Professional Documents

Culture Documents

ACTIVITY9 Investment in Equity Securities Q

Uploaded by

Hayna Marie AguilarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACTIVITY9 Investment in Equity Securities Q

Uploaded by

Hayna Marie AguilarCopyright:

Available Formats

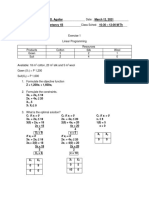

Acctng 2 – Conceptual Framework & Accounting Standards

Activity #9 – Investment in Equity Securities (100 points)

Submission Date: May 5, 2021

Class Discussion Date: May 7, 2021

Name: _________________ Program: _______________ Date: _____________

Exercise 1

1. When an investor does not have significant influence over the investee: (15 points)

a) At what amount Investment in Marketable Securities be carried on the statement

of financial position.

b) For trading securities, what items may affect net income.

c) For Investment in Securities @FVTOCI securities, what items may affect net

income.

d) What distinguishes trading securities from Investment in Securities @FVTOCI.

2. Discuss the rationale behind the requirement that reclassifications of investments between

FA@FVTOCI and FA@FVPL be made at market value rather than book value or cost.

(10 points)

3. What is meant by impairment loss on an investment in securities. (10 points)

4. Basically, the investor accounts for the receipt of an ordinary share dividend and a share

split in the same way. Briefly explain the accounting that should be followed by the

investor in these situations. (10 points)

5. What is a share right (share warrant)? If share rights have a market value, how would the

investor account for the receipt of share rights? (10 points)

6. Explain the following about accounting for equity securities under the equity method: (15

points)

a) Under what conditions it is appropriate to use the equity method.

b) At what amount securities accounted for with the equity method are carried on the

statement of financial position.

c) For equity securities, what items may affect net income.

d) Why the equity method is preferred for these securities.

7. What is meant by the term underlying as it relates to derivative financial instruments? (10

points)

8. What are the main distinctions between a traditional financial instrument and a derivative

financial instrument? (10 points)

9. In what situation will be unrealized holding gain or loss on a non-trading equity

investment be reported in income? (10 points)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CFAS Final Exam QuestionsDocument7 pagesCFAS Final Exam QuestionsHayna Marie AguilarNo ratings yet

- AEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Document3 pagesAEC4 - Aguilar, Hayna Marie - BSA1B - Exercise1Hayna Marie AguilarNo ratings yet

- Jimelyn Self-Service LaundryDocument2 pagesJimelyn Self-Service LaundryHayna Marie AguilarNo ratings yet

- Exercises Exercise 1-Accounting Information Systems: An OverviewDocument9 pagesExercises Exercise 1-Accounting Information Systems: An OverviewHayna Marie AguilarNo ratings yet

- Lesson Operations Management and Operations Function: ObjectivesDocument8 pagesLesson Operations Management and Operations Function: ObjectivesHayna Marie AguilarNo ratings yet

- CFAS Final ExamDocument4 pagesCFAS Final ExamHayna Marie AguilarNo ratings yet

- Research Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanDocument10 pagesResearch Proposal: Rhea Mea P. Panti Frances Nicole R. TarimanHayna Marie AguilarNo ratings yet

- Water Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksDocument11 pagesWater Quality Sensors: Home Orderingnews About Us Support ContactdistributorslinksHayna Marie AguilarNo ratings yet

- Chapter4 Art AppDocument1 pageChapter4 Art AppHayna Marie AguilarNo ratings yet

- Physicochemical (Research Paper)Document9 pagesPhysicochemical (Research Paper)Hayna Marie AguilarNo ratings yet

- Water Quality Analysis IntroductionDocument3 pagesWater Quality Analysis IntroductionHayna Marie AguilarNo ratings yet

- SalinityDocument2 pagesSalinityHayna Marie AguilarNo ratings yet

- Preferred Shares of Stock Issued by Any Corporation May Be Given Preference inDocument4 pagesPreferred Shares of Stock Issued by Any Corporation May Be Given Preference inHayna Marie AguilarNo ratings yet