Professional Documents

Culture Documents

Shri Wood Land Furniture & Furnishing.: Equity

Shri Wood Land Furniture & Furnishing.: Equity

Uploaded by

CMBS PVTLTDOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shri Wood Land Furniture & Furnishing.: Equity

Shri Wood Land Furniture & Furnishing.: Equity

Uploaded by

CMBS PVTLTDCopyright:

Available Formats

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

Balancesheet

As on 32/03/2079

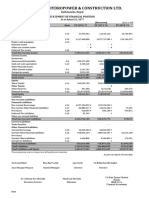

SOURCE OF FUNDS Sch. 3/32/2079 3/31/2078

Equity 5,299,000.00 -

Share Capital 1 5,000,000.00 -

Reserve & Surplus 2 299,000.00 -

NON-CURRENT LIABILITIES - -

CURRENT LIABILITIES 3 1,000.00 -

Current Liabilities 1,000.00 -

Total 5,300,000.00 -

APPLICATION OF FUNDS Sch. 3/32/2079 3/31/2078

NON -CURRENT ASSETS 8 549,125.00 -

Plant, Property and Equipment 549,125.00 -

CURRENT ASSETS 4,750,875.00

Inventory -

Sundry Debtors

Advance ,Security & Deposits 7 3,499,150.00

Cash And Cash Equivalents 1,251,725.00

Total 5,300,000.00 -

Schedule 1 to 8 annexed to form an integral part of the

Financial Statement

.

Proprietor Registered Auditor

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

Statement of profit or loss

For the year 2078/2079

PARTICULAR Sch. 2078/79 2077/78

Revenue from operation

Sales Revenue 4 3,000,000 -

Other Income - -

Less :Cost of Material Consumed 5 2,513,375 -

Gross Profit 486,625.00 -

Expenses

Administration Expenses 6 60,250 -

Depreciation 8 126,375

Selling Expenses -

Profit Before Tax 300,000.00

Provision for Income Tax (1,000)

Net Profit After Income Tax 299,000.00

Accumulated Loss of Last Year -

Balance forwarded to Balance-Sheet 299,000.00

Schedule 1 to 8 annexed to form an integral part of the Financial Statement

Proprietor Registered Auditor.

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

Balancesheet

As on 32 Ashad 2079 B.S

(IN NPR)

Particulars 2078/79 2077/78

CASH FLOW FROM OPERATING ACTIVITIES

Pripor Period Adjustment -

Net profit Before Tax 299,000.00 -

Adjustments for:

Depreciation 126,375.00 -

Finance cost - -

Cash Flow From operating Activities Before Working

Capital Changes 425,375.00 -

Changes in working capital

(Increase)/Decrease in Current Assets (3,499,150.00)

Increase/(Decrease) in Current Liabilities 1,000.00

Cash Generated by Operation (3,072,775.00)

Less:Income Tax Paid -

A.Net Cash from (Used in ) operating Activities (3,072,775.00)

CASH FLOW FROM INVESTING ACTIVITIES

Purchase/Construction of Property Plant & Equipments (675,500.00)

B.Net Cash from (Used in ) Investing Activities (675,500.00)

CASH FLOW FROM FINANCING ACTIVITIES

Issue of share capital 5,000,000.00

Increase (Decrease) in long Term Loan -

C.Net Cash flow from (Used in) Financing Activities 5,000,000.00

Net Increase/(Decrease) in cash and cash

Equivalents(A+B+C) 1,251,725.00

Cash & Cash Equivalents at the Beginning of the period -

Cash & Cash Equivalents at the End of the period 1,251,725.00 -

Schedule 1 to 8 annexed to form an integral part of the Financial

Statement

Proprietor

0

SHRI WOOD LAND FURNITURE & FURNISHING.

Schedules Forming Part of Financial Statements

For the year 2078/2079

Tarakeshwor-2,Kavresthali,Kathmandu

Equity Share Capital Schedule-1

Particulars 2078/79 2077/78

Authorized Share Capital

(5,000 Shares of Rs.100 Each) 5,000,000.00 -

Issued & Subscribed Share Capital 5,000,000.00 -

Proprietors Capital

(5,000 Shares of 100 Each ) 5,000,000.00

Total 5,000,000.00 -

Reserve & Surplus Schedule-2

Particulars 2078/79 2077/78

Opening Profit & Loss Account. -

This Year Profit 299,000.00

Total 299,000.00 -

Current Liabilities (Schedule-3)

Particulars 2078/79 2077/78

Provision for Income Taxes 1,000.00 -

Sundry Creditors -

T.D.S on Wages - -

Audit Fees Payables - -

T.D.S on Audit Fees - -

Total 1,000.00 -

Sales Revenue (Schedule- 4 )

Particulars 2078/79 2077/78

Sales of Goods 3,000,000.0

Scrap Sales - -

Other Income - -

Gross Sales Revenue 3,000,000.0 -

SHRI WOOD LAND FURNITURE & FURNISHING.

Schedules Forming Part of Financial Statements

For the year 2078/2079

Tarakeshwor-2,Kavresthali,Kathmandu

Cost of Material Consumed (Schedule-5)

Particulars 2078/79 2077/78

Opening Stock - -

Add: Purchase 4,500,000.00 -

Direct Expenses -

Less: Closing Stock 1,986,625.00 -

Total Consumption 2,513,375.00 -

Administrative Expenses (Schedule-6)

Particulars 2078/79 2077/78

Rent Expenses

Printing & Stationery Expenses 1,500.00

Electricity Expenses 45,750.00

Telephone Expenses -

Wages -

Audit Fee -

Miscelleneous Expenses -

Repair & Maintenance -

Transportation Expenses -

Cleaning Expenses -

Annual Renewal fee 13,000.00

Total 60,250.00 -

Advance ,Security & Deposits (Schedule 7)

Particulars 2078/79 2077/78

Advance Income Tax - -

Vat Receivable -

TDS Receivable

Other Advances 3,499,150.00

Total 3,499,150.00 -

Schedule 1 to 8 annexed to form an integral part of the Financial Statement

Proprietor

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

Schedules forming part of financial statements

For the year 2078/2079

Schedule 8: Schedule of Fixed Assets

Assets Cost Depreciation Net Assets

Block B Opening Balances Additions Disposal Depn Basis Rate % Amount

Furniture & Fixture 125,500.00 125,500.00 25% 31,375.00 94,125.00

Equipment & Tools - 25% - -

Warm Lights - 25% - -

Power Back Up 125,000.00 125,000.00 25% 31,250.00 93,750.00

Total - - -

Block D - - -

Machinery and Tools 425,000.00 425,000.00 15% 63,750.00 361,250.00

Total - - -

Grand Total - 675,500.00 - 675,500.00 126,375.00 549,125.00

Schedule 1 to 8 annexed to form an integral part of the Financial Statement

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

Significant Accounting Policies and Notes To Accounts

Schedule-6

1. SIGNIFICANT ACCOUNTING POLICIES

1.1 Basis of Accounting

Financial statements have been prepared under historical cost convention and accrual accounting concept (except as specifically

stated in this schedule) following Nepal Accounting Standards so far as applicable in compliance with the prevailing laws.

1.2 Revenue Recognition

Revenue has been recognized as and when the goods and services are delivered to customers unless there is uncertainty as to the

realization of amount.

1.3 Fixed Assets

Fixed Assets have been valued at cost. All expenses incurred for bringing the assets to their present location and conditions

have been capitalized.

1.4 Depreciation

Depreciation on fixed assets has been provided on Diminishing Balance Method at the following rates provided in Income

Tax Act 2058.

A. Buildings 5%

B. Office Equipment and Furniture & Fixtures 25%

C. Automobiles 20%

D. Machinery and Other Fixed Assets 15%

1.5 Inventories

Inventories have been valued at cost or market value whichever is lower. Value of inventories has been stated at the amount as

verified, valued & certified by the

management and the same are subject to physical verifications.

2. NOTES TO ACCOUNTS

2.1 Debtors and creditors

Balances in debtors, advances and creditors are subject to confirmation from the respective parties.

2.2 Provision for Income Tax

Provision for income tax has been provided as per Income Tax Act, 2058.

2.3 Previous years figures

Previous year figures has been regrouped and rearranged wherever necessary.

VAT Reconciliation Statement

SHRI WOOD LAND FURNITURE & FURNISHING.

Tarakeshwor-2,Kavresthali,Kathmandu

For the year 2078/2079

Months (Rs.)

Particulars 4 5 6 7 8 9 10 11 12 1 2 3 Return wise Sum

Vatable Sales - - - - - - - - - -

Vatable Purchase - - - - - - - - - -

-

Output vat - - - - - - - - - - - - -

Input Vat - - - - - - - - - - - - -

Net Vat( Receivale) /Payable. - - - - - - - - - - - - -

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- White Flower FS 2077.78Document16 pagesWhite Flower FS 2077.78CMBS PVTLTDNo ratings yet

- SGHCL - NFRS FSDocument238 pagesSGHCL - NFRS FSCMBS PVTLTDNo ratings yet

- My Shares ValuesDocument2 pagesMy Shares ValuesCMBS PVTLTDNo ratings yet

- OpinionDocument2 pagesOpinionCMBS PVTLTDNo ratings yet

- Gamal 78....Document6 pagesGamal 78....CMBS PVTLTDNo ratings yet

- Salle Pakhure Sichai Jal Upabhokta Sastha: Statement of Financial PositionDocument6 pagesSalle Pakhure Sichai Jal Upabhokta Sastha: Statement of Financial PositionCMBS PVTLTDNo ratings yet

- Advance Itt MarksheetDocument1 pageAdvance Itt MarksheetCMBS PVTLTDNo ratings yet

- Opinion NepaliDocument2 pagesOpinion NepaliCMBS PVTLTDNo ratings yet

- C F/ D FGTSF) JF NFTDocument8 pagesC F/ D FGTSF) JF NFTCMBS PVTLTDNo ratings yet