Professional Documents

Culture Documents

Non Performing Asset

Uploaded by

Neeraj SisodiyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non Performing Asset

Uploaded by

Neeraj SisodiyaCopyright:

Available Formats

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 23, Issue 3. Ser. VI (March 2021), PP 41-51

www.iosrjournals.org

Non-Performing Assets – A Comparative Analysis of Public

Sector Banks, Private Sector Banks and Foreign Banks

Mrs. Poonam Arora

Department of Commerce, Mata Sundri College for Women

University of Delhi

Abstract

Banks play a vital role in the overall development of any economy. They fill the gap by accumulating the idle

savings of people and making it available to investors, which leads to capital formation and thereby growth of a

country. They play the role of intermediators by collecting funds from saver and by providing it to borrowers in

an efficient manner. Indian banking sector is struggling with huge amount of Non- Performing Assets (NPAs),

which pose threat on the profitability, liquidity and survival of banks. The present study focuses on the trend of

NPA in all the commercial banks (public sector, private sector, foreign banks). Beside this it also deals with

composition of banks advances in term of standard advances and NPAs (which include Substandard, Doubtful

and Loss Advances). In the study, we have correlate the Gross NPA with Total Advances and found that there is

a high degree of positive relation between variables. The paper come out with conclusion that public sector

banks need to take effective measures to overcome the problem of NPAs otherwise it would be a big issue for

their survival.

Key words: Banking sector, Non -performing Assets, Gross NPA, Standard Assets, Provisioning norms

---------------------------------------------------------------------------------------------------------------------------------------

Date of Submission: 8-03-2021 Date of Acceptance: 20-03-2021

--------------------------------------------------------------------------------------------------------------------------- ------------

I. Introduction

Banking sector is a backbone of any economy because overall growth and prosperity of any economy

to great extent depends upon banking sector. Overall assets/advances of a bank can be bifurcate as standard or

performing assets and Non-performing assets. Standard assets are loans or advances without any problem. It

carries normal risk attached to a business. WhereasNon- performing Assets are like a virus in the banking sector.

It includes cash credits as well as overdrafts which remain out of order for a period of more than 90 days. NPA

puts financial burden on the banks or other lenders because huge amount of NPA indicates that bank financial

health is not good.

ASSETS / ADVANCES CLASSIFICATION

All the assets of banks and other financial institutions can be categories in two broad categories.

1. Standard / Performing Assets – All the assets which are performing well, means which are generating

income for the banks in term of interest are called as standard or performing asset. In other words, we can call

them assets without any problem.

2. Non - Performing Assets – All the assets which are not giving returns to banks according to scheduled

commitment are termed as non – performing assets. They can also be defined as assets with problem.

a. Substandard Assets

b. Doubtful Assets

c. Loss Assets

NON- PERFORMING ASSETS

Non - performing assets (NPA) or non- performing loan refers to the loans and advances on which

either interest or principal amount is due or in arears. An asset can be termed as NPA when it discontinue /

ceases to generate income for bank. Normally the risk level is higher in NPA, as compared to standard or

performing assets. A loan or advance will be considered as NPA when debtor is not in position or unable to

meet his/ her scheduled obligations. According to RBI, NPA can be defined as credit facility in which either the

interest or instalment or both has remained due for a certain period of time. A non performing asset is basically a

loan or advance in respect of which principal or interest payment or both, remained unpaid for a period of more

than 90 days. So, the time period which is generally used to defined an asset to be standard or NPA is 90 days.

In the other word we can say that a loan or advance become NPA when the interest or/and principal remain

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 41 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

outstanding for more than 90 days, although some lenders also use shorter window period for considering a loan

or advance as NPA.

CLASSIFICATION OF NPA

Banks are required to further bifurcate their entire NPA into following categories:

1. Substandard Assets – It refers to assets which remain NPA for a period of 12 months or less. It implies

that an NPA will be termed as substandard which remain NPA for either 12-month periods or less than that.

2. Doubtful Assets – It include all the assets which remain in the substandard category for a period of 12

months. So, if any particular asset remains in the substandard category for a period of 12 months, after the

expiry of 12 months period that asset will be termed as doubtful asset.

3. Loss Assets - According to RBI, any asset can be defined as loss asset if it is considered as

uncollectible and is of very little value, that it is not worth showing it as bank asset in the balance sheet of the

bank. Although there might be some salvage or recovery value attached to that asset.

All the non – performing assets clubbed together are known as gross NPA (GNPA).

GNPA = Substandard Assets + Doubtful Assets + Loss Assets

PROVISIONING NORMS FOR ADVANCES

All the financial institutions and Banks are required to make provision for the loan and advances

sanctioned by them to cover the loss arise in contingency due to non -recovery of loan amounts. The amount of

provision depends upon the type of assets and the risk level attached to a particular asset. Since the assets of

bank are classified into various categories, therefore the provisioning norms also varies accordingly.

For Performing / standard Assets

1. For loans and advances to SME and agriculture sector 0.25%

2. For commercial real estate residential 0.75%

3. For real estate commercial 1%

4. For teaser housing loan 2%

5. For all others standard assets 0.4%

For Non – Performing Assets

1. Substandard Assets

a. Secured substandard assets 15%

b. Unsecured substandard assets 25%

2. Doubtful Assets

a. Secured doubtful assets

i. Up to one year 25%

ii. 1 – 3 years 40%

iii. More than 3 years 100%

b. Unsecured doubtful assets 100%

3. Loss Assets 100%

II. Review Of Literature

Rai (2012) said that NPA is a major problem for Indian bank as it affects profitability as well as

liquidity and simultaneously deteriorate the financial position of the bank by declining quality of assets.

According to her the main cause of high NPA is the target-oriented approach of Indian banking sector due to

which banks ignore the quality aspects while lending. In her study, she evaluated the operational efficiency of

commercial banks, trends of NPA and she concluded that NPA is still a major threat for banking sector.

Barge (2012) said that NPA as an alarming threat which is sending distressing signal on the

sustainability of banks. In her paper she suggested that high level of NPA means high probability of credit

defaults. In her study she discussed the major reasons for an account becoming NPA and concluded that

management of NPA is very important exercise which should be pervasive in all the banks at all the levels of

management. She further added time is an essential parameter for deciding an account to be standard or

substandard. She said banks should ensure that an asset should not become NPA and if it does, then banks

should try to recover it early otherwise it would erode the profitability of banks.

Khanna (2012) in her paper studied the sector wise trends of NPAs of commercial banks. She

concluded that in PSBs major chunk of NPAs are in priority sector that basically include loans to agriculture,

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 42 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

small scale industries etc. whereas in private sector banks major chunk of NPAs are in Non -priority sector that

consist of loans to industries, educational loan, business loan, personal loan etc. she further concluded that due

diligence and utmost care must be taken by banks in sanctioning the loans and efficient management like

selection of appropriate borrower, timely disbursement, timely recovery are pre requisite for preventing and

minimizing NPAs. Then only creditability of banks will improve and that will make strong foundation of

country.

Narula and Singla (2014) said that as NPA is a crucial parameter in analysing the financial health or

performance of bank. According to them as NPA affects the profitability and liquidity of the bank together with

posing a threat for the quality of bank assets. In their paper, they assessed the NPA of PNB and its impact on

profitability. They concluded that there is a positive relation between Net Profits and NPA of bank. On the basis

of this they said that there is a mismanagement on the part of bank’s management as decline in NPA is must to

improve the profitability of banks.

Das & Dutta (2014) in their research paper tried to study the reasons for NPA and its impact on the

bank’s performance. They analyse the NPA of public sector banks using ANOVA and SPSS, and concluded that

there is no significant difference between the means of NPA for all the PSB and said that all the banks have

similar NPA irrespective of their operations.

Kapoor (2014) in his study said that NPA is the major problem in the Indian banking sector. He studied

the ratio analysis of Oriental Bank of Commerce and State Bank of Patiala. On the basis of various ratios, he

concluded that OBC has high NPAs ratio therefore is having low credit portfolio. Whereas state bank of Patiala

has low risk profile as compared to OBC. He further said that major NPA increase is govt. recommended

priority sectors.

Singh (2016) studied the trend of NPA of Indian scheduled commercial banks and also discussed

various recovery channels and at the same time suggested various measures to avoid and manage NPA. He

found that NPAs had always being a big problem for Indian banks. He suggested that banks should strengthen

the loan recovery procedure and there should be credit appraisal mechanism as well as post loan monitoring to

manage NPA. There must be follow up with clients. From data analysis, he concluded that NPA is

comparatively very high in PSB.

Chakraborty (2017), studied the effect on NPA on profitability by using various tools like mean,

standard deviation, coefficient of correlation and ANOVA. He found that SBI has the highest mean value for

gross NPA and high S.D. as well. He also concluded there is a significant relationship between various

variables like Net NPA to advances, Net NPA to total assets, Gross NPA to total assets etc. He further said

public sector banks have performed poorly as compare to private and foreign banks.

Kumar & Vasanthi (2017), studied the trend of Gross and Net NPA in PSBs and Foreign Banks, and

found that Net NPA advances issued by PSBs and Foreign banks have increased over the years. Over thefive-

year period NPA has increased by 441% in PSBs whereas in foreign banks it was 96%. Which according to

them is an alarming signal.

Sudarsan & Santosh (2018) in their study have tested for correlation between advances and non-

performing assets of Indian banks and found that there is a positive correlation between gross advances and

gross NPA in term of value in all the banks. But in terms of % of total assets there is negative correlation in all

banks between gross NPA and gross advances except foreign banks. According to them, which showed foreign

banks are able to control their NPAs.

Literature support that NPA is a big problem for all the banks, be it a public sector, private sector or

foreign banks. But problem is crucial in Public sector banks.

OBJECTIVE OF PAPER

Paper aims to fulfil below mentioned objectives:

1. To clarify conceptual framework of NPA and its classification

2. To help the readers understand the provisioning norms of bank

3. To study the trend of GNPA Ratio

4. To study the composition of advances in term of standard, substandard, doubtful and loss advances/assets

5. To find out is there any relation between gross NPA and total advances

III. Data Source And Research Mehodology

After review of available sources, data has been collected from official website of Reserve Bank of

India (RBI). According to availability of data 15 years period have been taken into consideration starting from

2006 – 2020. For 15 years period we have taken the data of all scheduled commercial banks from RBI website

which are categorised as public sector banks, private sector banks and foreign banks. All the tables are formed

on the basis of data collected from website of RBI.

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 43 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

As far research methodology is concern, we have calculated GNPA ratio to study the trend of NPA in the

various banks that are bifurcated in three main categories namely

1. Public sector banks

2. Private sector banks

3. Foreign banks

Where GNPA ratio stands for gross NPA ratio.

GNPA Ratio = Gross NPA / Total Advances x 100

After calculated GNPA ratio we have plotted them on graph to show the trend.

To study the composition of advances pie chart has been drawn showing average composition of different types

of advances. Where average has been calculated on the basis of past 15 years data which has been taken from

official website of RBI.

Thereafter to check is there any relation between gross NPA and total advances, we have applied the correlation

analysis, on the basis of which we can conclude whether there is positive relation, negative relation or no

relation between the variables.

IV. Interpretation Of Result

Public sector banks

Trend analysis of GNPA ratio

Gross NPA ratio = Gross NPA / Total advances x 100

Gross NPA ratio is used to check the financial health of banks. Beside this there are many others parameters like

provisioning coverage ratio, capital adequacy ratio, current account and saving account ratio (CASA ratio),

credit deposit ratio etc., with the help of which financial health of the banks can be measured.

But in this paper to study the trend of NPA, we have calculated GNPA ratio. Although there is no ideal GNPA

ratio but lower the GNPA ratio better it is, because higher GNPA ratio indicates more risk in the banks and it

shows that financial health of bank is not sound. High GNPA ratio indicates high risk of credit default by

borrowers.

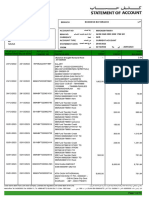

Table no 1 – Gross NPA and Total Advances of PSBs for the period 2006-2020 (Amount in Crores)

Year GNPA TOTAL ADVANCES GNPA

Ratio

2006 41400.00 1134000.00 3.7

2007 38900.00 1465100.00 2.7

2008 40500.00 1819100.00 2.2

2009 45000.00 2282800.00 2.0

2010 59900.00 2733500.00 2.2

2011 74700.00 3346500.00 2.2

2012 117300.00 3942800.00 3.0

2013 164500.00 4560100.00 3.6

2014 227263.91 5215919.66 4.4

2015 278468.00 5616717.47 5.0

2016 539956.34 5827499.40 9.3

2017 684732.00 5866374.00 11.7

2018 895601.00 6141698.00 14.6

2019 739541.00 6382460.85 11.6

2020 678317.00 6615111.61 10.3

Corelation 0.85

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 44 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Public sector Banks' GNPA Ratio

16.0

14.0

12.0

GNPA Ratio

10.0

8.0

6.0

4.0

2.0

0.0

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Years

Figure 1- Trend of GNPA Ratio of PSBs

Gross NPA ratio is showing increasing trend as it increased from 3.7 to 14.6 for the year 2006 to 2018,

which has shown almost three times increase, though for last two years GNPA ratio has declined slightly.

Although GNPA ratio has declined slightly for the year 2019 and 2020 but it has shown drastic increase for the

years before 2019.

Table no 2–composition of PSBs advances for the year 2006-2020

Year % of standard advances % of substandard advances % of doubtful advances % of loss advances

2006 96.4 1.0 2.2 0.5

2007 97.4 1.0 1.4 0.3

2008 97.8 1.0 1.1 0.2

2009 98.0 0.9 0.9 0.2

2010 97.8 1.1 0.9 0.2

2011 97.8 1.1 1.0 0.2

2012 97.0 1.6 1.2 0.2

2013 96.4 1.8 1.7 0.2

2014 95.6 1.8 2.3 0.2

2015 95.0 1.9 2.9 0.2

2016 90.7 3.4 5.5 0.3

2017 88.3 3.0 8.4 0.4

2018 85.4 3.5 10.2 0.9

2019 88.4 2.2 8.2 1.2

2020 89.7 2.1 6.4 1.8

Average 94.1 1.8 3.6 0.4

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 45 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Proportion of different advances in PSBs

1.8 0.4

3.6

94.1

Standard Advances Substandard Advances Doubtful Advances Loss Advances

Chart 1- pie chart showing average composition of PSBs advances

If we look at the composition of public sector banks advances, on an average 94.1% of advances are

standard whereas 5.9% are NPAs (consisting of 1.8% as substandard advances, 3.6% as doubtful advances and

0.4% as loss advances). When we compare average composition with the year wise composition of banks

advances, we can say that over the year the proportionate share of standard advances has declined from 96.4%

in the year 2006 to 89.7% in the year 2020. This shows the overall quality of banks advances have declined over

last 15 years period.

Private sector banks

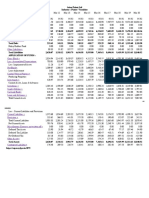

Table no 3- Gross NPA and Total Advances of Private sector banks for the period 2006-2020 ((Amount in

Crores))

Year GNPA TOTAL GNPA

ADVANCES Ratio

2006 7800.00 317600.00 2.5

2007 9200.00 420100.00 2.2

2008 13000.00 525900.00 2.5

2009 17000.00 585000.00 2.9

2010 17600.00 644200.00 2.7

2011 18200.00 811800.00 2.2

2012 18500.00 981400.00 1.9

2013 20800.00 1159200.00 1.8

2014 24189.56 1361322.87 1.8

2015 33700.01 1608657.47 2.1

2016 55853.12 1974239.97 2.8

2017 91915.00 2260408.00 4.1

2018 125863.00 2725891.00 4.6

2019 180872.44 3442346.66 5.3

2020 205847.82 3776231.27 5.5

Correlation 0.96

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 46 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Private sector Banks' GNPA Ratio

6.0

5.0

GNPA Ratio 4.0

3.0

2.0

1.0

0.0

Years

Figure 2- Trend of GNPA Ratio of Private sector banks

If we look at the trend line, we can see that GNPA ratio of private sector banks has also shown

increasing trend and GNPA ratio has increased from 2.2 for the year 2006 to 5.5 for the year 2020, which is

even more than double that of 2006. So, there is a drastic change in the NPA of private sector banks also.

Table no 4 – composition of Private sector banks advances for the year 2006-2020

Year % of % of substandard % of % of loss

standard advances doubtful advances

advances advances

2006 97.6 0.8 1.4 0.3

2007 97.8 1.0 0.9 0.2

2008 97.5 1.4 0.9 0.2

2009 97.1 1.8 0.9 0.2

2010 97.3 1.4 1.0 0.3

2011 97.8 0.6 1.3 0.4

2012 98.1 0.5 1.1 0.3

2013 98.2 0.6 1.0 0.3

2014 98.2 0.6 0.8 0.3

2015 97.9 0.7 1.1 0.3

2016 97.2 0.9 1.6 0.3

2017 95.9 1.4 2.3 0.4

2018 95.4 1.2 3.2 0.2

2019 94.7 1.3 3.7 0.3

2020 94.5 1.6 2.8 1.0

Average 97.0 1.0 1.6 0.3

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 47 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Proportion of different advances in

Private Sector Banks

1.0

1.6

0.3

97.0

Standard Advances Substandard Advances Doubtful Advances Loss Advances

Chart 2- pie chart showing average composition of Private Sector Banks advances

By looking at pie chart2, showing composition of different advances of private sector banks, we can

conclude that 97% of advances are standard and 3% of total advances are NPAs (consisting of 1% substandard

advances, 1.6% doubtful advances and 0.3% loss advances). When we compare the composition of advances of

PSBs with private sector banks, we have seen that PSBs are having only 94.1% standard advances which are

less as compared to the standard advances of private banks which is 97%. From this, we can say that private

banks are doing well in comparison to PSBs.

Foreign Banks

Table no 5- Gross NPA and Total Advances of foreign banks for the period 2006-2020 (Amount in Crores))

Year GNPA TOTAL GNPA

ADVANCES Ratio

2006 2100.00 98900.00 2.1

2007 2400.00 127900.00 1.9

2008 3100.00 163100.00 1.9

2009 7300.00 169700.00 4.3

2010 7100.00 167400.00 4.2

2011 5100.00 199400.00 2.6

2012 6300.00 234700.00 2.7

2013 8000.00 268900.00 3.0

2014 11567.76 299575.49 3.9

2015 10757.79 336608.97 3.2

2016 15800.00 376719.76 4.2

2017 13621.00 343921.00 4.0

2018 13830.00 363305.00 3.8

2019 12182.57 406881.32 3.0

2020 10208.30 436065.62 2.3

Correlation 0.88

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 48 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Foreign Banks' GNPA Ratio

5.0

4.5

4.0

3.5

GNPA Ratio

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Years

Figure 3- Trend of GNPA Ratio of foreign banks

Foreign banks have done better as their GNPA ratio was 2.1 in the year 2006 and 2.3 in the year 2020.

Although for the years 2009-2010 and 2016-2017, their GNPA ratio was around which was almost double. But

after that they have done good which can be seen in their declined GNPA ratio.

Table no 6 – composition of foreign banks advances for the year 2006-2020

Year % of % of substandard % of % of loss

standard advances doubtful advances

advances advances

2006 97.9 1.0 0.7 0.4

2007 98.1 1.1 0.5 0.4

2008 98.1 1.2 0.5 0.2

2009 95.7 3.5 0.6 0.3

2010 95.7 2.9 0.9 0.5

2011 97.5 0.9 1.1 0.6

2012 97.3 0.9 1.0 0.8

2013 97.0 1.1 1.0 0.9

2014 96.1 1.4 1.4 1.0

2015 96.8 0.7 1.6 0.9

2016 95.8 1.7 1.6 0.9

2017 96.0 1.2 2.4 0.4

2018 96.2 1.1 2.3 0.5

2019 97.0 0.8 2.0 0.3

2020 97.7 0.8 1.3 0.3

Average 96.9 1.3 1.2 0.5

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 49 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

Proportion of different advances in foreign

10.5

1.3.2

banks

96.9

Standard Advances Substandard Advances Doubtful Advances Loss Advances

Chart 3- pie chart showing average composition of Private Sector Banks advances

In analysis we have concluded that in foreign banks, 96.7% advances are standard which are almost

similar to private sector banks (97%), whereas in PSBs it was 94.1%. From this we can say that as compared to

PSBs even foreign banks are doing better and in their total advances composition only 3% advances are NPA.

Correlation analysis

Type of bank Correlation coefficient

Public sector banks 0.85

Private sector banks 0.96

Foreign banks 0.88

Correlation coefficient between the gross NPA and total advances have been calculated for PSBs,

Private sector banks and Foreign banks. We found correlation coefficient as 0.85, 0.96 and 0.88 for PSBs,

Private banks and foreign banks respectively. This shows that there is a high degree of positive correlation

between gross NPA and total advances in all the scheduled commercial banks.

OVERALL COMPARISION OF PSBs, PRIVATE SECTOR BANK AND FOREIGN BANKS

GNPA Ratio of Scheduled Commercial Bank

16.0

14.0

12.0

GNPA Ratio

10.0

8.0

public sector

6.0

Private sector"

4.0 Foreign Banks

2.0

0.0

Years

Figure 4- Trend of GNPA Ratio of scheduled commercial banks

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 50 | Page

Non-Performing Assets – A Comparative Analysis of Public Sector Banks, Private Sector ..

From the figure 4 it can be observed that in the year 2006 the GNPA ratio of all the scheduled

commercial banks was in the range of 2-4.But by the year 2020 the GNPA ratio of public sector banks has

touched to 10.3, whereas for private sector banks and foreign banks it was 5.5 and 2.3 respectively. So, we can

say that over the years the NPA of PSBs had increased a lot, whereas it was not that high in case of private

sector banks and foreign banks. Moreover, the average GNPA ratio of PSBs is 5.9 whereas for private sector

banks and foreign banks, it is 3 and 3.1 respectively. Which prove that in PSBs the NPA is a major problem.

Public sector banks are facing huge losses because higher the amount of gross NPA, higher would be the

provision. Higher NPAs may be due to lenient credit policy and inefficient management of NPA.

On the basis of composition of standard, substandard, doubtful and loss advances in overall advances

we have also seen that average standard advances are only 94.1% in PSBs whereas it is 97% and 96.9% in the

case of private sector banks and foreign banks respectively. Which also shows that in comparison to PSBs, the

private sector and foreign banks are performing better.

V. Conclusion

On the basis of data analysis, we have found that in term of performance efficiency private sector

banks and foreign banks are better than public sector banks. PSBs have high NPAs that may be due to liberal

credit policies and lenient terms and conditions of loans. If we look at the data of gross NPA ratio, it is 10.3 for

PSBs in the year 2020, which is almost double the private sector banks (5.5) and even more than four times as

compared to foreign banks (2.3).

In term of standard advances, PSBs have only 94.1% whereas private banks and foreign banks have

97% and 96.9. From all these we can conclude that there is mismanagement of NPAs which needs to be address

efficiently. Other reasons for high NPAs in public sector banks could be inefficiency in the credit sanctioning

and disbursements. High NPAs create problem for investors, lenders, depositors etc. It effects availability of

credit as well as hamper financial health of the banks. Therefore, there should be an efficient NPA management

system prevalent in all the banks, which ensure stringent scrutiny before disbursement of advances and also

monitoring and controlling after sanctioning of loans.

REFERENCES:

[1]. https://www.investopedia.com/terms/n/non-performing- assests.asp

[2]. https://www.rbi.org.in/scripts/BS_ViewMasCirculardetails.aspx%3FId%3D449

[3]. https://economictimes.indiatimes.com/definition/non-performing-assets

[4]. https://corporatefinanceinstitute.com/resources/knowledge/finance/non-performing-asset/

[5]. https://www.ixambee.com/blog/what-is-sma-npa-and-provisioning-for-npa/

[6]. https://bankingschool.co.in/loans-and-advances/loan-provisioning-process-explained-with-examples/

[7]. https://economictimes.indiatimes.com/wealth/save/check-the-financial-health-of-your-bank-with-these-8-ratios/gross-non-

performing-assets-npas/slideshow/74927100.cms

[8]. Khanna, Parul., (2012) “Managing Non-Performing Assets in Commercial Banks” GIAN JYOTI E-JOURNAL, Vol 1, Issue3

[9]. Rai, Kamini., (2012) “Study on performance of NPAs of Indian commercial banks”, Asian Journal of Research in Banking and

Finance, Vol.2, Issue 12

[10]. Barge, Anuja., (2012) “NPA management in Banks: An Indian Perspective”, IBMRD’s Journal of Management and Research, Vol

1

[11]. Narula, Dr. Sonia., & Singla, Monika. (2014), “Empirical study on Non - Performing Assets of Bank”, International Journal of

Advance Research in Computer Science and Management Studies, Vol. 2, Issue 1

[12]. Das, Sulagna., & Dutta, Abhijit., (2014) “A study of NPA of public sector banks in India”, IOSR Journal of Business and

Management, Vol 16, Issue 11

[13]. Kapoor, Manish., (2014) “Non - Performing Assets of Public Sector Banks in India”, International Journal of Innovation in

Engineering and Technology, Vol 3, Issue 3

[14]. Singh, Vivek Rajbahadur., (2016) “A study of Non – Performing Assets of Commercial Banks and it’s recovery in India, Annual

Research Journal of SCMS, Pune, Vol 4

[15]. Chakraborty, Sri Ayan., (2017), “Effects of NPA on Banks Profitability”, International Journal of Engineering Technology,

Management and Applied Science”, Vol. 5, Issue 5

[16]. Kumar, Aakash. & Vasanthi, Dr. G. (2017), “Trends of Gross and Net NPA in Public sector and Foreign Banks: A Comparative

Analysis”, Indian Journal of Accounting, Vol. XLIX, pp. 98-102

[17]. Sudarsan, Dr. K., & Santosh, Mr. K., (2018), “Correlation between advances and non – performing assets of Indian Banking sector,

Journal of Emerging Technologies and Innovative Research, Vol 5, Issue 10

Mrs. Poonam Arora. “Non-Performing Assets – A Comparative Analysis of Public Sector Banks,

Private Sector Banks and Foreign Banks.” IOSR Journal of Business and Management (IOSR-JBM),

23(03), 2021, pp. 41-51.

DOI: 10.9790/487X-2303064151 www.iosrjournals.org 51 | Page

You might also like

- Non Performing Assets (NPAs) : A Comparative Analysis of Selected Private Sector BanksDocument7 pagesNon Performing Assets (NPAs) : A Comparative Analysis of Selected Private Sector BanksinventionjournalsNo ratings yet

- 3515-Article Text-6773-1-10-20201223Document10 pages3515-Article Text-6773-1-10-20201223BADDAM PARICHAYA REDDYNo ratings yet

- Npa Research PaperDocument13 pagesNpa Research PaperEr Akhilesh SinghNo ratings yet

- Npa in SbiDocument96 pagesNpa in SbiApoorva M V100% (2)

- Final Report-NPA - PRINT OUT3Document74 pagesFinal Report-NPA - PRINT OUT3shovit singh0% (2)

- AssignmentDocument14 pagesAssignmentAbhiNo ratings yet

- Tools and Techniques of NPADocument9 pagesTools and Techniques of NPAPruthviraj RathoreNo ratings yet

- DJ WorkDocument49 pagesDJ WorkPratik GhadeNo ratings yet

- Non Performing Assets 111111Document23 pagesNon Performing Assets 111111renika50% (2)

- Non - Performing Assets - PublicationDocument12 pagesNon - Performing Assets - PublicationChandra SekarNo ratings yet

- Npa 119610079679343 5Document46 pagesNpa 119610079679343 5Teju AshuNo ratings yet

- (Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsDocument15 pages(Non Performing Assets) : Commercial Banks Assets Are of Various Types Such AsChaarvi ShridherNo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- Final ProjectDocument90 pagesFinal ProjectdgpatNo ratings yet

- Causes and Effects of Non-Performing Assets in The Banking SectorDocument10 pagesCauses and Effects of Non-Performing Assets in The Banking Sectorshubham kumarNo ratings yet

- Problem FormulationDocument35 pagesProblem FormulationJewel Binoy100% (1)

- R N P A R F C B - A S S I C BDocument19 pagesR N P A R F C B - A S S I C BAyona AduNo ratings yet

- Hum - A Comparative StudiesDocument17 pagesHum - A Comparative StudiesImpact JournalsNo ratings yet

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDocument8 pagesImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNo ratings yet

- A Study On Non Performing AssetsDocument85 pagesA Study On Non Performing AssetsAbhishek EraiahNo ratings yet

- A Comparative Study of Non-Performing Assets of Canara Bank & Icici BankDocument42 pagesA Comparative Study of Non-Performing Assets of Canara Bank & Icici BankASWATHYNo ratings yet

- Non Performing Assets Management in TheDocument10 pagesNon Performing Assets Management in TheAyona AduNo ratings yet

- Money and BankingDocument10 pagesMoney and BankingSahil ChadhaNo ratings yet

- Impactof NPAon Profitabilityof BanksDocument9 pagesImpactof NPAon Profitabilityof BanksShikha Sidar LLM 2021No ratings yet

- Dissertation Report On Determinants of Problem Loan in Indian BanksDocument43 pagesDissertation Report On Determinants of Problem Loan in Indian BanksshubhamNo ratings yet

- Icici Bank ProjectDocument82 pagesIcici Bank ProjectiamdarshandNo ratings yet

- Operational RiskDocument6 pagesOperational Riskaryandugar24No ratings yet

- 7 Vol 5 No 1Document5 pages7 Vol 5 No 1DevikaNo ratings yet

- A Study On NPA of Public Sector Banks in India: AssignmentDocument10 pagesA Study On NPA of Public Sector Banks in India: AssignmentSurya BalaNo ratings yet

- Ijrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksDocument9 pagesIjrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksmithiliNo ratings yet

- NPAkjhhkjhkjhjhjDocument54 pagesNPAkjhhkjhkjhjhjRintu AbrahamNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaSuryaNo ratings yet

- Chapter1: Introduction: Nonperforming Asset in BankDocument35 pagesChapter1: Introduction: Nonperforming Asset in BankMaridasrajanNo ratings yet

- 08 Chapter 01Document44 pages08 Chapter 01anwari risalathNo ratings yet

- A Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaDocument9 pagesA Study On Npa of Public Sector Banks in India: Sulagna Das, AbhijitduttaSunil Kumar PalikelaNo ratings yet

- Research Paper On Npa of BanksDocument4 pagesResearch Paper On Npa of Banksiqfjzqulg100% (1)

- Non Performing Assets and Profitability of Scheduled Commercial BanksDocument11 pagesNon Performing Assets and Profitability of Scheduled Commercial Banksneekuj malikNo ratings yet

- Problem and Solution To The Case of Increasing Non-Performing Assets in IndiaDocument2 pagesProblem and Solution To The Case of Increasing Non-Performing Assets in IndiaDeepesh SinghNo ratings yet

- Non Performing Assets and Profitability of Scheduled Commercial BanksDocument11 pagesNon Performing Assets and Profitability of Scheduled Commercial Banksadharav malikNo ratings yet

- Executive SummaryDocument56 pagesExecutive SummaryMurali Balaji M CNo ratings yet

- Eco ProjectDocument28 pagesEco ProjectpraveentitareNo ratings yet

- Institute - Usb Department - BbaDocument20 pagesInstitute - Usb Department - BbaAmanNo ratings yet

- A Study of Non Performing Assets in Bank of BarodaDocument68 pagesA Study of Non Performing Assets in Bank of BarodaMohamed Tousif81% (21)

- Non Performing AssetsDocument24 pagesNon Performing AssetsAmarjeet DhobiNo ratings yet

- Impact of NonDocument30 pagesImpact of NonAmardeep SinghNo ratings yet

- Management in Vijaya Bank: Under The Guidance ofDocument19 pagesManagement in Vijaya Bank: Under The Guidance ofSwarnaa Prakash babuNo ratings yet

- Tarun Project FileDocument32 pagesTarun Project FileTushar SikarwarNo ratings yet

- Causes of NPADocument7 pagesCauses of NPAsggovardhan0% (1)

- SBI NPA SynopsisDocument4 pagesSBI NPA SynopsisDon Iz BackNo ratings yet

- ContentDocument94 pagesContentsowmya chalumuruNo ratings yet

- M.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniDocument2 pagesM.Phil. Student, MDU Rohtak Associate Professor, Dept. of Commerce Govt. College, BhiwaniAmandeep Singh MankuNo ratings yet

- Tabarsum NON PERFORMING ASSETS AXIS BANKDocument73 pagesTabarsum NON PERFORMING ASSETS AXIS BANKSagar Paul'g100% (4)

- Non Performing AssetsDocument8 pagesNon Performing Assetsbhattcomputer3015No ratings yet

- Non Performing Assets - IdbiDocument7 pagesNon Performing Assets - IdbiKitten KittyNo ratings yet

- Bharath Project COMPLETEDocument52 pagesBharath Project COMPLETENithin GowdaNo ratings yet

- Non Performing AssetsDocument11 pagesNon Performing AssetssudheerNo ratings yet

- Docunment NpaDocument52 pagesDocunment NpaAditi KedariNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- IMNU HimasnhuPatel Anand Rathi Internship ReportDocument57 pagesIMNU HimasnhuPatel Anand Rathi Internship ReportHimanshu Patel33% (3)

- Mortgage Lab Reflective WritingDocument4 pagesMortgage Lab Reflective Writingapi-345263725No ratings yet

- A Beginners Guide To Algorithmic Trading 2017Document49 pagesA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaNo ratings yet

- Half Years Exam (Probable Questions - Answers)Document15 pagesHalf Years Exam (Probable Questions - Answers)Taz UddinNo ratings yet

- VLOOKUPDocument14 pagesVLOOKUPJeetendra ShresthaNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- Salome Kirimi CVDocument3 pagesSalome Kirimi CVsalome kirimiNo ratings yet

- Athanassakos, G. 2011. Do Value Investors Add Value. Journal of Investing, 20 (2), 86-100.Document16 pagesAthanassakos, G. 2011. Do Value Investors Add Value. Journal of Investing, 20 (2), 86-100.firebirdshockwaveNo ratings yet

- Account StatementDocument10 pagesAccount Statementalihassan459001No ratings yet

- CfroiDocument2 pagesCfroiPro Resources100% (1)

- Edev 311: Economic Development: Session 5: The Basic Tools of FinanceDocument16 pagesEdev 311: Economic Development: Session 5: The Basic Tools of FinanceCarlNo ratings yet

- SAP FICO Course ContentDocument3 pagesSAP FICO Course ContentSridhar MuthekepalliNo ratings yet

- Zambia Kwacha Currency Rebasing Brochure BarclaysDocument12 pagesZambia Kwacha Currency Rebasing Brochure BarclaysBen MusimaneNo ratings yet

- Investment Appraisal Relevant Cash Flows AnswersDocument8 pagesInvestment Appraisal Relevant Cash Flows AnswersdoannamphuocNo ratings yet

- Basic Finance MidtermDocument6 pagesBasic Finance MidtermRosevhic BadianaNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument3 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountA&P ConsultancyNo ratings yet

- Chap 19 TestDocument17 pagesChap 19 TestVanessa KhodrNo ratings yet

- Mcu - 2021 Bir Form No. 1709Document3 pagesMcu - 2021 Bir Form No. 1709Edwin AurellanoNo ratings yet

- UWIN ME13 s43Document43 pagesUWIN ME13 s43elearninglsprNo ratings yet

- American Chemical Corporation Case StudyDocument11 pagesAmerican Chemical Corporation Case StudyRahul Pandey100% (6)

- Tender - All-In-One - Shotterm FinalDocument60 pagesTender - All-In-One - Shotterm FinalTender TenderNo ratings yet

- Cash Management: Cash Management Refers To A Broad Area of Involving The Collection, Handling, and Usage of Cash. ItDocument2 pagesCash Management: Cash Management Refers To A Broad Area of Involving The Collection, Handling, and Usage of Cash. ItPawan kumar SinghNo ratings yet

- Jieya Kylah D. Casiple BSMA 4-BDocument4 pagesJieya Kylah D. Casiple BSMA 4-BJieya Kylah CasipleNo ratings yet

- Financial For Feasibility StudyDocument15 pagesFinancial For Feasibility StudyAbigail GeronimoNo ratings yet

- Financial Statement: Funds SummaryDocument1 pageFinancial Statement: Funds SummarymorganNo ratings yet

- 2015 Canadian Banknote CatalogueDocument64 pages2015 Canadian Banknote CatalogueAlri MochtarNo ratings yet

- FM ReportingDocument45 pagesFM ReportingOliwa OrdanezaNo ratings yet