Professional Documents

Culture Documents

Miftakhul Ikhwan Diskusi 3 Bahasa Inggris Niaga 3A

Uploaded by

Edwin MaherOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Miftakhul Ikhwan Diskusi 3 Bahasa Inggris Niaga 3A

Uploaded by

Edwin MaherCopyright:

Available Formats

Nama : Miftakhul Ikhwan

NIM : 042144896

Matkul : Bahasa Inggris Niaga

Diskusi 3

1. Why is Economic sanction given to a certain country? What happens to the country if it

gets economic sanction?

Answer :

Why is Economic sanction given to a certain country?

Economic sanctions are used as a foreign policy tool by many governments. The purpose

of sanctions is to apply pressure on the target country to act or stop acting in a certain way,

usually to bring about pressure for social or political change. Economic sanctions are imposed

by the government of one country on another country for one of two reasons: either the latter

is perceived as a threat to the security of the former country or the country treats its citizens

unfairly. They can be used as a coercive measure to achieve certain policy objectives related

to trade or for humanitarian abuses. Economic sanctions are used as an alternative weapon

instead of fighting to achieve the desired result. Usually Sanctions are criticized on

humanitarian grounds, as they negatively impact a country's economy and can also cause

additional damage to ordinary citizens. Some policy analysts believe that imposing trade

restrictions will only harm ordinary people, not government elites, and others equate the

practice with siege warfare. The United Nations Security Council (UNSC) has generally

refrained from imposing comprehensive sanctions since the mid-1990s, in part because of the

controversy over the efficacy and civilian harm associated with the sanctions against Iraq.

What happens to the country if it gets economic sanction?

What is certain is that the country will lose or experience a shortage of all imported

products. International relations Sometimes there is geopolitics that makes a country want to

strengthen its influence in a region. Economic sanctions are one way in which a country puts

pressure on another country. For example, when there was a war between Ukraine and Russia,

both sides implemented economic policies to pressure their opponents. Because the economy

is interconnected with each other, and there are effects that can not be imagined before.

Economic sanctions suppress economic growth in countries in conflict. For example, when the

Russian economy is sanctioned by the United States, the price of crude oil immediately rises

significantly because they are the largest supplier of oil and gas to Europe.

2. What matters do fiscal policy consist of? Why does the government apply fiscal policy?

Answer :

What matters do fiscal policy consist of?

Fiscal policy is a policy or guide or basis that is usually carried out by the government or

the leadership of a country/kingdom to regulate the financial condition and state revenues. In

addition, fiscal policy is also useful for directing a country's economy to be better by changing

or renewing government spending and income. Through fiscal policy, the government can

exercise control over the control of government and state expenditures and revenues.

There are four main components of Fiscal Policy, namely:

1. Tax Policy

2. Production Policy

3. Investment and Divestment Policy

4. Debt / Surplus Management

Why does the government apply fiscal policy?

With the implementation of fiscal policy, the government wants to achieve the goal of

reducing the unemployment rate. Where, with a high number of unemployed will increase the

tendency to not have money to spend. This can result in stunted economic growth. To achieve

this goal, the government can reduce taxes and implement fiscal policies that encourage and

cause companies to expand. This will simultaneously encourage increased employment

opportunities to reduce the number of unemployed in Indonesia.

Another objective of implementing this policy is to stabilize economic conditions, with a

view to avoiding inflation. Where, the country's economy will follow a pattern of global

expansion (boom), which is usually followed by an economic slowdown (busts). The

government can reduce this risk by increasing spending and reducing taxes. This is done to

control excessive expansion that can have a negative impact, such as high inflation. In essence,

the government can try to smooth the boom and bust trends to achieve a more stable trend of

constant economic growth.

The following are the objectives of fiscal policy:

1. Increase buto domestic product (GDP) and GDP per capita of the country.

2. Increase employment.

3. Maintain price stability.

4. Achieve national economic stability.

5. Stimulate the country's economic growth.

6. Help increase the rate of investment.

7. Open wide job opportunities.

8. Realizing social justice.

9. Build equity in income distribution.

10. Reduce unemployment.

11. Maintaining the stability or stability of the prices of goods and services.

12. to avoid inflation.

You might also like

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- Strategic National Development: National Development May Mean Progress and Growth, Maturity, or SimplyDocument9 pagesStrategic National Development: National Development May Mean Progress and Growth, Maturity, or SimplyMetch ApphiaNo ratings yet

- Fiscal PolicyDocument10 pagesFiscal PolicygyytgvyNo ratings yet

- Differences Between Fiscal and Monetary PoliciesDocument7 pagesDifferences Between Fiscal and Monetary PoliciesCheapestPapersNo ratings yet

- Monetary Policy and Its Influence On Aggregate Demand.Document16 pagesMonetary Policy and Its Influence On Aggregate Demand.Anonymous KNo ratings yet

- Monetary and Fiscal PolicyDocument11 pagesMonetary and Fiscal PolicyKai BrightNo ratings yet

- UntitledDocument1 pageUntitledRicha S ChinchakhandiNo ratings yet

- Qa edexcel6EC02Document7 pagesQa edexcel6EC02SaChibvuri JeremiahNo ratings yet

- chính trị học so sánhDocument18 pageschính trị học so sánhTrần Bích Ngọc 5Q-20ACNNo ratings yet

- The Instruments of Macroeconomic Policy.Document10 pagesThe Instruments of Macroeconomic Policy.Haisam Abbas IINo ratings yet

- On The Horizon: Likely To Happen Soon: GroupDocument3 pagesOn The Horizon: Likely To Happen Soon: GroupHiên TrầnNo ratings yet

- Interactions Between Macroeconomic Policy and Financial MarketsDocument4 pagesInteractions Between Macroeconomic Policy and Financial MarketsIjahss JournalNo ratings yet

- Yashasvi Sharma Public FinanceDocument18 pagesYashasvi Sharma Public FinanceYashasvi SharmaNo ratings yet

- Final Exam DEDE REZANDA - C1B022195Document4 pagesFinal Exam DEDE REZANDA - C1B022195Dede RezandaNo ratings yet

- Fiscal and Monetary PolicyDocument5 pagesFiscal and Monetary Policyasadasfprp2No ratings yet

- Monetary Policy NewDocument12 pagesMonetary Policy NewAbdul Kader MandolNo ratings yet

- Eco ResearchDocument5 pagesEco ResearchArdays BalagtasNo ratings yet

- Fiscal Policies - EditedDocument9 pagesFiscal Policies - Editedavisra ijazNo ratings yet

- Stagflation Is Generally Attributed To British Politician Iain Macleod, Who Coined The TermDocument8 pagesStagflation Is Generally Attributed To British Politician Iain Macleod, Who Coined The Term89hariharanNo ratings yet

- Answer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'Document5 pagesAnswer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'obydursharifNo ratings yet

- Transcription Doc Macroeconomic Policies and Tools: Speaker: Chris OatesDocument7 pagesTranscription Doc Macroeconomic Policies and Tools: Speaker: Chris OatesAnirban BhattacharyaNo ratings yet

- Economic Policy 1Document5 pagesEconomic Policy 1Rey Gil Flee Gabonada100% (1)

- Macro Answer - ChaDocument7 pagesMacro Answer - Chashann hein htetNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyshahmonali694No ratings yet

- 2nd Case Stidy (Mini - Chap2)Document6 pages2nd Case Stidy (Mini - Chap2)Anna Azriffah Janary GuilingNo ratings yet

- Economics - SssDocument1 pageEconomics - Sssequilife.foundationNo ratings yet

- Fiscal Policy - 1Document6 pagesFiscal Policy - 1Prashant SinghNo ratings yet

- Economic IndicatorsDocument4 pagesEconomic IndicatorsAbdullah Al FayazNo ratings yet

- Fiscal PolicyDocument1 pageFiscal PolicyMithil PatelNo ratings yet

- What Is Fiscal Policy?: Economic Conditions MacroeconomicDocument7 pagesWhat Is Fiscal Policy?: Economic Conditions Macroeconomicziashahid54545No ratings yet

- Fiscal Policy & Monetary PolicyDocument8 pagesFiscal Policy & Monetary PolicyFaisal AwanNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyapi-3695543100% (1)

- Q 1Document40 pagesQ 1Gaurav AgarwalNo ratings yet

- A. What Are The Goals of Macroeconomics? Full EmploymentDocument4 pagesA. What Are The Goals of Macroeconomics? Full EmploymentWassup WasabiNo ratings yet

- A. What Are The Goals of Macroeconomics? Full EmploymentDocument4 pagesA. What Are The Goals of Macroeconomics? Full EmploymentWassup WasabiNo ratings yet

- Fiscal PolicyDocument5 pagesFiscal PolicyGopal PolicherlaNo ratings yet

- Monetary Policy & Fiscal Policy (2) DDDDDDocument10 pagesMonetary Policy & Fiscal Policy (2) DDDDDepic gamesNo ratings yet

- Eco Case 2Document7 pagesEco Case 2Milisha ShresthaNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Topic: Economic Policies: I. Learning ObjectivesDocument11 pagesTopic: Economic Policies: I. Learning ObjectivesAlexis KingNo ratings yet

- L8B Introduction To MacroeconomicsDocument19 pagesL8B Introduction To Macroeconomicskurumitokisaki967No ratings yet

- Monetary PolicyDocument5 pagesMonetary Policyrameen kamranNo ratings yet

- Ngô Trần Hà Trang - Case Study 2Document5 pagesNgô Trần Hà Trang - Case Study 2trangNo ratings yet

- A Look at Fiscal and Monetary PolicyDocument6 pagesA Look at Fiscal and Monetary PolicyQonita QudwahtunnisaNo ratings yet

- Public Finance IIDocument8 pagesPublic Finance IIBimo Danu PriambudiNo ratings yet

- Public Fiscal ManagementDocument5 pagesPublic Fiscal ManagementClarizze DailisanNo ratings yet

- Class 1 ECO 214Document2 pagesClass 1 ECO 214Peter DundeeNo ratings yet

- Group 3 Economic DevelopmentDocument30 pagesGroup 3 Economic DevelopmentJENNIFER DELA ROSANo ratings yet

- Fiscal and Monetary PolicyDocument16 pagesFiscal and Monetary PolicyBezalel OLUSHAKINNo ratings yet

- BE NotesDocument9 pagesBE Notesroshantwenty10No ratings yet

- ANSWERS-WPS OfficeDocument5 pagesANSWERS-WPS OfficeisifumwiduNo ratings yet

- Module 2: The Philippine Economy and Its 21 Century Socioeconomic ChallengesDocument10 pagesModule 2: The Philippine Economy and Its 21 Century Socioeconomic ChallengesMa DistrictNo ratings yet

- Understanding InflationDocument5 pagesUnderstanding InflationMark Russel Sean LealNo ratings yet

- Economics Assignment. IfechukwuDocument3 pagesEconomics Assignment. IfechukwuAnunobi JaneNo ratings yet

- Fiscal Policy Refers To The Use of Government Spending and Tax Policies ToDocument5 pagesFiscal Policy Refers To The Use of Government Spending and Tax Policies ToSaclao John Mark GalangNo ratings yet

- Fiscal Policy NewDocument11 pagesFiscal Policy NewAnusha UNo ratings yet

- Fiscal PolicyDocument20 pagesFiscal PolicyPranav VaidNo ratings yet

- Fiscal Policy InformationDocument1 pageFiscal Policy Informationbadass.bazoookaNo ratings yet

- Classification of Economic EnvironmentDocument23 pagesClassification of Economic EnvironmentSagar MhatreNo ratings yet

- Online Quiz 1Document2 pagesOnline Quiz 1Mary Antonette LastimosaNo ratings yet

- Dayanand Anglo Vedic Public School, Airoli QUESTION BANK (SA-1) 2015-16 Class-Ix Sub - EnglishDocument18 pagesDayanand Anglo Vedic Public School, Airoli QUESTION BANK (SA-1) 2015-16 Class-Ix Sub - EnglishParth DevNo ratings yet

- S5 EntDocument70 pagesS5 EntKAWALYA UMAR100% (1)

- Macro On TapDocument43 pagesMacro On Tap20070433 Nguyễn Lê Thùy DươngNo ratings yet

- Michael Griffiths EC103H Final EssayDocument14 pagesMichael Griffiths EC103H Final Essaymunisnajmi786No ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- Case Study BrazilDocument2 pagesCase Study BrazilLaiza Mae LasutanNo ratings yet

- ADS465 SEMESTER OCT2020-FEB2021 Individual Assignment: Situational Based-AnalysisDocument8 pagesADS465 SEMESTER OCT2020-FEB2021 Individual Assignment: Situational Based-AnalysisFADZLIN SYAFIQAHNo ratings yet

- Aggregate PlanningDocument28 pagesAggregate PlanningskNo ratings yet

- T1-Global MarketDocument27 pagesT1-Global Marketcristell rodriguezNo ratings yet

- Three Phases of Labor Relations Process 1. Union OrganizingDocument2 pagesThree Phases of Labor Relations Process 1. Union OrganizingMj Bcial100% (1)

- Simon Diedong Dombo University of Business and Integrated Development Studies (Sdd-Ubids)Document8 pagesSimon Diedong Dombo University of Business and Integrated Development Studies (Sdd-Ubids)Addae ClintonNo ratings yet

- What Is Aggregate DemandqwertDocument9 pagesWhat Is Aggregate DemandqwertShahana KhanNo ratings yet

- Instructions For Form 1040-NRDocument48 pagesInstructions For Form 1040-NRAlan Mateo Escobar AgudeloNo ratings yet

- Econ 2002 Course Outline 2018Document3 pagesEcon 2002 Course Outline 2018Simone BrownNo ratings yet

- Benazir Bhutto Shaheed Youth Development Program Modified: Project Concept Clearance Proposal For Foreign AssistanceDocument36 pagesBenazir Bhutto Shaheed Youth Development Program Modified: Project Concept Clearance Proposal For Foreign AssistanceSiddiqui KarimNo ratings yet

- Jonathan Self AttestationDocument2 pagesJonathan Self Attestationjohn yorkNo ratings yet

- The Good Work Framework A New Business Agenda For The Future of Work2022Document30 pagesThe Good Work Framework A New Business Agenda For The Future of Work2022Mahamadou DiakiteNo ratings yet

- Abashayeli Sponsorship BrochureDocument5 pagesAbashayeli Sponsorship Brochurezenani france sibanyoniNo ratings yet

- Tupad: Requirements For AvailmentDocument2 pagesTupad: Requirements For AvailmentLiza Gelig100% (1)

- Low To Moderate Economic Growth For The Past 40 YearsDocument2 pagesLow To Moderate Economic Growth For The Past 40 YearsMarkean CondeNo ratings yet

- Chapter 23 - Agg Expenditure - Equilibrium Output-TheKeynesianCrossDocument30 pagesChapter 23 - Agg Expenditure - Equilibrium Output-TheKeynesianCrossSanjana JaggiNo ratings yet

- Accenture Skills To Succeed AcademyDocument2 pagesAccenture Skills To Succeed AcademyAbner James Yngente LagerfeldNo ratings yet

- Policy Brief On Wage Differential in Kenya by CPA Joash KosibaDocument6 pagesPolicy Brief On Wage Differential in Kenya by CPA Joash KosibaCosybaNo ratings yet

- Ncert Solutions For Class 9 Geography PDFDocument5 pagesNcert Solutions For Class 9 Geography PDFMuskan BatraNo ratings yet

- COVID-19 Impact AffidavitDocument1 pageCOVID-19 Impact AffidavitElieve GraphicsNo ratings yet

- Chapter 14 Practice QuestionsDocument12 pagesChapter 14 Practice QuestionsAbigail CubasNo ratings yet

- Cae 19 MartieDocument32 pagesCae 19 MartieandreeaNo ratings yet

- Grade 8 Practise PaperDocument4 pagesGrade 8 Practise PaperdhuriprashantNo ratings yet

- Debate Against GSTDocument3 pagesDebate Against GSTKshitij Gaur100% (3)

- Daniel Andrews: Six Months of All Talk and No ActionDocument20 pagesDaniel Andrews: Six Months of All Talk and No ActionVic CoalitionNo ratings yet

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The War after the War: A New History of ReconstructionFrom EverandThe War after the War: A New History of ReconstructionRating: 5 out of 5 stars5/5 (2)

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaFrom EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaRating: 4.5 out of 5 stars4.5/5 (12)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- Modern Warriors: Real Stories from Real HeroesFrom EverandModern Warriors: Real Stories from Real HeroesRating: 3.5 out of 5 stars3.5/5 (3)

- The Next Civil War: Dispatches from the American FutureFrom EverandThe Next Civil War: Dispatches from the American FutureRating: 3.5 out of 5 stars3.5/5 (50)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityRating: 5 out of 5 stars5/5 (1)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- The Red and the Blue: The 1990s and the Birth of Political TribalismFrom EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismRating: 4 out of 5 stars4/5 (29)

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- Confidence Men: Wall Street, Washington, and the Education of a PresidentFrom EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentRating: 3.5 out of 5 stars3.5/5 (52)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

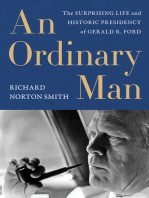

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)