0% found this document useful (0 votes)

253 views2 pagesNew IT Declaration Form

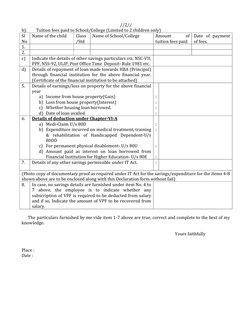

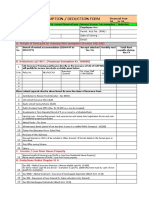

This document is a declaration form for employees to provide details for computing their income tax for the financial year 2022-2023. [1] It requests information such as the employee's name, designation, contact details, PF and PAN numbers. [2] It also asks for residential address details and rent paid if residing in a rented house. [3] The employee must provide details of deductions claimed under sections 80C, 80CCC of the Income Tax Act for items such as insurance premiums, tuition fees, investments, home loan repayment and more. [3] The form further asks for details of income/loss from property, deductions claimed under Chapter VI-A for medical expenditures and disabilities. [3] The

Uploaded by

Mahakaal Digital PointCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

253 views2 pagesNew IT Declaration Form

This document is a declaration form for employees to provide details for computing their income tax for the financial year 2022-2023. [1] It requests information such as the employee's name, designation, contact details, PF and PAN numbers. [2] It also asks for residential address details and rent paid if residing in a rented house. [3] The employee must provide details of deductions claimed under sections 80C, 80CCC of the Income Tax Act for items such as insurance premiums, tuition fees, investments, home loan repayment and more. [3] The form further asks for details of income/loss from property, deductions claimed under Chapter VI-A for medical expenditures and disabilities. [3] The

Uploaded by

Mahakaal Digital PointCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Personal and Employment Information

- Home Loan Declaration

- Insurance Policies

- Tuition Fee and Other Savings