Professional Documents

Culture Documents

ACTIVITY4-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

Uploaded by

Hayna Marie Aguilar0 ratings0% found this document useful (0 votes)

5 views4 pagesOriginal Title

ACTIVITY4-Conceptual Framework_Aguilar, Hayna Marie_BSA1B

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views4 pagesACTIVITY4-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

Uploaded by

Hayna Marie AguilarCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

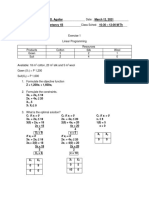

Acctng 2 – Conceptual Framework & Accounting Standards

Activity #4 – Conceptual Framework and Theoretical Structure of FAR 1

Name: Hayna Marie D. Aguilar Program: _BSA-1B__ Date: _March 16, 2021___

Exercise 1 - Discussion Questions:

1. What is the function and primary focus of financial accounting?

Financial accounting communicate and provide information about the economic

effects of accounting transaction and other events on a business entity that is useful to

users in making decisions relating to providing resources to these entity.

2. Discuss what is meant by: The benefits of accounting information must exceed the

costs.

The benefits of the accounting information must exceed the cost, meaning, in

providing financial information, the business entity must give more satisfaction in

providing information to the users under benefits, such as; diverse group of investors and

creditors and by customers because they are assured a steady supply of goods and

services and by the preparer itself, because they use it for internal decision making. These

are the users that has a great impact and a great help to the business entity. The business

must provide relevance and reliable financial information to these users for the continuity

of the business and the relationship with the suppliers and investors.

3. List and explain the main reasons that a conceptual framework of accounting is

important.

Conceptual framework is important because it provides a strong theoretical

foundation and allows for the systematic adaptation of accounting standards for a

changing business environment.

Conceptual framework plays a vital role in the development of new standards and

in the revision of previously issued standards. It guide the Board in developing

accounting and reporting standards.

Help preparers develop consistent accounting principles where there is no

standard in place and to assist all parties to understand and interpret the standards.

4. One objective of financial reporting is understandability. Understandable to whom?

The accounting or financial information should be understandable to the users

who have a reasonable knowledge of business and economic activities and who are

willing to study the information with reasonable diligence. It cannot be understandable to

the users who does not have the interest of reading and understand the information or

those without basic knowledge how business and corporate environment operates.

5. Distinguish between the qualities of relevance and reliability.

Relevance is a qualitative characteristics of bearing directly on the outcome of a

decision. A relevant financial information is capable of making a difference in the

decisions made by users. It results in information that is meaningful and useful to those

who need to know something about a certain organization.

Reliability is a qualitative characteristics of being representationally faithful,

variable, and neutral. It is financial information that is able to be trusted to use or provide

what is needed that is likely to be true or correct and information that is faithfully

presented to the maximum extent possible, complete, neutral and free from error.

6. Does reliability imply absolute accuracy?

Reliability is free from error but it doesn’t mean that it is absolute accurate or

have total freedom because a number of financial reporting measures involve estimates of

various types that incorporate management’s judgment. For instance, estimation, we have

estimated amount in accounting.

7. What are the components of relevant information? What are the components of

reliable information?

Relevant financial information is capable of making a differences in the decisions

if it has:

Predictable Value – if the financial information can be used as an input to

processes employed by users to predict future outcomes.

Confirmatory Value – if the financial information provides feedback about

previous evaluations, if it confirm or change. It helps users to confirm or correct

earlier predictions.

Relationship of Materiality to Relevance – it is the practical boundary or

constraint to achieving desired qualitative characteristics of relevance on the type

of information provided.

Reliable information is also called as faithful representation, it means that the

numbers and descriptions match what really existed or happened.

Completeness – means that all information necessary for a user to understand the

economic activity or a phenomenon must be depicted, including all necessary

description and explanations.

Neutrality – means that an enterprise cannot select information to favor one set

of interested parties over another.

Free from Errors – when an information item is free from error, it will be a more

accurate representation of a financial item. Faithful representation or reliability,

however, does not imply total freedom from error nor perfectly accurate in all

respect.

Measurement uncertainly – it does not prevent information from being useful.

8. What is meant by the term materiality in financial reporting?

Materiality in accounting context, if a more costly way of providing information

is not expected to have a material effect on decisions made by those using the

information, the less costly method may be acceptable. Materiality is an entity specific

reporting of relevance based on the nature or magnitude, or both of the items to which

information relates in the context of an individual entity’s financial report.

9. What is meant by the term “qualitative characteristics of accounting information”?

Qualitative characteristics of accounting information is the standards for judging

the information that accountants give to decisions makers. These are the characteristics of

financial information that is based on its quality, in order for this information to become

useful, it must both relevant and provide a faithful representation. Relevant and faithful

representation information are the fundamental qualitative characteristics of useful

financial information and the guiding concepts that apply throughout the revised

conceptual framework.

10. Under what conditions should an item be recognized in the financial statements?

The financial statement are normally organized and prepared on the assumption

that an enterprise is a going concern and will continue in operation for the foreseeable

future. However, it is assumed that the entity has neither the intention nor the need to

enter liquidation or to cease trading, if such an intention or need exists, the financial

statement may have to be prepared on a different basis and, if so, the basis used is

disclosed.

Exercise 2 - Fill in the Blanks with Correct Answers:

In the blanks provided to the left of the following eight statements, enter the letter of the

concept most closely associated with the statement.

Concepts

A. Reliability C. Comparability (includes consistency)

B. Relevance D. Some other concept

______C_____1. Improves comparisons of financial statements of successive reporting periods.

______A_____2. Financial statements are audited by an independent CPA.

______C_____3. A quality requiring that data should be comparable among entities and time.

______B_____4. The capacity of information to make a difference in decisions by helping users

make reasonable predictions about the future.

______D_____5. Acquisition cost is the proper starting point for asset valuation.

______A_____6. A quality that states accounting information should possess representational

faithfulness, verifiability and neutrality.

______B_____7. The primary stock exchanges, such as the Philippine Stock Exchange, will not

list the shares of stock of a corporation that does not provide independently audited financial

statements, or that has major exceptions specified in the opinion of the independent auditor.

______C_____8. A company cannot change to or from alternatively acceptable accounting

methods (such as FIFO, Weighted Average, etc.), each reporting period.

Exercise 3 – Matching Type:

List below are several terms and phrases associated with the IASB’s conceptual framework. Pair

each item from List A (by letter) with the item from list B that is most appropriately associated

with it.

List A

_______O______ 1. Predictive value

_______H______ 2. Relevance

_______G______ 3. Timeliness

_______A______ 4. Distribution to owners

_______J_______5. Confirmatory Value

_______P______ 6. Reliability

_______N______7. Gain

_______F______ 8. Faithfulness Representation

_______K______9. Comprehensive Income

_______E_____10. Materiality

_______C_____11. Comparability

_______M_____12. Neutrality

_______L_____13. Recognition

_______D_____14. Consistency

_______B_____15. Cost effectiveness

_______I_____16. Verifiability

List B

a. Decrease in equity resulting transfers to owners

b. Requires considerations of the costs and value of information

c. Important for making interfirm comparisons comparisons.

d. Applying the same practice overtime.

e. Along with relevance, a primary decision-specific quality

f. Agreement between a measure and the phenomenon it purports to represent.

g. Information is available prior to the decision.

h. Pertinent to the decision at hand.

i. Implies consensus among different measures.

j. Information confirms expectations.

k. The change in equity from non-owner transactions.

l. The process of admitting information into financial statements.

m. Accounting information should not in favor a particular group

n. Results if an asset is sold for more than its book value.

o. Information is useful in predicting the future.

p. Concerns the relative size of an item and its effect on decisions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Your Electricity Bill at A Glance: Total Due 198.32Document2 pagesYour Electricity Bill at A Glance: Total Due 198.32rodrigo batistaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jimelyn Self-Service LaundryDocument2 pagesJimelyn Self-Service LaundryHayna Marie AguilarNo ratings yet

- Employee Safety Training Matrix Template ExcelDocument79 pagesEmployee Safety Training Matrix Template Excelشاز إياسNo ratings yet

- Virgin Galactic Profile & Performance Business ReportDocument10 pagesVirgin Galactic Profile & Performance Business ReportLoic PitoisNo ratings yet

- CFAS Final Exam QuestionsDocument7 pagesCFAS Final Exam QuestionsHayna Marie AguilarNo ratings yet

- AEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Document3 pagesAEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Hayna Marie AguilarNo ratings yet

- Exercises Exercise 1-Accounting Information Systems: An OverviewDocument9 pagesExercises Exercise 1-Accounting Information Systems: An OverviewHayna Marie AguilarNo ratings yet

- Lesson Operations Management and Operations Function: ObjectivesDocument8 pagesLesson Operations Management and Operations Function: ObjectivesHayna Marie AguilarNo ratings yet

- CFAS Final ExamDocument4 pagesCFAS Final ExamHayna Marie AguilarNo ratings yet

- Research Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanDocument10 pagesResearch Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanHayna Marie AguilarNo ratings yet

- Water Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksDocument11 pagesWater Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksHayna Marie AguilarNo ratings yet

- Chapter4 Art AppDocument1 pageChapter4 Art AppHayna Marie AguilarNo ratings yet

- Physicochemical (Research Paper)Document9 pagesPhysicochemical (Research Paper)Hayna Marie AguilarNo ratings yet

- Water Quality Analysis IntroductionDocument3 pagesWater Quality Analysis IntroductionHayna Marie AguilarNo ratings yet

- SalinityDocument2 pagesSalinityHayna Marie AguilarNo ratings yet

- Preferred Shares of Stock Issued by Any Corporation May Be Given Preference inDocument4 pagesPreferred Shares of Stock Issued by Any Corporation May Be Given Preference inHayna Marie AguilarNo ratings yet

- Synopsis On NIDDocument9 pagesSynopsis On NIDradhika bansal50% (8)

- Passenger Elevator Operation ManualDocument24 pagesPassenger Elevator Operation ManualJahn Ray B. Lanozo100% (1)

- 22661-RET Notes-UNIT 02Document25 pages22661-RET Notes-UNIT 02jayeshdeore398No ratings yet

- Analogy - 10 Page - 01 PDFDocument10 pagesAnalogy - 10 Page - 01 PDFrifathasan13No ratings yet

- 6.1 Mean Median Mode and RangeDocument21 pages6.1 Mean Median Mode and RangeGilbert Guzman TurarayNo ratings yet

- 4194-Article Text-11162-1-10-20190903Document6 pages4194-Article Text-11162-1-10-20190903Akhsana SantosoNo ratings yet

- Fixed Asset Examples Excel TemplateDocument6 pagesFixed Asset Examples Excel TemplateHR BabitaNo ratings yet

- History of Operating SystemDocument16 pagesHistory of Operating SystemBryan John BerzabalNo ratings yet

- Rapid Prototyping and ToolingDocument2 pagesRapid Prototyping and ToolingelangandhiNo ratings yet

- Phys172 S20 Lab07 FinalDocument8 pagesPhys172 S20 Lab07 FinalZhuowen YaoNo ratings yet

- Kitimat JRP SummaryDocument17 pagesKitimat JRP SummaryNorthwest InstituteNo ratings yet

- (267.) SWOT - Cruise Industry & CarnivalDocument2 pages(267.) SWOT - Cruise Industry & CarnivalBilly Julius Gestiada100% (1)

- Free LinkDocument40 pagesFree LinkiguinhocoelhaoNo ratings yet

- L807268EDocument1 pageL807268EsjsshipNo ratings yet

- Formula and Functions in MS ExcelDocument9 pagesFormula and Functions in MS ExcelBhavana SangamNo ratings yet

- Cse205 Computer-Architecture-And-Organization TH 2.00 Ac26Document2 pagesCse205 Computer-Architecture-And-Organization TH 2.00 Ac26Ravi ThejaNo ratings yet

- Centralloy G4852 Micro R (Cast Austenitic Stainless Steel)Document2 pagesCentralloy G4852 Micro R (Cast Austenitic Stainless Steel)Anonymous w6TIxI0G8lNo ratings yet

- A321 DIFFERENCE GUIDE From A320Document72 pagesA321 DIFFERENCE GUIDE From A320NigelNo ratings yet

- QP English Viii 201920Document14 pagesQP English Viii 201920Srijan ChaudharyNo ratings yet

- Newyearbook PDFDocument165 pagesNewyearbook PDFAlberto CenniniNo ratings yet

- Literature Review of Centella AsiaticaDocument6 pagesLiterature Review of Centella Asiaticaea3vk50y100% (1)

- ALVAREZ, John Edriane A - Experiment No. 1Document7 pagesALVAREZ, John Edriane A - Experiment No. 1John Edriane AlvarezNo ratings yet

- Komatsu d65px 16 Parts BookDocument20 pagesKomatsu d65px 16 Parts Booklaura100% (54)

- Washback Effect in Teaching English As An International LanguageDocument13 pagesWashback Effect in Teaching English As An International LanguageUyenuyen DangNo ratings yet

- 22445-2022-Summer-Model-Answer-Paper (Msbte Study Resources)Document27 pages22445-2022-Summer-Model-Answer-Paper (Msbte Study Resources)Piyush NikamNo ratings yet

- JNTUK SGPA Calculator - JNTU Kakinada R20, R19, R16 SGPA Calculator OnlineDocument3 pagesJNTUK SGPA Calculator - JNTU Kakinada R20, R19, R16 SGPA Calculator OnlineRamesh Dasari0% (1)

- CHED - NYC PresentationDocument19 pagesCHED - NYC PresentationMayjee De La CruzNo ratings yet