Professional Documents

Culture Documents

In Come Tax Planning

Uploaded by

Ayyan ايانCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Come Tax Planning

Uploaded by

Ayyan ايانCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/325060456

Income Tax Planning: A Study of Tax Saving Instruments

Preprint · May 2013

DOI: 10.13140/RG.2.2.25046.55360

CITATIONS READS

0 48,931

1 author:

Savita Gautam

Maharshi Dayanand University

7 PUBLICATIONS 9 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Income tax Planning: A study of Tax Saving Instruments View project

All content following this page was uploaded by Savita Gautam on 10 May 2018.

The user has requested enhancement of the downloaded file.

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 83

Volume 2, No. 5, May 2013

Income Tax Planning: A Study of Tax Saving Instruments

Savita, Lecturer in Pt. Nakiram Sharma Government College, M. D. University, Rohtak

Lokesh Gautam, Senior Manager, legal and Secretarial, Realtech Group, New Delhi

ABSTRACT land. It does not amount to evasion of tax. It is an act of

prudence and farsightedness on the part of the taxpayer

Tax planning is an essential part of our financial who is entitle to reduce the burden of his tax liability to

planning. Efficient tax planning enables us to reduce our the maximum possible extent under the existing law. Tax

tax liability to the minimum. This is done by legitimately planning ensures not only accruals of tax benefit with in

taking advantage of all tax exemptions, deductions rebates the four corners of law, but it also ensures that the tax

and allowances while ensuring that your investments are obligations are properly discharged to avoid penal

in line with their long-term goals. The purpose of the study provision.

is to find out the most suitable and popular tax saving

instrument used to save tax and also to examine the A. Tax Evasion And Tax Avoidance

amount saved by using that instrument. Over all findings Tax Evasion: It refers to a situation where a person try to

reveals that the most adopted tax saving instrument is Life reduce his tax liability by deliberately suppressing the

Insurance policy, which got the first rank in this study and income or by inflating the expenditure showing the

the second most adopted tax saving instrument is income lower than the actual income and resorting to

Provident Fund. various types of deliberate manipulations. An assessee

guilty of tax evasion is punishable under the relevant law.

Keywords Tax evasion may involve stating an untrue statement

Tax, Tax saving Instruments, Tax Planning, Tax knowingly, submitting misleading documents, suppression

Management, Tax Evasion and Tax Avoidance of facts, not maintaining proper accounts of income earned

(if required under the law) omission of material facts in

assessments. An assessee, who dishonestly claims the

TAX PLANNING: AN INTRODUCTION benefit under the statute by making false statements,

would be guilty of tax evasion.

In other words all arrangements by which the tax is saved

by ways and means, which comply with the legal Tax avoidance: The line of demarcation between tax

obligation and requirements and are not colorable devices planning and tax avoidance is very thin and blurred. There

or tactics to meet the letters of law but not the sprite could be element of mollified motive involved in the tax

behind these, would constitute tax planning. Tax planning avoidance also. Any planning which, through done strictly

should not be done with an intent to defraud the revenue, according to legal requirements defeats the basic intention

All transactions entered into by an assessee could be of the legislature behind the statute could be termed as

legally correct, yet on the whole these transactions may be instance of tax avoidance. It is usually done by adjusting

devised to defraud the revenue. All such devices where the affair in such a manner the there is no infringement of

status is followed in strict words but actually spirit behind taxation laws and b taking full advantage of the loopholes

the statute is marred would be termed as colorable devices there in so as to attract the least incidence of tax.

and they do not form part of the tax planning. All

transactions in respects of tax planning must be in B. Tax Planning Excludes

according with the true spirit of statute and should be

Tax Planning is not tax evasion. It involves sensible

correct in form and substance.

planning of your income sources and investments. It

is not tax evasion, which is illegal under Indian

The form and substance of a transaction is real test of any

laws.

tax-planning device. The form of transaction, as it appears

Tax Planning is not just putting your money blindly

superficially and the real intention behind such transaction

into any 80C investments.

may remain concealed. Substance of a transaction refers to

lifting the veil of legal documents and ascertaining the Tax Planning is not difficult. Tax Planning is easy.

intention of parties behind the transaction. It can be practiced by everyone and with a very

little time commitment as long as one is organized

Tax planning is the arrangement of one’s affairs in such a with their finances.

manner that the tax planner may either reduce the incident

of tax wholly or reduce it to maximum possible extent as

may be permissible with in the framework of the taxation

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 84

Volume 2, No. 5, May 2013

C. Types of Tax Planning management is like knowing the medicine with out

The tax planning exercise ranges from devising a model knowing how to administer it.

for specific transaction as well as for systematic corporate

planning. These are; 2. THE POPULAR INVESTMENT

Short and long range tax planning: OPTIONS

Short range planning refers to year-to-year

planning to achieve some specific or limited objective. For

example, an individual assessee whose income is like to PPF (with post offices/banks), statutory provident

register unusual growth in a particular year as compared to fund (deducted and paid by the employees).

the preceding year, may plan to subscribe to the Life insurance premium (with the LIC or other

PPF/NSC’s with in the prescribed limits in order to enjoy private insurers).

substantive tax relief. By investing in such a way, he is not Unit-linked insurance (UTI & mutual funds).

making permanent commitment but is substantially saving Equity-linked saving schemes.

in the tax National Saving Certificates.

Long range planning on the other hand involves Infrastructure bonds.

entering in to activates, which may not pay off Home loans.

immediately, For example, when an assessee transfers his

equity shares to his minor son he knows that the income 3. TAX SAVING INSTRUMENTS

from the shares will be clubbed with his own income, but

clubbing would also cease after minor attains majority. Deduction under section 80C is allowed only to individual

Permissive tax planning: or HUF, up to a maximum limit of 1,00,000 Rs. and the

Permissive tax planning is tax planning under the deduction is allowed only when the amount has actually

express provisions of tax laws. Tax laws of our country been paid by the assesseee.

offer many exemptions and incentives. Following amount paid or deposited are allowed as

Purposive Tax planning: deduction u/s 80C:

Purposive tax planning is based on the measures, Contribution / subscription to PPF, NSC, NSS,

which circumvent the law. The permissive tax planning ULIP, ELSS

has the express sanction of the statute while the purposive Fixed Deposit with any schedule bank for at least

tax planning does not carry such sanctions, For example, 5 years

under section 60 to 65 of the income tax.1961 the income

Any sum deposited as five years’ time deposit in

of the other persons is clubbed in the income of the

an account under the Post Office Time Deposit

assessee. If the assessee is in a position to plan in such a

way that these provisions do not get attracted, such a plan

A. Equity Linked Saving Schemes

would work in favor of the tax payer because it would

ELSS is an instrument sold by mutual funds for the

increase his disposable resources. Such a tax plan could be

specific purpose of enabling taxpayers to save their taxes.

termed as “Purposive Tax Planning”. The proceeds from ELSS are mostly invested in the stock

market so that the investors get the benefit of appreciation

D. Tax management in stock prices, thereby making the stock market work for

Tax management is an internal part of the tax planning. It investors. The tax deduction for ELSS is available under

takes necessary precautions to comply with the legal

section 80C of the Income Tax Act 1961.

formalities to avail the tax exemption/ deductions, rebates

or relief as are contempt’s in the scheme of tax planning.

B. Life and Medical Insurance Plans

Tax management plays a vital role in calming allowance,

Life Insurance Policies have long been the most popular

deductions and tax exemptions by complying with the

tax saving instruments among taxpayers. Insurance

required conditions. For example, Where an assessee policies offer twin advantage for tax deductions on

follows mercantile system of accounting, the claim of

premium paid and insurance cover for the insurer and his

expenses should be made, subject to the provisions of

family in the event of a financially debilitating event such

section 43B, on accrual bases, if the assessee fails to make

as accident, death, etc. The premium paid on life insurance

such a claim, such expenses can not be deducted in

policies qualify for tax deductions under section 80C,

subsequent years. Similarly, the specified deductions subject to a maximum of Rs.1 lakh per annum. Most

under section 80IA, section 80JJA, etc., cannot be allowed

companies offering Life Insurance also offer medical

by the assessing officer suo motu. Tax management also

insurance policies as well as pension plans which offer tax

protects an assessee against penalty and prosecution by deduction under section 80D.

discharging tax obligations in time.

Thus, the study of tax planning is incomplete without tax

Deduction is allowed to an individual/HUF for payment

management. Tax planning with out the study of tax towards Medical Insurance Premium or to any

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 85

Volume 2, No. 5, May 2013

contribution made to the central Government health expenses like conveyance allowance; food coupons etc.

Scheme by any mode other than cash. also qualify for deductions. There are also special

Maximum 15,000 (For insurance of individual, deductions/concessions for senior and disabled tax payers.

spouse, dependent children) or 20,000 in case of senior

citizen, and

Maximum 15,000 (For insurance of parents) or 4. RESEARCH METHODOLOGY

20,000 if parents are senior citizen.

Research methodology is a way to systematically solve the

C. Housing Loan problem. The study of the research design is descriptive in

Repayment of principal amount of loan taken for nature because it throws light on relationship between age

purchase/construction of residential house property from group and income level on tax saving amount. Research

central/state Government, Bank, LIC, National Housing methodology for the present study is as follows:

Bank or from employer (where employer is statutory

corporation, public company, university, college, or local A. Objectives Of The Study

authority or co-operative society) under section 80C. The purpose of the study is to find out the most suitable

Public Provident Fund: tax saving instrument used to save tax and also to examine

The contributions made to the Employees provident fund the amount saved by using that instrument.

(EPF) and Public Provident Fund (PPF) are also eligible

for tax deductions under section 80C.While the B. Sample Design

contribution paid to EPF and PPF by the employees are The present study is based on convenience-cum-stratified

subject to the overall ceiling of Rs.1 Lakh under section sampling. Three heads of occupation have been taken as a

80C. sample and two sub-occupations have been identified from

heads shown in table N0. 1.

D. National Savings Certificate:

It can be bought at any post offices in the country. While C. Sample Unit

there is no upper limit for investment, the tax deduction on The scope of the tax includes the following areas,

NSC is available subject to overall limit of Rs.1 lakh under (a). Business class

section 80C. (b). Service class

(c). Others, like commission agents

E. Term Deposits and Bonds:

Many of the commercial banks have fixed deposit The persons includes in this study are of different age

schemes, which qualify for tax deductions. These deposits groups and various income groups. The area of the study

have a lock-in-period of five years. Investments in these covers Haryana and Delhi/NCR, but for the purpose of

deposits are subject to the overall ceiling limit of Rs.1 lakh collecting primary information form respondents the study

per annum under section 80C. has been limited to three heads of income tax. From 2

There are other specified expenses such as registration heads, 2 sub occupations have been selected. While

charges and stamp duty paid on house property, tuition selecting three heads enough care has been taken to see

fees for children’s education, among others, which qualify that this sample represents the whole of universe.

for deductions under section 80C. Under other sections,

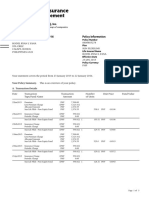

Table 1- Sample Unit

Heads Occupation Sample

Salary Teachers 15

Railway Employees 15

Business & Shopkeepers 10

Profession

Advocates 10

Others Commission Agents 20

Total 70

Source – based on primary data

On the basis of above-mentioned five occupations selected railway employees, 10 shopkeepers, 10 Advocates and 20

from three main heads. The total sample size of commission Agents.

respondents is 70, which constitutes 15 teachers, 15

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 86

Volume 2, No. 5, May 2013

D. Analysis of the study

General information:

SEX

60

53

No.of respondents 50

40

30 Series1

20 17

10

0

male female

Figure 1. Gender

In the given figure X-axis represent Gender of respondents 53 male & 17 female respondents. The percentage of

while Y-axis represents the total number of respondents. male & female respondents is 75.8 % & 24.2 %

The total numbers of respondents are 70 in which there are respectively.

location

location

40 35 35

no.of respondents

35

30

25

20

15

10

5

0

haryana delhi/ncr

categories

Figure 2. Geographical distribution

In the given figure X-axis represent the Geographical respondents are, 35 from Haryana & 35 from Delhi/NCR

distribution of study respondents while Y-axis represents having an equal percentage of 50% each.

the total number of respondents. The locations of the

Occupations

25

20

No.of respondent

20

15 15

15

10 10

10

0

Teachers Railway shopkeepers Advocates Commission

employees Agents

sample category

Figure 3. Occupation

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 87

Volume 2, No. 5, May 2013

In the given table X-axis represent the category of (21.4%), 15 railway employees (21.4%), 10 shopkeepers

occupations respondents while Y-axis represents the total (14.2%), 10 Advocates (14.2%), 20 Commission agents

number of respondents. The total respondents are further (28.4%).

divided in to six classes, which includes 15 teachers

25

21

20 18

17

20-30

15

No. of 11 30-40

respondent 40-50

10

50-60

5 3 60-70

0

1

Age

Figure 4. Age Group

In the given figure No. 4 X-axis represent the age groups from the age group of 50-60, 3 respondents (4.2%) are

of respondents while Y-axis represents the total Number from the age group of 60-70.

of respondents. The age of the respondents are classified

in to five groups, In which 17 respondents (24.2%) are Income Group

from the age group of 20-30, 21 respondents (30%) are Data was collected from various professionals, which

from the age group of 30-40, 11 respondents (15.71%) are belongs with different Income group. Following figure

from the age group of 40-50, 18 respondents (25.7%) are shows Income wise description of respondents-

Income group

30 30

30

25

20 <2 lakhs

no.of

15 2-5 lakhs

respondent

10 7 5-10 lakhs

3 <10 lakhs

5

0

1

income

Figure 5. Income Group

In the given figure No. 5 X-axis represent the income are 30 (42.8%), between the incomes of 5 to 10 lakh are 7

groups of respondents while Y-axis represents the total (10%) and the income more then 10 lakh are 3 (4.28%).

number of respondents. The respondents below the income

2 lakh are 30 (42.8%), between the incomes of 2 to 5 lakh

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 88

Volume 2, No. 5, May 2013

Investment in Tax Saving Instruments

Tax saving investment

25 23

20

no. of respondents

20 18

<10,000

15 10,000-30,000

30,000-50,000

10 50,000-70,000

6

70,000-90,000

5 3

0

1

Tax saving amount in Rs.

Figure 6. Amount invest in Tax saving Investment

In the given figure No. 6 X-axis represent the tax saving Long term Investment In tax Saving Instrument

amount of respondents while Y-axis represents the total In the given figure No. 7 X-axis represent the investment

number of respondent. There are 23 respondents (32.8%), in a long-term tax saving instruments while Y-axis

who save less then Rs. 10,000, 18 respondents (25.7%), represents the total number of respondent. There are 44

who save between Rs. 10,000 to 30,000, 3 respondents respondents (62.8%), who ensures that their investment in

(4.2%), who save between Rs. 30,000 to 50,000, 6 tax saving instruments are aligned to their long term

respondents (8.57%), who save between Rs. 50,000 to financial goals, 8 respondents (11.4%) are saying no and

70,000, and 20 respondents (28.57%), who save between 18 respondents (25.8%) don’t know about this.

Rs. 70,000 to 90,000.

50

44

45

40

no.of respondents

35

30

25

20 18

15

10 8

5

0

yes no don't know

investment in a long term tax saving instruments

Figure 7. Long term Investment In TSI

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 89

Volume 2, No. 5, May 2013

Preferred Tax Saving Instruments

Table 2. Preferred Tax saving Instruments

Source- based on primary data

According to these responses, rank is given to various tax preferred tax saving instruments. National Saving

saving instruments. The respondents preferred life Certificates ranked as Vth . Respondents preferred Unit

insurance as the best tax saving instrument and ranked as Linked Plans as the VIth and Health Insurance as VIIth .

One. Provident fund is the IInd highest ranked tax saving Equity Linked Saving Scheme and Infra Bonds are ranked

instrument while respondents ranked Fixed Deposits as as VIIIth and IXth respectively.

IIIrd. Home Loan and Education Loan are the IVth highest

Cross tabulation analysis between Age group/ Income group and Tax Saving Instruments

Table 3-Analysis of tax saving amount with various age groups

Tax

Saving <10 10-30 30-50 50-70 70-90

amount (in

Thousands)

Age

(In years)

20-30 11* 4 1 0 1

30-40 4 7* 0 4 6

40-50 3 3 1 0 4*

50-60 3 4 1 2 8*

60-70 2* 0 0 0 1

Source-based on primary data

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 90

Volume 2, No. 5, May 2013

* Mode and so on. There are 3 respondents in the 40 to 50 age

The rows in table 3 represent age groups while the group, who saves between Rs. 30,000 to 50,000 and so on.

columns represent tax saving amount. There are 11 There are 3 respondents in the 50 to 60 age group, who

respondents in the 20 to 30 age group, who saves less then saves between Rs. 50,000 to 70,000 and so on. There are 2

Rs. 10,000 and so on. There are 4 respondents in the 30 to respondents in the 60 to 70 age group, who saves between

40 age group, who saves between Rs. 10,000 to 30,000 Rs. 70,000 to 90,000 and so on.

Table 4- Analysis of tax saving amount with various Income groups

Tax

Saving <10 10-30 30-50 50-70 70-90

amount

(in

thousands)

Income

(in

lakhs)

<2 18* 11 0 0 1

2-5 5 7 2 5 11*

5-10 0 0 1 1 5*

> 10 0 0 0 0 3*

Source-based on primary data

* Mode 30 and 60 to 70, the tax saving amount is less then Rs.

The rows represent income groups while the columns 10,000, which shows that saving is very low in young age

represent tax saving amount. There are 18 respondents in and old age. Where as, between the age group of 30 to 40,

the income group of less then Rs. 2 lakhs, who saves less the tax saving amount increases between Rs. 10,000 to

then Rs. 10,000 and so on. There are 5 respondents in the 30,000. Further, the tax saving amount is between Rs.

income group of Rs. 2 lakh to 5 lakhs, who saves between 70,000 to 90,000 of the age groups between 40 to50 and

Rs. 10,000 to 30,000 and so on. There are 0 respondent in 50 to 60, which shows the highest income saved of this

the income group of Rs. 5 to 10 lakh, who saves between study.

Rs. 30,000 to 50,000 and so on. There are 0 respondent in (c). On an analysis of tax saving amount with various

the income group of more than Rs. 10 lakhs, who saves income groups, it is found that with the income of less

between Rs. 50,000 to 70,000 and so on. then Rs. 2 lakhs, the tax saving amount is less then Rs.

10,000. Further, with the increase in income such as

5. FINDING AND SUGGESTIONS between Rs. 2 to 5 lakhs, 5 to 10 lakhs and more than ten

lakhs, the tax saving amount is between Rs. 70,000 to

(a). On the bases of this study, the respondents rank 90,000. Which means that higher the income, higher the

various tax saving instruments according to their priority savings.

of saving tax. The most adopted tax saving instrument is

Life Insurance policy, which got the first rank in this 6. BIBLIOGRAPHY

study. The second most adopted tax saving instrument is

Provident Fund. Further, the third choice is Tax Saving [1.] Banks, J., Andrew Dilnot and Sarah Tanner (1997):

Fixed Deposits. After that Home/Education Loans, “Taxing Household Saving: What Role for the New

National Saving certificates, Unit Linked Insurance Plans, Individual Savings Account?” Commentary No. 66,

Health Insurance Plans and Equity Linked Saving London: The Institute for Fiscal Studies.

Schemes respectively. The instrument, which is least [2.] Capital Tax Group (1989): “Neutrality in the

adopted, as tax saving instrument is Infrastructure Bonds, Taxation of Savings: An Extended Role for PEPs”,

which got the ninth rank in this study. Commentary No. 17, London: Institute for Fiscal

(b). On an analysis of tax saving amount with various Studies.

age groups, it is found that, between the age group of 20 to [3.] Chelliah, Raja J. (1996): “An Agenda for

i-Xplore International Research Journal Consortium www.irjcjournals.org

International Journal of Management and Social Sciences Research (IJMSSR) ISSN: 2319-4421 91

Volume 2, No. 5, May 2013

Comprehensive Tax Reform” Towards sustainable

Growth- Essays in Fiscal and Financial Sector

Reforms In India, Oxford University Press, New

Delhi.

[4.] Chelliah, Raja J. and R. Kavita Rao (2001):

“Rational Ways of Increasing Tax Revenues in

India” presented in World Bank Conference Fiscal

Policies to Accelerate Economic Growth, New

Delhi, May 21-22.

[5.] Dr. Ahuja, Girish and Dr. Gupta, Ravi. (2007):

“Systematic approach to Income Tax and Central

Sales Tax” Book, Bharat Law House Pvt. Ltd.

Publication, New Delhi.

[6.] Lal, B.B and Vashisht, N. (2008): “Direct Taxes,

Income Tax, Wealth Tax and Tax planning” Book,

Pearson Education, New Delhi.

[7.] Planning Commission, Government of India (2001):

“Report of the Advisory Group on Tax Policy and

Tax Administration for the Tenth Plan”, New Delhi.

[8.] Dornbusch, R., Fischer, S., Startz R. (2004).

Macroeconomics 9th Ed. New York: McGraw-Hill.

[9.] Romer, D. (2001). Advanced macroeconomics (2nd

Ed). New York: McGraw-Hill.

[10.] Warner, KE. (1999). The psychology of saving.

Cheltenham: Edward Elgar Publishing Limited.

i-Xplore International Research Journal Consortium www.irjcjournals.org

View publication stats

You might also like

- Methods of Reducing Tax LiabilitiesDocument6 pagesMethods of Reducing Tax LiabilitiesAryan SharmaNo ratings yet

- Standard Form Contract AECOM - Bills ProjectDocument50 pagesStandard Form Contract AECOM - Bills ProjectWGRZ-TVNo ratings yet

- Trust Agreement: Back To Table of ContentsDocument16 pagesTrust Agreement: Back To Table of ContentsJurisprudence Law100% (1)

- Patent License Agreement Template 12-19.2014Document20 pagesPatent License Agreement Template 12-19.2014Narasimha NagaiahNo ratings yet

- 01 Taxation Law OutlineDocument58 pages01 Taxation Law OutlineDrew RodriguezNo ratings yet

- Advanced Tax Laws CS Professional, YES AcademyDocument33 pagesAdvanced Tax Laws CS Professional, YES AcademyKaran AroraNo ratings yet

- Tax Avoidance and Tax EvasionDocument14 pagesTax Avoidance and Tax EvasionKRISHNA GATTANI100% (1)

- Background Material On Bank Branch Audit - Manual CIRC ICAI PDFDocument54 pagesBackground Material On Bank Branch Audit - Manual CIRC ICAI PDFayushNo ratings yet

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Income Tax Planning in IndiaDocument61 pagesIncome Tax Planning in IndiaPRIYANKA LANDGENo ratings yet

- Test Bank 10Document6 pagesTest Bank 10Ahmad Rahhal100% (1)

- Meaning of Tax PlanningDocument5 pagesMeaning of Tax PlanningTanmoy ChakrabortyNo ratings yet

- Corporate Tax Planning & ManagemenDocument94 pagesCorporate Tax Planning & ManagemenArshit PatelNo ratings yet

- Tax PalnningDocument25 pagesTax PalnningVish Nu VichuNo ratings yet

- Notes On Corporate Tax PlanningDocument198 pagesNotes On Corporate Tax PlanningShainaNo ratings yet

- ECardDocument2 pagesECardsivaNo ratings yet

- AX Lanning: by Anup K SuchakDocument27 pagesAX Lanning: by Anup K SuchakanupsuchakNo ratings yet

- Taxation Project Sem VDocument21 pagesTaxation Project Sem VSara Parveen50% (2)

- In Come Tax PlanningDocument10 pagesIn Come Tax PlanningAyyan ايانNo ratings yet

- Income Tax Planning: A Study of Tax Saving Instruments: PreprintDocument11 pagesIncome Tax Planning: A Study of Tax Saving Instruments: PreprintPallavi PalluNo ratings yet

- In Come Tax PlanningDocument9 pagesIn Come Tax PlanningHitesh GuptaNo ratings yet

- Income Tax PlanningDocument28 pagesIncome Tax PlanningAtul GuptaNo ratings yet

- Introduction To Tax PlanningDocument14 pagesIntroduction To Tax Planningshanu RajputNo ratings yet

- Tax Planning Tax Avoidance AND Tax EvasionDocument17 pagesTax Planning Tax Avoidance AND Tax EvasionSpUnky RohitNo ratings yet

- Direct Law 7thDocument13 pagesDirect Law 7thDevansh PandeyNo ratings yet

- MeaningDocument9 pagesMeaningMrigendra MishraNo ratings yet

- Tax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityDocument12 pagesTax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityPallavi PalluNo ratings yet

- Tax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityDocument9 pagesTax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityEditor IJTSRDNo ratings yet

- Tax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CityDocument12 pagesTax Saving Instruments of Income Tax in India: A Study On Tax Assessee in Trichy CitySonali LadiNo ratings yet

- 1 TaxplanningchapterDocument60 pages1 TaxplanningchapterGieanne Prudence Venculado100% (1)

- A Project On: Tax Planning With Refrence To Location, Nature & Form of OrganisationDocument31 pagesA Project On: Tax Planning With Refrence To Location, Nature & Form of OrganisationCharuJagwaniNo ratings yet

- CS Pro DT New (05.06.20) PDFDocument175 pagesCS Pro DT New (05.06.20) PDFKapil KaroliyaNo ratings yet

- TM 8 PDFDocument10 pagesTM 8 PDFJai VermaNo ratings yet

- Corporate Tax Planning Unit 1Document26 pagesCorporate Tax Planning Unit 1Abinash PrustyNo ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- Tax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'Document4 pagesTax Efficiency Financial Plan Tax Liability: DEFINITION of 'Tax Planning'mba departmentNo ratings yet

- Bjectives of Tax PlanningDocument6 pagesBjectives of Tax PlanningSruthiDeetiNo ratings yet

- ET Meaning & Method of Tax PlanningDocument2 pagesET Meaning & Method of Tax PlanningVanyaNo ratings yet

- Cost AccountingDocument21 pagesCost AccountingXandarnova corpsNo ratings yet

- CT Part 1-IntroductionDocument45 pagesCT Part 1-IntroductionSHAURYA VERMANo ratings yet

- SynopsisDocument7 pagesSynopsisJagruti KisnaniNo ratings yet

- Tax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Document11 pagesTax Planning: Submitted By: Natasha Sharon Beck (Mba/10031/18) MANAS MAHESHWARI (MBA/10094/18)Manas MaheshwariNo ratings yet

- Tax PlanningDocument8 pagesTax Planninghgoyal190No ratings yet

- TM 4Document5 pagesTM 4Jai VermaNo ratings yet

- Unit 4 LAB FairDocument15 pagesUnit 4 LAB Fairmurugesan.NNo ratings yet

- Tax Planning, Avoidance, Tax EvasionDocument40 pagesTax Planning, Avoidance, Tax Evasionsimm170226No ratings yet

- Tax-Planning-and-Management Semester - 4Document65 pagesTax-Planning-and-Management Semester - 4RAMESHNo ratings yet

- Unit VDocument18 pagesUnit VdepeshsnehaNo ratings yet

- Tax AssignmentDocument5 pagesTax AssignmentDiwakar AnandNo ratings yet

- Corporate Tax PlanningDocument7 pagesCorporate Tax PlanningimamNo ratings yet

- Unit 1Document35 pagesUnit 1nandan velankarNo ratings yet

- Project 1Document6 pagesProject 1Jagruti KisnaniNo ratings yet

- 19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopeDocument8 pages19P0310314 - Corporate Tax Planning - Meaning, Objectives and ScopePriya KudnekarNo ratings yet

- What Is Tax Planning?Document4 pagesWhat Is Tax Planning?Mrigendra MishraNo ratings yet

- Topic 1 Summary STRATADocument10 pagesTopic 1 Summary STRATAShien Angel Delos ReyesNo ratings yet

- Sundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Document47 pagesSundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Abhay GroverNo ratings yet

- Legal & Ethical Dimension of Tax EvasionDocument12 pagesLegal & Ethical Dimension of Tax EvasionshehabkhankulawNo ratings yet

- Short Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Document22 pagesShort Answers: Submitted To: Prof.K.K.Bajpai Simran Gupta Mba (FC) 4 Sem ROLLNO.8131051Satvik MishraNo ratings yet

- Unit 1 Tax Planning Tax Evasion and TaxDocument29 pagesUnit 1 Tax Planning Tax Evasion and TaxAmisha Singh VishenNo ratings yet

- SHORT ANSWERS ChaurasiaDocument22 pagesSHORT ANSWERS ChaurasiaSatvik MishraNo ratings yet

- Concepts of Tax PlanningDocument1 pageConcepts of Tax PlanningKshetriyas Mass PrdiveNo ratings yet

- Tax PlanningDocument2 pagesTax Planningamrendra kumarNo ratings yet

- The Indian Tax Scenario - Part 1Document5 pagesThe Indian Tax Scenario - Part 1rk_rkaushikNo ratings yet

- Types of Planning Discussed AboveDocument2 pagesTypes of Planning Discussed AboveHarshika DaswaniNo ratings yet

- Final Project SunitaDocument37 pagesFinal Project SunitaAtul LabdiNo ratings yet

- Tax PlanningDocument16 pagesTax PlanningAddis YawkalNo ratings yet

- Apodaca v. NLRCDocument2 pagesApodaca v. NLRCPaul Joshua SubaNo ratings yet

- ISC Business StudiesDocument5 pagesISC Business Studies28 Khalid HalimNo ratings yet

- Care (Health Insurance Product) Prospectus Cum Sales LiteratureDocument49 pagesCare (Health Insurance Product) Prospectus Cum Sales LiteratureAnupam GhantiNo ratings yet

- 10 - Chapter 3 PDFDocument76 pages10 - Chapter 3 PDFharithaNo ratings yet

- Pramod Kumar PDFDocument1 pagePramod Kumar PDFMd Rashid100% (1)

- Internship Report NiB BankDocument10 pagesInternship Report NiB BankAbdul WaheedNo ratings yet

- Critical Reasoning PracticeDocument84 pagesCritical Reasoning PracticetiaraalfenzaNo ratings yet

- Progressive Final PaperDocument16 pagesProgressive Final PaperJordyn WebreNo ratings yet

- EEI PolicyDocument35 pagesEEI PolicyKhawar RiazNo ratings yet

- A Study of Consumer Behavior in Relation To Insurance Products in IDBIDocument9 pagesA Study of Consumer Behavior in Relation To Insurance Products in IDBIPurnanand SathuaNo ratings yet

- Bar Questions and Answers in Mercantile Law (Repaired)Document208 pagesBar Questions and Answers in Mercantile Law (Repaired)Ken ArnozaNo ratings yet

- Lesson2 - Dual TrainingDocument26 pagesLesson2 - Dual TrainingCristopher Sardon100% (1)

- Competition in Salaries, Credentials, and Signaling Prerequisites For Job (A J) 1976Document25 pagesCompetition in Salaries, Credentials, and Signaling Prerequisites For Job (A J) 1976pedronuno20No ratings yet

- Deloitte Big-Data ArticleDocument28 pagesDeloitte Big-Data ArticleDominic ArnoldNo ratings yet

- Anniversary Statement 25 January 2016Document3 pagesAnniversary Statement 25 January 2016Rodel Ryan YanaNo ratings yet

- 1.1. Different Types of General InsuranceDocument3 pages1.1. Different Types of General Insurancebeena antuNo ratings yet

- Financial ModellingDocument16 pagesFinancial ModellingthobeyceleNo ratings yet

- FRM Policy Schedule ViewDocument1 pageFRM Policy Schedule ViewStigan IndiaNo ratings yet

- Rejda rmiGE ppt01Document25 pagesRejda rmiGE ppt01Fadi OsamaNo ratings yet

- Industrial Training - Guidelines For Companies (26may21)Document20 pagesIndustrial Training - Guidelines For Companies (26may21)Heng PhinNo ratings yet

- Role of Development Banking in NigeriaDocument82 pagesRole of Development Banking in NigeriaGodwin ArigbonuNo ratings yet

- 4 Com-Cg-12-0020 Water Intrusion 08 30 2018 1Document4 pages4 Com-Cg-12-0020 Water Intrusion 08 30 2018 1api-576583097No ratings yet

- Half Yearly Unit Statement: PSRV2810021041104Document3 pagesHalf Yearly Unit Statement: PSRV2810021041104GURUMOORTHY PNo ratings yet