Professional Documents

Culture Documents

Matching Stage

Uploaded by

Sittie Islah Hadji Faisal0 ratings0% found this document useful (0 votes)

66 views3 pagesThe matching stage focuses on generating alternative strategies by aligning internal and external factors. Key techniques used include the SWOT matrix, SPACE matrix, BCG matrix, IE matrix, and grand strategy. The SWOT matrix involves identifying internal strengths and weaknesses and external opportunities and threats to develop four types of strategies. The SPACE matrix uses four dimensions to evaluate a company's strategic position and determine whether aggressive, conservative, defensive, or competitive strategies are most appropriate. The BCG matrix uses relative market share and growth rate to evaluate a product portfolio and suggest investment strategies for stars, cash cows, question marks, and dogs.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe matching stage focuses on generating alternative strategies by aligning internal and external factors. Key techniques used include the SWOT matrix, SPACE matrix, BCG matrix, IE matrix, and grand strategy. The SWOT matrix involves identifying internal strengths and weaknesses and external opportunities and threats to develop four types of strategies. The SPACE matrix uses four dimensions to evaluate a company's strategic position and determine whether aggressive, conservative, defensive, or competitive strategies are most appropriate. The BCG matrix uses relative market share and growth rate to evaluate a product portfolio and suggest investment strategies for stars, cash cows, question marks, and dogs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views3 pagesMatching Stage

Uploaded by

Sittie Islah Hadji FaisalThe matching stage focuses on generating alternative strategies by aligning internal and external factors. Key techniques used include the SWOT matrix, SPACE matrix, BCG matrix, IE matrix, and grand strategy. The SWOT matrix involves identifying internal strengths and weaknesses and external opportunities and threats to develop four types of strategies. The SPACE matrix uses four dimensions to evaluate a company's strategic position and determine whether aggressive, conservative, defensive, or competitive strategies are most appropriate. The BCG matrix uses relative market share and growth rate to evaluate a product portfolio and suggest investment strategies for stars, cash cows, question marks, and dogs.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

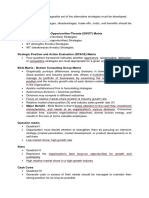

STAGE 2: MATCHING STAGE

Matching Stage

focuses on generating feasible alternative strategies by aligning key external and internal factors.

Techniques include the SWOT Matrix, the Strategic Position and Action Evaluation (SPACE)

Matrix, the Boston Consulting Group (BCG) Matrix, the Internal-External (IE) Matrix, and the

Grand Strategy.

FIVE TECHNIQUES USED IN MATCHING STAGE:

1.) SWOT (Strength, Weakness, Opportunity and Threats) MATRIX

It is an important matching tool that helps managers develop four types of strategies:

a. Strengths–Opportunities (SO) – use of internal strengths to take advantage of opportunities

b. Strengths–Threats (ST) - use of internal strengths to avoid or minimize the impact of threats.

c. Weaknesses–Opportunities (WO) - overcoming internal weaknesses by taking advantage of

external opportunities.

d. Weaknesses–Threats (WT) - Overcoming internal weaknesses and avoiding/minimizing

external threats.

There are eight steps involved in constructing a SWOT Matrix:

1. List the firm’s key external opportunities.

2. List the firm’s key external threats.

3. List the firm’s key internal strengths.

4. List the firm’s key internal weaknesses.

5. Match internal strengths with external opportunities and record the resultant SO Strategies in

the appropriate cell.

6. Match internal weaknesses with external opportunities and record the resultant WO Strategies.

7. Match internal strengths with external threats and record the resultant ST Strategies.

8. Match internal weaknesses with external threats and record the resultant WT Strategies.

2.) SPACE (Strategic Position and Action Evaluation) MATRIX

Its four-quadrant framework indicates whether aggressive, conservative, defensive, or

competitive strategies are most appropriate for a given organization.

The axes of the SPACE Matrix represent 4 Dimension:

two internal dimensions (financial position [FP] and competitive position [CP])

and,

two external dimensions (stability position [SP] and industry position [IP])

SPACE Matrix Axes:

Internal Strategic Position:

Financial Position [FP] – return on investment, leverage, liquidity, working capital,

cashflow, inventory turnover, earnings per share, price earnings ratio

Competitive Position [CP] – market share, product quality, product life cycle, customer

loyalty, capacity utilization, technological know-how, control over suppliers and

distributors

External Strategic Position:

Stability Position [SP] – tech changes, rate of inflation, demand variability, price range

of competing products, barriers to entry into market, competitive pressure, ease of exit

from market, price elasticity of demand, risk involved in business

Industry Position [IP] – growth potential, profit potential, financial stability, extent

leveraged, resource utilization, ease of entry into market, productivity, capacity

utilization.

The steps required to develop a SPACE Matrix are as follows:

1. Select a set of variables to define financial position (FP), competitive position (CP), stability

position (SP), and industry position (IP).

2. Assign a numerical value ranging from +1 (worst) to +7 (best) to each of the variables that make

up the FP and IP dimensions. Assign a numerical value ranging from -1 (best) to -7 (worst) to

each of the variables that make up the SP and CP dimensions. On the FP and CP axes, make

comparison to competitors. On the IP and SP axes, make comparison to other industries.

3. Compute an average score for FP, CP, IP, and SP by summing the values given to the variables

of each dimension and then by dividing by the number of variables included in the respective

dimension.

4. Plot the average scores for FP, IP, SP, and CP on the appropriate axis in the SPACE Matrix.

5. Add the two scores on the x-axis and plot the resultant point on X. Add the two scores on the y-

axis and plot the resultant point on Y. Plot the intersection of the new xy point.

6. Draw a directional vector from the origin of the SPACE Matrix through the new intersection

point. This vector reveals the type of strategies recommended for the organization: aggressive,

competitive, defensive, or conservative.

3.) BCG (Boston Consulting Group) MATRIX

It is a business tool, which uses relative market share and industry growth rate factors to

evaluate the potential of a business brand portfolio and suggest further investment

strategies.

The 4 Quadrant in BCG Matrix

Quadrant I of the BCG Matrix are called “Question Marks,” - the organization

must decide whether to strengthen them by pursuing an intensive strategy

(market penetration, market development, or product development) or to sell

them.

Quadrant II are called “Stars,”- represent the organization’s best long-run

opportunities for growth and profitability.

Quadrant III are called “Cash Cows,” – indicate that the firm generate cash in

excess of their needs.

Quadrant IV are called “Dogs.” – indicate that the businesses are often

liquidated, devastated, or trimmed through retrenchment.

Steps in construction of BCG

1. Choose the unit

2. Define the Market

3. Calculate relative market share

4. Find out Market growth rate

5. Draw the Circles on a matrix.

QUIZ

1. It is a business tool, which uses relative market share and industry growth rate factors to evaluate

the potential of a business brand portfolio and suggest further investment strategies. Ans: BCG

(Boston Consulting Group) MATRIX

2. SPACE stands for Ans: Strategic Position and Action Evaluation

3. -4 The following includes in the 4 quadrants in BCG Matrix:

Cat, Stars, Cash Cows, Question, Strength.

It focuses on generating feasible alternative strategies by aligning key external and internal

factors. Ans. Matching Stage

You might also like

- Chapter 5Document54 pagesChapter 5JulianNo ratings yet

- Chapter 4 Strategy Analysis and ChoiceDocument13 pagesChapter 4 Strategy Analysis and Choicemelvin cunananNo ratings yet

- Matching Stage: By: Anthony Mantuhac Bsa-2Document24 pagesMatching Stage: By: Anthony Mantuhac Bsa-2PremiumNo ratings yet

- The Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessDocument24 pagesThe Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessHannah Ruth M. GarpaNo ratings yet

- Chapter 6 Strategy Analysis and Choice Summary 17132120-002Document6 pagesChapter 6 Strategy Analysis and Choice Summary 17132120-002NOORI KhanaNo ratings yet

- Strama Mod 6Document13 pagesStrama Mod 6Jaysah BaniagaNo ratings yet

- Strat Reviewer Chapter 6Document20 pagesStrat Reviewer Chapter 6Ross John JimenezNo ratings yet

- Space & QSPMDocument41 pagesSpace & QSPMRadhik Kalra50% (2)

- SWOT and SPACE Matrices for Strategic ManagementDocument16 pagesSWOT and SPACE Matrices for Strategic ManagementM. E. C.No ratings yet

- Strategy Formulation. Strategy Analysis & Choice (8-10M)Document45 pagesStrategy Formulation. Strategy Analysis & Choice (8-10M)Muhammad FaisalNo ratings yet

- Strategic Position and Action EvaluationDocument3 pagesStrategic Position and Action EvaluationhusinorainNo ratings yet

- Chapter 6 Strategy Analysis and ChoiceDocument9 pagesChapter 6 Strategy Analysis and ChoiceAnn CruzNo ratings yet

- Strategy Analysis and ChoiceDocument10 pagesStrategy Analysis and ChoiceMichelle EsternonNo ratings yet

- WK 8Document55 pagesWK 8Muhammad AmryNo ratings yet

- FInal Part STRAMADocument18 pagesFInal Part STRAMAHannah Kate ToledoNo ratings yet

- LESSON 08 - Strategy FrameworkDocument46 pagesLESSON 08 - Strategy Frameworkpatricia navasNo ratings yet

- Strategic Management - Chapter 6Document56 pagesStrategic Management - Chapter 6juan faustian siregarNo ratings yet

- 3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizDocument53 pages3 Aquino Ronquillo Tapia Mondia Parada Origen Guadalupe Geronimo Arcay NarizrcdcaviteNo ratings yet

- Strategy Analysis and SelectingDocument26 pagesStrategy Analysis and SelectingNyadroh Clement MchammondsNo ratings yet

- Strategy Generation and Selection: Chapter EightDocument53 pagesStrategy Generation and Selection: Chapter EightAwesomely FairNo ratings yet

- Topic 5 Strategy Formulation 3 (Strategy Generation Selection)Document49 pagesTopic 5 Strategy Formulation 3 (Strategy Generation Selection)黄洁宣No ratings yet

- Chapter 3 - Strategy Analysis and Management Decision - SVDocument76 pagesChapter 3 - Strategy Analysis and Management Decision - SV8.Nguyễn Việt HoàngNo ratings yet

- Chapter 8 - Strategy Generation and Selection 2Document74 pagesChapter 8 - Strategy Generation and Selection 2safira dindaNo ratings yet

- SPACE Matrix Strategic Management MethodDocument15 pagesSPACE Matrix Strategic Management MethodAloja ValienteNo ratings yet

- Strate GY Analysi S and Choice: Chapter # 6Document5 pagesStrate GY Analysi S and Choice: Chapter # 6Vahaj Khan Yousuf ZaiNo ratings yet

- Strategic Management CH 6Document40 pagesStrategic Management CH 6karim kobeissiNo ratings yet

- Strategy Generation Techniques for Achieving Competitive AdvantageDocument20 pagesStrategy Generation Techniques for Achieving Competitive AdvantageMUHAMMAD ANAS BUKSHNo ratings yet

- Lesson 6-StramaaDocument61 pagesLesson 6-Stramaaishinoya keishiNo ratings yet

- Strategic Position and Action Evaluation (SPACE) MatrixDocument30 pagesStrategic Position and Action Evaluation (SPACE) Matrixmostafa elshehabyNo ratings yet

- CH. 6 Strategy Analysis and Choice PDFDocument27 pagesCH. 6 Strategy Analysis and Choice PDFHadjiNo ratings yet

- The Matching and Decision StageDocument14 pagesThe Matching and Decision StageLouie ManaoNo ratings yet

- 10 External Forces That Affect OrganizationsDocument14 pages10 External Forces That Affect OrganizationsCzarwin William PobleteNo ratings yet

- The SPACE Matrix AnalysisDocument6 pagesThe SPACE Matrix AnalysisMarwan Al-Asbahi100% (1)

- Chapter ViDocument8 pagesChapter ViMustafa AhmedNo ratings yet

- Strategic Analysis Tools for Optimal Business PlanningDocument19 pagesStrategic Analysis Tools for Optimal Business PlanningAlfredo Ananda KusumaNo ratings yet

- Strategic Analysis and Choice FrameworkDocument29 pagesStrategic Analysis and Choice FrameworkTa Ye GetnetNo ratings yet

- SPACE Matrix Strategic Management MethodDocument9 pagesSPACE Matrix Strategic Management MethodmakimphoNo ratings yet

- Analysis of StrategyDocument50 pagesAnalysis of StrategyVignesh KumarNo ratings yet

- Lecture 6 Strategic Analysis and Choice ImportantDocument34 pagesLecture 6 Strategic Analysis and Choice ImportantSarsal6067No ratings yet

- Strategy Generation and Selection: Chapter EightDocument62 pagesStrategy Generation and Selection: Chapter EightChristy MachaalanyNo ratings yet

- Strategic ChoiceDocument31 pagesStrategic ChoiceRajesh TandonNo ratings yet

- SM Chapter 6Document13 pagesSM Chapter 6Josh PinedaNo ratings yet

- The Strategic Position and Action Evaluation (SPACE) MatrixDocument5 pagesThe Strategic Position and Action Evaluation (SPACE) MatrixMahmoud OmranNo ratings yet

- CIPS Strategy AnalysisDocument9 pagesCIPS Strategy AnalysisSalman ZafarNo ratings yet

- Materi 6 STRATEGY ANALYSIS AND CHOICEDocument35 pagesMateri 6 STRATEGY ANALYSIS AND CHOICEFaishal Prastha MahadikaNo ratings yet

- Assignment - 1 Strategic Management: Submitted ToDocument14 pagesAssignment - 1 Strategic Management: Submitted ToNakulNo ratings yet

- Notes For Chapter 6Document6 pagesNotes For Chapter 6Fadi YounessNo ratings yet

- Strategic Managment TotalDocument49 pagesStrategic Managment TotalkailashdhirwaniNo ratings yet

- Chapter 5 - HandoutDocument21 pagesChapter 5 - HandoutNhật HoàngNo ratings yet

- Clarde - Research Task 1Document12 pagesClarde - Research Task 1RatRat DeulNo ratings yet

- Strategic Analysis & ChoicesDocument44 pagesStrategic Analysis & ChoicesHritesh RulesNo ratings yet

- MGT603 - Strategic Management Solved MCQ and Subjective Lecture Wise For Final Term Exam PreparationDocument76 pagesMGT603 - Strategic Management Solved MCQ and Subjective Lecture Wise For Final Term Exam Preparationmuhammad shahbazNo ratings yet

- BCG Matrix and GE Nine Cells MatrixDocument15 pagesBCG Matrix and GE Nine Cells MatrixBinodBasnet0% (1)

- Business Strategy and Management Chapter SummaryDocument50 pagesBusiness Strategy and Management Chapter SummaryXander MaxNo ratings yet

- 06 - Strategy Generation and Selection (For Sharing)Document30 pages06 - Strategy Generation and Selection (For Sharing)Andrew AndersonNo ratings yet

- Business Plan Checklist: Plan your way to business successFrom EverandBusiness Plan Checklist: Plan your way to business successRating: 5 out of 5 stars5/5 (1)

- Strategic Analysis of Internal Environment of a Business OrganisationFrom EverandStrategic Analysis of Internal Environment of a Business OrganisationNo ratings yet

- Model Answer: E-Commerce store launch by Unilever in Sri LankaFrom EverandModel Answer: E-Commerce store launch by Unilever in Sri LankaNo ratings yet

- Strategic Management - Sample Assignment Material & Discussion seriesFrom EverandStrategic Management - Sample Assignment Material & Discussion seriesNo ratings yet

- Retailing, Wholesaling and LogisticsDocument31 pagesRetailing, Wholesaling and LogisticsBilal Raja100% (2)

- ICICI Prudential StudyDocument43 pagesICICI Prudential StudyMaytanNo ratings yet

- Text Wawancara BerpasanganDocument4 pagesText Wawancara BerpasanganSanjiNo ratings yet

- Ksfe Organisation StudyDocument71 pagesKsfe Organisation StudyKrishna Priya100% (7)

- GMRC 5 - 4th Quarter ExaminationDocument12 pagesGMRC 5 - 4th Quarter ExaminationTeacher IanNo ratings yet

- Ed 62Document2 pagesEd 62api-550734106No ratings yet

- Eight Important Question Words: Italian Grammar Made EasyDocument2 pagesEight Important Question Words: Italian Grammar Made EasybeeNo ratings yet

- Pre-Employment Issues: by Group-6Document8 pagesPre-Employment Issues: by Group-6Debabratta PandaNo ratings yet

- EPI Program Member ManualDocument56 pagesEPI Program Member Manualcharina.nemenzo23No ratings yet

- Lgesp - Pura Neguma Reference Manual For Project StaffDocument62 pagesLgesp - Pura Neguma Reference Manual For Project StaffmuthunayakeNo ratings yet

- Matthew 9:18-26 Jesus Raises A Dead Girl and Heals A Sick WomanDocument1 pageMatthew 9:18-26 Jesus Raises A Dead Girl and Heals A Sick WomanCasey OwensNo ratings yet

- CCC Letter To CPMGDocument3 pagesCCC Letter To CPMGAjay PandeyNo ratings yet

- The Path of Kriya Yoga: An IntroductionDocument7 pagesThe Path of Kriya Yoga: An IntroductionGowthamanBalaNo ratings yet

- Slide Show On Kargil WarDocument35 pagesSlide Show On Kargil WarZamurrad Awan63% (8)

- Haj Committee of India: Tat Tory o Yoft e Ry I yDocument11 pagesHaj Committee of India: Tat Tory o Yoft e Ry I ysayyedarif51No ratings yet

- First 1000 Words in Arabic by Hear AmeryDocument66 pagesFirst 1000 Words in Arabic by Hear AmeryCaroline ErstwhileNo ratings yet

- Macro Solved Ma Econmoics NotesDocument120 pagesMacro Solved Ma Econmoics NotesSaif ali KhanNo ratings yet

- Strategic Human Resources Management: What Are Strategies?Document11 pagesStrategic Human Resources Management: What Are Strategies?fabyunaaaNo ratings yet

- As 2214-2004 Certification of Welding Supervisors - Structural Steel WeldingDocument8 pagesAs 2214-2004 Certification of Welding Supervisors - Structural Steel WeldingSAI Global - APAC50% (2)

- Web & Apps PortfolioDocument34 pagesWeb & Apps PortfolioirvingNo ratings yet

- Business Plan Highlights for Salon Beauty VenusDocument20 pagesBusiness Plan Highlights for Salon Beauty VenusEzike Tobe ChriszNo ratings yet

- Nota StrategicDocument2 pagesNota StrategicFakhruddin FakarNo ratings yet

- Functions of MoneyDocument15 pagesFunctions of MoneyRidhima MathurNo ratings yet

- French Revolution Notes Class 9Document6 pagesFrench Revolution Notes Class 9NonuNo ratings yet

- In - C2 - Comprensión - Textos - EscritosDocument9 pagesIn - C2 - Comprensión - Textos - EscritosEledhwen90No ratings yet

- Holy Child Multi-Purpose Cooperative: Gender and Development CommitteeDocument6 pagesHoly Child Multi-Purpose Cooperative: Gender and Development CommitteeRam KuizonNo ratings yet

- Finalplansw PDFDocument146 pagesFinalplansw PDFOffice of PlanningNo ratings yet

- DevOps All in OneDocument29 pagesDevOps All in OneABUZARNo ratings yet

- Indian Constitutional Law and Philosophy - Page 9Document32 pagesIndian Constitutional Law and Philosophy - Page 9Prinsu SenNo ratings yet

- Chapter 3: An Introduction To Consolidated Financial StatementsDocument44 pagesChapter 3: An Introduction To Consolidated Financial StatementsMUHAMMAD ARIFNo ratings yet