Professional Documents

Culture Documents

Entity

Entity

Uploaded by

Sto Kanigiri0 ratings0% found this document useful (0 votes)

6 views1 pageEntity

Original Title

entity

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEntity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageEntity

Entity

Uploaded by

Sto KanigiriEntity

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

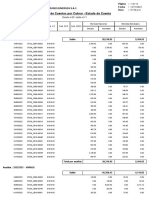

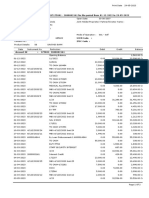

Pensioner Income Tax Calculation Statement for the FY 2022-2023

CFMS ID : 80230872 Name : V.MARIYAMMAL DOB :

Age : 000 TAN No : HYDS18339G PAN No :

Bank ID : SBIN0000959 Acc No : 34134904955 Type : F - Family Pension

DDO : 07080702001-S.T.O.KANIGIRI PPO : 5718-OG-

STO : 7706-STO - Kanigiri

Pension Category : 99 - ALL INDIA SERVICES

Month Gross Amount VR-Amount IT-Recovered VR-IT Amount

03/2022 7,298.00 0.00 0.00 0.00

04/2022 0.00 0.00 0.00 0.00

05/2022 0.00 0.00 0.00 0.00

06/2022 0.00 0.00 0.00 0.00

07/2022 0.00 0.00 0.00 0.00

08/2022 0.00 0.00 0.00 0.00

09/2022 0.00 0.00 0.00 0.00

10/2022 0.00 0.00 0.00 0.00

11/2022 0.00 0.00 0.00 0.00

12/2022 0.00 0.00 0.00 0.00

01/2023 0.00 0.00 0.00 0.00

02/2023 0.00 0.00 0.00 0.00

Total 7,298.00 0.00 0.00 0.00

Total DR : 0.00 Gross Amount : 87,576.00

House Rent Exmt. : 0.00 STD Deduction : 50,000.00

Gross Total Income : 37,576.00 Deduction under Section 80-C : 0.00

Net Taxable Income : 37,580.00 IT on Total Income : 0.00

Health and Education Cess : 0.00 Tax Payable : 0.00

Total Tax Deducted : 0.00 Tax to be paid : 0.00

Signature of the Treasury Officer

Note:- Out of the Total Income / Gross Amount Shown above, two Dearness relief installment

bills amounting to Rupees : 0.00/- shown against total DR column is not paid as on 31-03-2021

which may be brought to the notice of auditor at the time of filing the Income tax return and

carried forward to FY 2021-2022.

You might also like

- Kathleen Jasper - Praxis - PLT - 5622-K - 6Document284 pagesKathleen Jasper - Praxis - PLT - 5622-K - 6Jo Peng100% (1)

- Girdhar51 1603693312542 PDFDocument2 pagesGirdhar51 1603693312542 PDFjignesh parmarNo ratings yet

- Afro-Asian LiteratureDocument6 pagesAfro-Asian LiteratureQuennie57% (7)

- 17.1 Diesel - Hydro PowerDocument11 pages17.1 Diesel - Hydro PowerJim Lester AmodiaNo ratings yet

- The World Is An AppleDocument8 pagesThe World Is An AppleKeiKoNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 28/07/2021Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 28/07/2021SALES AMBATTUR - KUN VWNo ratings yet

- An Evaluation of The Efficiency of Loan Collection Policies and Procedures Among Selected MultiDocument7 pagesAn Evaluation of The Efficiency of Loan Collection Policies and Procedures Among Selected MultiSanta Dela Cruz NaluzNo ratings yet

- Bank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaDocument2 pagesBank Name: Medak DCC Bank LTD Branch Name: Siddipet Reportdate: 09-06-2022 Userid: 170601 Selection CriteriaPonnam VenkateshamNo ratings yet

- P4I5PHF2141826 Repayment ReportDocument4 pagesP4I5PHF2141826 Repayment ReportAartiNo ratings yet

- PF Statement For The Year - 2022-2023: For, Delphi-Tvs Diesel Systems Employees' Provident FundDocument1 pagePF Statement For The Year - 2022-2023: For, Delphi-Tvs Diesel Systems Employees' Provident FundsrinivasankNo ratings yet

- Adhe Nur AfdiDocument1 pageAdhe Nur Afdiel fitriana susantiNo ratings yet

- Contoh Angsuran LeasingDocument2 pagesContoh Angsuran LeasingBoston Trikora MahardikaNo ratings yet

- StatmentDocument2 pagesStatmentRatan SinghNo ratings yet

- Engkus Kusnadi - AmorDocument1 pageEngkus Kusnadi - AmorEngkus KusnadiNo ratings yet

- Repayment Schedule - 1707056150645Document4 pagesRepayment Schedule - 1707056150645mayank900990No ratings yet

- 403SPFGP670479 RPSDocument5 pages403SPFGP670479 RPSAfzal RNo ratings yet

- DownloadDocument1 pageDownloadmalcolmmarkeshlyNo ratings yet

- Jmo RSJHTDocument2 pagesJmo RSJHTGani Damara Adi SaputraNo ratings yet

- Cuentas Por Cobrar Al 12.11.2022Document12 pagesCuentas Por Cobrar Al 12.11.2022Javier RamosNo ratings yet

- Agreement Cardview 04762121002689 IndraDocument1 pageAgreement Cardview 04762121002689 IndrasalmanNo ratings yet

- 1676983262212PL PDFDocument2 pages1676983262212PL PDFAnuj ChaudharyNo ratings yet

- Repayment ScheduleDocument3 pagesRepayment ScheduleAarti ThdfcNo ratings yet

- View Customer CardDocument1 pageView Customer CardRocky SapuletteNo ratings yet

- AmorDocument1 pageAmorsyamsul hidayatNo ratings yet

- Darryl Janitra Adigraha - AmortisasiDocument3 pagesDarryl Janitra Adigraha - AmortisasiAry Samsul MangadilNo ratings yet

- rptExAnnualSlip WoRefLoanDocument1 pagerptExAnnualSlip WoRefLoanumesh chitrodaNo ratings yet

- NullDocument2 pagesNullKishore NithyaNo ratings yet

- 1699516930152-4622308668 Dwi Junita Elfikasari AmortisasiDocument3 pages1699516930152-4622308668 Dwi Junita Elfikasari AmortisasiDeny SubrotoNo ratings yet

- 160000818390Document2 pages160000818390Ashok FerraoNo ratings yet

- Scadentar ImprumutDocument5 pagesScadentar ImprumutNidelea mirelNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 02/08/2021Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 02/08/2021SALES AMBATTUR - KUN VWNo ratings yet

- GPF Statement For The Year 2021-22: O/o The Pr. Accountant General (A&E) - II, Madhya Pradesh, GwaliorDocument1 pageGPF Statement For The Year 2021-22: O/o The Pr. Accountant General (A&E) - II, Madhya Pradesh, GwaliorSHIVGOPAL KULHADENo ratings yet

- HDFC Bank LTDDocument5 pagesHDFC Bank LTDutkarshlegal96No ratings yet

- Ua STMT 0012052802901Document3 pagesUa STMT 0012052802901Gayan HewageNo ratings yet

- Absa - Statement BwinaDocument1 pageAbsa - Statement BwinaAllan NgetichNo ratings yet

- TN3004TW0093130Document2 pagesTN3004TW0093130Dhanaseelan PeriyasamyNo ratings yet

- Soa TN3004CD0230097Document2 pagesSoa TN3004CD0230097SaravananNo ratings yet

- TWR 020507016893Document6 pagesTWR 020507016893adimaygupta1123No ratings yet

- 09-2022 - NKDDocument5 pages09-2022 - NKDsrinivasNo ratings yet

- Customer Card 8051011910338Document2 pagesCustomer Card 8051011910338Vincent AnarkiNo ratings yet

- Aged - 2022-07-25T135817.589Document2 pagesAged - 2022-07-25T135817.589Meli GarzonNo ratings yet

- RPS 1699239810161Document4 pagesRPS 1699239810161Shashï SingħNo ratings yet

- Template BS QueryDocument3 pagesTemplate BS QueryllrafaellNo ratings yet

- Tmcgpayaug2023 Gpind 0Document1 pageTmcgpayaug2023 Gpind 0sai kiranNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 08/05/2020Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 08/05/2020K Jayakumar KandasamyNo ratings yet

- Due Date NO Amount Paid Amount Waived Amount Outstanding Principal Paid Date Principal LC LC Paid LC Waived 1,692,734.69 6,413,265.31Document1 pageDue Date NO Amount Paid Amount Waived Amount Outstanding Principal Paid Date Principal LC LC Paid LC Waived 1,692,734.69 6,413,265.31Kiararesty MeliantyNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 11/05/2020Document3 pagesHDFC Bank LTD Repayment Schedule: Date: 11/05/2020K Jayakumar KandasamyNo ratings yet

- Amour 18 BulanDocument1 pageAmour 18 BulanNabila SekarNo ratings yet

- HDFC Bank LTDDocument3 pagesHDFC Bank LTDapocryphonraNo ratings yet

- View Agreement CardDocument1 pageView Agreement CardOka ArtawanNo ratings yet

- UntitledDocument1 pageUntitledYogesh SureshNo ratings yet

- STMT of Ac F12Document2 pagesSTMT of Ac F12Asco Bank ArakkulamNo ratings yet

- RPS 1713192423106Document3 pagesRPS 1713192423106vpoorna3No ratings yet

- Reporting ServiceDocument3 pagesReporting Servicelincolntupa3No ratings yet

- TWR028206828157 - Soa MDocument5 pagesTWR028206828157 - Soa Madimaygupta1123No ratings yet

- Member Statement - 2022: Your Personal DetailsDocument2 pagesMember Statement - 2022: Your Personal Detailschii1000jhayNo ratings yet

- Teleperformance Global Business Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Business Private Limited: Full and Final Settlement - December 2023touheedahmed8269No ratings yet

- TWR 028206762182Document5 pagesTWR 028206762182adimaygupta1123No ratings yet

- ReportDocument1 pageReportmarty65432164No ratings yet

- Informe General de Facturación-20210505183014Document3 pagesInforme General de Facturación-20210505183014omar perezNo ratings yet

- Raswan - 5132216948Document1 pageRaswan - 5132216948aghosuryana525No ratings yet

- Exim Enq Ibb STMT-7Document6 pagesExim Enq Ibb STMT-7মাহবুব উল আলমNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- Sarwoto - 023614Document5 pagesSarwoto - 023614Mardi AntoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Semarang BanjarmasinDocument2 pagesSemarang BanjarmasinChristian ReskyNo ratings yet

- SCALP Handout 021Document3 pagesSCALP Handout 021GAMING ZELVNo ratings yet

- ProjectDocument2 pagesProjectYash YashNo ratings yet

- Model Agreement For An Assured Shorthold Tenancy and Accompanying GuidanceDocument50 pagesModel Agreement For An Assured Shorthold Tenancy and Accompanying GuidancesokrisbaNo ratings yet

- Salesforce QB - Internal FinalDocument6 pagesSalesforce QB - Internal Final20kd1a05c1No ratings yet

- Martinez Final ResearchDocument15 pagesMartinez Final ResearchFerdinand MartinezNo ratings yet

- Luis Alfredo Davila-Barrera, A074 583 018 (BIA Nov. 23, 2016)Document10 pagesLuis Alfredo Davila-Barrera, A074 583 018 (BIA Nov. 23, 2016)Immigrant & Refugee Appellate Center, LLC0% (1)

- Banking ProjectDocument24 pagesBanking ProjectHaseeb ParachaNo ratings yet

- Plato Idea of JusticeDocument2 pagesPlato Idea of JusticeZeeshanmirzaaNo ratings yet

- Assignment 1 - Integrated Marketing Communications: Nescafe'Document6 pagesAssignment 1 - Integrated Marketing Communications: Nescafe'Suman BandyopadhyayNo ratings yet

- Beyoncé and WaterDocument8 pagesBeyoncé and WaterkgazooNo ratings yet

- What's The Difference Between ESL, EFL, ESOL, ELL, and ESPDocument4 pagesWhat's The Difference Between ESL, EFL, ESOL, ELL, and ESPdavidcairobalzaNo ratings yet

- List of Members of Rajya SabhaDocument14 pagesList of Members of Rajya SabhaNo nameNo ratings yet

- A Comparative Study of Two Naval FamilieDocument19 pagesA Comparative Study of Two Naval FamilieSreejith RajaNo ratings yet

- Nursing Issues PPT Nurs 6900Document11 pagesNursing Issues PPT Nurs 6900api-676173784No ratings yet

- Language and Social Media: Joan Nicole P. BalugayDocument6 pagesLanguage and Social Media: Joan Nicole P. BalugayBalongNo ratings yet

- Fixed Asset and Depreciation ScheduleDocument5 pagesFixed Asset and Depreciation ScheduleDarkchild HeavensNo ratings yet

- Factories Act Cap 126 L F N 1990 Cap f1 L F N 2004Document121 pagesFactories Act Cap 126 L F N 1990 Cap f1 L F N 2004Empere Oyinkeprebi RobertNo ratings yet

- TibagDocument48 pagesTibagAngelika CalingasanNo ratings yet

- Commercial Laws of KuwaitDocument7 pagesCommercial Laws of KuwaitAssignmentLab.comNo ratings yet

- 6 10 RespectDocument22 pages6 10 Respectbtec jNo ratings yet

- Major Biomes of The World WSDocument17 pagesMajor Biomes of The World WShorne.legaci6826No ratings yet

- NSTP Community Service Activity PlanDocument3 pagesNSTP Community Service Activity PlanLoydifer ..No ratings yet

- Suresh PHP ResumeDocument4 pagesSuresh PHP Resumesuresh_mcaNo ratings yet

- Ang Pera Na Hindi BitinDocument15 pagesAng Pera Na Hindi BitinJason Tubilag100% (3)