Professional Documents

Culture Documents

Chapter 08

Uploaded by

Joel AldaveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 08

Uploaded by

Joel AldaveCopyright:

Available Formats

Problem 8.

1 Peregrine Funds -- Jakarta

Samuel Samosir trades currencies for Peregrine Funds in Jakarta. He focuses nearly all of his time and attention on the

U.S. dollar/Singapore dollar ($/S$) cross-rate. The current spot rate is $0.6000/S$. After considerable study, he has

concluded that the Singapore dollar will appreciate versus the U.S. dollar in the coming 90 days, probably to about

$0.7000/S$. He has the following optons on the Singapore dollar to choose from:

Option choices on the Singapore dollar: Call on S$ Put on S$

Strike price (US$/Singapore dollar) $0.6500 $0.6500

Premium (US$/Singapore dollar) $0.00046 $0.00003

Assumptions Values

Current spot rate (US$/Singapore dollar) $0.6000

Days to maturity 90

Expected spot rate in 90 days (US$/Singapore dollar) $0.7000

a) Should Samuel buy a put on Singapore dollars or a call on Singapore dollars?

Since Samuel expects the Singapore dollar to appreciate versus the US dollar, he should buy a call on Singapore dollars.

This gives him the right to BUY Singapore dollars at a future date at $0.65 each, and then immediately resell them in the

open market at $0.70 each for a profit. (If his expectation of the future spot rate proves correct.)

b Using your answer to part (a), what is Samuel's breakeven price?

Per S$

Strike price $0.65000

Note this does not include any interest cost on the premium. Plus premium $0.00046

Breakeven $0.65046

c) Using your answer to part (a), what is Samuel's gross profit and net profit (including premium) if the spot rate at

the end of 90 days is indeed $0.70/S$?

Gross profit Net profit

(US$/S$) (US$/S$)

Spot rate $0.70000 $0.70000

Less strike price ($0.65000) ($0.65000)

Less premium ($0.00046)

Profit $0.05000 $0.04954

d) Using your answer to part (a), what is Samuel's gross profit and net profit (including premium) if the spot rate at

the end of 90 days is $0.80/S$?

Gross profit Net profit

(US$/S$) (US$/S$)

Spot rate $0.80000 $0.80000

Less strike price ($0.65000) ($0.65000)

Less premium ($0.00046)

Profit $0.15000 $0.14954

You might also like

- 00 Real Estate Evaluator (New)Document7 pages00 Real Estate Evaluator (New)ryan tunNo ratings yet

- FX IV PracticeDocument10 pagesFX IV PracticeFinanceman4100% (4)

- Sensitivity Analysis Excel TemplateDocument5 pagesSensitivity Analysis Excel TemplateCele MthokoNo ratings yet

- Budget Summary Report1Document4 pagesBudget Summary Report1MarvvvNo ratings yet

- Commercial Management Construction 1st Edition PGguidance 2016Document62 pagesCommercial Management Construction 1st Edition PGguidance 2016Neminda Dhanushka KumaradasaNo ratings yet

- Taxation 2Document112 pagesTaxation 2cmv mendoza100% (7)

- Advantages of VATDocument9 pagesAdvantages of VATAnkit GuptaNo ratings yet

- Working Capital Collection Period 30 DaysDocument12 pagesWorking Capital Collection Period 30 DaysLinda Putri AsmaniaNo ratings yet

- Ecolab Inc. Income Statement: Gross ProfitDocument7 pagesEcolab Inc. Income Statement: Gross ProfitMahdiNo ratings yet

- Notes in Tax On IndividualsDocument4 pagesNotes in Tax On IndividualsPaula BatulanNo ratings yet

- Black Book Internship Traning ProjectDocument41 pagesBlack Book Internship Traning ProjectRahul Pujare67% (9)

- Final Tutorial Answer 2017Document12 pagesFinal Tutorial Answer 2017Shafayet JamilNo ratings yet

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- OffShore Vessel GlossaryDocument21 pagesOffShore Vessel Glossarydaniel8iosif_178% (9)

- Problem 8.1 Peregrine Funds - JakartaDocument5 pagesProblem 8.1 Peregrine Funds - JakartaAlexisNo ratings yet

- Sallie Schnudel currency option choicesDocument1 pageSallie Schnudel currency option choicesSamer100% (1)

- Chap08 Pbms MBF12eDocument15 pagesChap08 Pbms MBF12eBeatrice BallabioNo ratings yet

- DerivativeDocument16 pagesDerivativeShiro Deku100% (1)

- Laura Cervantes currency speculator problemDocument5 pagesLaura Cervantes currency speculator problemWOP INVESTNo ratings yet

- Problem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsDocument9 pagesProblem Set 5: Futures, Options & Swaps Q1.: British Pound Futures, US$/pound (CME) Contract 62,500 PoundsSumit GuptaNo ratings yet

- IFM 2017 Final Exam-Solution-SampleDocument12 pagesIFM 2017 Final Exam-Solution-SampleApiwat Benji PradmuangNo ratings yet

- Sallie Schnudel speculates on Singapore dollar appreciationDocument25 pagesSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Chap08 Pbms SolutionsDocument25 pagesChap08 Pbms SolutionsDouglas Estrada100% (1)

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- HW Chap 7Document2 pagesHW Chap 7Thao NgoNo ratings yet

- International Management Assignment 3Document2 pagesInternational Management Assignment 3Stefven PutraNo ratings yet

- Managing Transaction ExposureDocument43 pagesManaging Transaction ExposureWissal bidaneNo ratings yet

- Peleh's Put Options ProblemDocument10 pagesPeleh's Put Options ProblemveronikaNo ratings yet

- Solutions Guide: Reducing debt lowers financial riskDocument3 pagesSolutions Guide: Reducing debt lowers financial riskTatiana SanchezNo ratings yet

- Personal Bal SheetDocument6 pagesPersonal Bal SheetIrfan MalikNo ratings yet

- PL TemplateDocument1 pagePL TemplateyemaneatakNo ratings yet

- Personal Balance Sheet: AssetsDocument6 pagesPersonal Balance Sheet: AssetsamanullahjamilNo ratings yet

- Rental Analysis and Projections for The Meridian Apartments in BaltimoreDocument64 pagesRental Analysis and Projections for The Meridian Apartments in BaltimoreWill MillerNo ratings yet

- Loan Cost Optimizer Free Download 1Document13 pagesLoan Cost Optimizer Free Download 1sdohtem7No ratings yet

- Problem CH 8 Finc 320Document2 pagesProblem CH 8 Finc 320Fatema AliNo ratings yet

- Bond Price Value of A BondDocument3 pagesBond Price Value of A BondPham Quoc BaoNo ratings yet

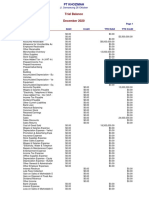

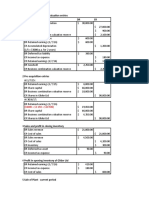

- Trial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD CreditDocument2 pagesTrial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD Creditkhozimah nurNo ratings yet

- Beefeaters RV Park General Journal Date Account Titles and Explanation Debit KreditDocument1 pageBeefeaters RV Park General Journal Date Account Titles and Explanation Debit Kredityogi fetriansyahNo ratings yet

- Options and Corporate FinanceDocument30 pagesOptions and Corporate FinanceBussines LearnNo ratings yet

- Plantilla Manejo Finanzas PersonalesDocument25 pagesPlantilla Manejo Finanzas PersonalesAngel Francisco Roque RamosNo ratings yet

- Buford StarbucksDocument7 pagesBuford StarbucksRESHMANo ratings yet

- Backtesting Challenge ResultsDocument47 pagesBacktesting Challenge ResultssaiNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceRangga Putra MudaNo ratings yet

- 2521 Kimball ST - Scenario AnalysisDocument11 pages2521 Kimball ST - Scenario AnalysisBrandon JonesNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceKhozimah ZimahNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Project Profile - CTG-KHI-CTG - Page 5Document1 pageProject Profile - CTG-KHI-CTG - Page 5MoontasirNasimNo ratings yet

- Hedging SampleDocument4 pagesHedging SampleJunior CelsiusNo ratings yet

- Currency Risk ManagementDocument52 pagesCurrency Risk ManagementWatan YarNo ratings yet

- Trading Plan ResultsDocument78 pagesTrading Plan ResultsVitu '-'No ratings yet

- SFM DJB - Nov20 Suggested Answers PDFDocument22 pagesSFM DJB - Nov20 Suggested Answers PDFJash BhagatNo ratings yet

- Personal Budget BreakdownDocument1 pagePersonal Budget BreakdownmsatriobudiNo ratings yet

- Tugas 5Document17 pagesTugas 5Syafiq RamadhanNo ratings yet

- STMT BBGN 001 TNJN000012 Jul2023Document9 pagesSTMT BBGN 001 TNJN000012 Jul2023mascotreal7No ratings yet

- S11171641 - Youvashni Shivali Narayan-20.7Document6 pagesS11171641 - Youvashni Shivali Narayan-20.7shivnilNo ratings yet

- Hedging Currency ExposureDocument37 pagesHedging Currency ExposuretrangngqNo ratings yet

- Five Year Plan (Service Industry) Model Inputs and Investor ScenarioDocument4 pagesFive Year Plan (Service Industry) Model Inputs and Investor Scenariomary34d100% (1)

- Latihan Currency Derivative V.01Document27 pagesLatihan Currency Derivative V.01Favian Maraville YadisaputraNo ratings yet

- Courtney Downs June 06Document54 pagesCourtney Downs June 06MarcyNo ratings yet

- Computron Industries Ratio Analysis For ClassDocument8 pagesComputron Industries Ratio Analysis For ClassRishabh JainNo ratings yet

- Commercial Cap Rate AnalysisDocument23 pagesCommercial Cap Rate AnalysisPatrick EdrosoloNo ratings yet

- How to Divide $36,000 in Necessary, Desirable and Savings ExpensesDocument1 pageHow to Divide $36,000 in Necessary, Desirable and Savings ExpensesAlejandro AriasNo ratings yet

- Personal Monthly Budget1Document2 pagesPersonal Monthly Budget1Taisa StocksNo ratings yet

- Cash Flow Statement Year 1-3 with Key MetricsDocument4 pagesCash Flow Statement Year 1-3 with Key MetricsHải Linh NguyễnNo ratings yet

- David JDocument18 pagesDavid JLucky LuckyNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Income Tax MCQ on Capital Gains & DeductionsDocument6 pagesIncome Tax MCQ on Capital Gains & DeductionsDurai ManiNo ratings yet

- Exide IndustriesDocument236 pagesExide IndustriesManas Kumar SahooNo ratings yet

- Form. HRIS PDFDocument2 pagesForm. HRIS PDFDickson ChongNo ratings yet

- Understanding Macroeconomics and Monetary PoliciesDocument14 pagesUnderstanding Macroeconomics and Monetary PoliciesMia MiatriacNo ratings yet

- Financial Reporting ReviewerDocument30 pagesFinancial Reporting ReviewerElla Marie Lopez100% (1)

- Transfer Pricing (Module 7-b)Document9 pagesTransfer Pricing (Module 7-b)Karlovy DalinNo ratings yet

- ECMDocument - BPP NOTES PDFDocument50 pagesECMDocument - BPP NOTES PDFpatriciadouceNo ratings yet

- Beams 12ge LN22Document51 pagesBeams 12ge LN22emakNo ratings yet

- 3303 Ex 1 Review Key 2013Document4 pages3303 Ex 1 Review Key 2013yangpukimiNo ratings yet

- Estimating Beta and WACC of HULDocument10 pagesEstimating Beta and WACC of HULSumedh BhagwatNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- KDF Foreign Valuation ExplanationDocument11 pagesKDF Foreign Valuation ExplanationAnanthakumar ANo ratings yet

- Bonds, Bond Valuation, and Interest RatesDocument52 pagesBonds, Bond Valuation, and Interest RatesMahmoud AbdullahNo ratings yet

- Problem 1246 Dan 1247Document2 pagesProblem 1246 Dan 1247Gilang Anwar HakimNo ratings yet

- 70 02 Oil Gas StatementsDocument10 pages70 02 Oil Gas Statementsmerag76668No ratings yet

- Quiz 2 Financial Accounting SolutionsDocument5 pagesQuiz 2 Financial Accounting SolutionsScribdTranslationsNo ratings yet

- Security Rate For Security GuardsDocument1 pageSecurity Rate For Security GuardsengelNo ratings yet

- Chapter 9 Term PaperDocument3 pagesChapter 9 Term PaperMardy TarrozaNo ratings yet

- BudgetCommentary - 2020-21 ICMAPDocument122 pagesBudgetCommentary - 2020-21 ICMAPDaud ShahNo ratings yet

- Allahbad Bank ProspectusDocument127 pagesAllahbad Bank ProspectusNamita SatijaNo ratings yet

- Golden Rules of AccountingDocument14 pagesGolden Rules of AccountingChiteej BiswakarmaNo ratings yet

- Methods for redemption of public debtDocument2 pagesMethods for redemption of public debtSana NasimNo ratings yet

- India Road SystemsDocument15 pagesIndia Road SystemsPartha Sarathi SenguptaNo ratings yet