Professional Documents

Culture Documents

Chapter 7 Inu

Uploaded by

Mark Kenneth Paragas0 ratings0% found this document useful (0 votes)

4 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views4 pagesChapter 7 Inu

Uploaded by

Mark Kenneth ParagasCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

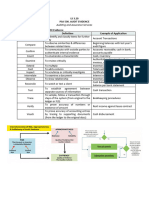

CHAPTER 7 (INU) Audit around the computer; or

Use Computer-Assisted Audit Techniques

CHARACTERICTICS OF COMPUTER (CAATs)

INFORMATION SYSTEMS (LCECSV)

SOME OF THE COMMONLY USED CAATs

Lack of visible transaction trails INCLUDE (TIP)

Consistency of performance

Ease of Access to data and computer Test data

Programs (EADCP) Integrated test facility (ITF)

Concentration of duties Parallel simulation

Systems generated transactions

Vulnerability of data and program storage OTHER CAATs (highly complicated

media (VDPSM) computerized system)

INTERNAL CONTROL PROCEDURES Snapshots

CLASSIFIED INTO TWO System control audit review files (SCARF)

General controls CHAPTER 8

Application controls TWO TYPES OF SUBSTANTIVE TEST (AT)

GENERAL CONTROL (OSADM) Analytical Procedures

OVERALL COMPUTER INFORMATION Test of details

SYSTEM CONTROLS INCLUDE: THE FOLLOWING GENERALIZATION MAY

Organizational controls BE HELPFUL IN ASSESSING THE

Systems development and documentation PREDICTABILITY OF THE ACCOUNTS.

controls (IAR)

Access controls

Data recovery controls Income statement account are more

Monitoring controls predictable compare to balance sheet

accounts

ORGANIZATIONAL CONTROLS Accounts that are not subject to

Segregation between the CIS department management discretion are generally

and user department predictable.

Segregation of duties within the CIS Relationships in a stable environment are

department more predictable than those in a dynamic or

unstable environment.

APPLICATION CONTROLS THESE

INCLUDES TEST OF DETAILS

Controls over input Test of details of balance

Controls over processing Test of details on transaction

Controls over output EFFEECTIVENESS OF SUBSTANTIVE TEST

EXAMPLE OF INPUT CONTOLS INCLUDE: affected by it’s; (NTE)

Key verification Nature of substantive test

Field check Timing of substantive test

Validity check Extent of substantive test

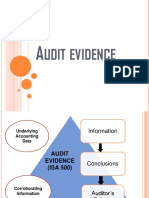

Self-checking digit AUDIT EVIDENCE CONSISTS OF; (UC)

Limit check

Control totals Underlying accounting data

Corroborating information

IN TESTING APPLICATION CONTROLS,

THE AUDITOR MAY EITHER: (AU)

WHEN OBTAINING AUDIT EVIDENCE Providing adequate defense in case

FROM EITHER TEST OF CONTROL OR of litigation.

SUBSTANTIVE TEST, AUDITOR CONSIDER;

FORM, CONTENT AND EXTENT OF AUDIT

Sufficiency DOCUMENT

Appropriateness

IN DECIDING ON FORM, CONTENT AND

FACTORS MAY BE CONSIDERED IN EXTENT OF AUDIT DOCUMENT WHAT

EVALUATING THE SUFFICIENCY OF WOULD ENABLE AN EXPERIENCE

EVIDENCE; (CMRE) AUDITOR, HAVING NO PREVIOUS

CONNECTION WITH AUDIT, TO

The competence of evidence UNDERSTAND;

The materiality of the item being examined

The risk involved in a particular account The nature, timing and extent of the audit

Experience gained during previous audit procedures performed to comply with PSAs

may indicate the amount of evidence taken and applicable legal and regulatory

before and whether such evidence was requirements;

enough. The results of the audit procedures and the

audit evidence obtained; and

GENERALIZATIONS COULD HELP THE Significant matters arising during the audit

AUDITOR IN ASSESSING THE and the conclusions reach thereon.

RELIABILITY OF AUDIT EVIDENCE;

IMPORTANT ITEM WOULD NORMALLY

Audit evidence obtained from independent REQUIRE AUDIT DOCUMENTATION

outside sources (for example, confirmation

received from a third party) is more reliable Significant matters

than that generated internally Depart from a basic principle or an essential

Audit evidence generated internally is more procedure

reliable when the related accounting and Nature, timing and extent or audit

internal control systems are effective procedures performed

Audit evidence obtained directly by the

auditor is more reliable than that obtained IN DOCUMENTING THE NATURE, TIMING

from the entity AND EXTENT OF AUDIT PROCEDURE

Audit evidence is the forms of documents PERFORM, AUDITOR SHOULD RECORD

and written representations is more Who performed the audit work and the date

reliable than oral representations. such work was completed; and

FUNCTION OF WORKING PAPER Who reviewed the audit work performed

and the date and extent of such review

Working paper are prepared primarily to

CLASSIFICATION OF WORKING PAPER

Support the auditor’s opinion on

financial statement Permanent file

Support the auditor’s representation Current file

as to compliance with PSA PERMANENT FILE INCLUDE (CMEOAI)

Assist the auditor in the planning,

performance, review and supervision Copies of the article of incorporation and by

of the engagement. laws

Major contracts

Secondarily, working paper also assist the Engagement letter

auditor in Organizational chart

Planning future audits Analyses of long-term account such as plant

Providing information useful in asset, long-term liabilities and stockholders’

rendering other service (MAS or Tax accounts

consultancy) Internal control analyses

CURRENT FILE NORMALLY INCLUDES

(AAWLDC)

AUDIT SAMPLING PLANS

A copy of the financial statements

Audit programs Attribute sampling

Working trial balance Variable sampling

Lead schedules BASIC STEPS IN AUDIT SAMPLING

Detailed schedules (DDDSAE)

Correspondence with other parties such as

lawyers, customers, bank and management. 1. Define the objective of the test

2. Determine the audit procedure to be

TECHNIQUES MAY BE USED BY THE performed

AUDITOR WHEN PREPARING WORKING 3. Determine the sample size

PAPERS (HICT) 4. Select the sample

Heading 5. Apply the procedure

Indexing 6. Evaluate the sample result

Cross-indexing/ cross referencing DIFFERENT BETWEEN AUDIT SAMPLING

Tick marks AND 100% EXAMINATION IS THAT AUDIT

CHAPTER 9 SAMPLING;

RISK IN SAMPLING Determine the sample size

Select of sample and

Sampling risk Projection of errors in evaluating the sample

Non-sampling risk results

TWO TYPES OF SAMPLING RISK THREE FACTORS AFFECTING THE

DETERMINATION OF SAMPLE RISK FOR

Alpha Risk TEST CONTROLS (ATE)

Beta Risk

Acceptable sampling risk

AUDITORS CONTROL SAMPLING RISK BY Tolerable deviation rate

Increasing the sample size, and (ISS) Expected deviation rate

Using an appropriate sample selection SAMPLE SELECTION METHOD FOR TEST

method (UASSM) CONTROLS

NON-SAMPLING RISK CAN BE MINIMIZED THREE PRINCIPAL METHOD OF

BY (PA) SELECTING SAMPLES

Proper planning; and Random number selection

Adequate direction, review and supervision Systematic selection

of the audit team (ADRSAT) Haphazard selection

TWO SAMPLING APPROACHES CAN BE GENERAL GUIDELINES MAY USED WHEN

USE TO GATHER SAE EVALUATION SAMPLE RESULTS FOR

Statistical Sampling TEST OF CONTROLS

Non-statistical sampling 1. Determine the sample deviation rate

STATISTICAL SAMPLING HELPS THE 2. Compare the sample deviation rate with the

AUDITO R TO (DMO) tolerable deviation rate and draw an overall

conclusion about the population

Design an efficient sample

Measure the sufficiency of evidence

obtained; and

Objectively evaluate the sample results

OTHER SAMPLING APPLICATION FOR

TEST OF CONTROLS

Sequential Sampling

Discovery sampling

FACTORS IN DETERMINING THE SAMPLE

SIZE FOR SUBSTANTIVE TEST (ATEV)

Acceptable sampling risk

Tolerable misstatement

Expected misstatement

Variation in the population

SAMPLE SELECTION METHOD

SELECTING A SAMPLE FOR SUBSTANTIVE

TESTS (SV)

Stratified sampling

Value weighted selection

EVALUATING SAMPLE RESULTS FOR

SUBSTANTIVE TEST

Project the misstatement to the population

Compare the projected misstatement

together with the tolerable misstatement and

draw an overall conclusion

(CPMTTMDOC)

You might also like

- Google Cloud Platform GCP Audit ProgramDocument31 pagesGoogle Cloud Platform GCP Audit ProgramjohnNo ratings yet

- Luci’s CPA Method Earn With Rewards SiteDocument3 pagesLuci’s CPA Method Earn With Rewards Sitemaster-rich0% (1)

- Training Material - AS9100 Internal AuditDocument49 pagesTraining Material - AS9100 Internal AuditTemram KomgrichNo ratings yet

- PSA 500 RedraftedDocument11 pagesPSA 500 RedraftedMario LabangNo ratings yet

- Confidentiality Agreement GuideDocument11 pagesConfidentiality Agreement GuideSeema WadkarNo ratings yet

- Computer Aided Audit TechniqueDocument24 pagesComputer Aided Audit TechniqueTeddy HaryadiNo ratings yet

- System Validation (SEBOK)Document15 pagesSystem Validation (SEBOK)Marcial Enrique Vásquez RubioNo ratings yet

- Audit Evidence AndTestingDocument15 pagesAudit Evidence AndTestingSigei LeonardNo ratings yet

- OPERATIONAL AUDITING Chapter 2Document41 pagesOPERATIONAL AUDITING Chapter 2Janine Lerum100% (1)

- CMS Control of Internal AuditingDocument6 pagesCMS Control of Internal AuditingAmine RachedNo ratings yet

- Auditing IT Controls Part IDocument64 pagesAuditing IT Controls Part IJoness Angela BasaNo ratings yet

- Audit PlanningDocument21 pagesAudit Planningablay logeneNo ratings yet

- PHSS Control Strategy White PaperDocument13 pagesPHSS Control Strategy White PaperAkuWilliams100% (1)

- Audit Evidence and Audit Documentation Nature and Types Audit EvidenceDocument4 pagesAudit Evidence and Audit Documentation Nature and Types Audit EvidenceCattleyaNo ratings yet

- Auditing IT Controls Part 1: SOX and GovernanceDocument5 pagesAuditing IT Controls Part 1: SOX and GovernanceMylene Sunga AbergasNo ratings yet

- The Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsFrom EverandThe Sarbanes-Oxley Section 404 Implementation Toolkit: Practice Aids for Managers and AuditorsNo ratings yet

- Daniel Bell's Concept of Post-Industrial Society: Theory, Myth, and IdeologyDocument42 pagesDaniel Bell's Concept of Post-Industrial Society: Theory, Myth, and IdeologyTeni ChitananaNo ratings yet

- ISMS Mandatory Documentation RequirementsDocument7 pagesISMS Mandatory Documentation RequirementsKashif RehmanNo ratings yet

- NEw IC 38 SummaryDocument80 pagesNEw IC 38 SummaryMadhup tarsolia100% (2)

- Compliance AuditDocument37 pagesCompliance AuditADITYA GAHLAUT100% (2)

- LS 3.00 - PSA 330 Auditor's Response To Assessed RiskDocument5 pagesLS 3.00 - PSA 330 Auditor's Response To Assessed RiskSkye LeeNo ratings yet

- 9.401 Auditing: The Study of Internal Control and Assessment of Control RiskDocument30 pages9.401 Auditing: The Study of Internal Control and Assessment of Control RiskShalin LataNo ratings yet

- At.3204 Nature and Type of Audit EvidenceDocument7 pagesAt.3204 Nature and Type of Audit EvidenceDenny June CraususNo ratings yet

- Sample Ch09Document54 pagesSample Ch09jikee11No ratings yet

- Gathering and Evaluating Audit EvidenceDocument4 pagesGathering and Evaluating Audit EvidenceAlyssa Abbas DiatorNo ratings yet

- Substantive TestingDocument18 pagesSubstantive TestingMichelle SicangcoNo ratings yet

- AT.3404 - Audit Evidence and DocumentationDocument6 pagesAT.3404 - Audit Evidence and DocumentationMonica GarciaNo ratings yet

- AA-Audit EvidenceDocument15 pagesAA-Audit EvidenceRafsan JazzNo ratings yet

- Module 1 3 Audi313Document12 pagesModule 1 3 Audi313Katrina PaquizNo ratings yet

- Audit EvidenceDocument18 pagesAudit Evidenceandi priatamaNo ratings yet

- Audit Evidence and ProceduresDocument10 pagesAudit Evidence and ProceduresLeroyNo ratings yet

- Masalah Bukti Dan Pembuktian Dalam Audit Serta Kertas Kerja PemeriksaanDocument39 pagesMasalah Bukti Dan Pembuktian Dalam Audit Serta Kertas Kerja PemeriksaanMalinda KharistaNo ratings yet

- Chapter 2 Audit EvidenceDocument13 pagesChapter 2 Audit EvidencelohitacademyNo ratings yet

- Materi Test of ControlDocument66 pagesMateri Test of ControlIntan100% (1)

- CIS Report PAPS1009 CAATSDocument28 pagesCIS Report PAPS1009 CAATSJohn David Alfred EndicoNo ratings yet

- NSA 500.doc, 313-332Document10 pagesNSA 500.doc, 313-332BAZINGANo ratings yet

- Chapter 1 AuditingDocument29 pagesChapter 1 AuditingAisa TriNo ratings yet

- Lecture 5 - Completion of Audit (Part 1)Document17 pagesLecture 5 - Completion of Audit (Part 1)Mohammed Saeed Al-rashdiNo ratings yet

- Audit documentation requirementsDocument4 pagesAudit documentation requirementsJoyce Anne GarduqueNo ratings yet

- AUDIT EVIDENCE: 2 KEY TYPESDocument9 pagesAUDIT EVIDENCE: 2 KEY TYPESJames LopezNo ratings yet

- RMQI - Notes 3 - 2023Document54 pagesRMQI - Notes 3 - 2023Umair MehmoodNo ratings yet

- Audit Evidence Types & ProceduresDocument64 pagesAudit Evidence Types & ProceduresMAAN SHIN ANGNo ratings yet

- ACC 213 SylabusDocument5 pagesACC 213 Sylabusfbicia218No ratings yet

- Quality Management System and AuditingDocument72 pagesQuality Management System and Auditingrtiyer1970No ratings yet

- LS 3.20 - PSA 500 Audit EvidenceDocument3 pagesLS 3.20 - PSA 500 Audit EvidenceSkye LeeNo ratings yet

- ISA Ou NIA 500 Dez 04 Paragrafo 15 e Seguinte Asserc SBJ DFDocument11 pagesISA Ou NIA 500 Dez 04 Paragrafo 15 e Seguinte Asserc SBJ DFeusebio macuacuaNo ratings yet

- Welcome To Presentation By: Knowledge SeekersDocument39 pagesWelcome To Presentation By: Knowledge Seekersfaraazxbox1No ratings yet

- Chapter 12 Audit ProceduresDocument8 pagesChapter 12 Audit ProceduresRichard de LeonNo ratings yet

- Item 5 - Lift Inspection and Accreditation To 17020Document15 pagesItem 5 - Lift Inspection and Accreditation To 17020Cassandra StapelbergNo ratings yet

- REVIEWERDocument8 pagesREVIEWERKaela SerranoNo ratings yet

- Computer System Validation WhitepaperDocument11 pagesComputer System Validation Whitepaperamr ADELNo ratings yet

- 4 5850471109056532139Document40 pages4 5850471109056532139Yehualashet MulugetaNo ratings yet

- Chapter 12 Audit Procedures - ppt179107590Document8 pagesChapter 12 Audit Procedures - ppt179107590Clar Aaron BautistaNo ratings yet

- Audit Evidence and Specific Considerations For Certain Items - ACCA GlobalDocument19 pagesAudit Evidence and Specific Considerations For Certain Items - ACCA Globalbasit ovaisiNo ratings yet

- Consideratio N of Internal Control: Presented By: Hannah Binas Christine Mae FelixDocument12 pagesConsideratio N of Internal Control: Presented By: Hannah Binas Christine Mae FelixChristine Mae FelixNo ratings yet

- CA. Saju Sreedhar.K, FCADocument22 pagesCA. Saju Sreedhar.K, FCASimon QuinnyNo ratings yet

- Assurance - Chapter 4 - STDocument35 pagesAssurance - Chapter 4 - STLinh KhanhNo ratings yet

- Audits and ImprovementsDocument48 pagesAudits and Improvementssukhjit78No ratings yet

- Tutorial Pemeriksaan AkuntansiDocument43 pagesTutorial Pemeriksaan AkuntansiNovi YantiNo ratings yet

- Janice AudDocument13 pagesJanice AudHillary CanlasNo ratings yet

- Audit Procedures and Risk ResponseDocument7 pagesAudit Procedures and Risk ResponseJwyneth Royce DenolanNo ratings yet

- Overview of Working Papers in RAMDocument21 pagesOverview of Working Papers in RAMIsha PopNo ratings yet

- Audit EvidenceDocument43 pagesAudit EvidenceJasmine Putri FaradhisaNo ratings yet

- Kuliah Bukti Audit Dan DokumentasiDocument27 pagesKuliah Bukti Audit Dan DokumentasiYamunasri MariNo ratings yet

- Audit in A CIS Environment 2Document3 pagesAudit in A CIS Environment 2Shyrine EjemNo ratings yet

- COE. Act. 9298Document8 pagesCOE. Act. 9298Mark Kenneth ParagasNo ratings yet

- Prepare and verify CIS input data controlsDocument6 pagesPrepare and verify CIS input data controlsMark Kenneth ParagasNo ratings yet

- Chapter 10 IdenDocument4 pagesChapter 10 IdenMark Kenneth ParagasNo ratings yet

- Accounting Information SystemDocument12 pagesAccounting Information SystemMark Kenneth ParagasNo ratings yet

- Auditing Subsequent Events ProceduresDocument8 pagesAuditing Subsequent Events ProceduresMark Kenneth ParagasNo ratings yet

- Management Science chpt8Document20 pagesManagement Science chpt8Mark Kenneth ParagasNo ratings yet

- Management Science Chpt6Document16 pagesManagement Science Chpt6Mark Kenneth ParagasNo ratings yet

- Management Science chpt9Document10 pagesManagement Science chpt9Mark Kenneth ParagasNo ratings yet

- Leadership in The Remote, Freelance, and Virtual Workforce EraDocument6 pagesLeadership in The Remote, Freelance, and Virtual Workforce EraRenata JapurNo ratings yet

- Tenses 1Document6 pagesTenses 1DhimasNo ratings yet

- The Thief of AmsterdamDocument2 pagesThe Thief of AmsterdamBlagitsa Arizanova ShopovNo ratings yet

- Acr-Emergency HotlinesDocument2 pagesAcr-Emergency HotlinesRA CastroNo ratings yet

- Dealey Field Day 10 FlyerDocument1 pageDealey Field Day 10 FlyercooperrebeccaNo ratings yet

- Foodborg+Assignment FinalDocument6 pagesFoodborg+Assignment Finalarti shrivastava0% (1)

- Marginal TeacherDocument19 pagesMarginal TeacherAndy AcuinNo ratings yet

- Free Tuition Fee Application Form: University of Rizal SystemDocument2 pagesFree Tuition Fee Application Form: University of Rizal SystemCes ReyesNo ratings yet

- Stamped Original Petition, RFD, and Request For D R-2Document8 pagesStamped Original Petition, RFD, and Request For D R-2KHOU100% (1)

- Cymar International, Inc. v. Farling Industrial Co., Ltd.Document29 pagesCymar International, Inc. v. Farling Industrial Co., Ltd.Shienna Divina GordoNo ratings yet

- Skadden:Lexis NexisDocument7 pagesSkadden:Lexis Nexismklimo13No ratings yet

- Environmental Impact Assessment (EIA) in Nepal: Ministry of Population and EnvironmentDocument11 pagesEnvironmental Impact Assessment (EIA) in Nepal: Ministry of Population and EnvironmentAden ShahuNo ratings yet

- UN Supplier Code of Conduct. United Nations.Document4 pagesUN Supplier Code of Conduct. United Nations.Daniel BorrEka MalteseNo ratings yet

- Production Operation Management Final Project Bata Shoes CompanyDocument10 pagesProduction Operation Management Final Project Bata Shoes CompanyrazaNo ratings yet

- The Warrior KingDocument4 pagesThe Warrior Kingapi-478277457No ratings yet

- Questionnaire RAAM GroupDocument7 pagesQuestionnaire RAAM GroupVinayak ChaturvediNo ratings yet

- GSCR Report China KoreaDocument313 pagesGSCR Report China KoreaD.j. DXNo ratings yet

- Strong WindDocument3 pagesStrong WindYuli IndrawatiNo ratings yet

- Integration of Islamic Education in Public SchoolsDocument7 pagesIntegration of Islamic Education in Public SchoolstimespergerakanNo ratings yet

- CHAPTER 1 (Under Revision Wahahaha) The Problem and Its BackgroundDocument6 pagesCHAPTER 1 (Under Revision Wahahaha) The Problem and Its BackgroundAira TantoyNo ratings yet

- 05 Task Performance - ARG: RequirementsDocument3 pages05 Task Performance - ARG: Requirementssungit comiaNo ratings yet

- National DanceDocument2 pagesNational DanceJohn Paul CasaclangNo ratings yet

- Former Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerDocument2 pagesFormer Ohio Wildlife Officer Convicted of Trafficking in White-Tailed DeerThe News-HeraldNo ratings yet

- Salem Steel PlantDocument69 pagesSalem Steel PlantKavuthu Mathi100% (2)

- New Ford Endeavour Brochure Mobile PDFDocument13 pagesNew Ford Endeavour Brochure Mobile PDFAnurag JhaNo ratings yet