Professional Documents

Culture Documents

Irs 1

Uploaded by

Asa Seamur Bey0 ratings0% found this document useful (0 votes)

34 views1 pageunlawful tax notice color of authority via inquisition revenue service

Original Title

irs1

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentunlawful tax notice color of authority via inquisition revenue service

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views1 pageIrs 1

Uploaded by

Asa Seamur Beyunlawful tax notice color of authority via inquisition revenue service

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

GP IRS Raeariite Sasi

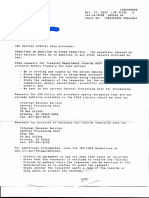

Frivolous Return Prog., Stop 4450 In reply refer to: 1486900000

OGDEN UT 84201-0088 Oct. 21, 2022 LTR 3175¢ 0

sox xe-8598, 000000 00

Input Op: 1483324354 00042845

BoDC: WI

CHARLES PHILEMON

Dear Taxpayer:

This is in reply to your correspondence received Apr. 11, 2022.

We have determined that the arguments you raised are frivolous and

have no basis in law. Federal courts have consistently ruled against

such arguments and imposed significant fines for taking such frivolous

positions.

If you persist in sending frivolous correspondence, we will not

continue to respond to it. Our lack of response does not convey

agreement or acceptance of the arguments stated. If you desire to

comply with the law concerning your tax liability, you are encouraged

to seek advice from a reputable tax practitioner or attorney

The claims presented in your correspondence do not relieve you from

your legal responsibilities to file federal tax returns and pay taxes.

We urge you to honor those legal duties.

This letter advises you of the legal requirements for filing and

paying federal individual income tax returns and informs you of the

potential consequences of the position you have taken. Please observe

that the Internal Revenue Code (IRC) Sections listed below expressly

authorize IRS employees that act on behalf of the Secretary of the

Treasury to:

1. examine taxpayer books, papers, records, or other data which may

be relevant;

2. issue summonses in order to gain possession of records so that

determinations of tax liability can be made or for ascertaining

the correctness of any return filed by a person; and

3. collect any such liability.

There are people who encourage others to violate our nation's tax laws

by arguing there is no legal requirement for them to file income tax

returns or pay income taxes. Their arguments are based on legal

statements taken out of context and on frivolous arguments that have

been repeatedly rejected by federal courts. People who rely on this

kind of information can u2timately pay more in tax, interest, and

penalties than they would have paid simply by filing correct tax

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quo Warranto Against IrsDocument3 pagesQuo Warranto Against IrsAsa Seamur BeyNo ratings yet

- Default Judgment Against Inquisition Revenue ServiceDocument3 pagesDefault Judgment Against Inquisition Revenue ServiceAsa Seamur Bey100% (1)

- Letter 2 Ha-Satan IRS DevilsDocument2 pagesLetter 2 Ha-Satan IRS DevilsAsa Seamur BeyNo ratings yet

- Irs 3Document1 pageIrs 3Asa Seamur BeyNo ratings yet

- Irs 2Document1 pageIrs 2Asa Seamur Bey100% (1)

- Irs 4Document1 pageIrs 4Asa Seamur BeyNo ratings yet