Professional Documents

Culture Documents

ACTIVITY6A-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

ACTIVITY6A-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

Uploaded by

Hayna Marie AguilarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACTIVITY6A-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

ACTIVITY6A-Conceptual Framework - Aguilar, Hayna Marie - BSA1B

Uploaded by

Hayna Marie AguilarCopyright:

Available Formats

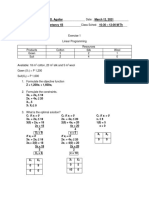

Acctng 2 – Conceptual Framework & Accounting Standards

Activity #6A – Preparation of FS

Name: Hayna Marie D. Aguilar Program: BSA-1B Date: March 21, 2021

Exercise 1

_____A___ 1. Cash

_____G___ 2. Bonds payable (due in 8 years)

_____C___ 3. Machinery

_____J___ 4. Deficit

_____A___ 5. Unexpired insurance

_____D___ 6. Franchise (net)

_____B___ 7. Fund to retire preference shares

_____F___ 8. Current portion of mortgage payable

_____√___ 9. Accumulated depreciation

_____D___10. Copyrights (net)

_____B___11. Investment in held-to-maturity bonds

_____A __12. Allowance for doubtful accounts

_____B___13. Notes receivable (due in 3 years)

_____F___14. Property taxes payable

_____G___15. Deferred taxes payable

_____G___16. Premium on preference shares

_____G___17. Premium on bonds payable (due in 8 years)

_____A___18. Goods in process

_____I___19. Shares capital, P1 par

_____C___20. Land

_____I___21. Treasury stock (at cost)

Exercise 2

Indicate by letter how each of the following should be classified:

____D___1. Advertising expense

____F__2. Amortization of a patent held as an investment

____D___3. Cash dividend received on short-term investment

____B___4. Depreciation on plant that manufactures good for sale (prior to sale of the goods)

____B___5. Freight on sales

____H___6. Income tax effect of loss on sale of plant

____F___7. Income tax on gain on sale of short-term investment in securities

____D___8. Interest expense

____A___9. Interest revenue

____C___10. Loss on sale of patent

____E___11. Dividend revenue from investment

____D___12. Salary of company president

____A___13. Sales

____E___14. Sales returns

____A___15.Services sold

Exercise 3

___B__1. Payments for merchandise

___F__2. Payments for interest

___F__3. Payments for dividends

___D__4. Payments for plant and equipment

___D__5. Payments for bond payable retirements

___D__6. Payments for marketable securities

___B__7. Payments for employees

___B__8. Payments to governments

___G__9. Issuing a stock dividend

___A__10. Cash from customers

___E__11. Cash from issuing common share

___C__12. Cash from dividends

___A__13. Cash from sale of old building

___C__14. Cash from interest

Exercise 4

Identify the element or elements associated with the nine elements below.

a. Obligation to transfer resources arising from past transaction. - Liabilities

b. Increases ownership interest. – Income and Asset

c. Declares and pays cash dividends to owners. - Equity

d. Increases in net assets in a period from non-owner sources. - Income

e. Items characterized by service potential or future economic benefits. - Liabilities

f. Equals increase in assets less liabilities during the year, after adding distributions to

owners and subtracting investments by owners. – Asset and Equity

g. Residual interest in the assets of the enterprise after deducting its liabilities. – Equity

h. Increases assets during a period through sale of product. – Income

i. Decreases assets during the period by purchasing the company’s own shares. – Expense

and Equity

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- CFAS Final Exam QuestionsDocument7 pagesCFAS Final Exam QuestionsHayna Marie AguilarNo ratings yet

- AEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Document3 pagesAEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Hayna Marie AguilarNo ratings yet

- Jimelyn Self-Service LaundryDocument2 pagesJimelyn Self-Service LaundryHayna Marie AguilarNo ratings yet

- Exercises Exercise 1-Accounting Information Systems: An OverviewDocument9 pagesExercises Exercise 1-Accounting Information Systems: An OverviewHayna Marie AguilarNo ratings yet

- Lesson Operations Management and Operations Function: ObjectivesDocument8 pagesLesson Operations Management and Operations Function: ObjectivesHayna Marie AguilarNo ratings yet

- Water Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksDocument11 pagesWater Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksHayna Marie AguilarNo ratings yet

- CFAS Final ExamDocument4 pagesCFAS Final ExamHayna Marie AguilarNo ratings yet

- Chapter4 Art AppDocument1 pageChapter4 Art AppHayna Marie AguilarNo ratings yet

- Research Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanDocument10 pagesResearch Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanHayna Marie AguilarNo ratings yet

- Water Quality Analysis IntroductionDocument3 pagesWater Quality Analysis IntroductionHayna Marie AguilarNo ratings yet

- Physicochemical (Research Paper)Document9 pagesPhysicochemical (Research Paper)Hayna Marie AguilarNo ratings yet

- Preferred Shares of Stock Issued by Any Corporation May Be Given Preference inDocument4 pagesPreferred Shares of Stock Issued by Any Corporation May Be Given Preference inHayna Marie AguilarNo ratings yet

- SalinityDocument2 pagesSalinityHayna Marie AguilarNo ratings yet