Professional Documents

Culture Documents

Ifrs15 (Students) Đáp Án Cô S A

Ifrs15 (Students) Đáp Án Cô S A

Uploaded by

Xuân AnhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ifrs15 (Students) Đáp Án Cô S A

Ifrs15 (Students) Đáp Án Cô S A

Uploaded by

Xuân AnhCopyright:

Available Formats

Telecom operator, ABC Corp. entered into a contract with Johnny on 1 July 20X1.

In line with the contract, Johnny subscribes for ABC's monthly plan for 12

months and in return, Johnny receives free handset from ABC Corp. Johnny will pay a monthly fee of CU 100. Johnny gets the handset immediately after

contract signature.

ABC sells the same handsets for CU 300 and the same monthly plans for CU 80/month without handset.

How should ABC recognize revenues from the contract with Johnny in 20X1 under IFRS 15?

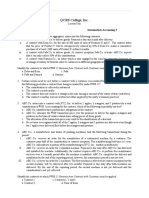

Step 1: Identify the contract with a customer

= written contract between Johnny and ABC Corp.

Step 2: Identify the performance obligations

How many performance obligations (PO)? 2

CC handset

cung cấp dịch vụ network

Step 3: Determine the transaction price

Monthly fee: 100

Months of subscription: 12

Total transaction price: 1,200

Step 4: Allocate the transaction price to the performance obligations

Stand-alone Allocated

Performance obligations Revenue Billing

selling price transaction price

Network services 960 914 76 100

Handset 300 286 286 0

Total 1,260 1,200

Step 5: Recognize revenue when (or as) an entity satisfies a performance obligation

PO #1: Network services (monthly plan) ghi nhận vào cuối mỗi tháng

PO #2: Handset ghi nhận tại thời điểm chuyển giao

Journal entries:

Revenue from handset:

Debit Contract assets 286 => Contract asset = entity’s right to consideration in exchange for goods or services

that the entity has transferred to a customer when that right is conditioned on

Credit Revenues from sales of -286 something other than the passage of time (for example, the entity’s future

goods (For Handset) performance).

0

Invoice - month 1:

100

Debit Trade receivables -24

Credit Contract assets

Credit Revenues from services (For -76

Network services) 0

Total revenue in 20X1:

Revenue from handset 286

Revenue from network services (6 months 457

Total: 743

www.IFRSbox.com Example 2: Contract modification IFRS 15 Revenue from Contracts with Customers

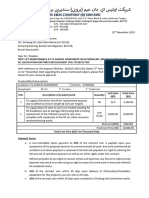

Ball PC, computer manufacturer, enters into contract with Forward University to deliver 300 computers for total price of CU 600 000 (CU 2 000 per computer).

Due to necessary preparation works, Forward University agrees to deliver computers in 3 separate deliveries during the forthcoming 3 months (100 computers in each

delivery). Forward University takes control over the computers at delivery.

After the first delivery is made, Forward University and Ball PC amend the contract. Ball PC will supply 200 additional computers (500 in total).

How should Ball PC account for the revenue from this contract if:

Scenario 1: The price for additional 200 computers was agreed at CU 388 000, being CU 1 940 per computer. Ball PC provided a volume discount of 3% for additional delivery

which reflects the normal volume discounts provided in similar contracts with other customers.(phản ánh mức chiết khấu khối lượng thông thường được cung cấp trong các

hợp đồng tương tự với các khách hàng khác.)

As of 31 December 20X1, Ball PC delivered 400 computers (300 as agreed initially and 100 under the contract amendment).

How shall Ball PC account for the contract modification under IFRS 15?

1.1 Assessing the type of contract modification 1. nghĩa vụ cụ thể là giao 300 máy tính cho đại học Forward

2.quyền lợi nhận được là 300*2000=600.000

3. được giao thành 3 đợt, mỗi đợt 100 máy tính

Máy tính bổ sung là khác biệt với máy tính được nêu trong hợp đồng cũ.

Giá đã chiết khấu 3% phản ánh giá giao dịch bình thường với khách hàng khác

, không áp dụng riêng cho Forward University.

--> lập một hợp đồng mới riêng biệt

1.2 Amount of revenue

Revenue from the original contract (contract #1):

Products delivered until 31 December 20X1 300

Originally agreed price: 2,000

Total revenue from contract #1: 600,000

Revenue from the additional contract (contract #2):

Products delivered until 31 December 20X1 100 Debit Contract assets 794,000

Agreed price: 1,940 Credit Revenues from sales -794,000

Total revenue from contract #2: 194,000 of goods 0

Total revenue in 20X1 from contracts #1 and #2: 794,000 CU

Advise how Ball PC recognizes revenue in 20X1 if:

Scenario 2: The price for additional 200 computers was agreed at CU 268 000, being CU 1 340 per computer. The price for additional computers was reduced significantly

due to the following:

- Ball PC provided a discount of 30% for additional delivery because it hopes for the future cooperation with Forward University (nothing even discussed yet). As a result,

initial price for additional products was set at CU 1 400 per computer.

- After initial delivery, Forward University discovered minor defects on 50 computers and as a result, Ball PC agreed to provide partial credit of CU 240 per computer. This

credit is incorporated into the new agreed price for additional 200 computers (resulting price of (1 400*200-240*50)/200 = 1 340/computer).

Note: contract amendment was made after the first delivery.

As of 31 December 20X1, Ball PC delivered 400 computers (300 as agreed initially and 100 under the contract amendment).

2.1 Assessing the type of contract modification

1. hoàn trả CU240/ 1 máy tính ch1. hoàn trả CU240/ 1 máy1. hoàn trả CU240/ 1 máy tính cho 50 máy tính đã chuyển giao bị sai sót

--> hàng hóa bổ sung không riên--> hàng hóa bổ sung khô--> hàng hóa bổ sung không riêng biệt với hợp đồng cũ

--> giữ hợp đồng cũ, lập 1 bảng p--> giữ hợp đồng cũ, lập --> giữ hợp đồng cũ, lập 1 bảng phụ lục điều chỉnh trực tiếp trên hợp đồng cũ

-->catch-up adjustment -->catch-up adjustment

2 .200 máy tính bổ sung giảm 30% giá bán

-> 200 máy tính mới khác với 300 máy tính hợp đồng cũ nhưng giá bán không phản ánh giá bán thông thường cho khách hàng bình thường

-->không phải giá bán độc lập, căn cứ dựa trên giá chiết khấu từ hợp đồng cũ

'-->hủy hợp đồng cũ, lập hợp đồng mới

2.2 Contract modification - type II

a) Revenue from the original contract - before modification:

Products delivered before contract modification 100

Originally agreed price: 2,000

Total revenue from contract #1: 200,000

b) Reduction of revenue for initial 50 computers ("catch-up")

N. of products with minor defects (initial delivery) 50

Reduction of price per computer 240

Total adjustment of revenue for initial delivery 12,000

Debit Contract assets 188,000

Total revenue before contract modification 188,000 Credit Revenues -188,000

from sales of goods) 0

2.2 Contract modification - type III

a) Total n. of products after modification:

Products from original contract not yet delivered before modification 200

Products agreed in modification 200

Total n. of products to be delivered after modification 400

b) Total consideration to allocate

Consideration from original contract not yet recognized 400,000

Consideration from contract modification 280,000 without the credit for defective products

Total 680,000

c) Total revenue after modification until 31 December 20X1:

Allocated price per 1 computer 1,700 (b/a)

N. of computers delivered after modification until 31/12/20X1

from original contract (300-100) 200

from modification 100 510,000

Debit Contract assets

Total n. of computers 300 -510,000

Credit Revenues from sales of goods)

Total revenue after modification until 31 December 20X1: 510,000 0

Total revenue in 20X4 698,000

www.IFRSbox.com Example 2: Contract modification IFRS 15 Revenue from Contracts with Customers

www.IFRSbox.com Example 5: Variable consideration with constraint IFRS 15 Revenue from Contracts with Customers

BigBooks Corp. is a company providing centralized accounting services for corporations. It enters into a 3-year contract with client A. The contract states:

- BigBooks will maintain all bookkeeping and document processing activities for client A, including preparing annual financial statements, monthly reports and tax returns. BigBooks

prepare monthly reports and annual financial statements only in conjunction with bookkeeping and data processing performed by BigBooks' team.

- The annual fee is CU 272 000 per year , consisting of: CU 250 000 per year for up to 50 000 accounting entries, CU 1 000 per month for monthly reports and and CU 10 000 per year for

annual financial statements and tax return. BigBooks is entitled to CU 5 per accounting entry in excess of 50 000 entries per year.

- BigBooks is entitled to an annual bonus payment of CU 12 000 if the average processing time of 1 batch of 1 000 documents is less than 1 week in the particular year.

Careful analysis of client's A activities and past accounting records show that in the first year, n. of accounting entries is assumed at 48 000, in the second year at 50 000 and in the third

year at 53 000.

Based on past work records and delivery times BigBooks Corp. assumes that the probability of processing time of 1 000 documents in less than 1 week is 30%.

Identify individual performance obligations in the contract and determine the transaction price.

1. Step #1 - Identify the contract with customer

- Hợp đồng được ký kết bởi BigBooks Corp. và khách hàng A

2. Step #2 - Identify individual performance obligations

- BigBooks sẽ duy trì tất cả các hoạt động ghi sổ và xử lý tài liệu cho khách hàng A,

- Lập báo cáo tài chính hàng năm và tờ khai thuế.

- Lập báo cáo hàng tháng

Không một báo cáo hàng tháng, báo cáo tài chính nào có thể

lập ra khi không có hoạt động ghi sổ và xử lý tài liệu

=> Không thể tách rời, riêng biệt

=> Hợp đồng một nghĩa vụ (Kết hợp cả ba hợp đồng trên)

3. Step #3 - Determine the transaction price

3.1 Fee for accounting records:

Year 1 - 48 000 entries 250,000

Year 2 - 50 000 entries 250,000

Year 3 - 53 000 entries (250 000+5*3 000) 265,000

Total - fee for accounting records: 765,000

3.2 Fee for monthly reports / annual financial statements

Monthly reports - Year 1-3 36,000 =(3*12)*1.000

Annual financial statements - Year 1-3 30,000 = 3*10.000

Total - fee for monthly reports / annual fin. statements 66,000

3.3 Performance bonus 0 or 12 000 Constraint limits the amount of revenue as BigBooks can recognize only 0 or

Total performance bonus (3*12 000) 36,000 12 000 per year (nothing in between).

Therefore, based on 30% probability, BigBooks limits the bonus to zero until it

Probability of processing 1 000 docs under 1 week 30% becomes highly probable that the average processing times fall below 1 week and

Expected value of variable consideration 10,800 BigBooks will be entitled to bonus.

After the effect of constraint 0

Total transaction price 831,000

How would the transaction price change if the contract states that BigBooks is entitled to an annual bonus amounting to CU 0-12 000 and its precise amount depends on

number of times when the batch processing time for 1 000 docs fell below 1 week during the year?

3.3 Performance bonus - variable amount 0 -12 000

Total performance bonus (3*12 000) 36,000 Here, the constraint does not limit the amount of bonus as BigBooks can get anything

Probability of processing 1 000 docs under 1 week 30% from 0 to 12 000 based on real performance in individual weeks.

Expected value of variable consideration 10,800 In case 1, with 30% probability, it was highly probable that BigBooks will not achieve

After the effect of constraint 10,800 overall annual target of average time below 1 week.

But in case 2, it is 30% probable that BigBooks will achieve individual average times

below 1 week during some individual weeks of the year.

www.IFRSbox.com Example 8: Recognition over time vs. at the point of time IFRS 15 Revenue from Contracts with Customers

RE Construct, property developer, builds a residential complex consisting of 50 apartments. Apartments have a similar size

and proportions - however, they can be customized to clients’ needs.

RE Construct enters into 2 contracts with 2 different clients (A and B). Both clients want to buy almost identical RE Construct, nhà phát triển bất động sản, xây dựng một khu dân cư phức hợp bao gồm 50 căn hộ. Các căn hộ có kích thước và tỷ lệ tương tự

apartments and agree with total price of CU 100 000 per apartment. The payment schedule is as follows: nhau - tuy nhiên, chúng có thể được tùy chỉnh theo nhu cầu của khách hàng.

- Upon the signature of a contract, clients pay deposit of CU 10 000 each. RE Construct ký kết 2 hợp đồng với 2 khách hàng khác nhau (A và B). Cả hai khách hàng đều muốn mua những căn hộ gần như giống hệt nhau

- Milestone: 1 year prior planned completion, RE Construct will deliver progress reports to clients and clients need to pay và đồng ý với tổng giá 100.000 CU / căn. Tiến độ thanh toán như sau:

CU 50 000 each.

- Completion: Upon the completion of the construction, the legal ownership to apartments is transferred to clients and - Sau khi ký hợp đồng, khách hàng đặt cọc mỗi người 10 000 CU.

they pay the remaining amount of CU 40 000 each. - Mốc quan trọng: Hoàn thành trước kế hoạch 1 năm, RE Construct sẽ gửi báo cáo tiến độ cho khách hàng và khách hàng cần thanh toán 50 000

Assumed period of construction is 2 years from the date of contract. RE Construct has the right to retain the payments CU cho mỗi công việc.

from any client in the situation when that client defaults on the contract before its completion. - Hoàn thiện: Sau khi hoàn thành việc xây dựng, quyền sở hữu hợp pháp đối với căn hộ được chuyển nhượng cho khách hàng và khách hàng

The contracts with clients A and B are NOT identical. Further contractual terms specify that: thanh toán số tiền còn lại là 40 000 CUỐN.

- No other specific terms in the contract with client A. Thời gian thi công giả định là 2 năm kể từ ngày ký hợp đồng. RE Construct có quyền giữ lại các khoản thanh toán từ bất kỳ khách hàng nào trong

- The contract with client B specifies that RE Construct cannot transfer or direct the apartment to another client and in trường hợp khách hàng đó mặc định hợp đồng trước khi hoàn thành.

return, the client B cannot terminate the contract. If the client B defaults on the contract before its completion, RE Các hợp đồng với khách hàng A và B KHÔNG giống nhau. Các điều khoản hợp đồng khác chỉ rõ rằng:

Construct has the right for all contractual price if RE Construct decides to complete the contract. - Không có điều khoản cụ thể nào khác trong hợp đồng với khách hàng A.

Total assumed cost of construction is CU 80 000, thereof CU 35 000 in the first year of construction and CU 45 000 in the

second year of construction. - Hợp đồng với khách hàng B quy định RE Construct không được chuyển nhượng, chuyển nhượng căn hộ cho khách hàng khác và đổi lại, khách

hàng B không được chấm dứt hợp đồng. Nếu khách hàng B mặc định hợp đồng trước khi hoàn thành, RE Construct có quyền đối với tất cả giá

When and how shall RE Construct recognize revenue from contract A and contract B? hợp đồng nếu RE Construct quyết định hoàn thành hợp đồng.

Tổng chi phí xây dựng giả định là 80 000 CU, trong đó CU 35 000 trong năm xây dựng đầu tiên và 45 000 CU trong năm xây dựng thứ hai.

RE Construct sẽ ghi nhận doanh thu từ hợp đồng A và hợp đồng B khi nào và như thế nào?

1. Contract A

1.1 Assessment

The third criterion for recognizing revenue over time is NOT met, for the following reasons:

1) An apartment can be easily sold / transferred to another client in the case of default.

2) RE Construct has NO enforceable right to payment for performance up to date (keeps only the progress payments - these might not be sufficient)

RE construct must recognize revenue from the contract A at the point of time.

1.2 Revenue recognition

Year 1

No revenue is recognized.

Year 2 - at delivery of apartment to a client

RE Construct will recognize revenue of CU 100 000 (full amount) at the point of delivery.

1.3 Journal entries

Upon the signature of contract - deposit received from client A

Debit Cash 10,000

Credit Contract liability -10,000

0

Milestone 1 - progress payment received from client A

Debit Cash 50,000

Credit Contract liability -50,000

0

Completion - final payment received from client A

Debit Cash 40,000

Credit Contract liability

-40,000

Delivery of apartment to the client A

Debit Contract liability 100,000

Credit Revenue -100,000

0

2. Contract B

2.1 Assessment

The third criterion for recognizing revenue over time IS met, due to following reasons:

1) RE Construct cannot direct the apartment for the alternative use (the contract with client B does not permit the transfer).

2) RE Construct has the enforceable right to payment for performance completed to date.

RE Construct recognizes revenue from the contract B over time.

2.2 Revenue recognition

Year 1

Revenue is recognized with reference to the progress towards completion. (theo tiến độ hoàn thành)

In this case, it is appropriate to measure progress towards completion by the input method.

Year Costs Progress Revenue

1 35,000 43.75% 43,750

2 45,000 56.25% 56,250

Total 80,000 100.00% 100,000

2.3 Journal entries

Upon the signature of contract - deposit received from client B

Debit Cash 10,000

Credit Contract liability -10,000

0

Milestone 1 - progress payment received from client B

Debit Cash 50,000

Credit Contract liability -50,000

0

Year 1 - revenue recognized from contract B

Debit Contract liability 43,750

Credit Revenue from contract B -43,750

0

Completion - final payment received from client B

Debit Cash 40,000

Credit Contract liability -40,000

0

Delivery of apartment to the client B + revenue in the year 2

Debit Contract liability 56,250

Credit Revenue -56,250

0

You might also like

- Robots Fail Too - A Case StudyDocument3 pagesRobots Fail Too - A Case StudyShaharyar Khan100% (4)

- Rise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Document24 pagesRise of Digital Banks in Indonesia - MW - March 2021 - Updated May 2021Reisan100% (5)

- ACC110 P2 Q2 Answer - Docx 2Document13 pagesACC110 P2 Q2 Answer - Docx 2Sherwin SarzueloNo ratings yet

- Topic 11 - Revenue From Contract With Customers (IFRS 15) - SVDocument56 pagesTopic 11 - Revenue From Contract With Customers (IFRS 15) - SVHONG NGUYEN THI KIMNo ratings yet

- Ifrs15 Illustrative ExamplesDocument4 pagesIfrs15 Illustrative ExamplesPrabir Kumer Roy100% (1)

- Seafile Business Edition WhitepaperDocument7 pagesSeafile Business Edition WhitepaperElena SterpuNo ratings yet

- G O Ms No 571 PDFDocument46 pagesG O Ms No 571 PDFanilkc9100% (2)

- IFRS15 Examples (Students)Document27 pagesIFRS15 Examples (Students)quyetduong.31211022149No ratings yet

- Example 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyDocument13 pagesExample 1 Illustration of 5-Step Model (Telecom Contract) Example 2 Contract Modification Example 3 Explicit vs. Implicit Performance Obligations Example 5 Variable Consideration With ContingencyHồ Đan ThụcNo ratings yet

- N. Title Location: List of Examples IFRS 15 Revenue From Contracts With CustomersDocument27 pagesN. Title Location: List of Examples IFRS 15 Revenue From Contracts With CustomersHồ Đan ThụcNo ratings yet

- Ifrs 15: Revenue From Contract With CustomersDocument42 pagesIfrs 15: Revenue From Contract With CustomersHanh CaoNo ratings yet

- IFRS15 5-Stepmodel ExampleDocument4 pagesIFRS15 5-Stepmodel ExampleMyo NaingNo ratings yet

- Example 1: 5-Step Model: Step 1: Identify The Contract With A CustomerDocument4 pagesExample 1: 5-Step Model: Step 1: Identify The Contract With A CustomerJhon SudiarmanNo ratings yet

- IFRS15 5stepmodel ExampleDocument4 pagesIFRS15 5stepmodel ExampleAnees KhanNo ratings yet

- CACC031 Mock Test 1 SSDocument11 pagesCACC031 Mock Test 1 SSMartia NongNo ratings yet

- Chapter 7 RevenuesDocument17 pagesChapter 7 RevenuesTiya AmuNo ratings yet

- ACC 311 Module 4 - PFRS 15 Revenue From Contracts With Customers 1Document19 pagesACC 311 Module 4 - PFRS 15 Revenue From Contracts With Customers 1Casey MagpileNo ratings yet

- Ind AS 115Document21 pagesInd AS 115Vrinda KNo ratings yet

- Chapter 8 FranchisorDocument11 pagesChapter 8 FranchisorNiño Rey LopezNo ratings yet

- Topic 11 - Revenue - IFRS 15 - v2022Document31 pagesTopic 11 - Revenue - IFRS 15 - v2022trangdoan.31221023445No ratings yet

- IFRS 15 - Revenue From Contract With CustomersDocument33 pagesIFRS 15 - Revenue From Contract With Customersfanhungchangcananh284No ratings yet

- F7 - C7 RevenueDocument76 pagesF7 - C7 RevenueNgô Thành DanhNo ratings yet

- Topic 11 - XH-IFRS 15 - VN-Revenue From Contract With CustomersDocument31 pagesTopic 11 - XH-IFRS 15 - VN-Revenue From Contract With CustomersThanh NgânNo ratings yet

- PDF - Revenue From Contract With Customers (IFRS 15)Document27 pagesPDF - Revenue From Contract With Customers (IFRS 15)Tram NguyenNo ratings yet

- Chapter 8 Franchise AccountingDocument11 pagesChapter 8 Franchise AccountingFaithful FighterNo ratings yet

- Illustrations of IFRS 15 Revenue With ExamplesDocument35 pagesIllustrations of IFRS 15 Revenue With ExamplesMohammad Monir uz ZamanNo ratings yet

- F7 - C7 Revenue FullDocument83 pagesF7 - C7 Revenue FullK59 Vo Doan Hoang AnhNo ratings yet

- IFRS 15 (CAF5 S18) : Part (A) (05) Part (B)Document1 pageIFRS 15 (CAF5 S18) : Part (A) (05) Part (B)amitsinghslideshareNo ratings yet

- IA3 - Mid-Term Examination PDFDocument3 pagesIA3 - Mid-Term Examination PDFAilene Quinto75% (4)

- Sol. Man. Chapter 8 Acctg For Franchise Operations Franchisor 2021 EditionDocument11 pagesSol. Man. Chapter 8 Acctg For Franchise Operations Franchisor 2021 EditionkoyNo ratings yet

- Chapter6 ReVeNueDocument9 pagesChapter6 ReVeNueOktober FestNo ratings yet

- 5TH.B Provisions, Contingent Liabilities and Contingent AssetsDocument4 pages5TH.B Provisions, Contingent Liabilities and Contingent AssetsAnthony DyNo ratings yet

- Contract Costing 1 Day Revision NotesDocument12 pagesContract Costing 1 Day Revision NotesSanskar VarshneyNo ratings yet

- Accounting For EngineersDocument31 pagesAccounting For EngineerssuniljayaNo ratings yet

- Problem 3 Consignment SalesDocument7 pagesProblem 3 Consignment Salesskilled legilimence0% (1)

- 20 - Ind As 115 (R)Document82 pages20 - Ind As 115 (R)S Bharhath kumarNo ratings yet

- Step 1: Identify The Contract With The Customer: AcctranDocument8 pagesStep 1: Identify The Contract With The Customer: AcctranPrecy Joy TrimidalNo ratings yet

- CONTRACT COSTING - NOTES (UPDATEDMFRS15) EditDocument10 pagesCONTRACT COSTING - NOTES (UPDATEDMFRS15) EditnarinaesterNo ratings yet

- Quiz 3 QuestionsDocument7 pagesQuiz 3 QuestionsVernnNo ratings yet

- Accounting For Corporations: ACT B861FDocument66 pagesAccounting For Corporations: ACT B861FCalvin MaNo ratings yet

- Ppe 1Document12 pagesPpe 1Jerome_JadeNo ratings yet

- Contract CostingDocument6 pagesContract Costingfathima fidaNo ratings yet

- Ifrs 15Document9 pagesIfrs 15Nguyễn Thị Mỹ HòaNo ratings yet

- Entity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Document12 pagesEntity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Shohag RaihanNo ratings yet

- IFRS 15 Revenue From Contracts With CustomersDocument24 pagesIFRS 15 Revenue From Contracts With CustomersAbdul RehmanNo ratings yet

- Notes WFDocument5 pagesNotes WFSyahira AmranNo ratings yet

- Chapter 8 - Teacher's Manual - Afar Part 1Document7 pagesChapter 8 - Teacher's Manual - Afar Part 1Angelic100% (3)

- Solutions To Prob 4 - Multiple Choice - Accounting For Franchise Operations - FranchisorDocument3 pagesSolutions To Prob 4 - Multiple Choice - Accounting For Franchise Operations - Franchisormhikeedelantar100% (6)

- Topic 11 - Revenue From Contract With Customers (IFRS 15)Document24 pagesTopic 11 - Revenue From Contract With Customers (IFRS 15)ANH LÊ THỊ QUÝNo ratings yet

- Jeevansathi AgreementDocument7 pagesJeevansathi AgreementSubham YtNo ratings yet

- 51 Avenue CSB Belt Replacement DiscountDocument3 pages51 Avenue CSB Belt Replacement DiscountAngelyna Vera JudeNo ratings yet

- Chapter 3 - Revenue From Contracts With CustomersDocument7 pagesChapter 3 - Revenue From Contracts With CustomersXienaNo ratings yet

- RFQ 3002 Ceiling AVD Rev.B1Document34 pagesRFQ 3002 Ceiling AVD Rev.B1Bangkit SamosirNo ratings yet

- Project TermsDocument3 pagesProject TermsHeather BarberNo ratings yet

- Construction ContractsDocument4 pagesConstruction ContractsJi YuNo ratings yet

- FMA Distance Assigment 2019Document7 pagesFMA Distance Assigment 2019Agat100% (3)

- Contract CostingDocument17 pagesContract CostingHarshit DaveNo ratings yet

- AffDocument69 pagesAffdishanialahakoonNo ratings yet

- Compra BFX Invoice 2001134755 - MauricioDocument2 pagesCompra BFX Invoice 2001134755 - MauricioIvan Leonardo Sosa MunevarNo ratings yet

- AS 7 Construction ContractDocument7 pagesAS 7 Construction Contractakshat beriwalaNo ratings yet

- Chapter 3 Prob 3 4 Key AnswerDocument7 pagesChapter 3 Prob 3 4 Key AnswerShang LajerbaNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Online GamesDocument41 pagesOnline GamesJessicaGanibanNo ratings yet

- 6se7087 6BH70 PDFDocument74 pages6se7087 6BH70 PDFAmir SayahanNo ratings yet

- Green Synthesis and Characterization of Carica Papaya Leaf Extract Coated Silver NanoparticlesDocument8 pagesGreen Synthesis and Characterization of Carica Papaya Leaf Extract Coated Silver Nanoparticlesmuhammad attiqueNo ratings yet

- International Human Resource Management 4thDocument547 pagesInternational Human Resource Management 4th722h0159No ratings yet

- Unit 1: Benefits of XML 1.structured DocumentDocument26 pagesUnit 1: Benefits of XML 1.structured Document923 Rishi kumar G GNo ratings yet

- Assessment of Nutritional Status of Children Under Five Years of Age, Pregnant Women, and Lactating Women Living in Relief Camps After The Tsunami in Sri LankaDocument9 pagesAssessment of Nutritional Status of Children Under Five Years of Age, Pregnant Women, and Lactating Women Living in Relief Camps After The Tsunami in Sri LankaMUHAMMAD SHAHAZAD MANZOORNo ratings yet

- Members of Greater Chennai Corporation TN (Tamil Nadu)Document11 pagesMembers of Greater Chennai Corporation TN (Tamil Nadu)priya selvarajNo ratings yet

- C-1269 - 97 (2012) - Standard Practice Foradjusting The Operational Sensitivity Setting of In-PlantWalk-Through Metal DetectorsDocument6 pagesC-1269 - 97 (2012) - Standard Practice Foradjusting The Operational Sensitivity Setting of In-PlantWalk-Through Metal DetectorsMahmut KILIÇNo ratings yet

- Hino 500 Series Brochure NewDocument6 pagesHino 500 Series Brochure Newtrong phamNo ratings yet

- IB AssignmentDocument13 pagesIB AssignmentTang Wei PhangNo ratings yet

- Solucionado - Internal Boot Drive Replacement - Dell CommunityDocument8 pagesSolucionado - Internal Boot Drive Replacement - Dell CommunitywalkerNo ratings yet

- Azh Ho ChecklistDocument7 pagesAzh Ho ChecklistNik Hanisah Zuraidi AfandiNo ratings yet

- ADBOND® QUIKSET™ Concentrate (SDS)Document6 pagesADBOND® QUIKSET™ Concentrate (SDS)Alexis GonzalezNo ratings yet

- Annual Report Powerpoint TemplateDocument40 pagesAnnual Report Powerpoint TemplateTeam Advertising HARDIANNo ratings yet

- Side Effects of General AnesthesiaDocument7 pagesSide Effects of General AnesthesiaPADAYON MEDISINANo ratings yet

- Astm A488Document1 pageAstm A488Mohamed FaragNo ratings yet

- Questin and ProblesDocument3 pagesQuestin and Problesikran caaqilNo ratings yet

- Chapter 4Document14 pagesChapter 4Hamed NikbakhtNo ratings yet

- Physics Review Prob PDFDocument5 pagesPhysics Review Prob PDFBryan YuNo ratings yet

- Impacting Digital Payments in India KPMG ReportDocument32 pagesImpacting Digital Payments in India KPMG Reportsaty16No ratings yet

- Stress Management Among Bank Employees: AbstractDocument10 pagesStress Management Among Bank Employees: AbstractJoy SathaNo ratings yet

- DSD Till 18.01.23 PDFDocument11 pagesDSD Till 18.01.23 PDFAyushiNo ratings yet

- Tài liệu ôn tập tiếng anh 4Document7 pagesTài liệu ôn tập tiếng anh 4Ngọc AmiiNo ratings yet

- CacnionesDocument56 pagesCacnionesLucia BermejoNo ratings yet

- SAP S:4HANA Central Finance (CFIN) - Configuration - SAP Consultant in BangladeshDocument16 pagesSAP S:4HANA Central Finance (CFIN) - Configuration - SAP Consultant in BangladeshRohan Anand100% (2)

- Development of A Rock Mass Characteristics Model For TBM Penetration Rate PredictionDocument16 pagesDevelopment of A Rock Mass Characteristics Model For TBM Penetration Rate PredictionnnsdellNo ratings yet