Professional Documents

Culture Documents

Bonds - December 1 2022

Uploaded by

Lisle Daverin Blyth0 ratings0% found this document useful (0 votes)

37 views3 pagesBonds - December 1 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBonds - December 1 2022

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views3 pagesBonds - December 1 2022

Uploaded by

Lisle Daverin BlythBonds - December 1 2022

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

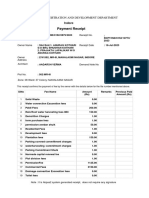

Markets and Commodity figures

01 December 2022

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 2,407 81.04 bn Rbn 74.10 203 42.86 bn Rbn 43.13

Week to Date 6,423 195.42 bn Rbn 182.58 1,293 230.22 bn Rbn 212.77

Month to Date 2,407 81.04 bn Rbn 74.10 203 42.86 bn Rbn 43.13

Year to Date 313,191 9,472.60 bn Rbn 9,028.80 65,557 12,171.91 bn Rbn 11,407.92

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 89 5.53 bn Rbn 4.82 14 2.17 bn Rbn 1.74

Current Day Sell 172 14.41 bn Rbn 12.92 23 6.44 bn Rbn 5.79

Net -83 -8.87 bn Rbn -8.11 -9 -4.27 bn Rbn -4.05

Buy 260 16.45 bn Rbn 14.35 44 7.63 bn Rbn 6.38

Week to Date Sell 354 25.82 bn Rbn 22.72 60 17.26 bn Rbn 16.02

Net -94 -9.38 bn Rbn -8.36 -16 -9.63 bn Rbn -9.64

Buy 89 5.53 bn Rbn 4.82 14 2.17 bn Rbn 1.74

Month to Date Sell 172 14.41 bn Rbn 12.92 23 6.44 bn Rbn 5.79

Net -83 -8.87 bn Rbn -8.11 -9 -4.27 bn Rbn -4.05

Buy 15,913 1,083.72 bn Rbn 1,013.25 3,503 692.22 bn Rbn 606.33

Year to Date Sell 16,333 1,236.89 bn Rbn 1,146.08 4,350 1,238.05 bn Rbn 1,176.57

Net -420 -153.17 bn Rbn -132.84 -847 -545.83 bn Rbn -570.24

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 All Bond Index 10.578% 817.980

Top 20 Composite 852.448 -4.04% -0.58%

GOVI 10.582%

ALBI20 Issuer Class Split - 806.357

GOVI 840.412 -4.05% -0.68%

OTHI 10.522%

ALBI20 Issuer Class Split - 876.624

OTHI 912.510 -3.93% 0.56%

CILI15 4.518%

Composite Inflation 313.675

Linked Index Top 15 317.856 -1.32% 0.25%

ICOR 4.765%

CILI15 Issuer Class 400.785

Split - ICOR 402.017 -0.31% 4.38%

IGOV 4.491%

CILI15 Issuer Class 310.275

Split - IGOV 314.631 -1.38% 0.07%

ISOE 5.020%

CILI15 Issuer Class 342.939

Split - ISOE 343.427 -0.14% 3.67%

MMI JSE Money Market Index

0 308.980 308.921 0.02% 4.66%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Aug 2025

AFRICA 10.170% 9.560% 8.33% 10.37%

R203 REPUBLIC OF SOUTH

Apr 2026

AFRICA 10.140% 9.530% 8.47% 10.42%

ES18 ESKOM HOLDINGSOctLIMITED

2026 9.675% 9.065% 7.54% 10.03%

R204 REPUBLIC OF SOUTH

Dec 2026

AFRICA 9.320% 8.710% 7.57% 9.52%

R207 REPUBLIC OF SOUTH

Nov 2027

AFRICA 11.630% 11.020% 9.47% 11.87%

R208 REPUBLIC OF SOUTH

Jan 2030

AFRICA 10.970% 10.245% 9.04% 11.09%

ES23 ESKOM HOLDINGSOctLIMITED

2030 12.530% 11.805% 10.63% 12.69%

DV23 DEVELOPMENT FebBANK

2031

OF SOUTHERN

11.340%AFRICA 10.615% 9.31% 11.41%

R2023 REPUBLIC OF SOUTH

Mar 2032

AFRICA 11.510% 10.790% 9.47% 11.52%

ES26 ESKOM HOLDINGSSepLIMITED

2033 12.860% 12.165% 10.84% 12.86%

R186 REPUBLIC OF SOUTH

Jul 2034

AFRICA 12.695% 12.000% 10.55% 12.70%

R2030 REPUBLIC OF SOUTH

Feb 2035

AFRICA 11.900% 11.210% 9.89% 11.90%

R213 REPUBLIC OF SOUTH

Mar 2036

AFRICA 11.920% 11.225% 9.89% 11.92%

R2032 REPUBLIC OF SOUTH

Jan 2037

AFRICA 12.080% 11.395% 10.08% 12.08%

ES33 ESKOM HOLDINGSJanLIMITED

2040 12.185% 11.490% 10.23% 12.19%

R209 REPUBLIC OF SOUTH

Oct 2040

AFRICA 13.210% 12.520% 11.42% 13.33%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 12.030% 11.340% 10.22% 12.03%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 13.090% 12.400% 11.29% 13.12%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 12.120% 11.435% 10.30% 12.12%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 12.010% 11.320% 10.22% 12.03%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.820% 6.820% 3.58% 6.82%

JIBAR1 JIBAR 1 Month 7.017% 7.017% 3.74% 7.02%

JIBAR3 JIBAR 3 Month 7.200% 7.200% 3.89% 7.20%

JIBAR6 JIBAR 6 Month 7.842% 7.833% 4.66% 7.85%

RSA 2 year retail bond 8.50% 0 0 0

RSA 3 year retail bond 9.00% 0 0 0

RSA 5 year retail bond 10.50% 0 0 0

RSA 3 year inflation linked retail

4.00%

bond 0 0 0

RSA 5 year inflation linked retail

4.50%

bond 0 0 0

RSA 10 year inflation linked retail

5.00%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Bonds - November 14 2022Document3 pagesBonds - November 14 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 24 2022Document3 pagesBonds - November 24 2022Lisle BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 15 2022Document3 pagesBonds - November 15 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 20 2022Document3 pagesBonds - November 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 16 2020Document3 pagesBonds - July 16 2020Lisle Daverin BlythNo ratings yet

- Bonds - October 27 2022Document3 pagesBonds - October 27 2022Lisle BlythNo ratings yet

- Bonds - April 27 2020Document3 pagesBonds - April 27 2020Lisle Daverin BlythNo ratings yet

- Bonds - March 15 2022Document3 pagesBonds - March 15 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 2 2022Document3 pagesBonds - November 2 2022Lisle BlythNo ratings yet

- Bonds - November 8 2022Document3 pagesBonds - November 8 2022Lisle BlythNo ratings yet

- Bonds - September 7 2022Document3 pagesBonds - September 7 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 9 2022Document3 pagesBonds - November 9 2022Lisle BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 18 2022Document3 pagesBonds - May 18 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 17 2022Document3 pagesBonds - May 17 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 17 2021Document3 pagesBonds - May 17 2021Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - September 5 2022Document3 pagesBonds - September 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 12 2022Document3 pagesBonds - July 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 16 2022Document3 pagesBonds - November 16 2022Lisle BlythNo ratings yet

- Bonds - August 12 2021Document3 pagesBonds - August 12 2021Lisle Daverin BlythNo ratings yet

- Bonds - July 13 2022Document3 pagesBonds - July 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 28 2022Document3 pagesBonds - September 28 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 16 2022Document3 pagesBonds - October 16 2022Lisle BlythNo ratings yet

- Bonds - April 20 2022Document3 pagesBonds - April 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 20 2022Document3 pagesBonds - September 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 18 2022Document3 pagesBonds - October 18 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 13 2020Document3 pagesBonds - May 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - September 4 2022Document3 pagesBonds - September 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 31 2022Document3 pagesBonds - October 31 2022Lisle BlythNo ratings yet

- Bonds - April 2 2020Document3 pagesBonds - April 2 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - April 3 2019Document3 pagesBonds - April 3 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 16 2021Document3 pagesBonds - September 16 2021Lisle Daverin BlythNo ratings yet

- Bonds - April 4 2022Document3 pagesBonds - April 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 22 2022Document3 pagesBonds - May 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - January 12 2022Document3 pagesBonds - January 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 19 2022Document3 pagesBonds - July 19 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 21 2021Document3 pagesBonds - September 21 2021Lisle Daverin BlythNo ratings yet

- Bonds - December 7 2017Document3 pagesBonds - December 7 2017Tiso Blackstar GroupNo ratings yet

- Bonds - July 5 2022Document3 pagesBonds - July 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 25 2020Document3 pagesBonds - August 25 2020Lisle Daverin BlythNo ratings yet

- Bonds - September 1 2022Document3 pagesBonds - September 1 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - December 2 2021Document3 pagesBonds - December 2 2021Lisle Daverin BlythNo ratings yet

- Bonds - May 31 2022Document3 pagesBonds - May 31 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 7 2021Document3 pagesBonds - December 7 2021Lisle Daverin BlythNo ratings yet

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythNo ratings yet

- Bonds - September 19 2022Document3 pagesBonds - September 19 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 23 2020Document3 pagesBonds - April 23 2020Lisle Daverin BlythNo ratings yet

- Bonds - November 29 2022Document3 pagesBonds - November 29 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 4 2022Document3 pagesBonds - July 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 27 2020Document3 pagesBonds - May 27 2020Lisle Daverin BlythNo ratings yet

- Bonds - October 11 2022Document3 pagesBonds - October 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 7 2022Document3 pagesBonds - December 7 2022Lisle BlythNo ratings yet

- Bonds - November 4 2021Document3 pagesBonds - November 4 2021Lisle Daverin BlythNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 11 2022Document1 pageFuel Prices - December 11 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- Liberty - December 11 2022Document1 pageLiberty - December 11 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: 14 June 2017Document2 pagesMarkets and Commodity Figures: 14 June 2017Tiso Blackstar GroupNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Liberty - December 9 2022Document1 pageLiberty - December 9 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - August 6 2020Document2 pagesFairbairn - August 6 2020Lisle Daverin BlythNo ratings yet

- Liberty - December 6 2022Document1 pageLiberty - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 6 2022Document1 pageFuel Prices - December 6 2022Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 9 2022Document1 pageFuel Prices - December 9 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - August 6 2020Document2 pagesFairbairn - August 6 2020Lisle Daverin BlythNo ratings yet

- Liberty - December 5 2022Document1 pageLiberty - December 5 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 6 2022Document2 pagesSanlam Stratus Funds - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 5 2022Document3 pagesBonds - December 5 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- Fuel Prices - December 1 2022Document1 pageFuel Prices - December 1 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - December 5 2022Document2 pagesFairbairn - December 5 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - December 1 2022Document2 pagesSanlam Stratus Funds - December 1 2022Lisle Daverin BlythNo ratings yet

- Liberty - November 30 2022Document1 pageLiberty - November 30 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- Fairbairn - August 6 2020Document2 pagesFairbairn - August 6 2020Lisle Daverin BlythNo ratings yet

- Bonds - November 30 2022Document3 pagesBonds - November 30 2022Lisle Daverin BlythNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- Liberty - December 1 2022Document1 pageLiberty - December 1 2022Lisle Daverin BlythNo ratings yet

- Liberty - November 29 2022Document1 pageLiberty - November 29 2022Lisle Daverin BlythNo ratings yet

- Fairbairn - November 29 2022Document2 pagesFairbairn - November 29 2022Lisle Daverin BlythNo ratings yet

- Thomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyDocument240 pagesThomas J. Sargent, Jouko Vilmunen Macroeconomics at The Service of Public PolicyHamad KalafNo ratings yet

- ISO 20022 Data Source Schemes (DSS)Document15 pagesISO 20022 Data Source Schemes (DSS)aNo ratings yet

- REMIC and CDO Reporting Directory: Find Tax Information for Real Estate Mortgage Investment Conduits and Collateralized Debt ObligationsDocument74 pagesREMIC and CDO Reporting Directory: Find Tax Information for Real Estate Mortgage Investment Conduits and Collateralized Debt Obligationsprunfeldt5399No ratings yet

- Household Budget Tracker Shows Income Over ExpensesDocument6 pagesHousehold Budget Tracker Shows Income Over ExpensesDavin AgustaNo ratings yet

- Remote Deposit CaptureDocument60 pagesRemote Deposit Capture4701sandNo ratings yet

- Schedule 17Document2 pagesSchedule 17colinandrusNo ratings yet

- Summer Moon Presentation December 13,2004Document25 pagesSummer Moon Presentation December 13,2004Essam Al BakryNo ratings yet

- Mitc Credit CardsDocument41 pagesMitc Credit CardsAlok ThakkarNo ratings yet

- Answers To Problem Sets: How Much Should A Corporation Borrow?Document8 pagesAnswers To Problem Sets: How Much Should A Corporation Borrow?priyanka GayathriNo ratings yet

- EFA AssignmentDocument5 pagesEFA AssignmentDeviNo ratings yet

- Marico Fund FlowDocument10 pagesMarico Fund FlowAbhishek KothariNo ratings yet

- BR Act 1949Document25 pagesBR Act 1949dranita@yahoo.comNo ratings yet

- Master Budget Case: Toyworks Ltd. (A)Document4 pagesMaster Budget Case: Toyworks Ltd. (A)RIKUDO SENNIN100% (1)

- Soal Assignment Financial Audit IiDocument2 pagesSoal Assignment Financial Audit IiEunice ShevlinNo ratings yet

- Helb DennisDocument6 pagesHelb DennisDennis Onchieku OnyandoNo ratings yet

- Chap 016Document8 pagesChap 016Bobby MarionNo ratings yet

- BUS 6140 module 1 AssignmentDocument4 pagesBUS 6140 module 1 AssignmentvertmeddNo ratings yet

- Accounting Principle - CHAPTER - 1&2 HanaDocument20 pagesAccounting Principle - CHAPTER - 1&2 HanaNigussie BerhanuNo ratings yet

- Accounting for Partnerships: A Comprehensive GuideDocument74 pagesAccounting for Partnerships: A Comprehensive GuideHussen Abdulkadir100% (2)

- Tariff Order 2010-11Document187 pagesTariff Order 2010-11Nannapaneni P. ChowdaryNo ratings yet

- Reconcile Nostro Februari 2023Document56 pagesReconcile Nostro Februari 2023Riko RudyantoNo ratings yet

- Detailed Bank Statement SummaryDocument2 pagesDetailed Bank Statement SummaryAjay Chowdary Ajay ChowdaryNo ratings yet

- Gov Act Reviewer (Punzalan)Document13 pagesGov Act Reviewer (Punzalan)Kenneth WilburNo ratings yet

- Working Capital Finance AdvisoryDocument18 pagesWorking Capital Finance AdvisoryAnnaNo ratings yet

- Balance Sheet of Bajaj FinanceDocument8 pagesBalance Sheet of Bajaj FinanceAJ SuriNo ratings yet

- Undisclosed Insider Activities at 21 Vianet GroupDocument37 pagesUndisclosed Insider Activities at 21 Vianet GroupTrinity Research Group0% (1)

- Payment Receipt: Urban Administration and Development DepartmentDocument2 pagesPayment Receipt: Urban Administration and Development Departmentaadarsh vermaNo ratings yet

- ETF Screener - JustETF A2Document4 pagesETF Screener - JustETF A2fish0123No ratings yet

- JhunjhunwalaDocument12 pagesJhunjhunwalapercysearchNo ratings yet

- Ghana Stock Exchange CourseDocument7 pagesGhana Stock Exchange CoursePrinceNo ratings yet