Professional Documents

Culture Documents

Investments 2

Uploaded by

Alora Eu100%(1)100% found this document useful (1 vote)

32 views2 pagesThis document contains 20 multiple choice questions testing knowledge of accounting for investments, including held for trading securities, derecognition of investments, equity method of accounting for associates, and impairment of investments in associates. The questions cover topics such as unrealized gains/losses, amortization of discounts/premiums, recognition of share of profit/loss and other comprehensive income of associates, and reducing the investment for dividends received.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 20 multiple choice questions testing knowledge of accounting for investments, including held for trading securities, derecognition of investments, equity method of accounting for associates, and impairment of investments in associates. The questions cover topics such as unrealized gains/losses, amortization of discounts/premiums, recognition of share of profit/loss and other comprehensive income of associates, and reducing the investment for dividends received.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

32 views2 pagesInvestments 2

Uploaded by

Alora EuThis document contains 20 multiple choice questions testing knowledge of accounting for investments, including held for trading securities, derecognition of investments, equity method of accounting for associates, and impairment of investments in associates. The questions cover topics such as unrealized gains/losses, amortization of discounts/premiums, recognition of share of profit/loss and other comprehensive income of associates, and reducing the investment for dividends received.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

1. Which of the following is not correct in regard to held for trading securities?

a. They are held to be sold in a short period of time.

b. Unrealized holding gains and losses are reported as part of profit or loss.

c. Any discount or premium is not amortized.

d. All of these are correct.

2. On derecognition of investment, choose the correct statement

a. the unrealized gain or loss from FVPL securities is transferred to statement of other comprehensive

income.

b. The cumulative gain or loss from FVOCI securities is transferred directly to equity.

c. The gain or loss from FVOCI securities is recognized in the income statement.

d. All the above statement are incorrect.

3. An entity did not amortize the discount on its “trading” bond investment. What effect would this have on

the carrying amount of the investment and on net income, respectively?

a. Overstated, overstated

b. Understated, overstated

c. understated, understated

d. No effect, no effect

4. If in the rare circumstance that a reliable measure of fair value is no longer available, it becomes

appropriate to carry a financial asset without a fixed maturity cost, the fair value carrying amount of the

financial asset becomes the new cost basis and any previous gain or loss that has been recognized in

other comprehensive income shall

a. Remain in other comprehensive income until the financial asset is sold or otherwise disposed of.

b. Be recognized in earnings immediately

c. Included in retained earnings

d. Be amortized over a reasonable period to profit or loss

5. Which statement is correct concerning recognition of unrealized gains and losses on financial assets?

I. Unrealized gains and losses on financial assets held for trading shall be included in profit or loss

II. Unrealized gains and losses on financial assets measured at amortized cost shall be included as

component of other comprehensive income

a. I only

b. II only

c. Both I and II

d. Neither I nor II

6. The equity method should be applied in which of the following?

a. The investor previously held only 10% interest but subsequently acquires additional 10% interest in

the associate.

b. The investor is an unlisted subsidiary whose parent allows it not to apply equity method.

c. The investment is classified as held for sale under PFRS 5.

d. The parent is exempted from presenting consolidated financial statements.

7. Under the equity method, which of the following does not decrease the investment account?

a. share in dividends declared by the associate.

b. amortization of overvaluation of asset.

c. share in associate’s loss

d. amortization of undervaluation of asset.

8. Which of the following statements best describes the term “significant influence”?

a. The holding of a significant proportion of the share capital in another entity

b. The contractually agreed sharing of control over an economic entity

c. The power to participate in the financial and operating policy decisions of an entity

d. The mutual sharing in the risks and benefits of a combined entity

9. An entity shall apply PAS 28

a. to investments which give the entity significant influence over the investee

b. to account for investments in associates in the entitys separate financial statements

c. any of these

d. even when significant influence is lost

10. For investments in associates, the investor shall not

a. recognize a share in the associates discontinued operations.

b. recognize a share in the associates revenue, expenses and profit before tax.

c. recognize a share in the associates other comprehensive income.

d. recognize a share in the associates profit or loss.

11. How is the impairment test carried out for an investment in associate?

a. The goodwill is separated from the rest of the investment and is impairment tested individually.

b. The entire carrying amount of the investment is tested for Impairment by comparing its recoverable

amount with the carrying amount.

c. The carrying value of the investment shall be compared with its market value.

d. The recoverable amounts of all investments in associates shall be assessed together to determine

whether there has been an impairment on all investment.

12. If under the equity method, an investor’s share of losses of an associate equals or exceeds the carrying

amount of an investment, which of the following is incorrect?

a. The investor ordinarily discontinues its share of further losses.

b. Additional losses are provided or a liability is recognized to the extent that the investor has incurred

legal or constructive obligations or made payments on behalf of the associate.

c. If the associate subsequently reports profits, the investor resumes its share of those profits without

regard to the share of net losses not previously recognized.

d. The investment is reported at NIL value.

13. Dane, Inc., owns 35% of Marin Corporation. During the calendar year 2004, Marin had net earnings of

₱300,000 and paid dividends of ₱30,000. Dane mistakenly recorded these transactions using the fair

value method rather than the equity method of accounting. What effect would this have on the

investment account, net income, and retained earnings, respectively?

a. Understate, overstate, overstate

b. Overstate, understate, understate

c. Overstate, overstate, overstate

d. Understate, understate, understate

14. When an investor uses the equity method to account for investments in common stock, the investment

account will be increased when the investor recognizes

a. a proportionate share of the net income of the investee.

b. a cash dividend received from the investee.

c. periodic amortization of the goodwill related to the purchase.

d. depreciation related to the excess of fair value over carrying amount of the investee's depreciable

assets at the date of purchase by the investor.

15. When an investor uses the equity method to account for investments in common stock, cash dividends

received by the investor from the investee should be recorded as

a. an increase in the investment account.

b. a deduction from the investment account.

c. dividend revenue.

d. a deduction from the investor's share of the investee's profits.

16. Which statement is incorrect concerning the equity method?

a. The investment in associate is initially recorded at cost

b. The investment in associate is increased or decreased by the investor’s share of the profit or loss of

the investee after the date of acquisition

c. The investor’s share of the profit or loss of the investee is not recognized in the investor’s profit or loss

d. Distributions received from the investee reduce the carrying amount of the of the investment

17. Goodwill arising from investment in associate is

a. Included in the carrying amount of the investment and amortized over the useful life.

b. Included in the carrying amount of the investment and not amortized.

c. Excluded from the carrying amount of the investment but charged to retained earnings.

d. Excluded from the carrying amount of the investment but charged to expense immediately.

18. PAS 28 does not require the equity method to be applied when the associate has been acquired and held

with a view to its disposal within a certain time period. What is the period within which the associate

must be disposed of?

a. Six months from the end of the reporting period

b. Twelve months from the end of the reporting period

c. Twelve months from the date of the classification as held for sale

d. In the near future

19. The excess of purchase cost of an investment in associate over the fair value of the interest acquired

represents

a. goodwill that is not required to be accounted for separately.

b. goodwill that should not be amortized but tested for impairment at least annually.

c. negative goodwill that should be recognized in the investors profit or loss in the year of acquisition

d. negative goodwill that should be deferred and amortized.

20. Which statement is incorrect concerning the equity method?

a. The investment in associate is initially recorded at cost

b. The investment in associate is increased or decreased by the investor’s share of the profit or loss of

the investee after the date of acquisition

c. The investor’s share of the profit or loss of the investee is not recognized in the investor’s profit or

loss

d. Distributions received from the investee reduce the carrying amount of the of the investment

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Investment in Associate ReviewerDocument18 pagesInvestment in Associate ReviewerAl-Rafzahir Bandingan80% (5)

- TFAR2304 - Investment in Equity SecuritiesDocument3 pagesTFAR2304 - Investment in Equity SecuritiesBea GarciaNo ratings yet

- 1st Midterm Quiz QuestionnaireDocument11 pages1st Midterm Quiz QuestionnaireAthena Fatmah AmpuanNo ratings yet

- Patrick T. Barena: Chapter 32 - Investment in AssociateDocument9 pagesPatrick T. Barena: Chapter 32 - Investment in AssociateKimberly Claire AtienzaNo ratings yet

- PAS 28 - Investment in Associate,, Equity Method, Cost Method, DividendsDocument3 pagesPAS 28 - Investment in Associate,, Equity Method, Cost Method, Dividendsd.pagkatoytoyNo ratings yet

- Compre ReviewerDocument33 pagesCompre Reviewermarinel pioquidNo ratings yet

- ECO 444 Investments Test Bank-No AnswersDocument17 pagesECO 444 Investments Test Bank-No AnswersAllan Genesis Romblon100% (1)

- Investments TheoryDocument8 pagesInvestments TheoryralphalonzoNo ratings yet

- InvestmentsDocument2 pagesInvestmentsAlora EuNo ratings yet

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Investment in AssociateDocument2 pagesPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Investment in AssociateKendrew SujideNo ratings yet

- ACT112 Final Exam Set 1 QuestionnaireDocument10 pagesACT112 Final Exam Set 1 QuestionnaireBashayer M. Sultan100% (1)

- Investment-in-Associates Practice SetDocument4 pagesInvestment-in-Associates Practice SetCIRILO EMIL BAYLOSISNo ratings yet

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - INVESTMENTS IN ASSOCIATE QUIZDocument5 pagesACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - INVESTMENTS IN ASSOCIATE QUIZMarilou Arcillas PanisalesNo ratings yet

- Chapter 18 - Investment in Associate (Other Accounting Issues)Document3 pagesChapter 18 - Investment in Associate (Other Accounting Issues)Liana LopezNo ratings yet

- Intermediate Accounting ReviewerDocument5 pagesIntermediate Accounting ReviewerJosephine YenNo ratings yet

- AC78.6.2 Final Examinations Questions and Answers 1Document15 pagesAC78.6.2 Final Examinations Questions and Answers 1rheaNo ratings yet

- Chapter 9 KDocument38 pagesChapter 9 KPauline DacirNo ratings yet

- Investment in Associates - Practice SetDocument4 pagesInvestment in Associates - Practice Setroseberrylacopia18No ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- INVESTMENTS ACC124 With ANSWERSDocument15 pagesINVESTMENTS ACC124 With ANSWERSAyesha Eunice SalvaleonNo ratings yet

- Theory - Part 2 PDFDocument21 pagesTheory - Part 2 PDFBettina OsterfasticsNo ratings yet

- 15 - Investments - TheoryDocument8 pages15 - Investments - TheoryROMAR A. PIGANo ratings yet

- Chap 17Document24 pagesChap 17alice123h210% (1)

- Investments in Associates FA AC OverviewDocument85 pagesInvestments in Associates FA AC OverviewHannah Shaira Clemente73% (11)

- Audit Prob Part 2Document6 pagesAudit Prob Part 2Koko LaineNo ratings yet

- Investment in Associates TheoryDocument4 pagesInvestment in Associates TheoryMiru YuNo ratings yet

- Investment in Associates TheoryDocument4 pagesInvestment in Associates Theorycristinelarita18No ratings yet

- 4 Mock FAR 4th LEDocument9 pages4 Mock FAR 4th LENatalia LimNo ratings yet

- Investment in Equity - MCDocument5 pagesInvestment in Equity - MCLeisleiRago100% (1)

- 8216 Cpar Consolidated FSDocument8 pages8216 Cpar Consolidated FSDaniela Ramos67% (3)

- Act-6j03 Comp1 1stsem05-06Document14 pagesAct-6j03 Comp1 1stsem05-06RegenLudeveseNo ratings yet

- Gold and Blue Summary Notes - Investment in AssociateDocument6 pagesGold and Blue Summary Notes - Investment in AssociateBryzan Dela CruzNo ratings yet

- CH 17 JWBDocument38 pagesCH 17 JWBFarisa MachmudNo ratings yet

- MCQ On Holding CompanyDocument4 pagesMCQ On Holding Companytushar100% (3)

- Investments: Pas 32 Financial Instruments - PresentationDocument11 pagesInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- A. Business CombinationDocument30 pagesA. Business CombinationJason SheeshNo ratings yet

- IA 3 ReviewerDocument23 pagesIA 3 ReviewerLarra NarcisoNo ratings yet

- Debt Securities ReviewerDocument30 pagesDebt Securities Reviewerjhie boterNo ratings yet

- Palmones Adrio B. Investment in Equity SecuritiesDocument18 pagesPalmones Adrio B. Investment in Equity SecuritiesAndrei GoNo ratings yet

- English To Math and VocabDocument10 pagesEnglish To Math and VocabezaNo ratings yet

- AICPADocument2 pagesAICPAAngeline RamirezNo ratings yet

- CFAS Final ExamDocument9 pagesCFAS Final ExamMarriel Fate CullanoNo ratings yet

- Questionnaire IntactDocument10 pagesQuestionnaire Intact?????No ratings yet

- Afar Quick NotesDocument35 pagesAfar Quick NotesMichelle AlvarezNo ratings yet

- AFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)Document7 pagesAFAR MIDTERM EXAM REVIEWER - Part 2 (With Answers)AuroraNo ratings yet

- Toa PreboardDocument9 pagesToa PreboardLeisleiRagoNo ratings yet

- Multiple ChoiceDocument9 pagesMultiple ChoiceCj SernaNo ratings yet

- CHAPTER 11 - PFRS FOR SMEsDocument7 pagesCHAPTER 11 - PFRS FOR SMEsXiena100% (2)

- 6 - Investments Theory of Accounts: Payments of Principal and InterestDocument7 pages6 - Investments Theory of Accounts: Payments of Principal and InterestandreamrieNo ratings yet

- Which Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in AssociatesDocument1 pageWhich Statement Is Incorrect Regarding The Application of The Equity Method of Accounting For Investments in Associatesjahnhannalei marticio0% (1)

- Theory of Accounts - 1Document9 pagesTheory of Accounts - 1Joovs JoovhoNo ratings yet

- Prac I InvestmentsDocument16 pagesPrac I InvestmentsJohn PasquitoNo ratings yet

- Operation Arising From Its Effective PortionDocument14 pagesOperation Arising From Its Effective PortionShey INFTNo ratings yet

- Afar ToaDocument19 pagesAfar ToaRicamae Mendiola100% (1)

- Fin Acc Valix PDFDocument58 pagesFin Acc Valix PDFKyla Renz de LeonNo ratings yet

- Ies2 Edited Pero Di Ko Sure 2Document4 pagesIes2 Edited Pero Di Ko Sure 2Lyn AbudaNo ratings yet

- Investment in Associate 18Document3 pagesInvestment in Associate 18gab camonNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Natsem Income and Wealth ReportDocument40 pagesNatsem Income and Wealth ReportABC News OnlineNo ratings yet

- Hue Cosmetics BPDocument26 pagesHue Cosmetics BPDennis ZaldivarNo ratings yet

- Horizontal Analysis (Grate)Document6 pagesHorizontal Analysis (Grate)Leonelson CorralNo ratings yet

- Tax Unit 1-2 - 5-6Document2 pagesTax Unit 1-2 - 5-6joy BoseNo ratings yet

- IAR Auditing ConclusionDocument23 pagesIAR Auditing Conclusionmarlout.sarita100% (1)

- Guyito Had The Following Data For 2010 Taxable YearDocument2 pagesGuyito Had The Following Data For 2010 Taxable YearQueen ValleNo ratings yet

- FS Analysis - Part 1 - 2020Document24 pagesFS Analysis - Part 1 - 2020Llyod Francis LaylayNo ratings yet

- Pertemuan 2 - Ch02-Keown-New (Understanding FS & CF)Document26 pagesPertemuan 2 - Ch02-Keown-New (Understanding FS & CF)ilham setiawanNo ratings yet

- Lecture 5 - Financial Statement AnalysisDocument36 pagesLecture 5 - Financial Statement AnalysisIsyraf Hatim Mohd TamizamNo ratings yet

- Part 1 - Financial Statements AnalysisDocument38 pagesPart 1 - Financial Statements AnalysisAjmal KhanNo ratings yet

- INTRODUCTIONDocument41 pagesINTRODUCTIONSatyajeet SinghNo ratings yet

- Comprehensive Problem Part Note You Must Complete Part B PDFDocument2 pagesComprehensive Problem Part Note You Must Complete Part B PDFdrjack9650No ratings yet

- Module 10 - Government GrantDocument7 pagesModule 10 - Government GrantJehPoyNo ratings yet

- Jawaban English Sesi 4Document2 pagesJawaban English Sesi 4Chindy Claudya SaragihNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- H.S. 2nd Year 2-WPS OfficeDocument11 pagesH.S. 2nd Year 2-WPS OfficeRaju aliNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Study Material - Consumer BehaviourDocument19 pagesStudy Material - Consumer BehaviourSUBHRAJYOTINo ratings yet

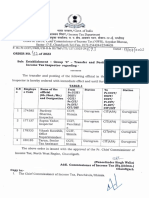

- Transfer and Posting in The Cadre of ITI Dated 13.07.2023.Document2 pagesTransfer and Posting in The Cadre of ITI Dated 13.07.2023.InspectorNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- The Economic Impacts of The California Almond Industry 2Document53 pagesThe Economic Impacts of The California Almond Industry 2amit agarwal gmailNo ratings yet

- White Flower FS 2077.78Document16 pagesWhite Flower FS 2077.78CMBS PVTLTDNo ratings yet

- Chapter 11 Capital Budgeting Cash FlowsDocument33 pagesChapter 11 Capital Budgeting Cash FlowsShahadNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisstudentoneNo ratings yet

- Fund Flow StatementDocument17 pagesFund Flow StatementPrithikaNo ratings yet

- Answer Key CH3 PalmDocument2 pagesAnswer Key CH3 PalmaghaNo ratings yet

- Alka Kumari Sinha: ParticularsDocument6 pagesAlka Kumari Sinha: ParticularsCa Nishikant mishraNo ratings yet

- Exercise 2.21Document5 pagesExercise 2.21Edgardo Baula Balauag Jr.No ratings yet

- Financial Accounting: Accounting For Merchandise OperationsDocument31 pagesFinancial Accounting: Accounting For Merchandise OperationsGiang PhungNo ratings yet

- Economics: Fiji Year 13 Certificate Examination 2018Document14 pagesEconomics: Fiji Year 13 Certificate Examination 2018rikanshaNo ratings yet