Professional Documents

Culture Documents

EDU. Loan Tirth A Patel & Ashish K Patel

Uploaded by

jitendra tirthyaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EDU. Loan Tirth A Patel & Ashish K Patel

Uploaded by

jitendra tirthyaniCopyright:

Available Formats

`THE KALUPUR COMMERCIAL CO-OP.

BANK LIMITED

NOTES FROM LOAN DEPARTMENT – NAVA VADAJ BRANCH

NEW PROPOSAL

Name of Applicant Mr./Miss. (Student) Tirth Ashish Patel CIF 11455290

Mr/ Mrs. Co-applicant I) Ashish Kanubhai Patel CIF 10456388

Address 12, Dev Ashish society, Opp. Swastik High School, Nava Vadaj, Ahmedabad

Income Details Co - Applicant 1 Co-Applicant 2

A.Y. 2019-20 A.Y. 2018-19 A.Y. 2019-20 A.Y. 2018-19

11.47 Lakh 13.50 Lakh NA NA

CIBIL Particular Cibil Remark Date of Birth

Score

Applicant (student) Tirth Ashishbhai Patel -1 Insufficient credit 12/30/1899

history

Co-applicant 1 Ashish Kanubhai Patel 696 Satisfactory 08/04/1970

Guarantors 1 Ushaben Ashishkumar Patel 786 Satisfactory 04/03/1971

Guarantors 2 Kamal Harikrishna Patel 792 Satisfactory 15/12/1970

Income Tax

A.Y. 2019-20 A.Y. 2018-19 A.Y. 2017-18

Return Date (A.Y.)

Co-applicant 1 12/30/1899 06/09/2018 07/10/2017

Guarantors 1 26/09/2019 06/09/2018 20/09/2017

Guarantors 2 03/07/2019 11/07/2018 N. A.

Nature of Income Salary / Business / Profession / Service income

Brief Detail of Co-

Co-applicant Business Person (**** Including 24 Months Moratorium Period)

applicants i)

Applicant's Request Branch Recommendation

Loan Amt Loan Amt Tenure

Tenure

TOTAL 32.00 Lakh 120 Months 30.00 Lakh 120 Months*****

APPRAISAL NOTE PAGE NO. 1 of 6

Security Description of the Property Owner Valuation

Plot No. 12, Radhe Industrial Estate, Nr. Mrs. Ushaben 1,12,00,000/-

Umiya Industrial Estate, Zak Kadadara, Ashishkumar Patel

Road, Zak Dehgam, Gandhinagar

Valuer : Bakul N Desai Valution Date 21/05/2019

Total --- Rs: lacs

Details of Name PAN Income

Guarantors

i) Mrs. Ushaben Ashishkumar Patel AUJPP2728F 6.10 Lakh

ii) Mr. Kamal Harikrishna Patel AOSPP8935K 5.36 Lakh

ELIGIBILTY CRIETERIA:

NO CRITERIA REMARKS STATUS

1 Student's Standard Results Year of

Academic history Passing

SSC 74.50% 2013

HSC 70.07% 2015

B. E. in Mechanical Engineering 8.55 CGPA 2019

IELTS 7 BAND 2019

GRE Appear 2019

2 University & Particular Remarks

course validity

Name of the The University of Texas at Arlington

University

Course Materials Engineering (Masters)

Duration of the 2 YEARS

Course

2 Future scope of There is a Good scope of Income after Completion of Course.

the Income of

student after

completion of

study.

APPRAISAL NOTE PAGE NO. 2 of 6

3 Fees+ other exps Particular Amount (Currency: USD) Rs: 30 Lakh

Total Fees (Tution & Living Fees) Amount

AU$/CAD$/USD/ Euro/other *Total (Currency:$25,467 *2 Year)

Term / year )

Add : Air Ticket Approx. ($1690 USD)

Add : Visa Fees ($350 USD)

Total Fees with Above Expenses Amount (Currency: $ 52974

USD)

Add : Other Incidental Expenses Amount (Currency: _______)

1 AU$/USD$/CAD$/Euro etc Rs: 37.61 Lakh

1USD = 71 INR

Total Rs: 37.61 Lakh

80% of above Rs: 30.08 Lakh

Application (Loan amt) Rs: 30 Lakh

4 60%/70% of market Particular Amount Margin Security Rs: 72 Lakh

value of self (Rs in lacs) required

occupied

residential/commer Proposed Rs. 30 Lakh 30.00% Rs. 43 Lakh

cial property. education loan

Security valuation Available for Education loan Rs. 72 Lakh

( Calculation Give Under for Security )

Security coverage 134.93%

5 Eligibility as per Mr. Ashish Kanubhai Patel Rs: 11.45 Lakh (AY 2019-20) Rs: 30 Lakh

the calculation

sheet attached EMI/NMI Ratio is 45 % which is acceptable.

with this report

(** Here we consider only 96 months repayment period for

EMI/NMI Ratio.)

6 Applicant/ Education loan Rs: 30 Lakh Rs: 30 Lakh

Branch's Request

Loan Eligibility – Minimum of Sr. No. 3 , 4, 5 & 6 Rs: 30 Lakh

Other Observation:

Applicant-1 Cibil Mr. Tirth Ashishbhai Patel

There is insufficient credit history.

There is no inquiry shown in his cibil score.

Co-Applicant-1 Cibil Mr. Ashish Kanubhai Patel

As per cibil loan account shown 7 out of which 5 account are shown zero Outstanding.

APPRAISAL NOTE PAGE NO. 3 of 6

Cibil score of Ashish kanubhai Patel is satisfactory.

One loan account shown in overdue but actually there is no overdue in account.

2 account are running and its belongs to individual ownership.

There is 2 new inquiry shown in cibil both are generated in our bank for renewal of OD account and

education loan.

Guarantor-1 Cibil Mrs. Ushaben Ashishkumar Patel

As per cibil loan account shown 4 out of which 2 account are shown zero Outstanding.

Cibil score of Ushaben Ashishkumar Patel is satisfactory.

There is no single day overdue shown in loan account.

There is 2 loan account is running but actually SOD account is closed as on 19/11/19.01635100026

There is 2 new inquiry shown in cibil both are generated in our bank for renewal of OD account and

education loan.

Guarantor-2 Cibil Mr. Kamal Harikrishna Patel

As per cibil loan account shown 6 out of which 4 account are shown zero Outstanding.

Cibil score of Kamal Harikrishna Patel is satisfactory.

There is no single day overdue shown in loan account.

There is 2 loan account is running both are belongs to individual ownership.

There is No New inquiry shown in cibil in the last year.

BRANCH RECOMMENDATIONS WITH JUSTIFICATIONS

Applicant Mr. Tirth Ashishbhai Patel Patel has completed B.E. In Mechanical Engineering from

Gujarat Technical University Ahmedabad and scoring good marks.

Mr. Tirth A. Patel got admission in the university of “The university of Texas at Arlington” for Master

Degree of Materials Engineering. This is 2 year duration course and has good income of scope after

completion of this degree.

Co-applicant Mr. Ashish Kanubhai Patel is doing business under name of M/s Amarjyot Metal Cast

and M/s Amardeep Metal Cast as partner since 2011, He has earning 11.47 lakh as per A.Y. 2019-

20.

Mr. Ashish Kanubhai Patel is associated with us since 2011 and his cibil score is satisfactory and

financial condition is also strong.

Amarjyot Metal Cast is doing manufacturing business of metal related produnct i.e. pipe joints etc.

which is enjoying Hypo Stock & Book Debt facility.

Applicant will go to USA for Master degree and his educational background is good.

Relation Between Applicants and Guarantors:-

◦ Applicant 1 is son of Applicant 2 .

◦ Guarantor 1 i.e. Ushaben Ashishbhai Patel is Mother of Appliacnt 1 i.e. Tirh A Patel.

◦ Guarantor 2 i.e. Kamal Harikrishna Patel stand as third party gurantee.

APPRAISAL NOTE PAGE NO. 4 of 6

Customer is given Industrial Shade for Mortgage Purpose for this education loan. which is belongs

to Guarantor 1 of this education loan. Applicant provide common property for the proposed

education loan and Hypo Stock & Book-debt OD with us since 2013.

Security coverage is available for this education loan.

(** Customer enjoying Benefit of rate concession in OD limit i.e. 10.50% interest hence I consider full

amount in security required for calculation of security coverage ratio)

Mrs. Ushaben Ashishkumar Patel is owner of above mention property who is stand as guarantor 1

for this education loan.

1st

guarantor, Mrs Ushaben Ashishkumar Patel is also doing busniess under name of M/s Amarjyot

Metal Cast as partner and she is earning 6.10 lakh as per ITR A.Y. 2019-20.

2nd guarantor, Mr. Kamal Harikrishna Patel is doing service as Sr. IT. Technician in patel Airtemp

(INDIA) Ltd. Since 1994, he earned 5.36 lakh as per last ITR A.Y. 2019-20.

Mr. Kamal H Patel also enjoying housing loan facility with us since 2015 and conduct of account is

satisfactory (01633500007).

We recommend you to sanction this loan for 120 Months including 24 Months Moratorium Period.

We will also take affidavit from the student before disbursement of education loan that he has not

availed any other education loan from any Other Bank/Financial institution as per circular dated as

on 01/01/2019 Ref. No. H.O./Inspection/94/2018-19.

For Calculation of EMI/NMI ratio I consider last two year income and also consider loan tenure after

deducting loan moratorium period as per circular dated 3 rd july 2019. H.O./Advance/34/2019-20.

EMI/NMI ratio is 45% which is allowed as per circular H.O./Advance/34/2019-20.

Here I consider 1 USD$ rate is 71 Rupee INR.

APPRAISAL NOTE PAGE NO. 5 of 6

Herewith We recommendate you to Sanction above mentioned advance facility of Education Loan for

USA Master Degree Course for Rs. 30 Lakhs for 10 Years @ ROI 9.25%.( 120 Months including 24

Months Moratorium Period) (We have consider circular as on 02/01/2019 for interest rate based on CIR

report.)

Prepared By: Jitendra Tirthyani (1328) Loan Officer: Shachi Patel

(20/11/2019) (20/11/2019)

Branch Manager: Darshil Shah

(20/11/2019)

APPRAISAL NOTE PAGE NO. 6 of 6

You might also like

- Practical Cybersecurity ArchitectureDocument267 pagesPractical Cybersecurity ArchitectureManish Sharma100% (1)

- QA Onboarding Basics - CentralDocument53 pagesQA Onboarding Basics - CentralRodrigo Hidalgo100% (1)

- LCA Engine Oil SummaryDocument12 pagesLCA Engine Oil Summarysimaproindia100% (1)

- Poka Yoke PDFDocument62 pagesPoka Yoke PDFmartinNo ratings yet

- Fee RecieptDocument1 pageFee RecieptAnshuNo ratings yet

- Travel Market Research 2019 AGN OfficialDocument25 pagesTravel Market Research 2019 AGN Officialcarere teiNo ratings yet

- Use of Business / Accountancy Models: Annotated Examples of Research and Analysis - Topic 8Document2 pagesUse of Business / Accountancy Models: Annotated Examples of Research and Analysis - Topic 8Reznov KovacicNo ratings yet

- Highlights of The CREATE LawDocument3 pagesHighlights of The CREATE LawChristine Rufher FajotaNo ratings yet

- Interest CertificateDocument1 pageInterest Certificatebhagyaraju67% (15)

- Cosmatic & Stationary 3 Lak FullDocument8 pagesCosmatic & Stationary 3 Lak Fullkartik DebnathNo ratings yet

- Bank Statements AY 2020-21Document21 pagesBank Statements AY 2020-21rohit madeshiyaNo ratings yet

- Alumni Scholarship Updated-MergedDocument14 pagesAlumni Scholarship Updated-Mergedtarun garlapatiNo ratings yet

- DR AlliDocument20 pagesDR AlliDr K. Mamatha Prof & Hod FMTNo ratings yet

- Sem 2Document1 pageSem 2Raj PaliwalNo ratings yet

- Invoice RINA INDIA Dec 2019 - PN-IGLDocument1 pageInvoice RINA INDIA Dec 2019 - PN-IGLPrem NautiyalNo ratings yet

- 2016-17 ItDocument36 pages2016-17 ItKingKamalNo ratings yet

- GTE Financial Capacity Matrix (S) - Title & Name (2021)Document4 pagesGTE Financial Capacity Matrix (S) - Title & Name (2021)Anupriya RoyNo ratings yet

- BSBFIA401 AT2 Asset Registers Carlos Quintero Ocampo 01Document2 pagesBSBFIA401 AT2 Asset Registers Carlos Quintero Ocampo 01Zenith ShresthaNo ratings yet

- Business Plan Full Write Up For MicroDocument10 pagesBusiness Plan Full Write Up For MicrokiranNo ratings yet

- BB Investment Declaration Form FY 2023-24Document3 pagesBB Investment Declaration Form FY 2023-24ms.roy007No ratings yet

- G. Pulla Reddy Engineering College (Autonomous) : KurnoolDocument1 pageG. Pulla Reddy Engineering College (Autonomous) : KurnoolHari ReddyNo ratings yet

- 11881526 (2)Document1 page11881526 (2)Luis de leonNo ratings yet

- Salary Slip of MR Indra Nath Mishra March 20Document1 pageSalary Slip of MR Indra Nath Mishra March 20Indra MishraNo ratings yet

- 6572beeb1353b - Tea Stall 2Document11 pages6572beeb1353b - Tea Stall 2Prashant Sunali C'naNo ratings yet

- N.S.K.F.D.C Schemes: Project Report ON Manufacturing of Mixture, Namkin, Papad, Muri Etc (Manufacturingunit)Document7 pagesN.S.K.F.D.C Schemes: Project Report ON Manufacturing of Mixture, Namkin, Papad, Muri Etc (Manufacturingunit)Global Law FirmNo ratings yet

- Project Profile On Garbage Bags and Dust Bins SL No DescriptionDocument9 pagesProject Profile On Garbage Bags and Dust Bins SL No DescriptionPreetham InduriNo ratings yet

- Aari Work 120-180 PDFDocument6 pagesAari Work 120-180 PDFkfc financesNo ratings yet

- Rishit P Bhagat Invoice 7002-2020Document1 pageRishit P Bhagat Invoice 7002-2020Akash AgarwalNo ratings yet

- Invoice 2022-23-321Document1 pageInvoice 2022-23-321Ruby DianaNo ratings yet

- Central Institute of Plastics Engineering & Technology (Cipet) (An Autonomous Body Under Ministry of Chemicals & Fertilizers, Govt of India)Document7 pagesCentral Institute of Plastics Engineering & Technology (Cipet) (An Autonomous Body Under Ministry of Chemicals & Fertilizers, Govt of India)shridharpandian psgNo ratings yet

- Fee Structure2019 2020 (Hits)Document21 pagesFee Structure2019 2020 (Hits)VivekMedaramitlaNo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Dha Bahawalpur Three Years Cost of Land Payment Plan - 6th Ballot Five Marla ResidentialDocument6 pagesDha Bahawalpur Three Years Cost of Land Payment Plan - 6th Ballot Five Marla ResidentialSoccerMasterNo ratings yet

- Common Form For Bills Upto 25000Document1 pageCommon Form For Bills Upto 25000vijay patilNo ratings yet

- Please Pay This AmountDocument1 pagePlease Pay This AmountEdz Votefornoymar Del RosarioNo ratings yet

- Project Report ON Electrical&Electronics Repairing (Service Sector Unit) Under P.M.E.G.PDocument6 pagesProject Report ON Electrical&Electronics Repairing (Service Sector Unit) Under P.M.E.G.PGlobal Law FirmNo ratings yet

- 9 - 11 - 2019 11 - 34 - 28 Am PDFDocument1 page9 - 11 - 2019 11 - 34 - 28 Am PDFHarshitNo ratings yet

- Aqar Report 2017-18 Umiya CollegeDocument36 pagesAqar Report 2017-18 Umiya CollegeAcross BordersNo ratings yet

- Økwshkík Xìflkku÷Kusf÷ Þwrlkðšmkxe: Important CircularDocument1 pageØkwshkík Xìflkku÷Kusf÷ Þwrlkðšmkxe: Important CircularAnand KalaniNo ratings yet

- Bit - Fe - STDR (1) - 1Document1 pageBit - Fe - STDR (1) - 1Karan PeshwaniNo ratings yet

- NonDocument6 pagesNonb jayaNo ratings yet

- Annex-8-Master Global (2022-2023) CARPENTRY With AssessmentDocument4 pagesAnnex-8-Master Global (2022-2023) CARPENTRY With AssessmentNeNe DoblarNo ratings yet

- Agri BusinessDocument12 pagesAgri Businessashiquecse2015No ratings yet

- Quotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyDocument1 pageQuotation - ABS 2020-21 - E203 - Mr. K Ramesh ReddyairblisssolutionsNo ratings yet

- Duplicate: Plot No.2, Sector 17-A, Yamuna Expressway Greater Noida, Gautam Budh Nagar, Uttar Pradesh 201310Document1 pageDuplicate: Plot No.2, Sector 17-A, Yamuna Expressway Greater Noida, Gautam Budh Nagar, Uttar Pradesh 201310Sachin VikalNo ratings yet

- Quotation - ABS 2020-21 E207 - Mrs. G. PriyankaDocument2 pagesQuotation - ABS 2020-21 E207 - Mrs. G. PriyankaairblisssolutionsNo ratings yet

- Corporate Tutorial FinalDocument12 pagesCorporate Tutorial Finalshikha khanejaNo ratings yet

- Application SummaryDocument4 pagesApplication SummaryAditya ThesiaNo ratings yet

- FINANCIAL MatrixDocument1 pageFINANCIAL Matrixramana raoNo ratings yet

- Dry Fish 3 LakDocument6 pagesDry Fish 3 Lakkartik DebnathNo ratings yet

- L&ADV. (Modified 27 - 9 - 09Document11 pagesL&ADV. (Modified 27 - 9 - 09kunalNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherRavanan v.sNo ratings yet

- Salin-BJU - Umum 6Document18 pagesSalin-BJU - Umum 6Arya RahmatNo ratings yet

- Bikash Paul PMEGPDocument6 pagesBikash Paul PMEGPKartik DebnathNo ratings yet

- Dot Notice ZD080623051455D 20230615041115Document5 pagesDot Notice ZD080623051455D 20230615041115khushinagar9009No ratings yet

- B TechlateralDocument1 pageB TechlateralDebabrat SaikiaNo ratings yet

- Sadhan ProjectDocument26 pagesSadhan Projectsk74209No ratings yet

- Powered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovDocument4 pagesPowered & Maintained by NSDL E-Governance Infrastructure LTD.© 2015 NSDL E-GovMohamed SharifNo ratings yet

- In The Books of ATITHI: Name PRN No. Division BatchDocument10 pagesIn The Books of ATITHI: Name PRN No. Division BatchAnanya ChoudharyNo ratings yet

- ST TH ST TH ND TH ST TH ND TH RD TH TH THDocument2 pagesST TH ST TH ND TH ST TH ND TH RD TH TH THGundeti TejaNo ratings yet

- HDFC Bank LTDDocument6 pagesHDFC Bank LTDutkarshlegal96No ratings yet

- Process NoteDocument11 pagesProcess NoteSANKALPNo ratings yet

- Pradhan Mantri Mudra Yojana (Pmmy) Kishore SchemeDocument5 pagesPradhan Mantri Mudra Yojana (Pmmy) Kishore SchemeGlobal Law FirmNo ratings yet

- Application SummaryDocument4 pagesApplication Summarydarshit mepaniNo ratings yet

- Par DownloadDocument4 pagesPar Downloadanand DoliaNo ratings yet

- Cambodia: Energy Sector Assessment, Strategy, and Road MapFrom EverandCambodia: Energy Sector Assessment, Strategy, and Road MapNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- ASN SOD Finacial AnalysisDocument6 pagesASN SOD Finacial Analysisjitendra tirthyaniNo ratings yet

- Apple Enterprise Financial AnalysisDocument6 pagesApple Enterprise Financial Analysisjitendra tirthyaniNo ratings yet

- Hinglaj Light Renewal 2018Document4 pagesHinglaj Light Renewal 2018jitendra tirthyaniNo ratings yet

- Home Loan Testing FileDocument2 pagesHome Loan Testing Filejitendra tirthyaniNo ratings yet

- Nelba: Case StudyDocument7 pagesNelba: Case StudyVictor Sabrera ChiaNo ratings yet

- FSUU Board ResolutionDocument2 pagesFSUU Board ResolutionJudeRamos0% (1)

- David SMCC16ge ppt07Document46 pagesDavid SMCC16ge ppt07Thanh MaiNo ratings yet

- MII BAMC Action ProjectDocument11 pagesMII BAMC Action ProjectAmar Mohamed AliNo ratings yet

- Organizing For Advertising and Promotion: The Role of Ad Agencies and Other Marketing Communication OrganizationsDocument20 pagesOrganizing For Advertising and Promotion: The Role of Ad Agencies and Other Marketing Communication OrganizationsPrasad KapsNo ratings yet

- Sap Fico and S4 Hana Finance and FioriDocument4 pagesSap Fico and S4 Hana Finance and FioriNafis AlamNo ratings yet

- Cherukuri Vinay Kumar-AWS Cloud EngineerDocument1 pageCherukuri Vinay Kumar-AWS Cloud EngineerEmdadul Hoque TusherNo ratings yet

- Nation With Namo, Cover LetterDocument2 pagesNation With Namo, Cover LetterAbhay GuptaNo ratings yet

- Srisaila Devasthanam: Phone: 8333901351, 8333901352, 8333901353, 8333901354, 8333901355, 8333901356 Fax: 08524-287126Document1 pageSrisaila Devasthanam: Phone: 8333901351, 8333901352, 8333901353, 8333901354, 8333901355, 8333901356 Fax: 08524-287126Ajay Chowdary Ajay ChowdaryNo ratings yet

- QsbankDocument2 pagesQsbankAmrita PatilNo ratings yet

- Samruddha Vilas Ghodake - Offer - SalesDocument2 pagesSamruddha Vilas Ghodake - Offer - SalesSam GNo ratings yet

- 1 EODB Law-BOSS CARAVANDocument16 pages1 EODB Law-BOSS CARAVANgulp_burpNo ratings yet

- Hs Entrepreneurship Performance Indicators 3Document20 pagesHs Entrepreneurship Performance Indicators 3api-374581067No ratings yet

- BillFor5 2022Document5 pagesBillFor5 2022PadmanabanNo ratings yet

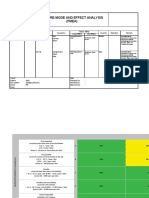

- Lat FmeaDocument7 pagesLat FmeaMendi SeptiantoNo ratings yet

- Hanwha Engineering & Construction - Brochure - enDocument48 pagesHanwha Engineering & Construction - Brochure - enAnthony GeorgeNo ratings yet

- Software TestDocument378 pagesSoftware TestUriel TijerinoNo ratings yet

- Group 7 Bergerac Systems - Challenge of Backward IntegrationDocument4 pagesGroup 7 Bergerac Systems - Challenge of Backward Integrationkiller dramaNo ratings yet

- Britannia IndustriesDocument40 pagesBritannia IndustriesabhilashjadhavNo ratings yet

- Marriage Biodata Doc Word Formate ResumeDocument2 pagesMarriage Biodata Doc Word Formate ResumeIqbal Kabir50% (4)

- Infrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersDocument106 pagesInfrastructure Development Within The Context of Africa's Cooperation With New and Emerging Development PartnersKadmiri. SNo ratings yet

- A.national Value Capture Finance Policy FrameworkDocument16 pagesA.national Value Capture Finance Policy FrameworkAnirban MandalNo ratings yet

- Implied AuthorityDocument4 pagesImplied AuthorityDevendra Babu100% (1)