Professional Documents

Culture Documents

OBIEN MC-Assignment

Uploaded by

Shigure KousakaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OBIEN MC-Assignment

Uploaded by

Shigure KousakaCopyright:

Available Formats

Multiple Choice Problems: Partnership Formation

1. The accounting for partnerships differs from the accounting for sole proprietorships, corporations and

cooperatives with regards to the accounting for

a. assets b. liabilities c. equity d. all of the above

2. The asset contribution of the partners to the partnership, and any related liabilities assumed by the

partnerships, are recorded in the partnership books at

a. historical cost. b. carrying amount c. fair value d. any of these

3. A and B agreed to form a partnership. A contributed cash of P600,000, while B contributed a

machine costing P1,700,000 but with a current fair value of P1,900,000. The partners agreed that since A

will be bringing in his expertise and experience to the business, A and B shall have a 60:40 interest,

respectively. The initial credits to the partners' capital accounts shall reflect this agreement. What is the

balance of B's capital account immediately after formation of the partnership

a. P 600,000 b. P 1,000,000 c. P 1,500,000 d. P 1,900,000

4. Kathrene and Daniel agreed to form a partnership. Kathrene will contribute cash in the amount of

P500,000 and Daniel will contribute equipment amounting to P600,000 when originally purchase, but at

the time of the partnership formation, the carrying amount is P550,000. The existing fair market value is

P680,000. The equipment has an outstanding balance of P 25,000 which will not be assumed by the

partners.

Required:

Prepare the journal entry to record the transaction.

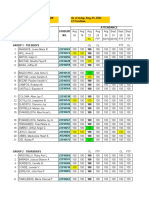

5. A and B agreed to form a partnership. The following are their contributions:

A B

Cash P 200,000 P 1,800,000

Inventories 1,200,000

Furniture and Fixtures 2,000,000

Additional Information:

a. The inventories are fairly valued. However, one-half is unpaid. The partnership assumes the

repayment of the unpaid balance to the suppliers.

b. The furniture and fixtures have a fair value of P1,400,000

Requirements:

1. Compute for the adjusted balances of the partners' capital accounts.

2. Prepare the journal entry to record the transaction.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- WAYS TO IMPROVE WPS OfficeDocument8 pagesWAYS TO IMPROVE WPS OfficeShigure KousakaNo ratings yet

- ConfidenceDocument2 pagesConfidenceShigure KousakaNo ratings yet

- Local Media8284171895155609016Document1 pageLocal Media8284171895155609016Shigure KousakaNo ratings yet

- Accounting For Long Term Construction PRDocument12 pagesAccounting For Long Term Construction PRShigure KousakaNo ratings yet

- Reverse EngineeringDocument1 pageReverse EngineeringShigure KousakaNo ratings yet

- WF Aud Assu Princ 11amDocument7 pagesWF Aud Assu Princ 11amShigure KousakaNo ratings yet

- WF Acctg. For Bus Com 430pmDocument7 pagesWF Acctg. For Bus Com 430pmShigure KousakaNo ratings yet

- TTH OM and TQM 230pmDocument12 pagesTTH OM and TQM 230pmShigure KousakaNo ratings yet