per book ₱ 2,100,000

Add: Credit Memos ₱ 550,000

Total ₱ 2,650,000

Less: Service Charge ₱ 50,000

NSF Check ₱ 100,000 ₱ 150,000

Adjusted book balance ₱ 2,500,000

Balance per bank ₱ 2,400,000

Add: Deposit in transit ₱ 500,000

Total ₱ 2,900,000

Less: Outstanding Checks ₱ 400,000

Adjusted bank balance ₱ 2,500,000

Problem 2 – (Answers and solutions)

1. Adjusted balance method.

CENTER Company

PROOF OF CASH

For the month of April

March 31, 2020 Receipts Disbursements April 30,

2020

Balance per book ₱ 200,000 ₱ 800,000 ₱ 720,000 ₱ 280,000

Note collected:

March ₱ 60,000 (60,000)

April ₱ 100,000 ₱ 100,000

Bank service charge:

March (₱ 8,000) (₱ 8,000)

April ₱ 2,000 (₱ 2,000)

NSF check:

March (₱ 20,000) (₱ 20,000)

April ₱ 30,000 (₱ 30,000)

Adjusted book balance ₱ 232,000 ₱ 840,000 724,000 348,000

Balance per bank ₱ 330,000 ₱ 700,000 ₱ 530,000 ₱ 500,000

Deposit in transit

March 31 ₱ 80,000 (₱ 80,000)

April 30 ₱ 220,000 ₱ 220,000

Outstanding checks:

March 31 (₱ 178,000) (₱ 178,000)

April 30 ₱ 372,000 (₱ 372,000)

Adjusted bank balance ₱ 232,000 ₱ 840,000 ₱ 724,000 ₱ 348,000

2. Book to bank balance method.

CENTER Company

PROOF OF CASH

For the month of April

March 31, 2020 Receipts Disbursements April 30, 2020

Balance per book ₱ 200,000 ₱ 800,000 ₱ 720,000 ₱ 280,000

Note collected:

March ₱ 60,000 (₱ 60,000)

April ₱ 100,000 ₱ 100,000

Bank service charge:

March (₱ 8,000) (₱ 8,000)

April ₱ 2,000 (₱ 2,000)

NSF check:

March (₱ 20,000) (₱ 20,000)

April ₱ 30,000 (₱ 30,000)

Deposit in transit

March 31 (₱ 80,000) ₱ 80,000

April 30 (₱ 220,000) (₱ 220,000)

Outstanding check

March 31 ₱ 178,000 ₱ 178,000

April 30 (₱ 372,000) ₱ 372,000

Balance per bank ₱ 330,000 ₱ 700,000 ₱ 530,000 ₱ 500,000

3. Bank to book balance method.

CENTER Company

PROOF OF CASH

For the month of April

March 31, 2020 Receipts Disbursements April 30, 2020

Balance per bank ₱ 330,000 ₱ 700,000 ₱ 530,000 ₱ 500,000

Deposit in transit:

March 31 ₱ 80,000 (₱ 80,000)

April 30 ₱ 220,000 ₱ 220,000

Outstanding checks:

March 31 (₱ 178,000) (₱ 178,000)

April 30 ₱ 372,000 (₱ 372,000)

Note collected:

March (₱ 60,000) ₱ 60,000

April (₱ 100,000) (₱ 100,000)

Service charge:

March ₱ 8,000 ₱ 8,000

April (₱ 2,000) ₱ 2,000

NSF check:

March ₱ 20,000 ₱ 20,000

April (₱ 30,000) ₱ 30,000

Balance per book ₱ 200,000 ₱ 800,000 ₱ 720,000 ₱ 280,000

You might also like

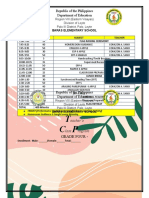

- ATTENDANCEDocument22 pagesATTENDANCEElc Elc ElcNo ratings yet

- DLL in Art 5Document4 pagesDLL in Art 5Elc Elc ElcNo ratings yet

- Cover PageDocument1 pageCover PageElc Elc ElcNo ratings yet

- Final Las Math5 Q4 W4Document4 pagesFinal Las Math5 Q4 W4Elc Elc ElcNo ratings yet

- GenEd SCIENCEDocument5 pagesGenEd SCIENCEElc Elc ElcNo ratings yet

- DLL in Art 5Document4 pagesDLL in Art 5Elc Elc ElcNo ratings yet

- Catan Selina Mari Unit 2 Intacc3 099Document12 pagesCatan Selina Mari Unit 2 Intacc3 099Elc Elc ElcNo ratings yet

- Local Media1661580103363576118Document1 pageLocal Media1661580103363576118joshNo ratings yet

- Project Work Plan and Budget MatrixDocument10 pagesProject Work Plan and Budget MatrixElc Elc ElcNo ratings yet

- ACR3Document5 pagesACR3Elc Elc ElcNo ratings yet

- Progress Report TemplateDocument1 pageProgress Report TemplateElc Elc ElcNo ratings yet

- Induction of Officers ProgramDocument4 pagesInduction of Officers ProgramElc Elc ElcNo ratings yet

- Minutes-Invitation LetterDocument9 pagesMinutes-Invitation LetterElc Elc ElcNo ratings yet

- NFJPIA EVC 2223 25th RMYC Data Privacy AgreementDocument3 pagesNFJPIA EVC 2223 25th RMYC Data Privacy AgreementElc Elc ElcNo ratings yet

- Construction Contracts Sample-1Document8 pagesConstruction Contracts Sample-1Elc Elc ElcNo ratings yet

- Baras Es Phil Iri Report 2018 19Document3 pagesBaras Es Phil Iri Report 2018 19Elc Elc ElcNo ratings yet

- BARASES PHIL IRI Oral Reading Form A School Reading ProfileDocument5 pagesBARASES PHIL IRI Oral Reading Form A School Reading ProfileElc Elc ElcNo ratings yet

- SPSPS DatabaseDocument808 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- Homeroom Parents Teachers. Oath of OfficeDocument1 pageHomeroom Parents Teachers. Oath of OfficeElc Elc ElcNo ratings yet

- SPSPS DatabaseDocument808 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- Cohort Survival RateDocument2 pagesCohort Survival RateElc Elc ElcNo ratings yet

- Panimulang PagbasaDocument15 pagesPanimulang PagbasaElc Elc Elc100% (1)

- SPSPS DatabaseDocument808 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- SPSPS DatabaseDocument226 pagesSPSPS DatabaseElc Elc ElcNo ratings yet

- Grade 3 Class Program 2022-2023Document1 pageGrade 3 Class Program 2022-2023Elc Elc Elc100% (6)

- Grade 1 Class Program 2022-2023Document2 pagesGrade 1 Class Program 2022-2023Elc Elc Elc100% (1)

- Grade 2 Class Program 2022-2023Document2 pagesGrade 2 Class Program 2022-2023Elc Elc ElcNo ratings yet

- Grade 4 Classroom Program 2022-2023Document3 pagesGrade 4 Classroom Program 2022-2023Elc Elc ElcNo ratings yet

- Grade 4 Apple Classroom Program 2022-2023Document2 pagesGrade 4 Apple Classroom Program 2022-2023Elc Elc ElcNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Engineering Ethics in Practice ShorterDocument79 pagesEngineering Ethics in Practice ShorterPrashanta NaikNo ratings yet

- Basic Terms/Concepts IN Analytical ChemistryDocument53 pagesBasic Terms/Concepts IN Analytical ChemistrySheralyn PelayoNo ratings yet

- Categorical SyllogismDocument3 pagesCategorical SyllogismYan Lean DollisonNo ratings yet

- Sabian Aspect OrbsDocument8 pagesSabian Aspect Orbsellaella13100% (2)

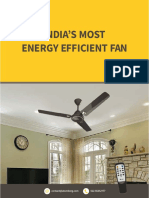

- Atomberg Gorilla FanDocument12 pagesAtomberg Gorilla FanjothamNo ratings yet

- D E S C R I P T I O N: Acknowledgement Receipt For EquipmentDocument2 pagesD E S C R I P T I O N: Acknowledgement Receipt For EquipmentTindusNiobetoNo ratings yet

- Bone Surface MarkingsDocument2 pagesBone Surface MarkingsNurul Afiqah Fattin AmatNo ratings yet

- Passage To Abstract Mathematics 1st Edition Watkins Solutions ManualDocument25 pagesPassage To Abstract Mathematics 1st Edition Watkins Solutions ManualMichaelWilliamscnot100% (50)

- Michael Clapis Cylinder BlocksDocument5 pagesMichael Clapis Cylinder Blocksapi-734979884No ratings yet

- Homework 9Document1 pageHomework 9Nat Dabuét0% (1)

- Cameron International Corporation: FORM 10-KDocument31 pagesCameron International Corporation: FORM 10-KMehdi SoltaniNo ratings yet

- Six Sigma PresentationDocument17 pagesSix Sigma PresentationDhular HassanNo ratings yet

- 2013-01-28 203445 International Fault Codes Eges350 DTCDocument8 pages2013-01-28 203445 International Fault Codes Eges350 DTCVeterano del CaminoNo ratings yet

- EPW, Vol.58, Issue No.44, 04 Nov 2023Document66 pagesEPW, Vol.58, Issue No.44, 04 Nov 2023akashupscmadeeaseNo ratings yet

- solidworks ขั้นพื้นฐานDocument74 pagessolidworks ขั้นพื้นฐานChonTicha'No ratings yet

- Philo Q2 Lesson 5Document4 pagesPhilo Q2 Lesson 5Julliana Patrice Angeles STEM 11 RUBYNo ratings yet

- For Accuracy and Safety: Globally ApprovedDocument4 pagesFor Accuracy and Safety: Globally ApprovedPedro LopesNo ratings yet

- Logistic RegressionDocument7 pagesLogistic RegressionShashank JainNo ratings yet

- TM Mic Opmaint EngDocument186 pagesTM Mic Opmaint Engkisedi2001100% (2)

- Man Bni PNT XXX 105 Z015 I17 Dok 886160 03 000Document36 pagesMan Bni PNT XXX 105 Z015 I17 Dok 886160 03 000Eozz JaorNo ratings yet

- Title: Smart Monitoring & Control of Electrical Distribution System Using IOTDocument27 pagesTitle: Smart Monitoring & Control of Electrical Distribution System Using IOTwaleed HaroonNo ratings yet

- Halloween EssayDocument2 pagesHalloween EssayJonathan LamNo ratings yet

- CE162P MODULE 2 LECTURE 4 Analysis & Design of Mat FoundationDocument32 pagesCE162P MODULE 2 LECTURE 4 Analysis & Design of Mat FoundationPROSPEROUS LUCKILYNo ratings yet

- "Organized Crime" and "Organized Crime": Indeterminate Problems of Definition. Hagan Frank E.Document12 pages"Organized Crime" and "Organized Crime": Indeterminate Problems of Definition. Hagan Frank E.Gaston AvilaNo ratings yet

- Internal Resistance To Corrosion in SHS - To Go On WebsiteDocument48 pagesInternal Resistance To Corrosion in SHS - To Go On WebsitetheodorebayuNo ratings yet

- Designed For Severe ServiceDocument28 pagesDesigned For Severe ServiceAnthonyNo ratings yet

- Management PriniciplesDocument87 pagesManagement Priniciplesbusyboy_spNo ratings yet

- Executive Summary: 2013 Edelman Trust BarometerDocument12 pagesExecutive Summary: 2013 Edelman Trust BarometerEdelman100% (4)

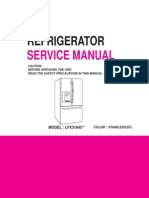

- LG LFX31945 Refrigerator Service Manual MFL62188076 - Signature2 Brand DID PDFDocument95 pagesLG LFX31945 Refrigerator Service Manual MFL62188076 - Signature2 Brand DID PDFplasmapete71% (7)

- 5.0008786 Aluminum GrapheneDocument11 pages5.0008786 Aluminum GrapheneBensinghdhasNo ratings yet