Professional Documents

Culture Documents

Circular On IGST ITC Declaration

Uploaded by

Jnanaranjan NayakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Circular On IGST ITC Declaration

Uploaded by

Jnanaranjan NayakCopyright:

Available Formats

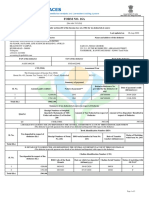

Office of the

Commissioner of Commercial Taxes,

Telangana State, Nampally,

Hyderabad – 500001

CIRCULAR

EIU/IGST SETTLEMENT/01/2019, dated : 07 -11-2022.

CIRCULAR No. 02 /2022

Sub:- Commercial Taxes Department - EIU – IGST Settlement – Proper

Declaration of lapsed/in-eligible ITC in Form GSTR-3B – Regarding.

Ref:- 1. CBIC Notification No. 14/2022, dated : 5 th July,2022.

2. CBIC Circular No.170/02/2022-GST, dated: 06th July,2022.

Sir/Madam,

1. The provision of CGST/TGST Act envisages that the taxpayers should declare

the IGST/CGST/SGST ITC and then make reversals wherever applicable under

appropriate head.

2. However, it is noticed that the certain taxable persons are directly declaring the

net ITC in Table 4(A) instead of declaring the Gross ITC and then making

reversals.

3. The said declaration of Gross ITC and reversals is to be made compulsorily as

non-declaration/wrong declaration leads to loss of revenue to the state.

4. Further, vide CBIC Notification number 14/2022, dated: 5 th July,2022 GSTR-3B

return format was amended with following changes.

GSTR-3B

Amended (Now) Earlier

( Table:4)

4(B) – ITC Reversed ITC Reversed

As per Rule 38,42&43 of CGST

As per Rule 42&43 of

4(B)(1) Rules and Sub-section (5) of

CGST Rules

section 17

4(B)(2) Others Others

Other details Ineligible ITC

4(D) –

ITC reclaimed which was

4(D)(1) reversed under Table 4(B)(2) in As per Sec 17(5)

earlier tax period.

Ineligible ITC under Sec 16(4) &

4(D)(2) ITC not eligible due to PoS Others

reasons.

5. In this connection, CBIC has issued circular instructions Circular No.

170/02/2022-GST, dated: 06th July, 2022 on the issue of proper declaration of

ITC in GSTR-3B returns.

6. The aforesaid change in the manner of reporting ITC related claims is to ensure

correct accountable and accurate settlement of funds between the Central and

State Governments.

7. Now, IGST settlement is being made to the states basis the declaration made by

the taxpayers at columns 4(B)(1) and 4(D)(2) of Form GSTR-3B.

8. In this connection, CBIC has issued circular instructions Circular No.

170/02/2022-GST, dated: 06th July, 2022 on the issue of proper declaration of

ITC in GSTR-3B returns.

9. The taxpayers are expected to declare the IGST ITC Reversed/Reduced in the

appropriate fields in Form GSTR-3B and it may be noted that Section 17(5) and

Rule 38 declarations are now moved to Table 4(B)(1).

10. Therefore, the taxpayers may take note of the amendments in Form GSTR-3B

and go through the contents of the said circular while filing the return for the

month of October, 2022.

11. The taxpayers can contact the officers of EIU for further clarification.

Sd/-

Commissioner(CT)

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- Payslip 20200731Document1 pagePayslip 20200731Sg BalajiNo ratings yet

- Transcom Worldwide Philippines, Inc.: Taxable Income DetailsDocument1 pageTranscom Worldwide Philippines, Inc.: Taxable Income DetailsarbyjamesNo ratings yet

- 1040 Engagement LetterDocument2 pages1040 Engagement LetterAshru AshrafNo ratings yet

- Tax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)Document2 pagesTax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)rodgington duneNo ratings yet

- Deductions From The Gross Estate Supplementary Pro 230712 100820Document8 pagesDeductions From The Gross Estate Supplementary Pro 230712 100820nichNo ratings yet

- Indirect Taxes 1,2,3Document34 pagesIndirect Taxes 1,2,3Welcome 1995No ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDocument40 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNo ratings yet

- Par B 9 CIR vs. United Salvage Tower PhilsDocument4 pagesPar B 9 CIR vs. United Salvage Tower PhilsCyruz TuppalNo ratings yet

- What Is TaxationDocument5 pagesWhat Is TaxationvimalabharathNo ratings yet

- Circular 169 2022 GSTDocument4 pagesCircular 169 2022 GSTJnanaranjan NayakNo ratings yet

- Taco 0136872080600011Document1 pageTaco 0136872080600011Jnanaranjan NayakNo ratings yet

- CRN 6755634000Document3 pagesCRN 6755634000Jnanaranjan NayakNo ratings yet

- Process DocumentDocument3 pagesProcess DocumentJnanaranjan NayakNo ratings yet

- NEWFATCA Non - IndividualsDocument2 pagesNEWFATCA Non - IndividualsJnanaranjan NayakNo ratings yet

- NN 21 2022 EnglishDocument1 pageNN 21 2022 EnglishJnanaranjan NayakNo ratings yet

- Order ID 4360705122Document1 pageOrder ID 4360705122Jnanaranjan NayakNo ratings yet

- Amendment of Form GSTR-3B 11112022Document9 pagesAmendment of Form GSTR-3B 11112022Jnanaranjan NayakNo ratings yet

- Order ID 4366169065Document1 pageOrder ID 4366169065Jnanaranjan NayakNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToJnanaranjan NayakNo ratings yet

- Order ID 4361340771Document1 pageOrder ID 4361340771Jnanaranjan NayakNo ratings yet

- Introduction To Accounting: Earning BjectivesDocument22 pagesIntroduction To Accounting: Earning Bjectiveslalu morwalNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToJnanaranjan NayakNo ratings yet

- Introduction To Accounting: Earning BjectivesDocument22 pagesIntroduction To Accounting: Earning Bjectiveslalu morwalNo ratings yet

- 05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsDocument40 pages05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsAradhana AndrewsNo ratings yet

- 05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsDocument40 pages05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsAradhana AndrewsNo ratings yet

- Model Answers On PBMDocument6 pagesModel Answers On PBMJnanaranjan NayakNo ratings yet

- SummaryDocument3 pagesSummaryJnanaranjan NayakNo ratings yet

- 1st TrimesterDocument2 pages1st TrimesterJnanaranjan NayakNo ratings yet

- Home Results Result Search: Master of Business AdministrationDocument2 pagesHome Results Result Search: Master of Business AdministrationJnanaranjan NayakNo ratings yet

- Moon Eclipse in FutureDocument1 pageMoon Eclipse in FutureJnanaranjan NayakNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Reflection TaxDocument2 pagesReflection TaxHannah Alvarado BandolaNo ratings yet

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navNo ratings yet

- TaxationDocument3 pagesTaxationMegumi HideyukiNo ratings yet

- Work Book Paper7Document174 pagesWork Book Paper7Arvind KumarNo ratings yet

- Fill in All Applicable White Spaces. Mark All Appropriate Boxes With An 'X'Document1 pageFill in All Applicable White Spaces. Mark All Appropriate Boxes With An 'X'Sarah AzoreNo ratings yet

- Fee - International Conference MSMF10Document1 pageFee - International Conference MSMF10Kamal MankariNo ratings yet

- Amgen Financial AnalysisDocument2 pagesAmgen Financial AnalysisNiNo ratings yet

- Accounting For Employment Benefits PDF FreeDocument5 pagesAccounting For Employment Benefits PDF FreeTrisha Mae BujalanceNo ratings yet

- Algo Trading Agreement: Know All Men by These Presents: DATEDocument3 pagesAlgo Trading Agreement: Know All Men by These Presents: DATEPrashant MahadikNo ratings yet

- Annex C RR 11-2018Document2 pagesAnnex C RR 11-2018Maureen PascualNo ratings yet

- Profit and Loss Statement TemplateDocument6 pagesProfit and Loss Statement TemplateyashveerNo ratings yet

- DIAGEO vs. CIR - VillarmeaDocument2 pagesDIAGEO vs. CIR - VillarmeaJan EchonNo ratings yet

- Income Taxation in General Income TaxDocument5 pagesIncome Taxation in General Income TaxRose Anne PerejaNo ratings yet

- Taxation (Malawi) : Monday 6 June 2011Document10 pagesTaxation (Malawi) : Monday 6 June 2011angaNo ratings yet

- 14 Tax Saving OptionsDocument4 pages14 Tax Saving OptionsleninbapujiNo ratings yet

- GST Vanshika Bheda WRO719720Document33 pagesGST Vanshika Bheda WRO719720Vanshika BhedaNo ratings yet

- Tax Newsletter January 2019 PDFDocument9 pagesTax Newsletter January 2019 PDFinobestconsultingNo ratings yet

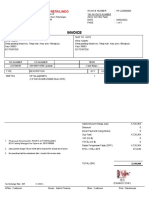

- Invoice LaptopDocument1 pageInvoice LaptopWina YulantriNo ratings yet

- Pyq NgoDocument5 pagesPyq NgoArbaz KhanNo ratings yet